Consumer's Guide to Repossession Practices - California

Consumer's Guide to Repossession Practices is a legal document that was released by the California Department of Consumer Affairs - a government authority operating within California.

FAQ

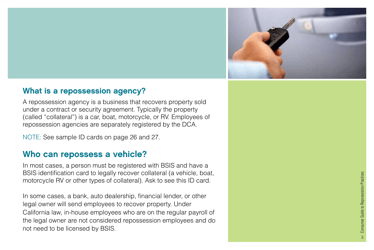

Q: What is repossession?

A: Repossession is when a creditor takes back someone's property as collateral for an unpaid debt.

Q: When can a creditor repossess my property in California?

A: In California, a creditor can repossess your property if you default on the loan agreement.

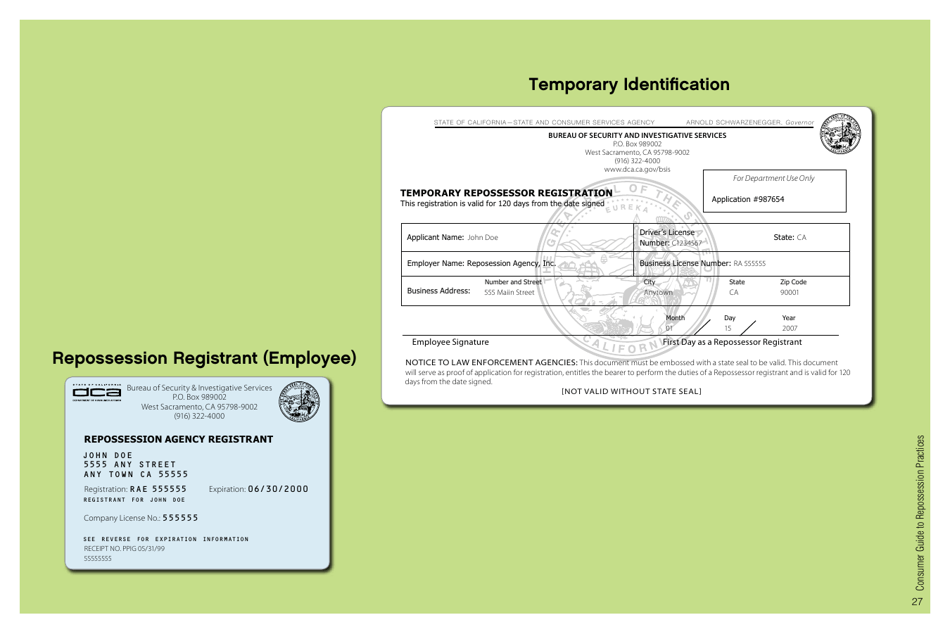

Q: What are the rights of consumers in California during repossession?

A: Consumers in California have the right to receive notice before repossession, the right to redeem the property, and the right to reinstate the loan.

Q: Can a creditor repossess my property without a court order?

A: In most cases, a creditor cannot repossess your property without a court order in California.

Q: Can a creditor repossess my property using force or threats?

A: No, a creditor cannot use force or threats to repossess your property in California.

Q: What should I do if my property is repossessed in California?

A: If your property is repossessed in California, you should contact an attorney to understand your rights and options.

Q: Can I get my property back after repossession?

A: In some cases, you may be able to get your property back after repossession by paying off the debt or reaching an agreement with the creditor.

Q: Is there a statute of limitations for repossession in California?

A: Yes, there is a statute of limitations for repossession in California, which generally ranges from 2 to 4 years, depending on the type of property.

Form Details:

- The latest edition currently provided by the California Department of Consumer Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the California Department of Consumer Affairs.