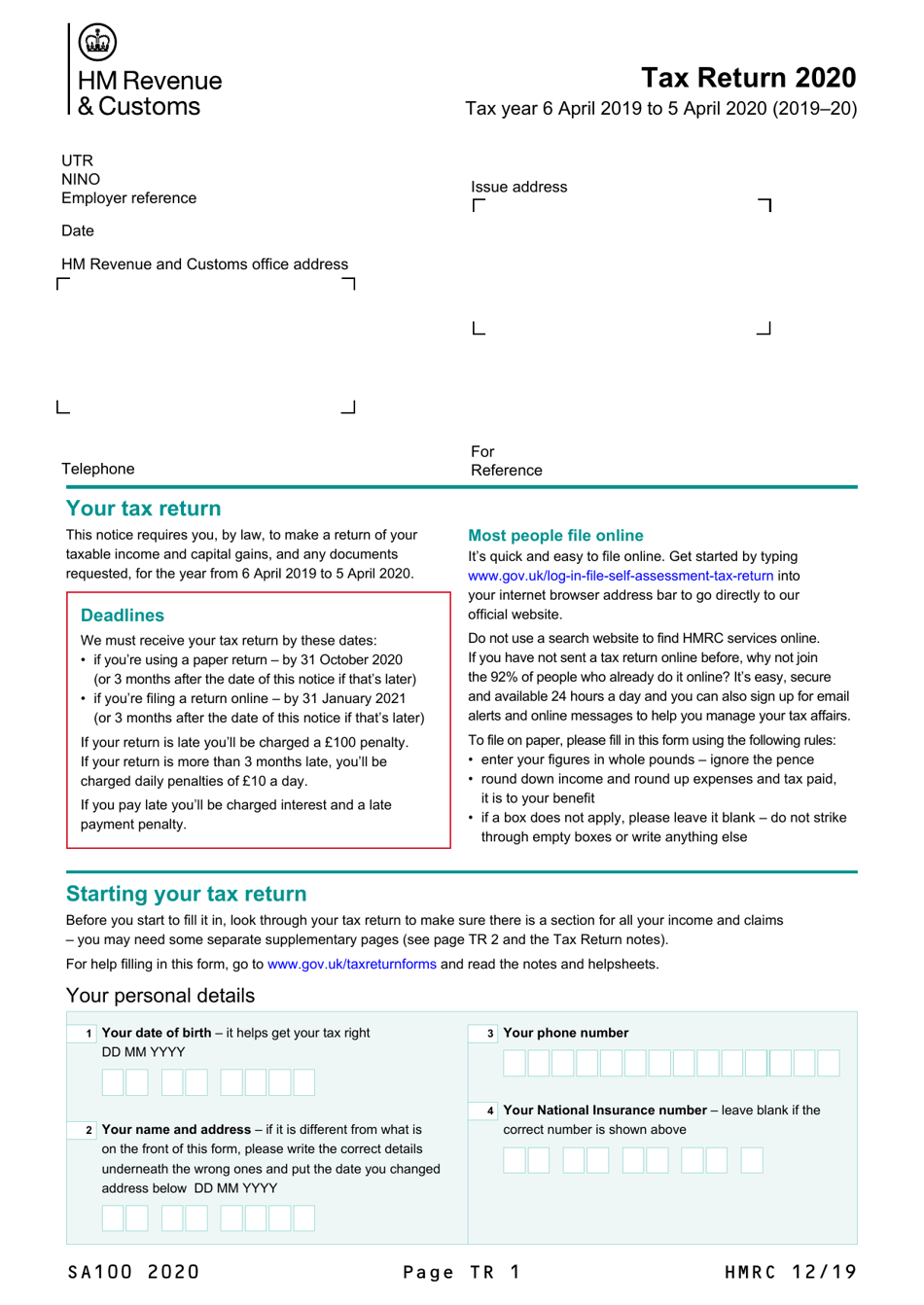

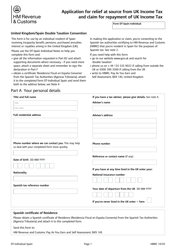

Form SA100 Tax Return - United Kingdom

What Is Form SA100?

Form SA100, Tax Return , is a formal statement used for reporting income, loan repayments, pensions, annuities, charitable contributions, and tax allowances. Additionally, this document can be prepared to receive tax refunds and claim the government owes you money from previous tax filings.

Alternate Names:

- United Kingdom Tax Return Form;

- Tax Self Assessment Form.

This is the main tax form to use to submit details about your income - add supplemental documentation to report details on your income, savings, and investments. The deadline for a paper tax return submitted by an individual is October 31st of each year.

How to Get a SA100 Form?

You can download a fillable Form SA100 through the link below. This document was issued by the United Kingdom HM Revenue & Customs. The latest version of the form became available on December 1, 2019 , with all previous editions obsolete.

How to Complete SA100 Form?

Follow these steps to prepare SA100 Form:

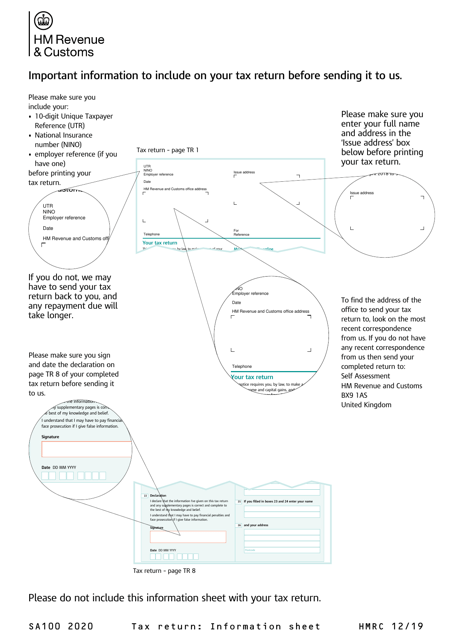

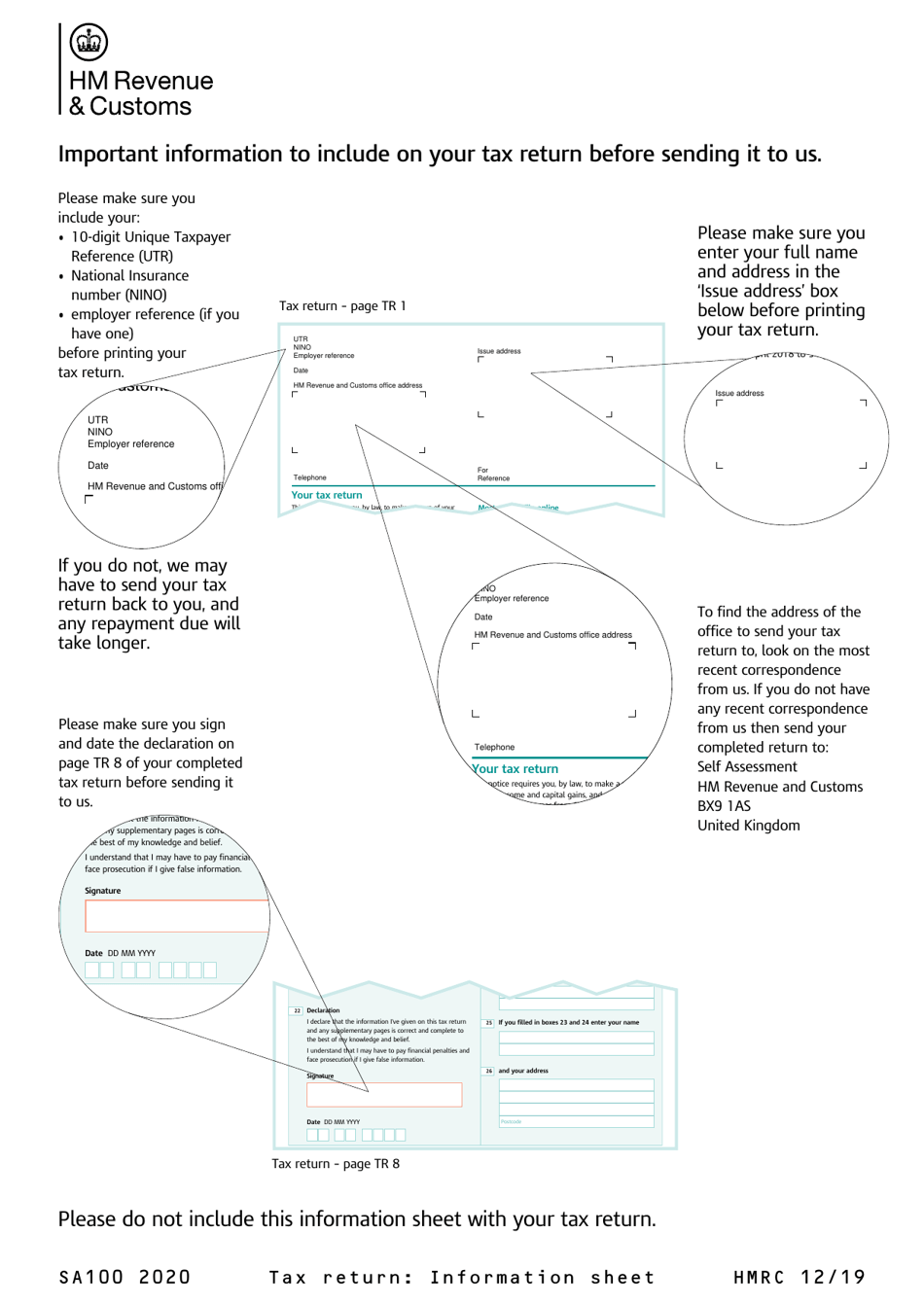

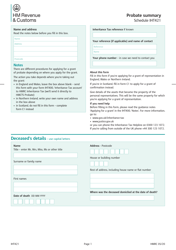

- Indicate your Unique Taxpayer Reference Number, National Insurance Number, and employer reference if applicable. Add your name and mailing address.

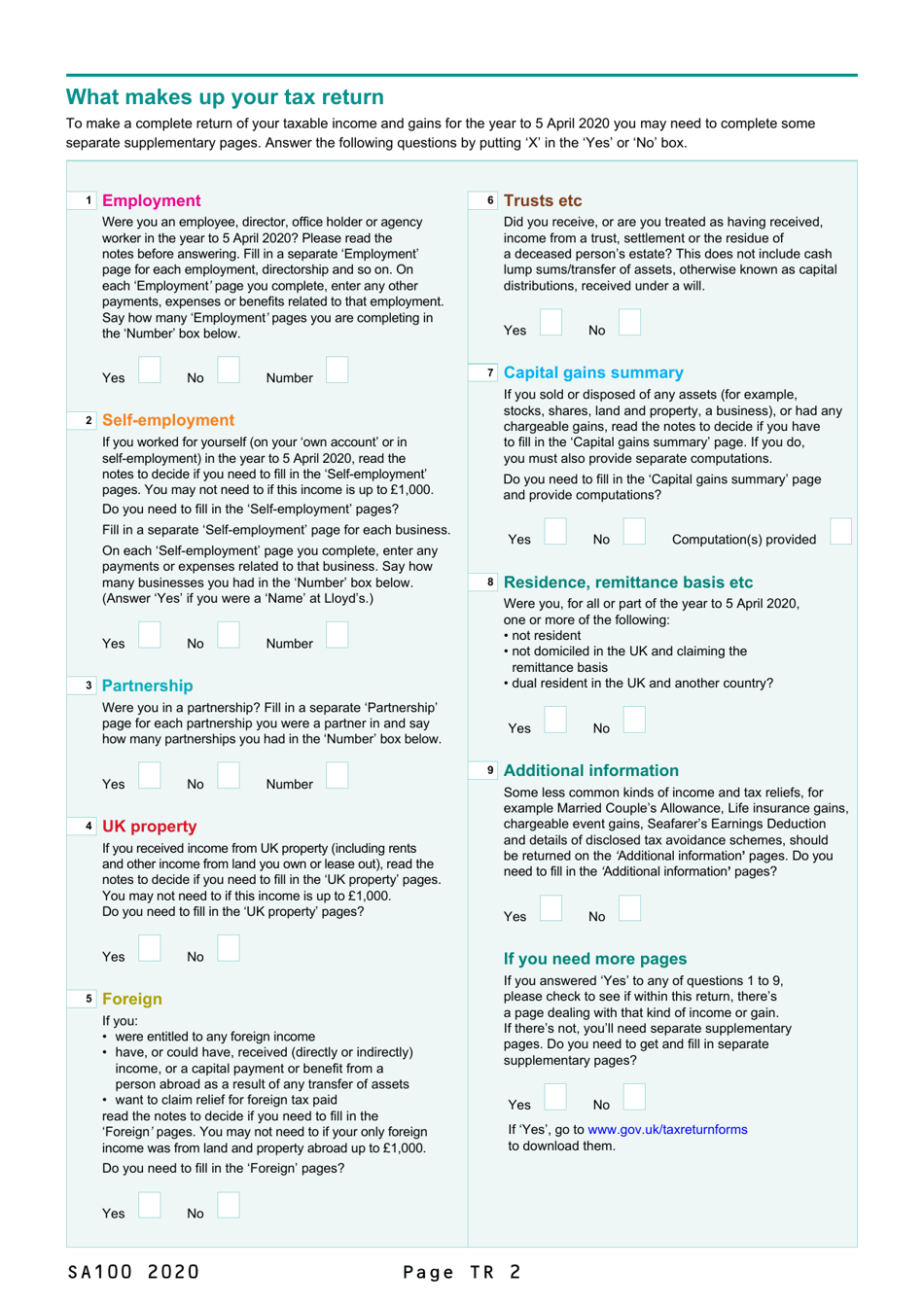

- Check the appropriate boxes to show how many supplementary pages you file and what category they belong (employment, self-employment, partnership, assets, foreign, trusts, profits earned after you sold your assets, residence basis, etc.).

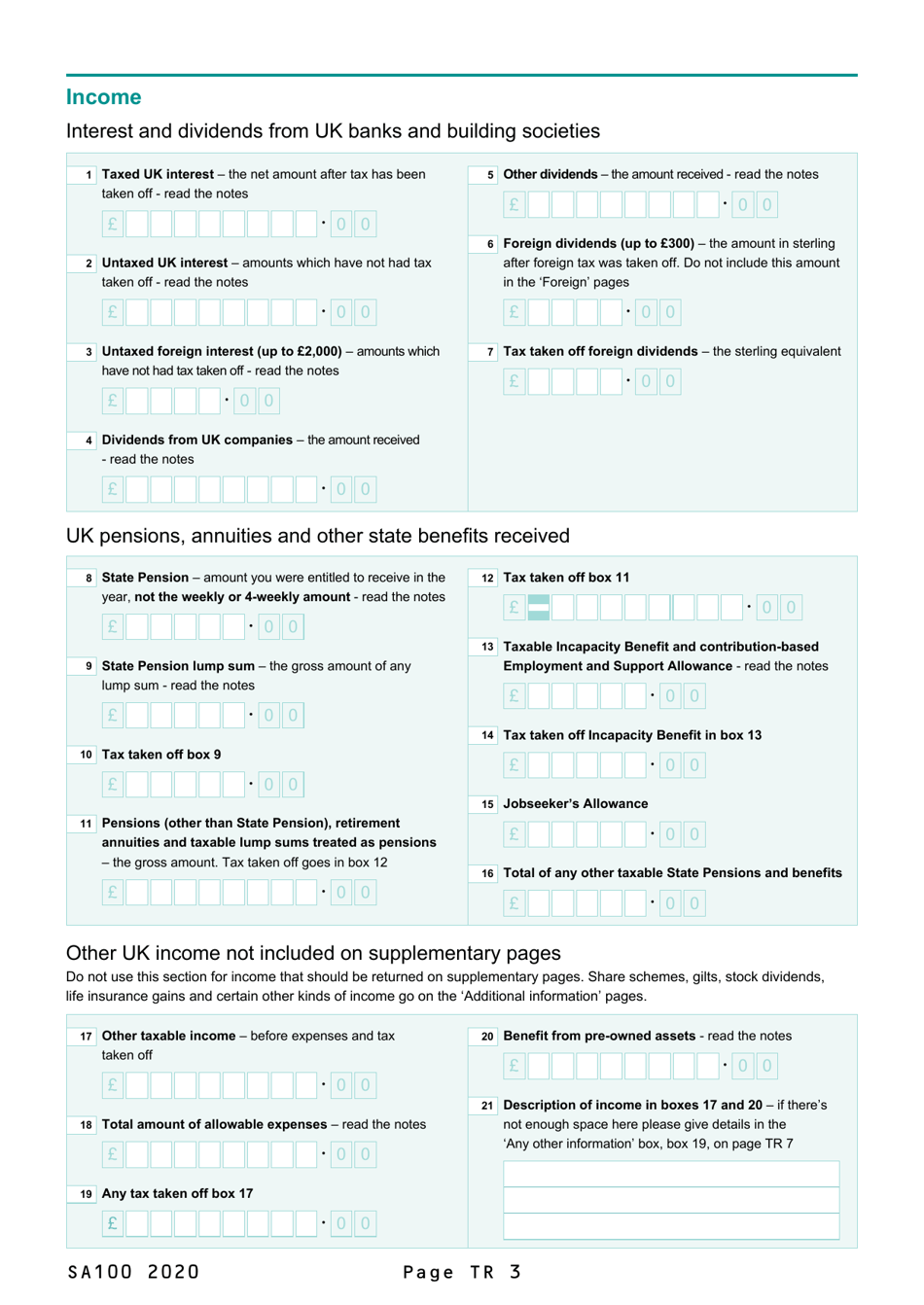

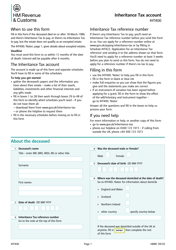

- List the amount of interest and dividends you have received from banks and building societies. Outline the number of state benefits you have obtained during the reporting year. Provide a brief summary of other domestic income not included in other categories.

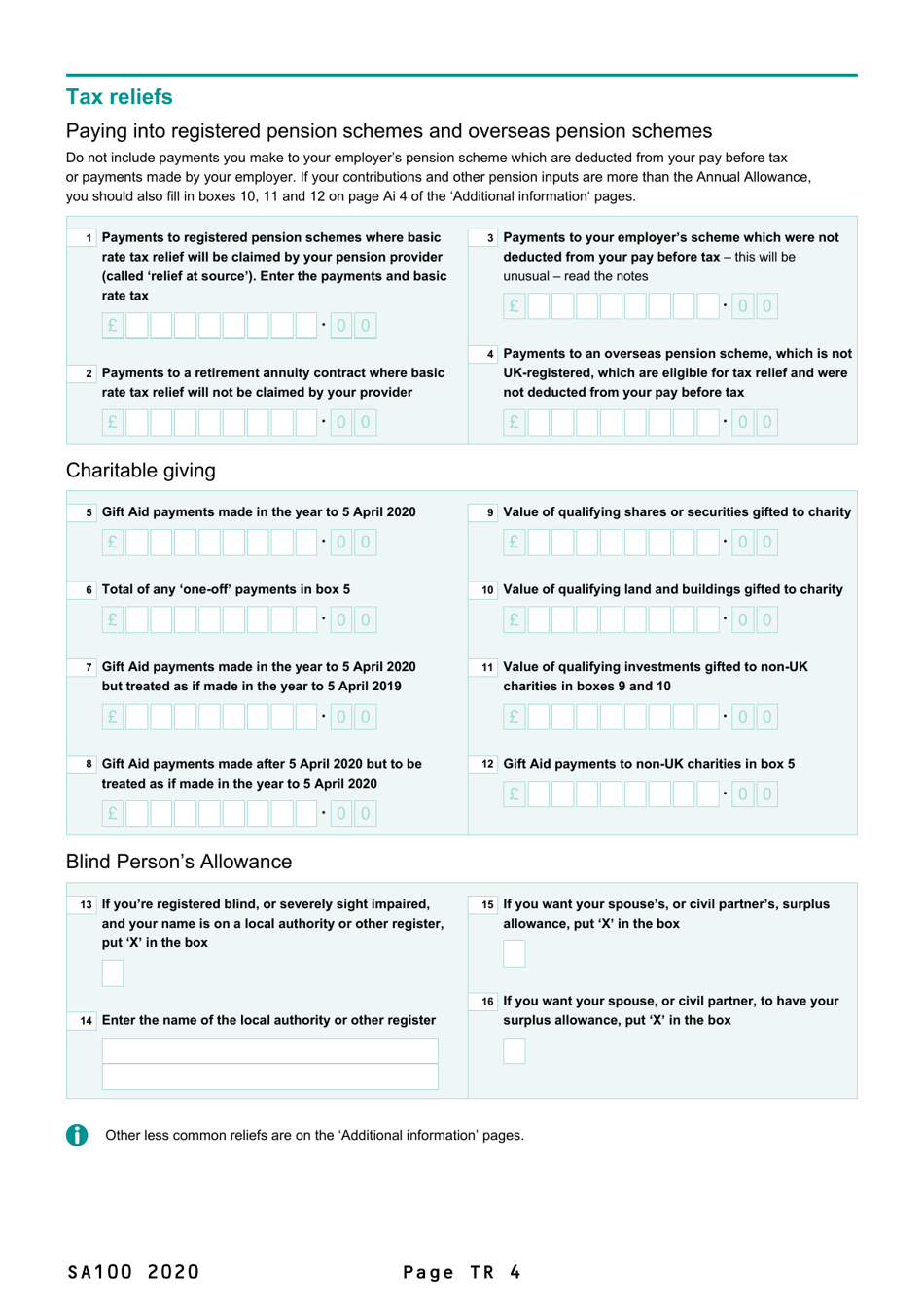

- Record the tax reliefs you have a right to if you have made qualified payments such as Gift Aid payments or need to receive a Blind Person's Allowance.

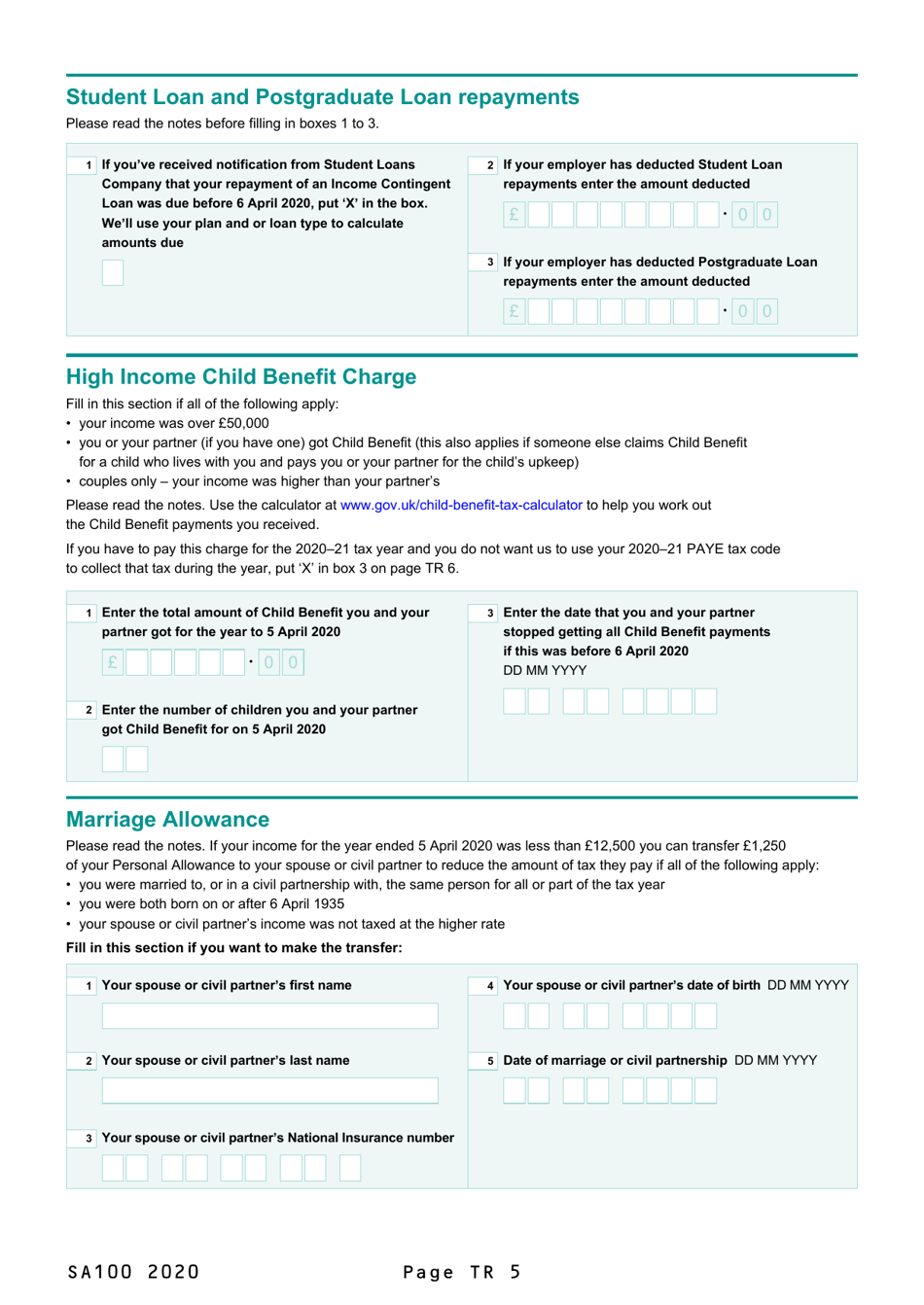

- Calculate the amount of your student loan and postgraduate loan repayments deducted by your employer.

- Indicate the amount of child benefit you have received and indicate the number of children that were eligible for this payment.

- If you want to transfer your marriage allowance to your spouse, write down their name, National Insurance number, date of birth, and the date of your marriage.

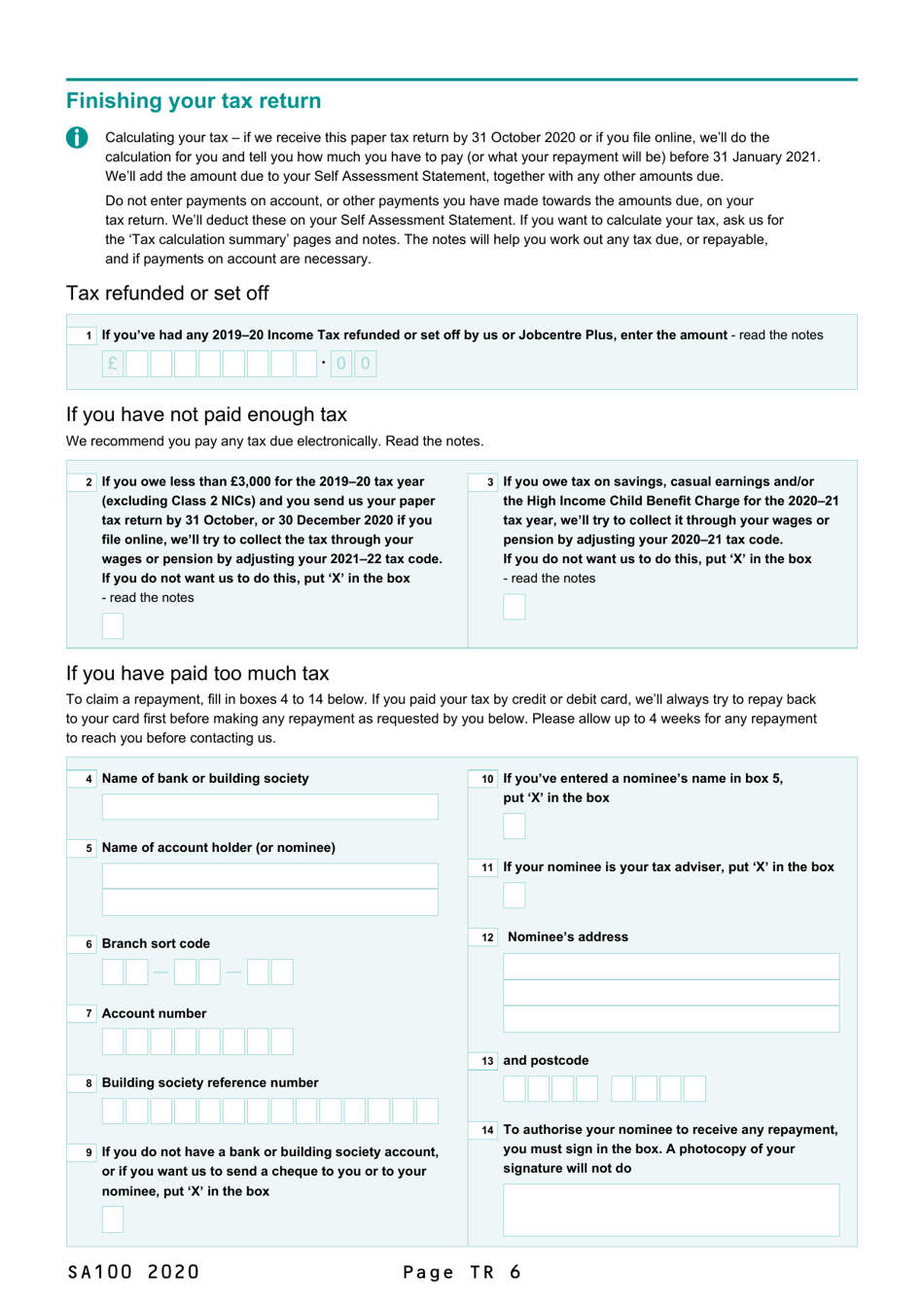

- Enter the amount of the tax refund you have received during the reporting year. Taxpayers are often looking for an "HMRC Uniform Tax Rebate Application Form" but this information must be submitted via the general Tax Return Form.

- If you owe tax to the United Kingdom HM Revenue & Customs or believe you have paid too much tax in the past, check the appropriate box or enter your bank account information to receive the repayment.

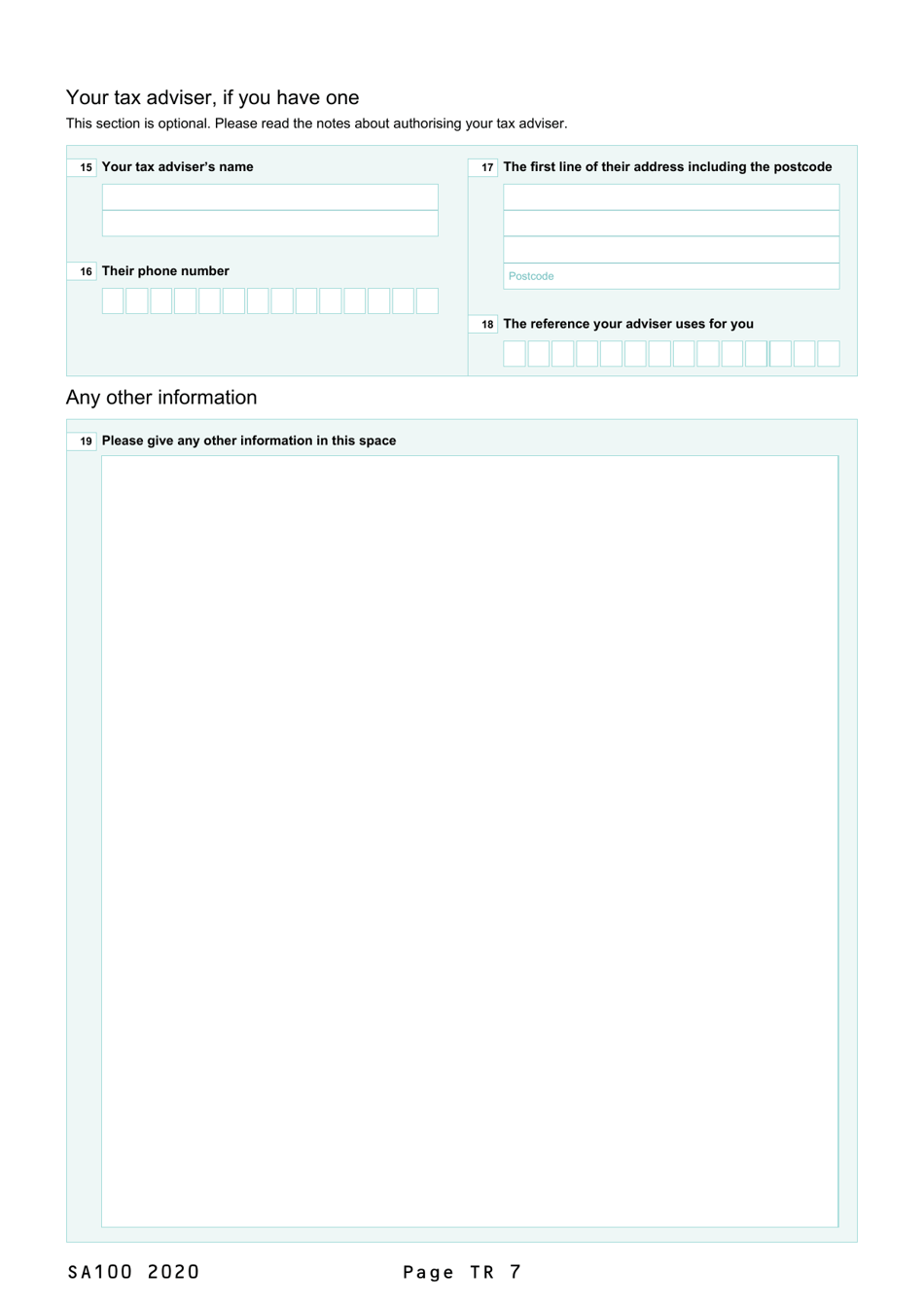

- In case your tax adviser helped you to complete the return, write down their details.

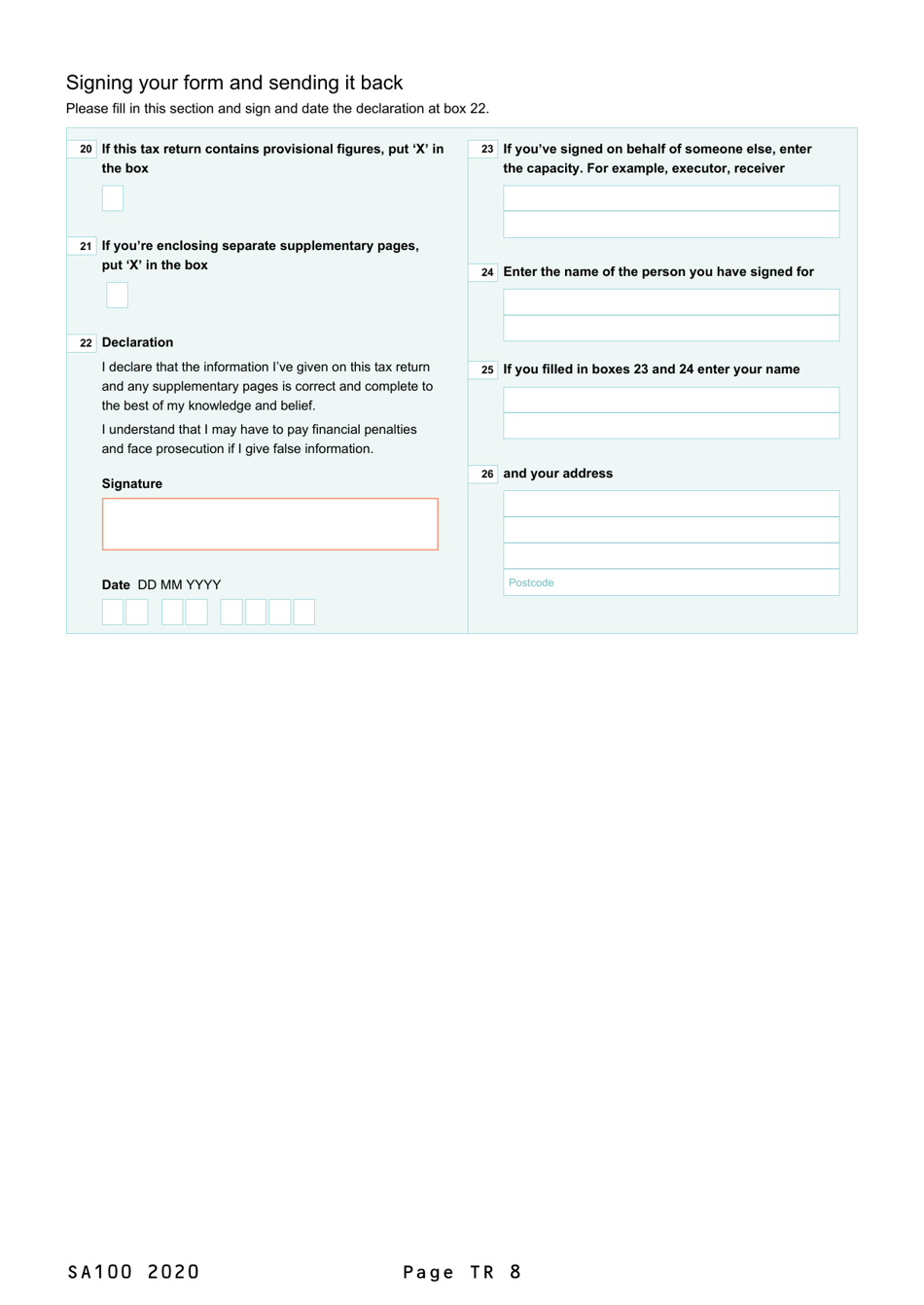

- Use free space to add important details about the return. If the form is prepared by a legal representative of the taxpayer, they must state their information. Check the boxes to verify the number of pages you are filing, sign and date the form.