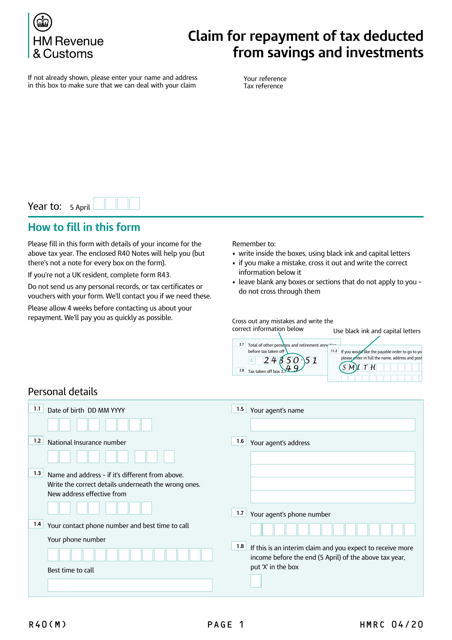

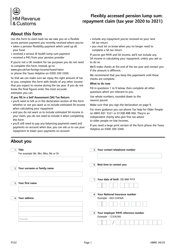

Form R40 Claim for Repayment of Tax Deducted From Savings and Investments - United Kingdom

What Is Form R40?

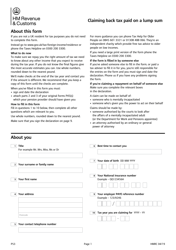

Form R40, Claim for Repayment of Tax Deducted from Savings and Investments , is a document used by individuals looking to claim a repayment of tax on their savings interest. This document allows individuals to make a repayment claim if they think they are entitled to it.

Alternate Names:

- Tax Form R40;

- HMRC Form R40;

- R40 Tax Repayment Form.

The form was issued by the United Kingdom HM Revenue & Customs and was last revised on April 1, 2020 . A printable R40 Form can be downloaded through the link below. This form is supposed to only be used by residents of the United Kingdom. If a non-resident would like to make a claim they can use Form R43, Claim to Personal Allowances and Tax Repayment by an Individual Not Resident in the UK.

It is important to note that individuals can only make a claim via Form R40 or Form R43 if they do not meet the self-assessment criteria provided on the official website of the government of the United Kingdom. If they do meet the criteria, they are supposed to make a claim on their Self Assessment Tax Return which can be filed online.

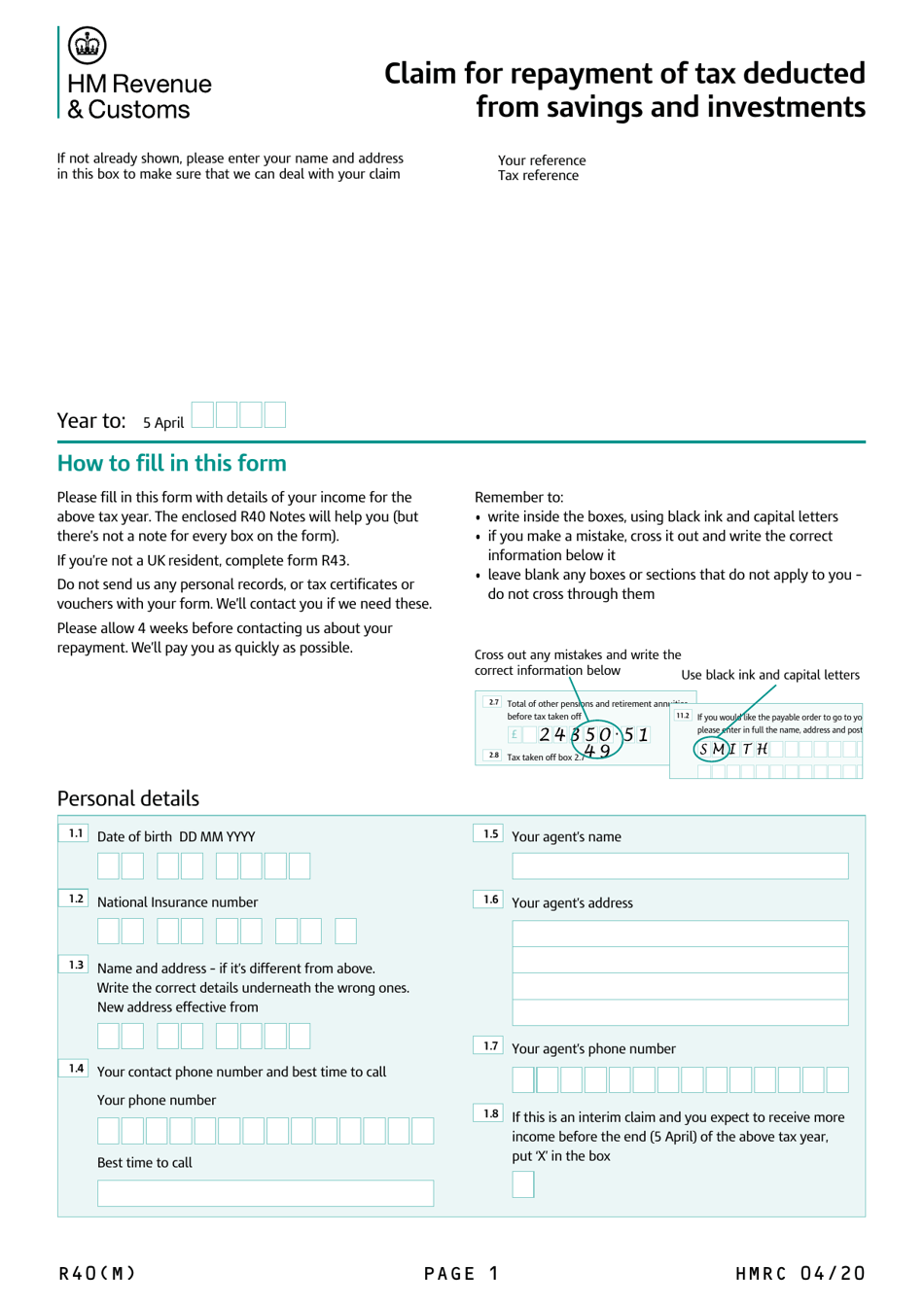

How to Complete Form R40?

The R40 Tax Form consists of several large parts, namely:

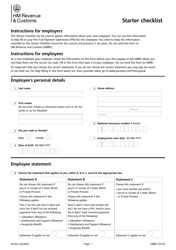

- About the Individual. In the first part of the document, individuals must provide their personal details. It includes their name, national insurance number, and contact details. Additionally, individuals can indicate when is the best time to call them. Individuals can also state their agent's name, address, and phone number.

- Income, Pensions, and State Benefits. Here, individuals must designate a total income from all their employments, pensions, and other types of taxable state benefits.

- Interest and Dividends. Individuals are supposed to state the net interest they have received from banks, building societies, etc., and the amount of tax taken off it. If individuals have any untaxed interest, company dividends, or stock dividends they must designate them in this section of the form as well.

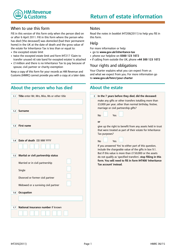

- Trust, Settlement, and Estate Income. Here individuals must indicate any type of income they have received from trusts, settlements, and their estate. They must indicate the Unique Taxpayer Reference (UTR) of the trust and the details of the income they have received from them.

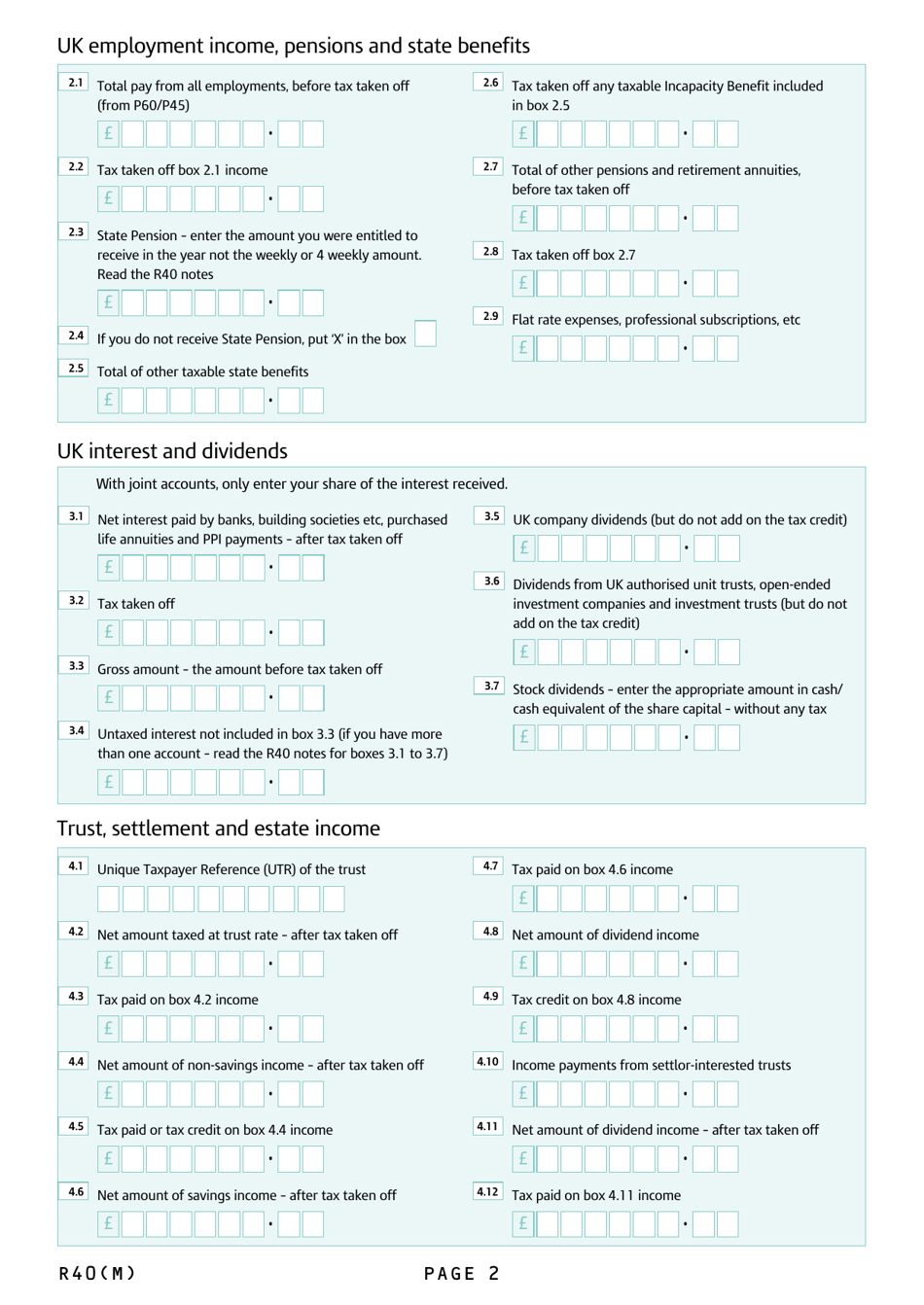

- Land and Property. If individuals have any land or property in the United Kingdom that brings them profit, they must state the income they receive from it. They must also designate their losses from the current year and from other years which had to be paid recently and other expenses.

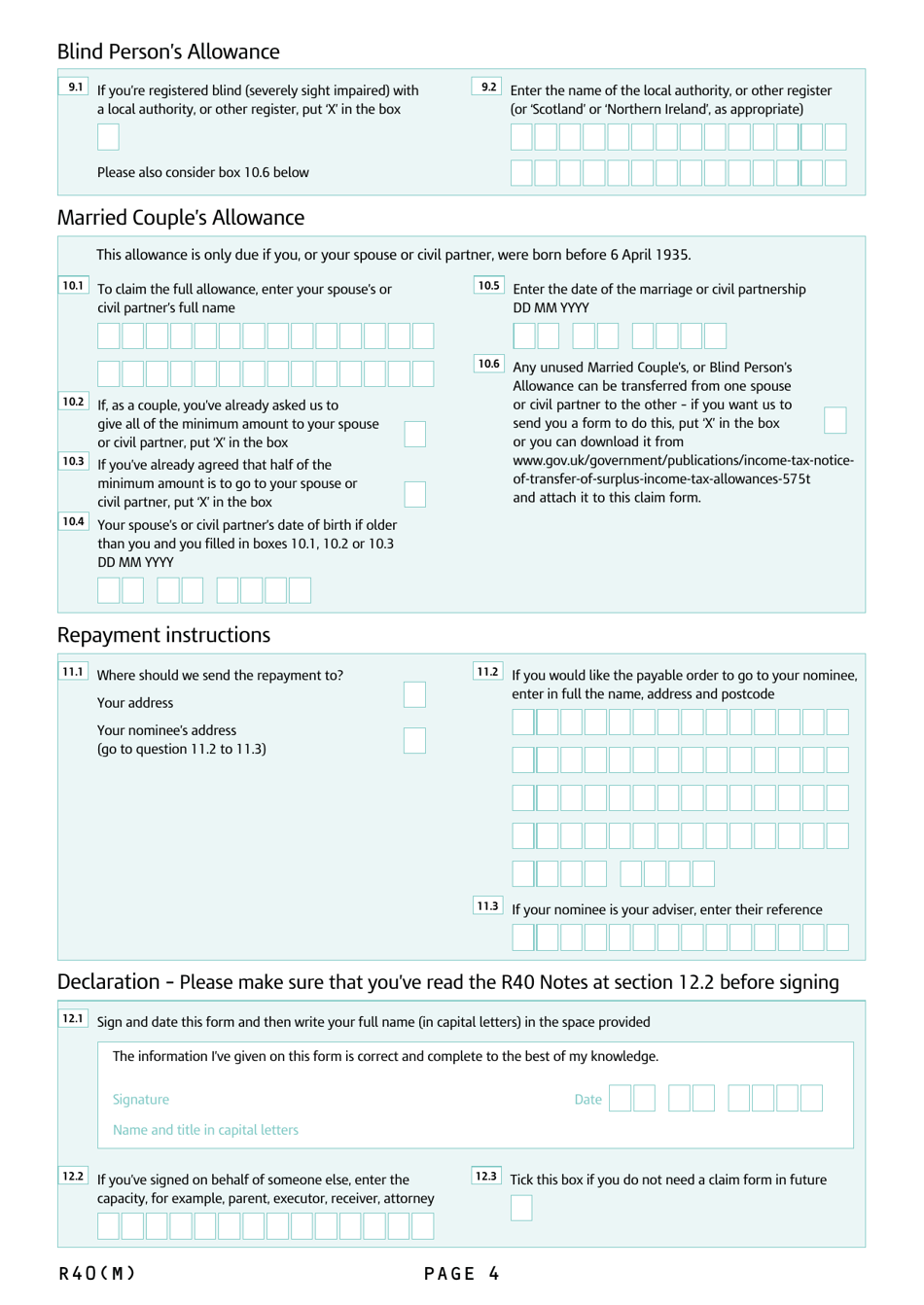

- Blind's Person Allowance. This part of the claim is supposed to be completed only if individuals are registered blind with a local authority, or another register.

- Signature and Date. At the end of the form, individuals must declare that the information they provided on the form is true and correct. Then they must put their signature and date.

Form R40 also contains other sections where individuals are required to provide details about their foreign income, gift aid, allowances, repayment details, and other types of information. A small part with guidelines on what to designate in the document is also included in the form.

Where to Send Form R40?

The completed R40 Tax Form should be posted to the United Kingdom HM Revenue & Customs at Pay-As-You-Earn, HM Revenue and Customs, BX9 1AS, United Kingdom. Nevertheless, before sending this form, individuals should check with the official website of the government of the United Kingdom in case any changes have taken place.

On that website, individuals are also offered an opportunity to apply for repayment online. To do so individuals will need their Government Gateway ID and their password, or they can create one while using the service. After applying, individuals will be provided with a reference number that they can use to track their claim.