Starter Checklist - United Kingdom

What Is HMRC Starter Checklist?

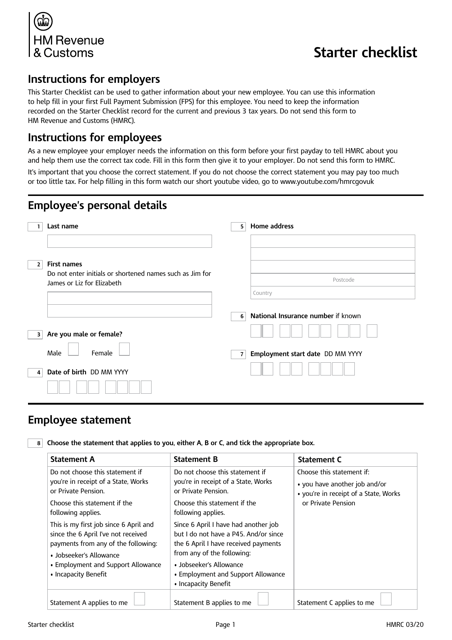

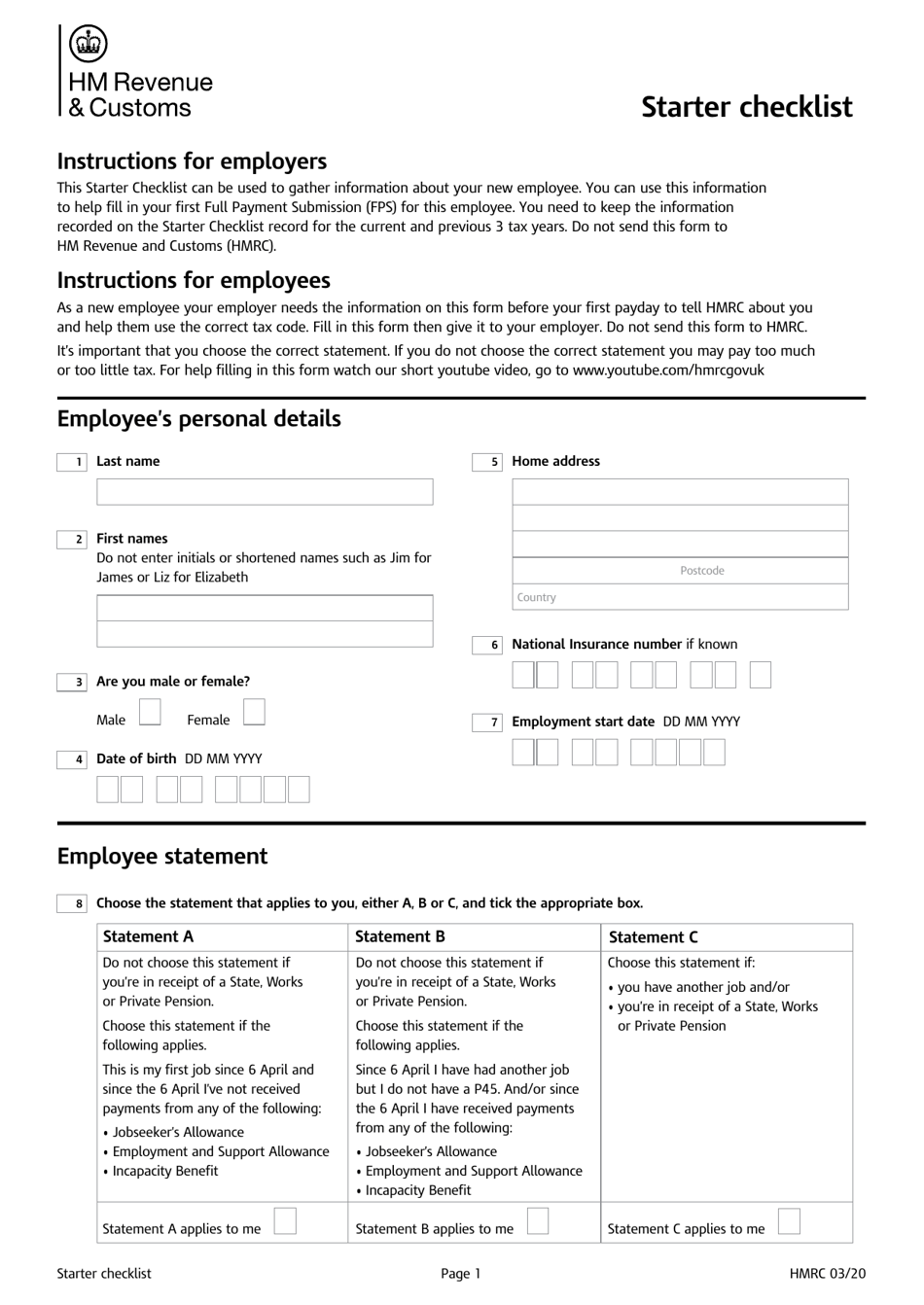

The HMRC Starter Checklist is an official form that allows employers to collect information about their employees, their previous employment, and the pension and benefits they are entitled to. This form was released by the United Kingdom HM Revenue & Customs with the latest version of the document issued on March 1, 2020 , with all previous editions obsolete. A printable HMRC Starter Checklist can be downloaded through the link below.

Alternate Names:

- HMRC Start Form;

- HMRC New Starter Form;

- HMRC Employee Starter Checklist.

The employer needs to give the HMRC Starter Checklist to any new hire that does not have Form P45, Details of Employee Leaving Work , prepared and signed by their former employer on hand. The details from the checklist will be used by the new employer to retain proper records on every employee and to apply the correct tax code before the new employee's first payday. Additionally, a properly-completed HMRC Starter Checklist will help the employee avoid paying too much or too little tax on their earnings.

How to Fill Out HMRC Starter Checklist?

HMRC Starter Checklist instructions are as follows:

-

Indicate your legal name, gender, and date of birth. Write down your residential address, National Insurance number, and the date you began working for your current employer.

-

Examine three statements and choose the one that applies to your situation:

- Confirm your present employment is your first job since April 6th, and you have not received any allowances granted to unemployed individuals;

- Verify you have had another employment since April 6th, but the former employer did not give you Form P45. Additionally, you had no benefit payments;

- State you have another job at the moment and/or you are receiving a pension.

-

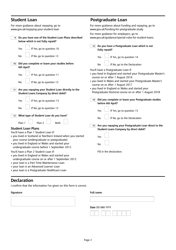

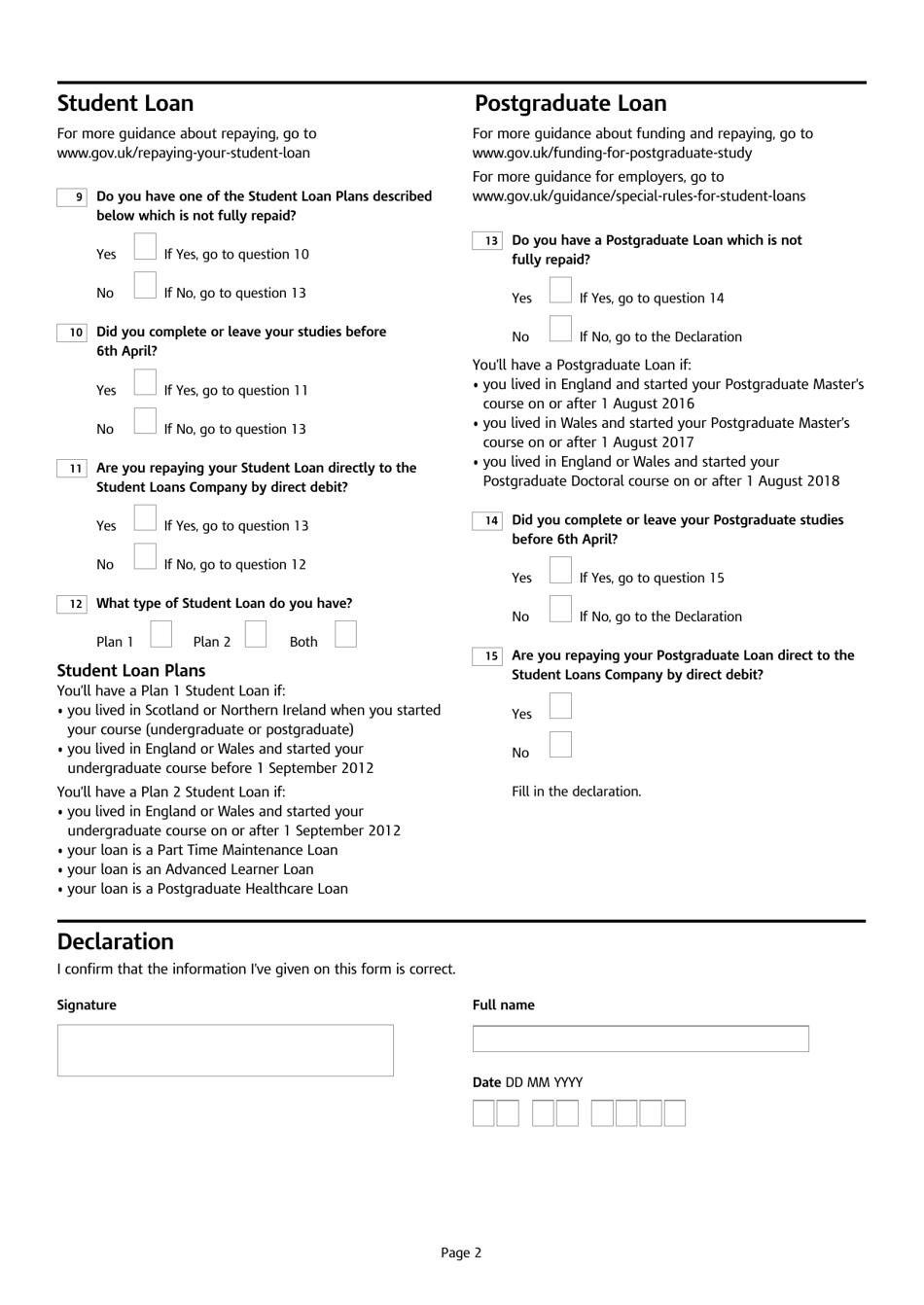

If you are responsible for paying student loans, tick the box to confirm it. Specify whether you completed or left your studies before April 6th, and whether you repay the debts using direct debit. Select the type of student loan you currently have - you can see their descriptions below the questions.

-

If you are still paying your postgraduate loan, answer "yes" - the definition of a postgraduate loan is also available in the checklist, make sure you comply with the requirements prescribed by the United Kingdom HM Revenue & Customs. If you completed or left your studies before April 6th, tick the box. In case you are still handling the payments via direct debit, specify it in the form.

-

Confirm all the details you have listed in the document are true and correct. Write down your legal name, sign and date the checklist.

Once you have filled out all applicable sections in the form, give it to your employer. They will keep it for the company records - there is no need to submit the checklist to the United Kingdom HM Revenue & Customs but the documentation may become necessary in the event of an audit. This document must be retained in the payroll records of the organization for the current year and three more years.