This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 706-GS(D-1)

for the current year.

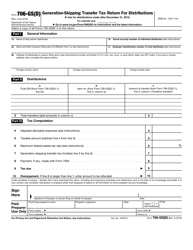

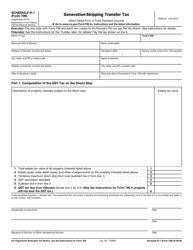

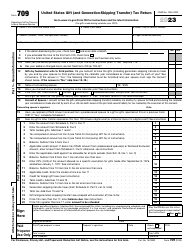

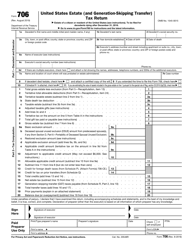

Instructions for IRS Form 706-GS(D-1) Notification of Distribution From a Generation-Skipping Trust

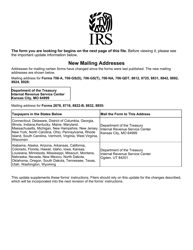

This document contains official instructions for IRS Form 706-GS(D-1) , Notification of Distribution From a Generation-Skipping Trust - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 706-GS(D-1) is available for download through this link.

FAQ

Q: What is IRS Form 706-GS(D-1)?

A: IRS Form 706-GS(D-1) is a form used to report the distribution from a generation-skipping trust.

Q: Who needs to file IRS Form 706-GS(D-1)?

A: Individuals who are responsible for making a distribution from a generation-skipping trust need to file IRS Form 706-GS(D-1).

Q: What is a generation-skipping trust?

A: A generation-skipping trust is a trust that allows assets to be transferred to grandchildren or more remote generations, bypassing the children.

Q: When is IRS Form 706-GS(D-1) due?

A: IRS Form 706-GS(D-1) is generally due on the same date as the federal estate tax return, which is 9 months after the decedent's death.

Q: What information is required on IRS Form 706-GS(D-1)?

A: IRS Form 706-GS(D-1) requires information about the trust, the distribution, and the beneficiaries receiving the distribution.

Q: Are there any penalties for not filing IRS Form 706-GS(D-1)?

A: Yes, there can be penalties for not filing or filing late, including monetary penalties and potential loss of the generation-skipping transfer (GST) tax exemption.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.