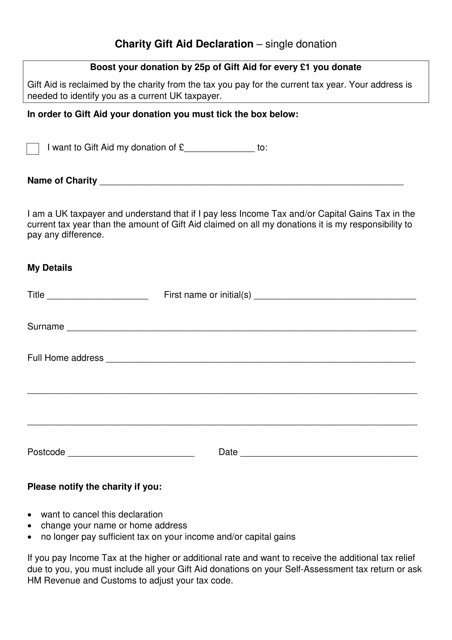

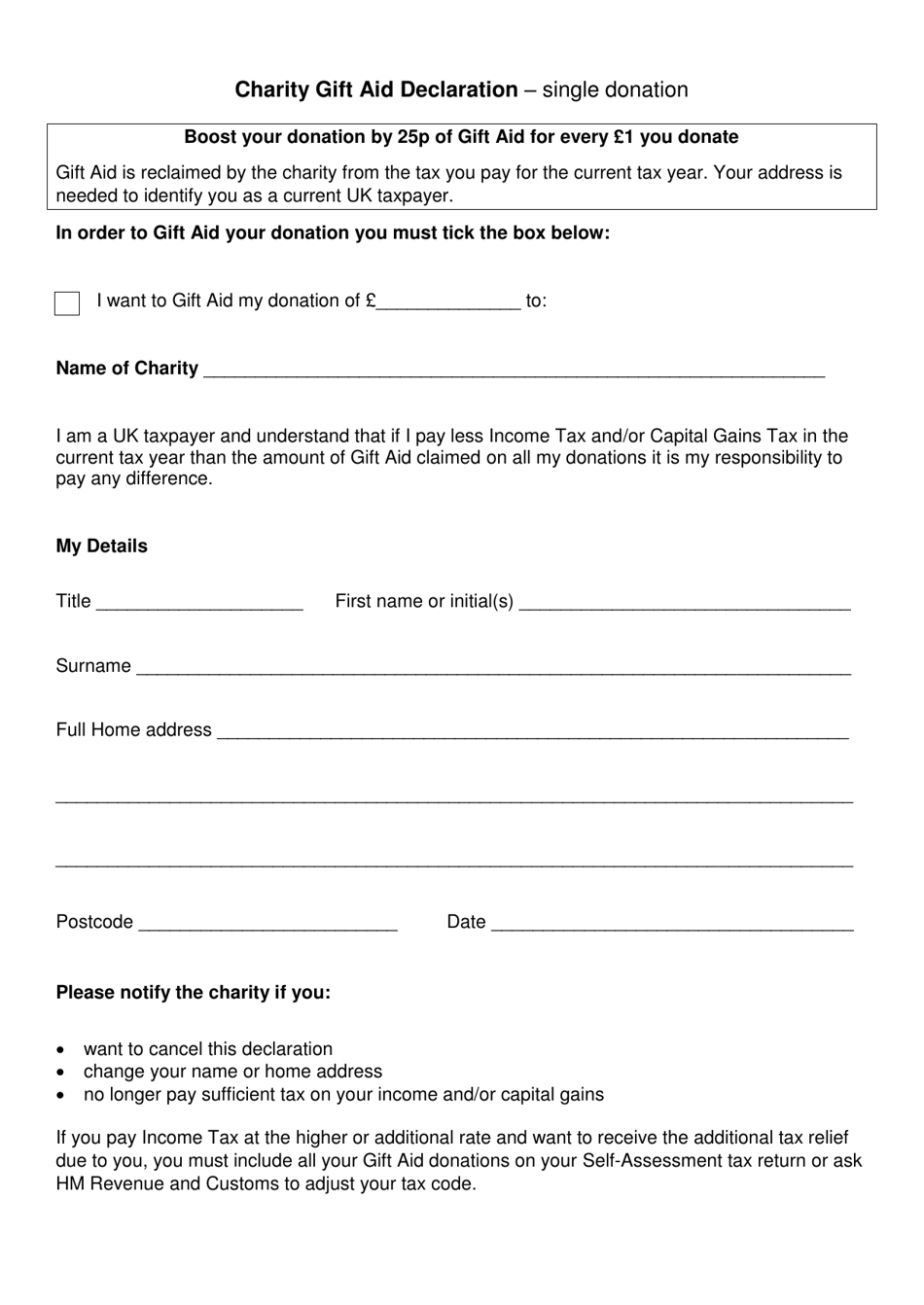

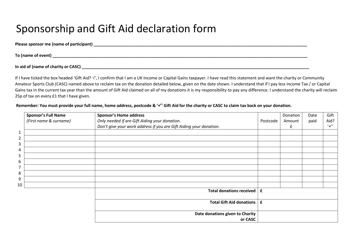

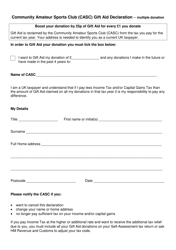

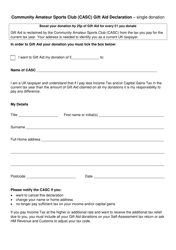

Charity Gift Aid Declaration - Single Donation - United Kingdom

The Charity Gift Aid Declaration - Single Donation in the United Kingdom is a form that allows individuals to declare that they are a UK taxpayer and give permission to a charity to claim back the basic rate tax on their donation. This increases the value of the donation by 25% at no extra cost to the donor.

In the United Kingdom, the person making the donation files the Charity Gift Aid Declaration for a single donation.

FAQ

Q: What is a Charity Gift Aid Declaration?

A: A Charity Gift Aid Declaration is a way for individuals in the United Kingdom to declare that they would like any donations they make to a registered charity to be treated as Gift Aid donations.

Q: What is Gift Aid?

A: Gift Aid is a UK tax incentive that allows charities to claim an extra 25p for every £1 donated by a UK taxpayer, at no extra cost to the taxpayer.

Q: Who can make a Charity Gift Aid Declaration?

A: Any individual who is a UK taxpayer and has paid enough income tax and/or capital gains tax in the tax year can make a Charity Gift Aid Declaration.

Q: How does the Charity Gift Aid Declaration work?

A: When an individual makes a donation to a registered charity and completes a Charity Gift Aid Declaration, the charity can claim back the basic rate of tax on the donation, increasing its value.

Q: Is there a minimum donation amount to make a Charity Gift Aid Declaration?

A: No, there is no minimum donation amount to make a Charity Gift Aid Declaration.

Q: Is there a limit to how much Gift Aid can be claimed?

A: No, there is no limit to how much Gift Aid a charity can claim, as long as the donor has paid enough tax to cover the amount being claimed.

Q: Can a Charity Gift Aid Declaration be backdated?

A: No, a Charity Gift Aid Declaration cannot be backdated. It must be made before or at the same time as the donation is made.

Q: What happens if a taxpayer stops paying taxes?

A: If a taxpayer stops paying taxes or their tax circumstances change, they should inform the charity to stop claiming Gift Aid on their donations.

Q: Can a taxpayer cancel a Charity Gift Aid Declaration?

A: Yes, a taxpayer can cancel a Charity Gift Aid Declaration at any time by notifying the charity.