Form 17 Declaration of Beneficial Interests in Joint Property and Income - United Kingdom

What Is HMRC Form 17?

Form 17, Declaration of Beneficial Interests in Joint Property and Income , is used by individuals who own property with their spouses or civil partners to inform the appropriate government authority that the joint owners would like to change the portion of the income from their property for tax purposes.

Alternate Name:

- HMRC Form 17.

Generally, when spouses or civil partners own the property as joint owners, they are taxed on an even share of income. If the individuals would like to be taxed on their actual share, they can file HMRC Form 17.

This form was issued by United Kingdom HM Revenue & Customs and was last revised on June 1, 2011 . A printable HMRC Form 17 is available for download through the link below for reference purposes. The actual form can only be only filed online on the official website of the government of the United Kingdom.

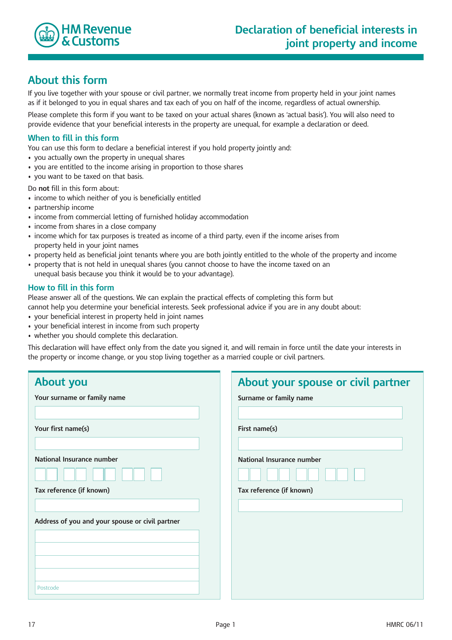

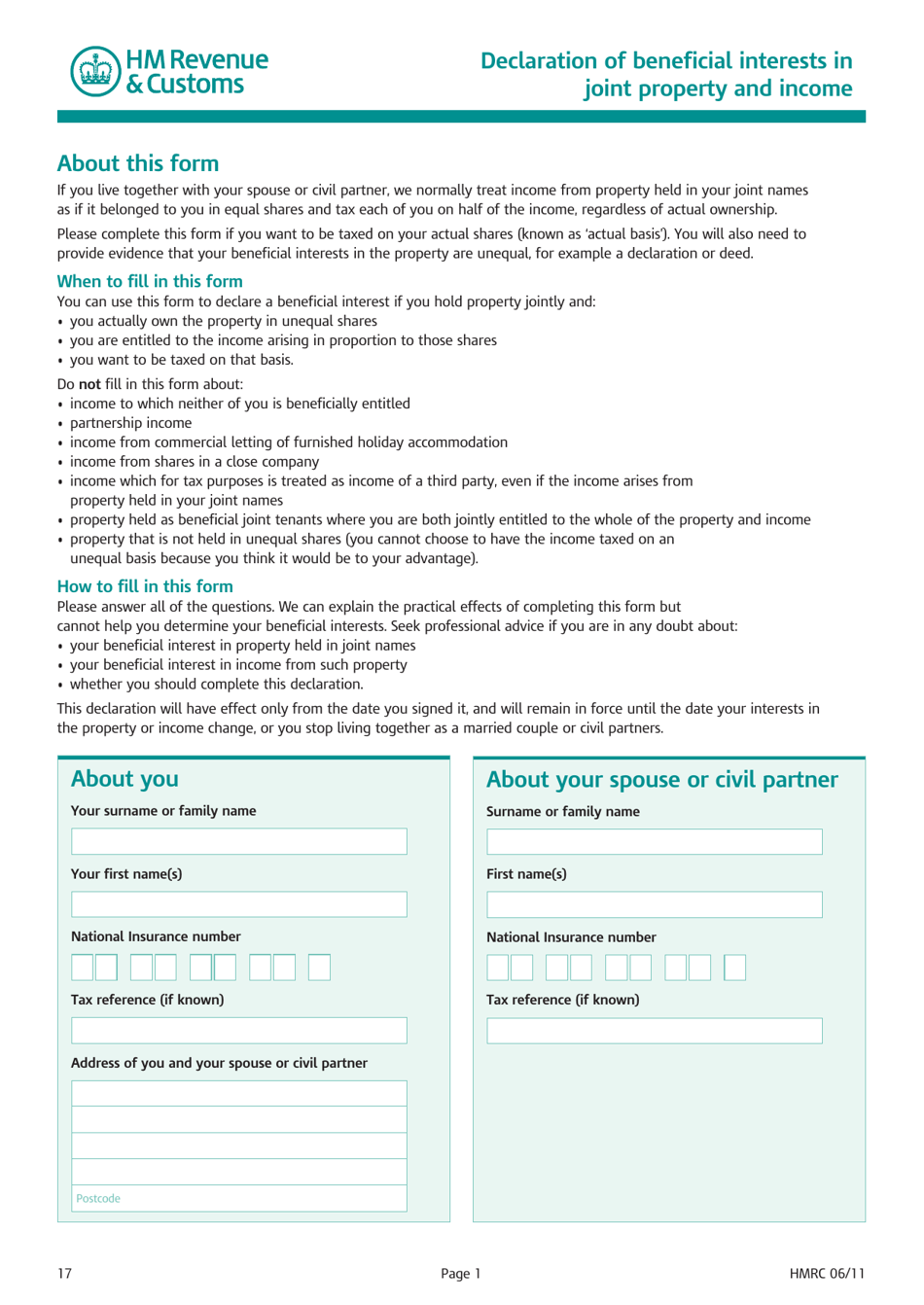

HMRC Form 17 Instructions

- Introduction. In the first part of the document, applicants are provided with instructions on how to complete the document, a brief description of the purpose of the form, and information on who can file it.

- Information About the Individual. Applicants are supposed to use this section of the declaration to designate their name, national insurance number, and the address where they live with their partner.

- Information About the Individual's Spouse/Civil Partner. Here, the partner of the applicant must designate their name, national insurance number, and tax reference.

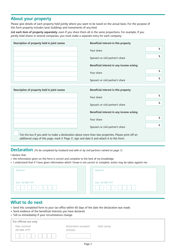

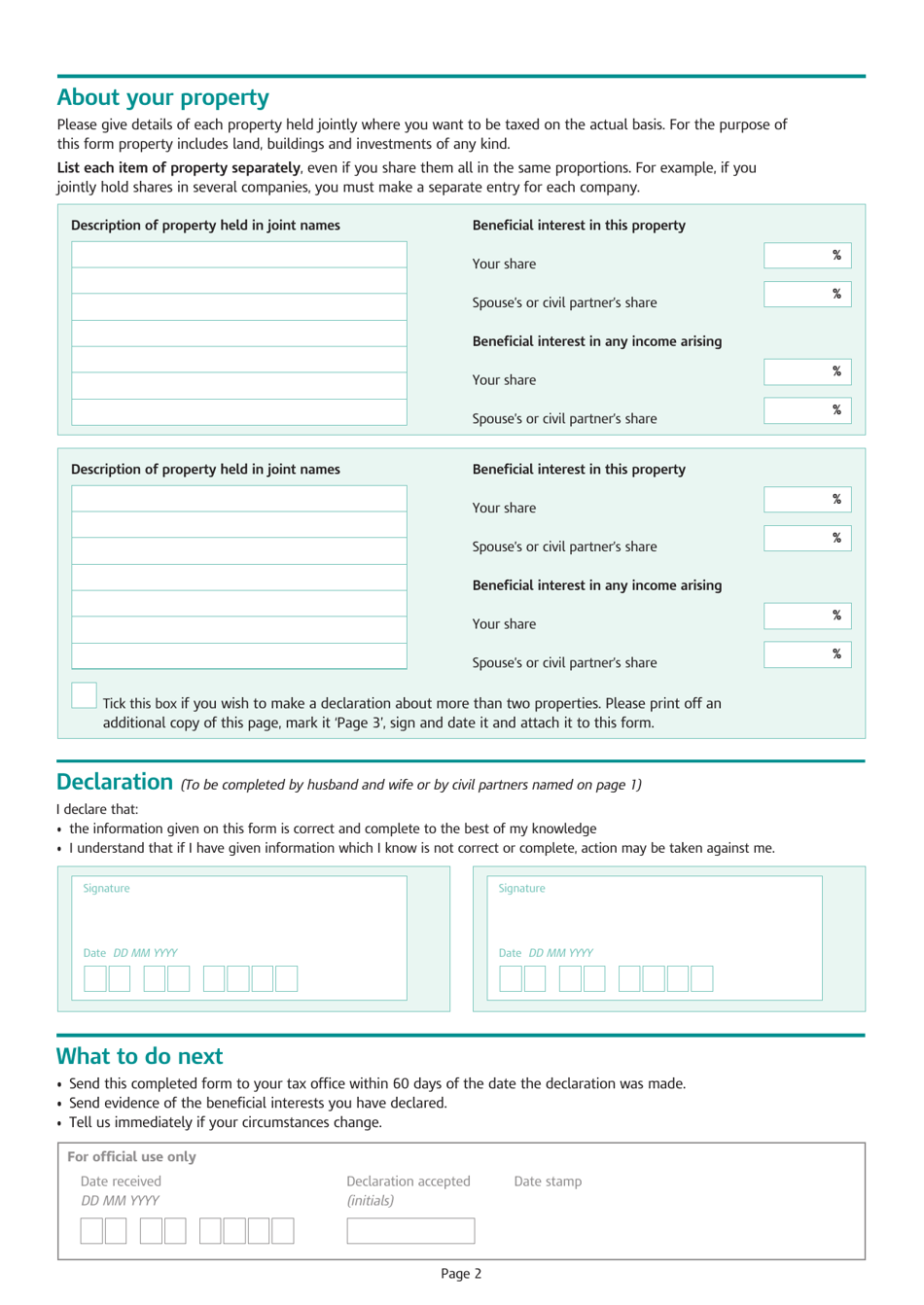

- Property Details. Applicants must use this part of the form to provide details about the property they own jointly and to state the shares they each own independently.

- Signatures. At the end of the declaration, the applicant and their spouse or civil partner must sign and date the document. By doing so, they will indicate that the information they presented is true and correct.

In order to change splits, applicants are supposed to provide proof that their beneficial interest is unequal. HMRC Form 17 evidence can be presented in the form of a declaration or a deed.