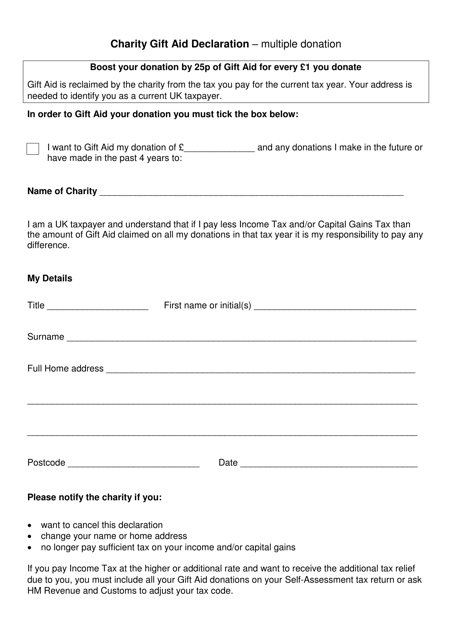

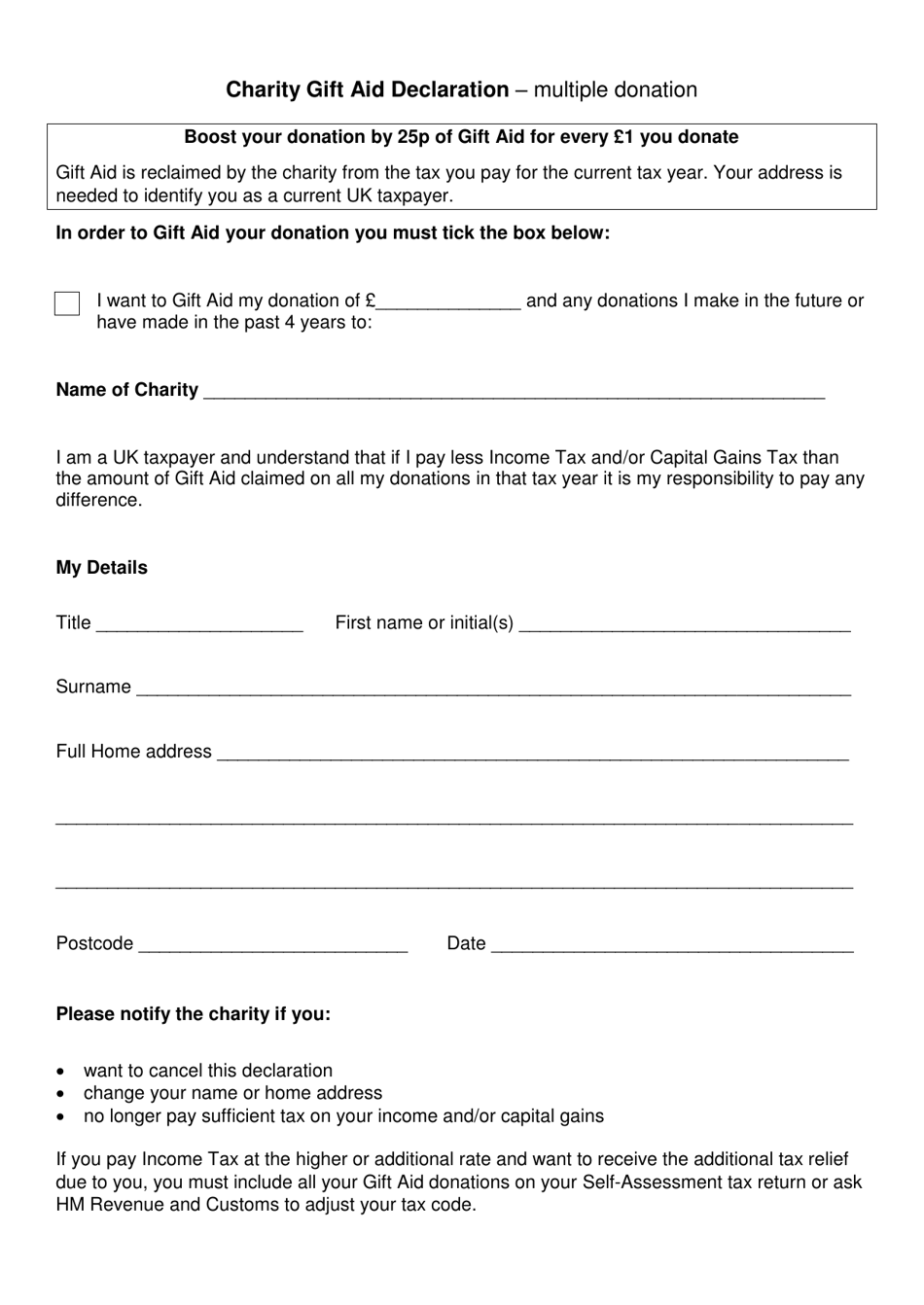

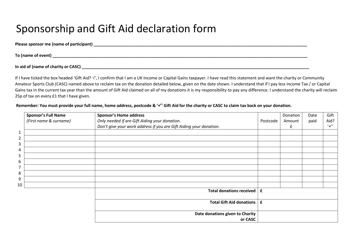

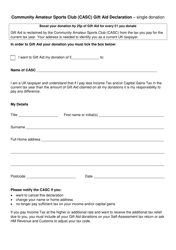

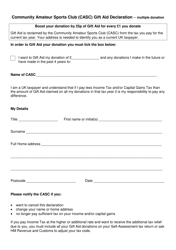

Charity Gift Aid Declaration - Multiple Donation - United Kingdom

The Charity Gift Aid Declaration - Multiple Donation in the United Kingdom is for individuals who wish to give multiple donations to charity and claim Gift Aid on all of them. Gift Aid allows charities to claim back the basic rate of tax on the donations made by UK taxpayers.

The donor or the individual making the multiple donations files the Charity Gift Aid Declaration in the United Kingdom.

FAQ

Q: What is a Charity Gift Aid Declaration?

A: A Charity Gift Aid Declaration is a form that individuals in the United Kingdom can complete to allow charities to claim Gift Aid on their donations.

Q: What is Gift Aid?

A: Gift Aid is a tax relief provided by the UK government that allows charities to claim an additional 25p for every £1 donated by a taxpayer, at no extra cost to the donor.

Q: Who can make a Charity Gift Aid Declaration?

A: Any individual in the United Kingdom who pays tax can make a Charity Gift Aid Declaration.

Q: What does a Charity Gift Aid Declaration allow charities to do?

A: A Charity Gift Aid Declaration allows charities to claim Gift Aid on donations made by the individual.

Q: Are there any requirements for making a Charity Gift Aid Declaration?

A: Yes, the individual making the declaration must have paid enough tax to cover the Gift Aid claimed by the charity.

Q: Can I make a Charity Gift Aid Declaration for multiple donations?

A: Yes, it is possible to make a Charity Gift Aid Declaration for multiple donations.

Q: How long does a Charity Gift Aid Declaration last?

A: A Charity Gift Aid Declaration remains in place until further notice or until the individual cancels it.

Q: Is there a deadline for submitting a Charity Gift Aid Declaration?

A: There is no specific deadline for submitting a Charity Gift Aid Declaration.

Q: Do I need to keep records of my donations for Gift Aid?

A: Yes, it is important to keep records of your donations, such as bank statements or receipts, as proof for Gift Aid.

Q: Can I backdate a Charity Gift Aid Declaration?

A: No, you cannot backdate a Charity Gift Aid Declaration. It will only apply to donations made after the declaration is made.