Form SH03 Return of Purchase of Own Shares - United Kingdom

Fill PDF Online

Fill out online for free

without registration or credit card

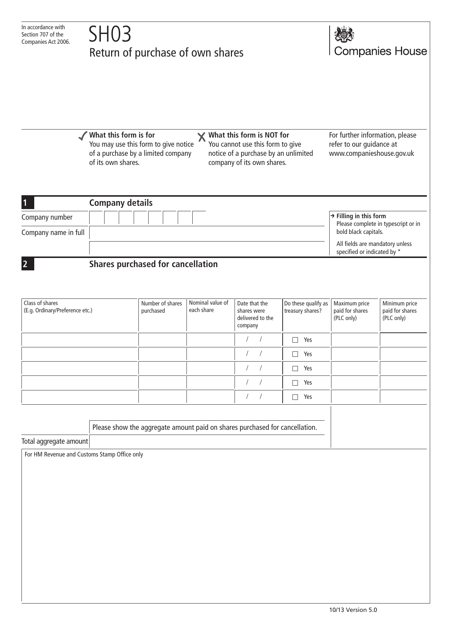

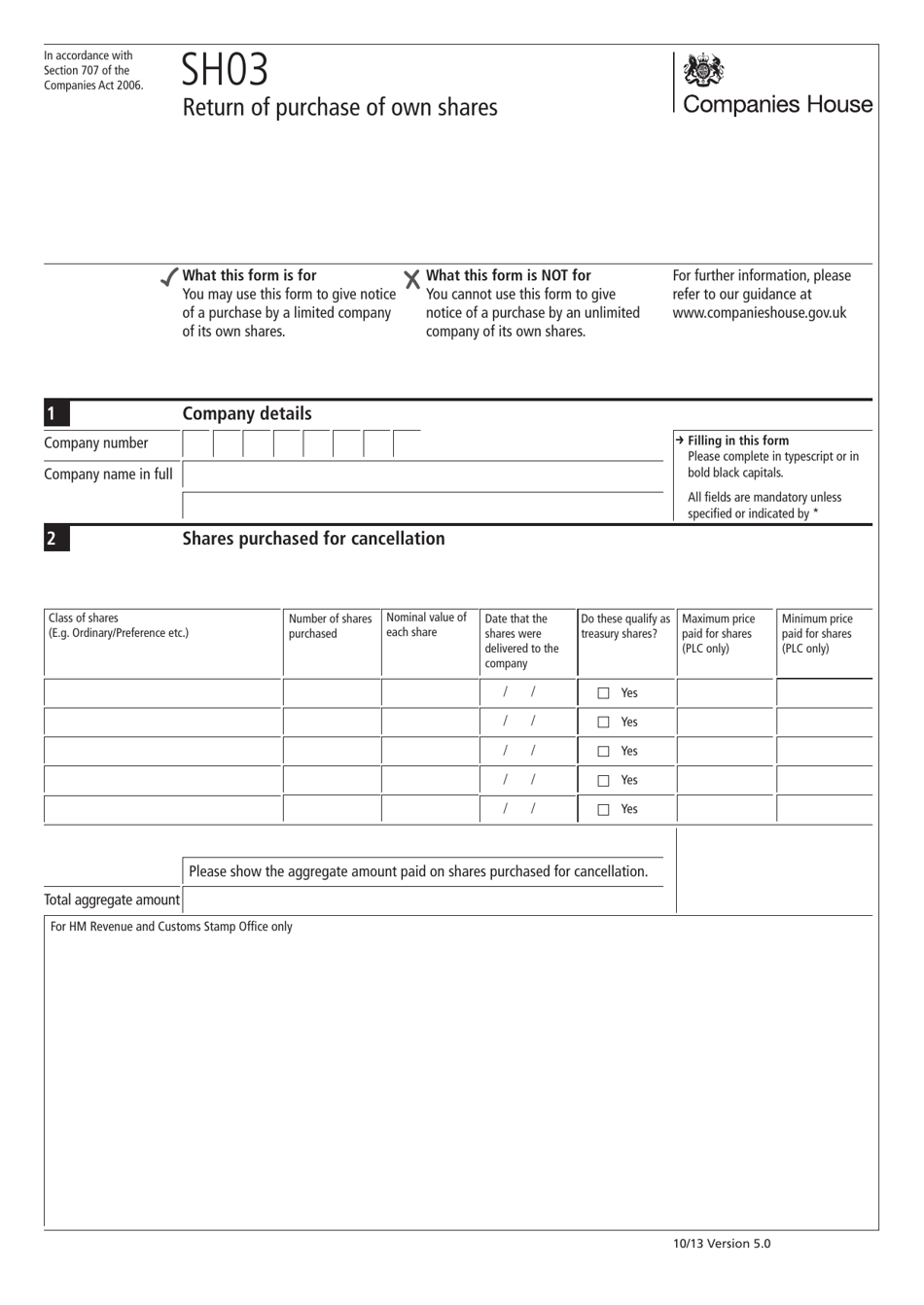

What Is Form SH03?

Form SH03, Return of Purchase of Own Shares , is a document prepared by a representative of a limited company to inform the government about the purchase of shares issued by the company in the past. Any company can buy shares from its shareholders and cancel or redenominate them which comes in handy when one of the shareholders expresses their wish to leave the company and other shareholders cannot purchase their shares for some reason.

Alternate Name:

- United Kingdom Share Transfer Form.

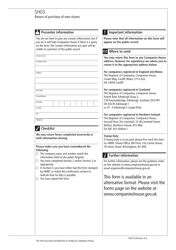

This form was issued by the United Kingdom Companies House on October 1, 2013 , with all previous editions obsolete. You can download Form SH03 through the link below.

UK Share Transfer Form Instructions

Follow these steps to complete Form SH03:

- Name the company you represent and add its number from the incorporation certificate.

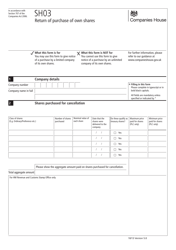

- List categories of shares purchased, their number, value, date of purchase, the maximum and minimum price paid for them. Indicate whether the shares qualify as treasury shares.

- Record the aggregate amount paid on shares your business has purchased for cancellation.

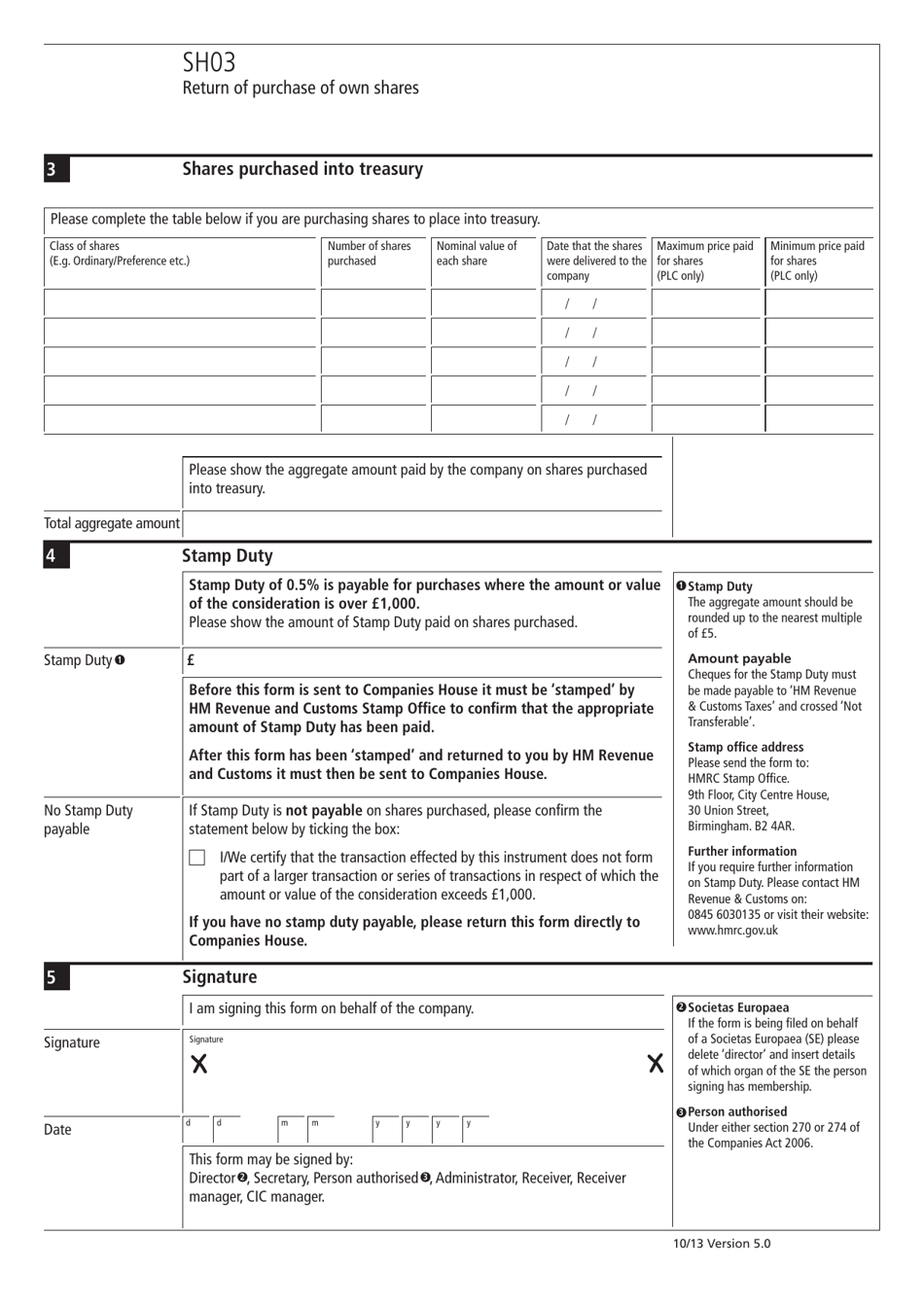

- If you plan to place purchased shares into the treasury, list them and state their amount and aggregate value.

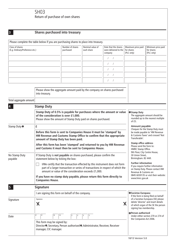

- Write down the amount of Stamp Duty - you can calculate it by multiplying the value of the shares by 0.5%. If the transaction does not belong to a series of transactions or a larger transaction, you can tick the appropriate box to confirm no Stamp Duty is required.

- Sign and date the form. It can be drafted and signed by the director, administrator, secretary, or another individual authorized to prepare this statement by the internal documentation of the company.

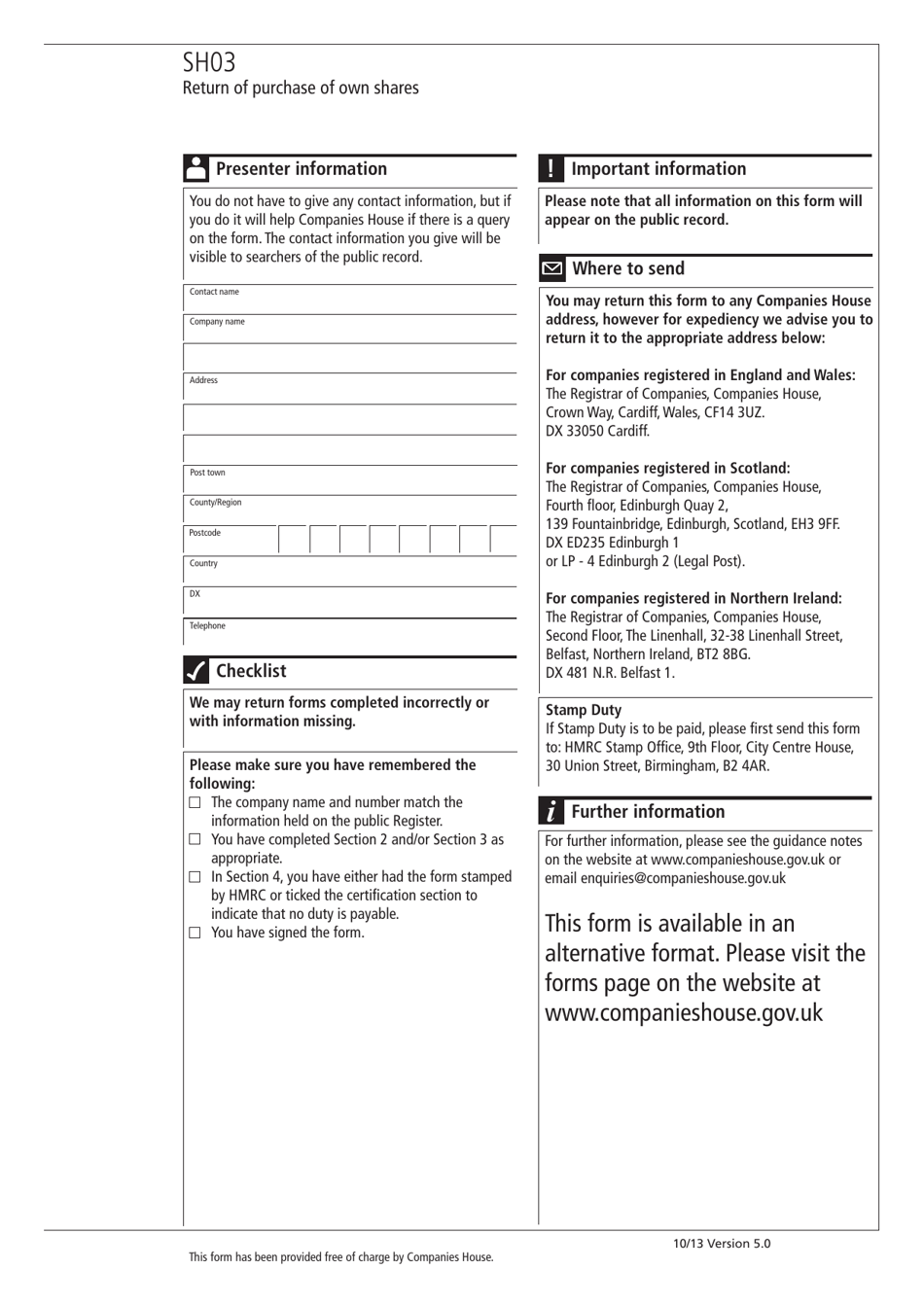

- Add your contact information if you agree to participate in upcoming queries about the form.