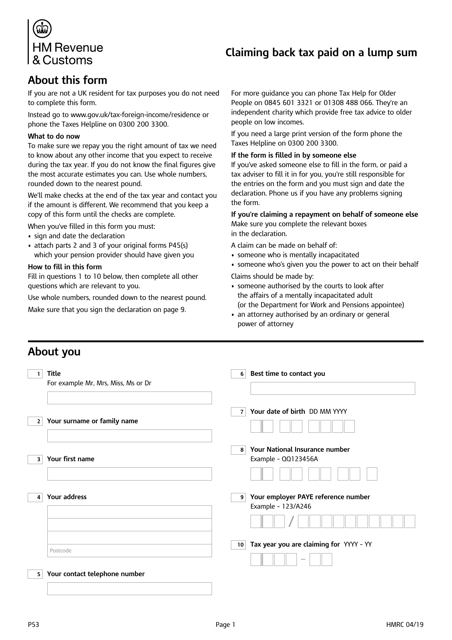

Form P53 Claiming Back Tax Paid on a Lump Sum - United Kingdom

Fill PDF Online

Fill out online for free

without registration or credit card

What Is Form P53?

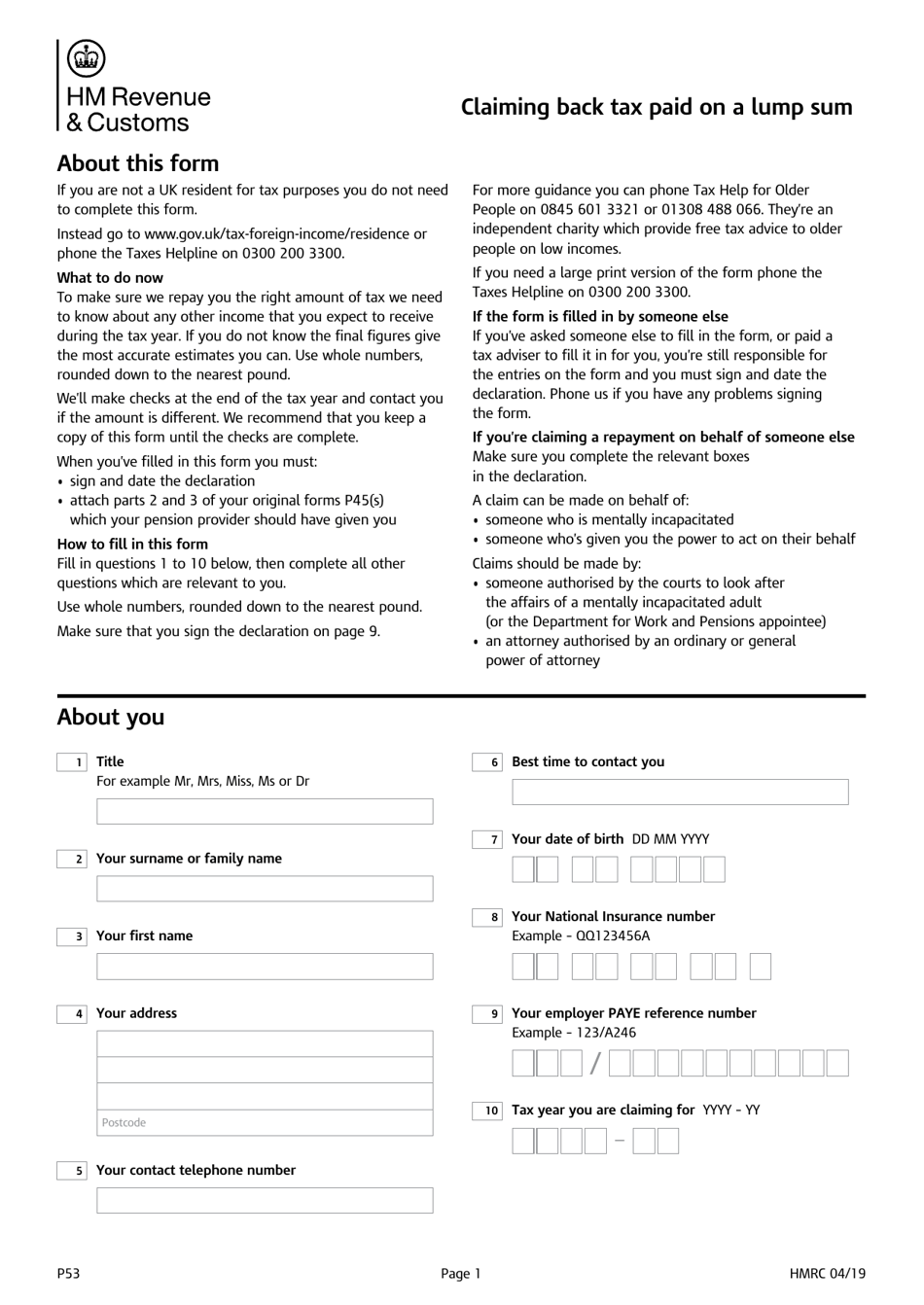

Form P53, Claiming Back Tax Paid on a Lump Sum , is a formal document used by individuals who want to claim back tax the government owes them on the lump sum they have obtained. Whether you received a small pension as a lump sum payment or opted for a trivial commutation to get a one-off cash payment instead of a pension, this is the statement you need to prepare to confirm you qualify for a tax refund.

Alternate Name:

- P53 Tax Form.

This form was issued by the United Kingdom HM Revenue & Customs on April 1, 2019 , with all previous editions obsolete. Download a printable P53 Form through the link below.

Form P53 Instructions

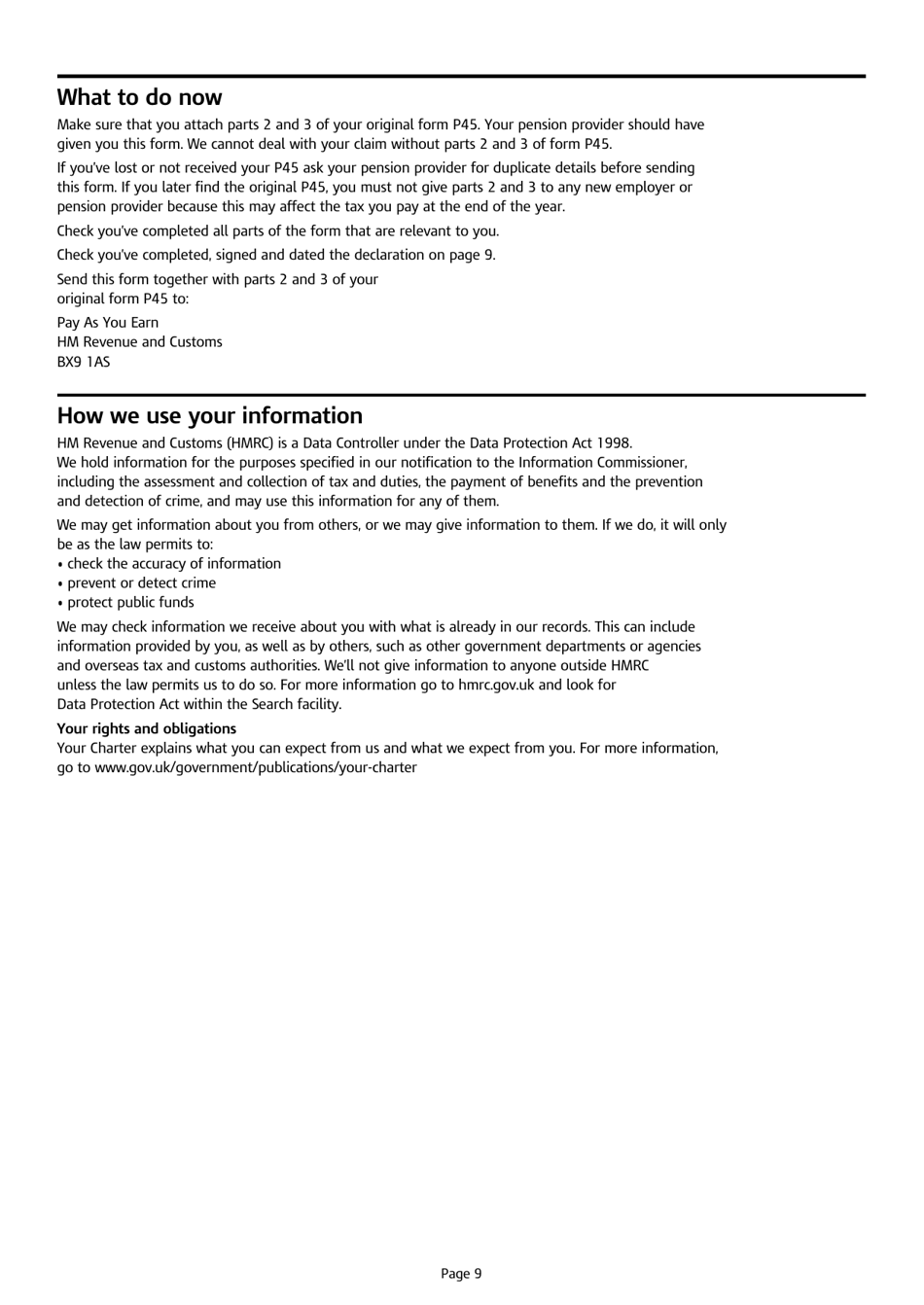

Follow these steps to fill out Form P53:

- Enter your personal details (your title, name, birthdate, National Insurance Number) and contact information. Indicate the Pay-As-You-Earn reference number of your employer and the appropriate tax year.

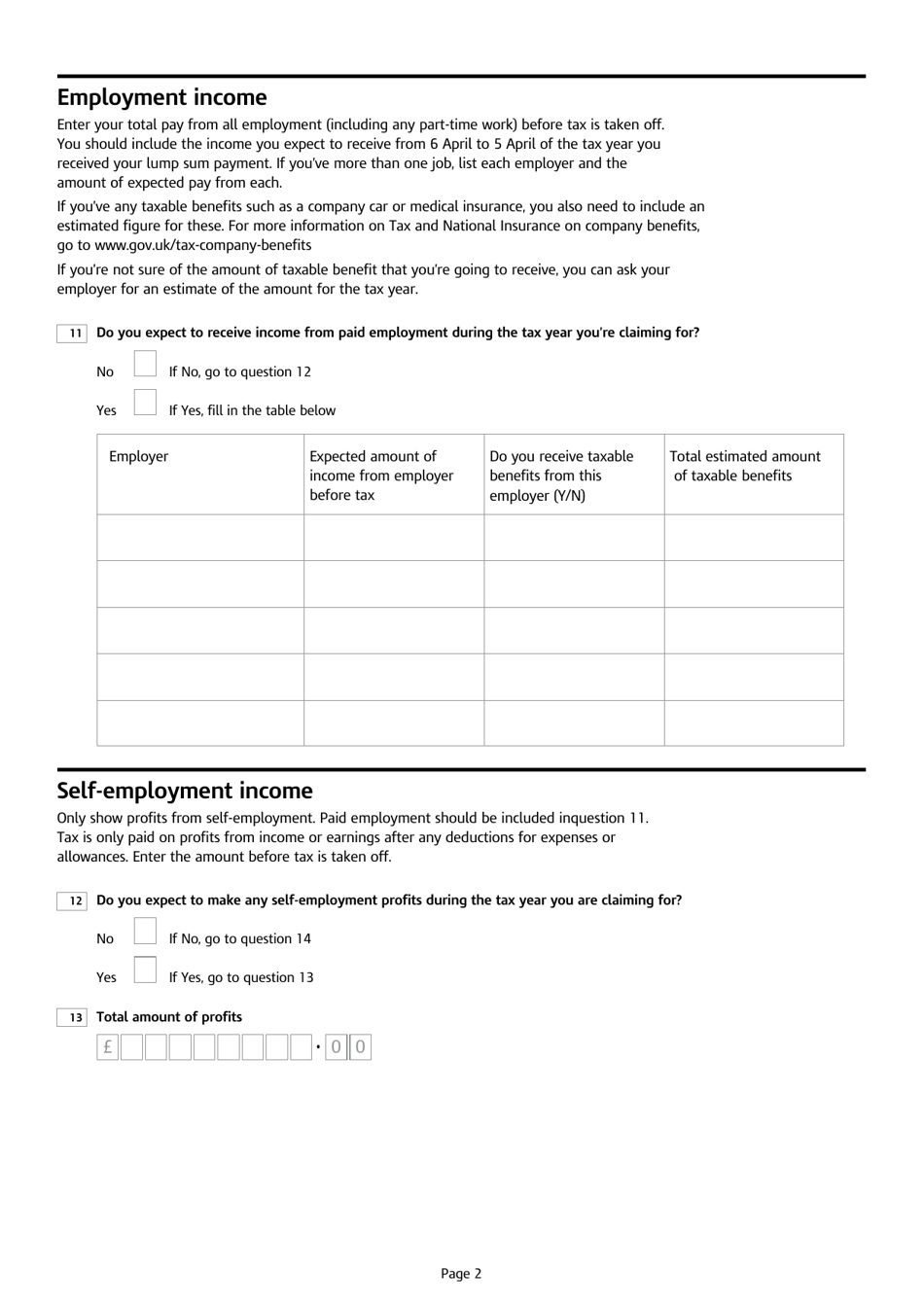

- List the total amounts of income from all employers and state the estimated amount of benefits subject to taxation. If you are self-employed, tick the box and record the total amount of profits you receive during the year.

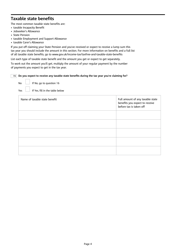

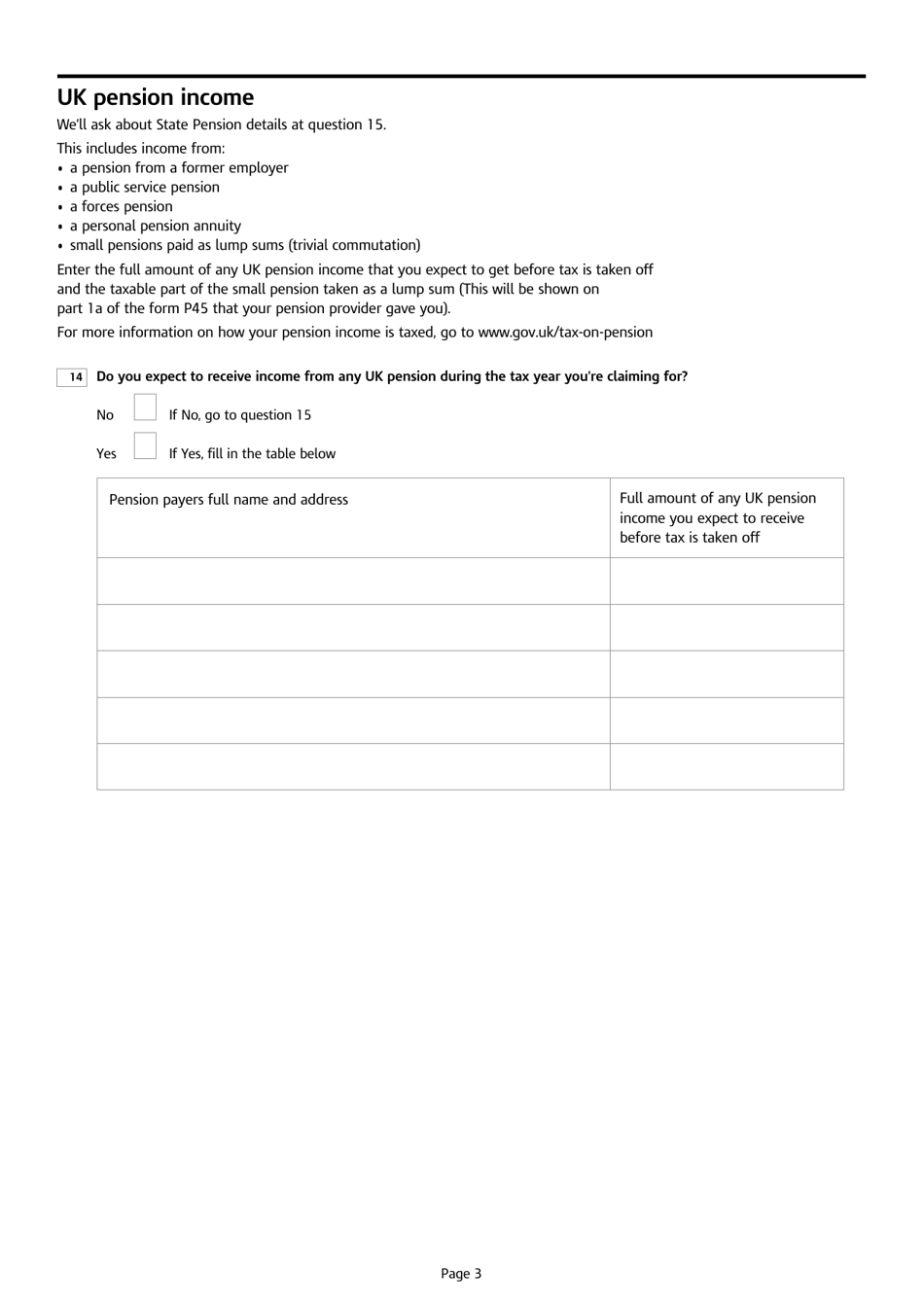

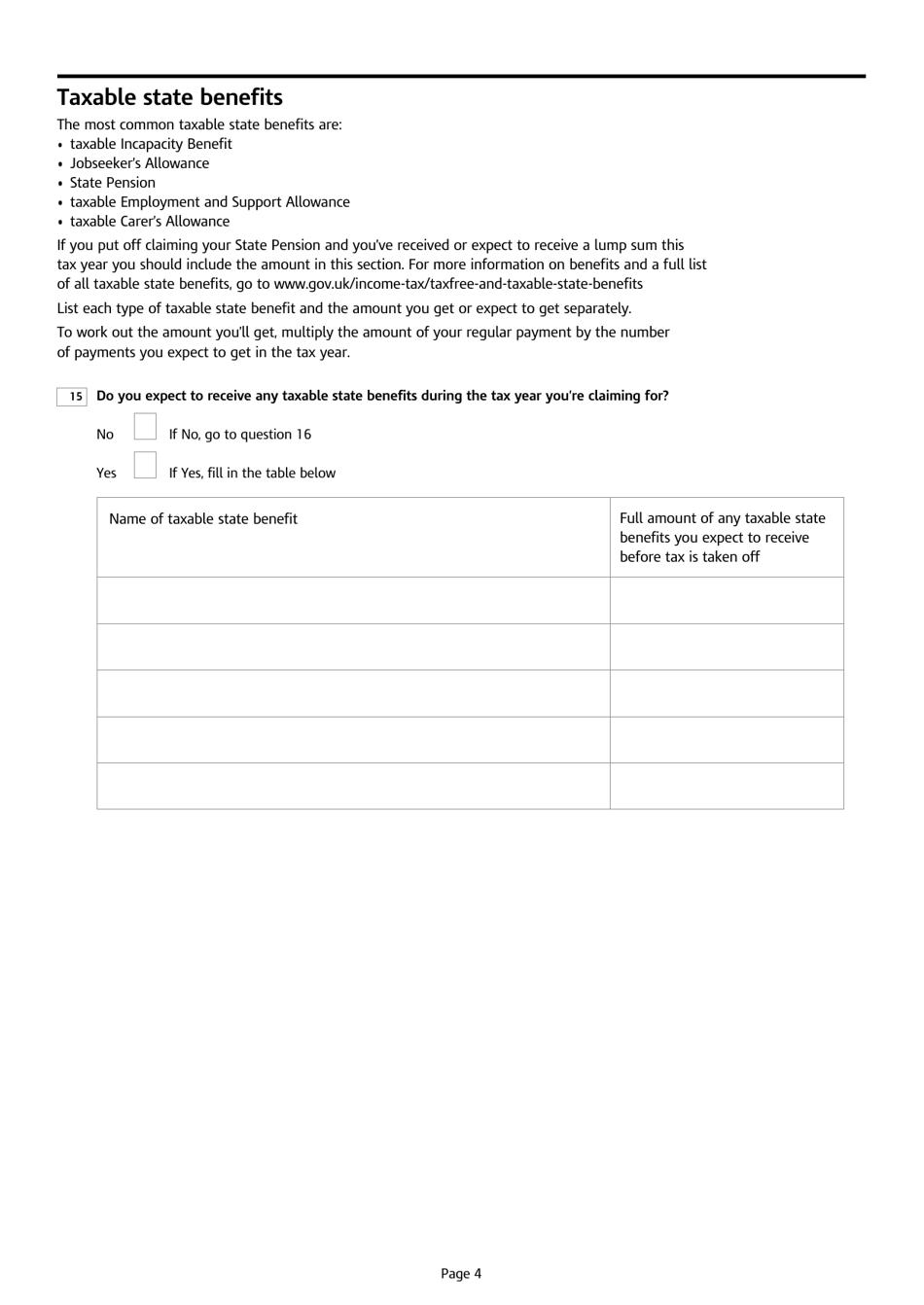

- Write down the amount of pension amount you are planning to receive before tax. List all your taxable benefits and allowances alongside their amounts.

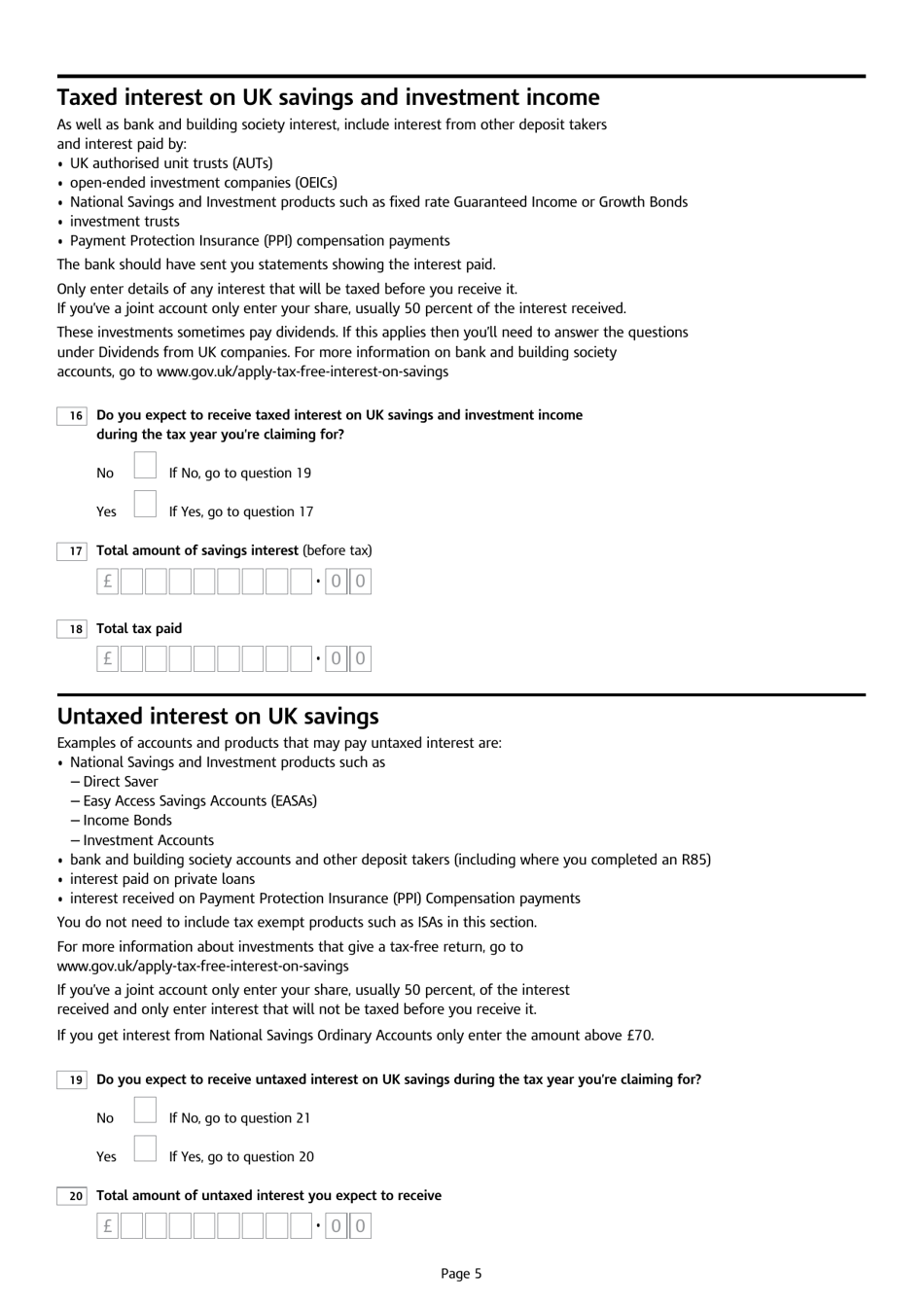

- In case you have any interest in savings and investments, indicate their amounts and tax already paid. There might be untaxed interest on savings (state its estimated amount).

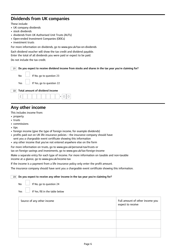

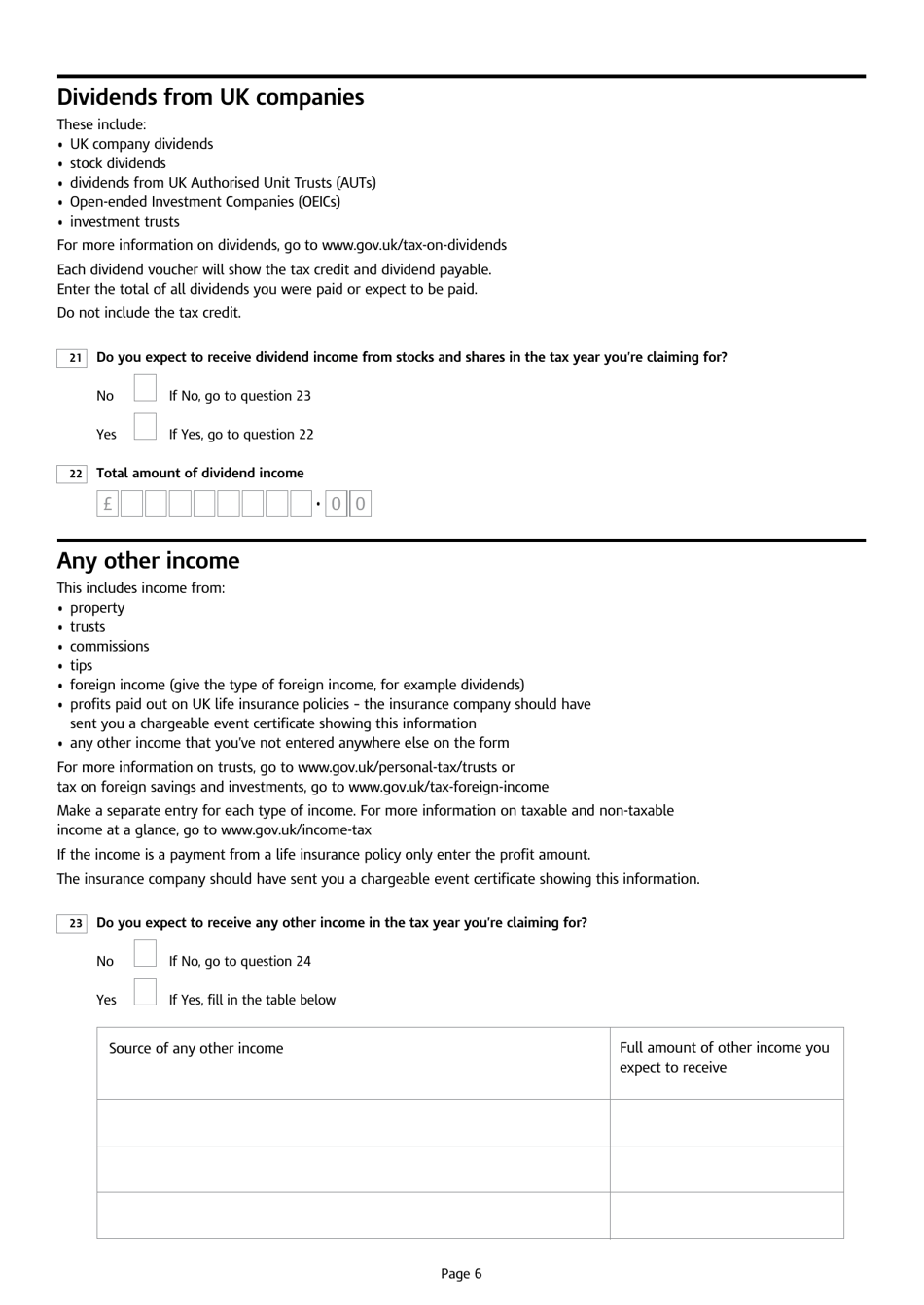

- Enter the amounts of United Kingdom dividends and other sources of income you are entitled to.

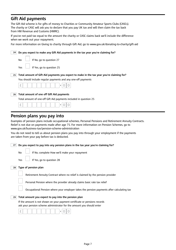

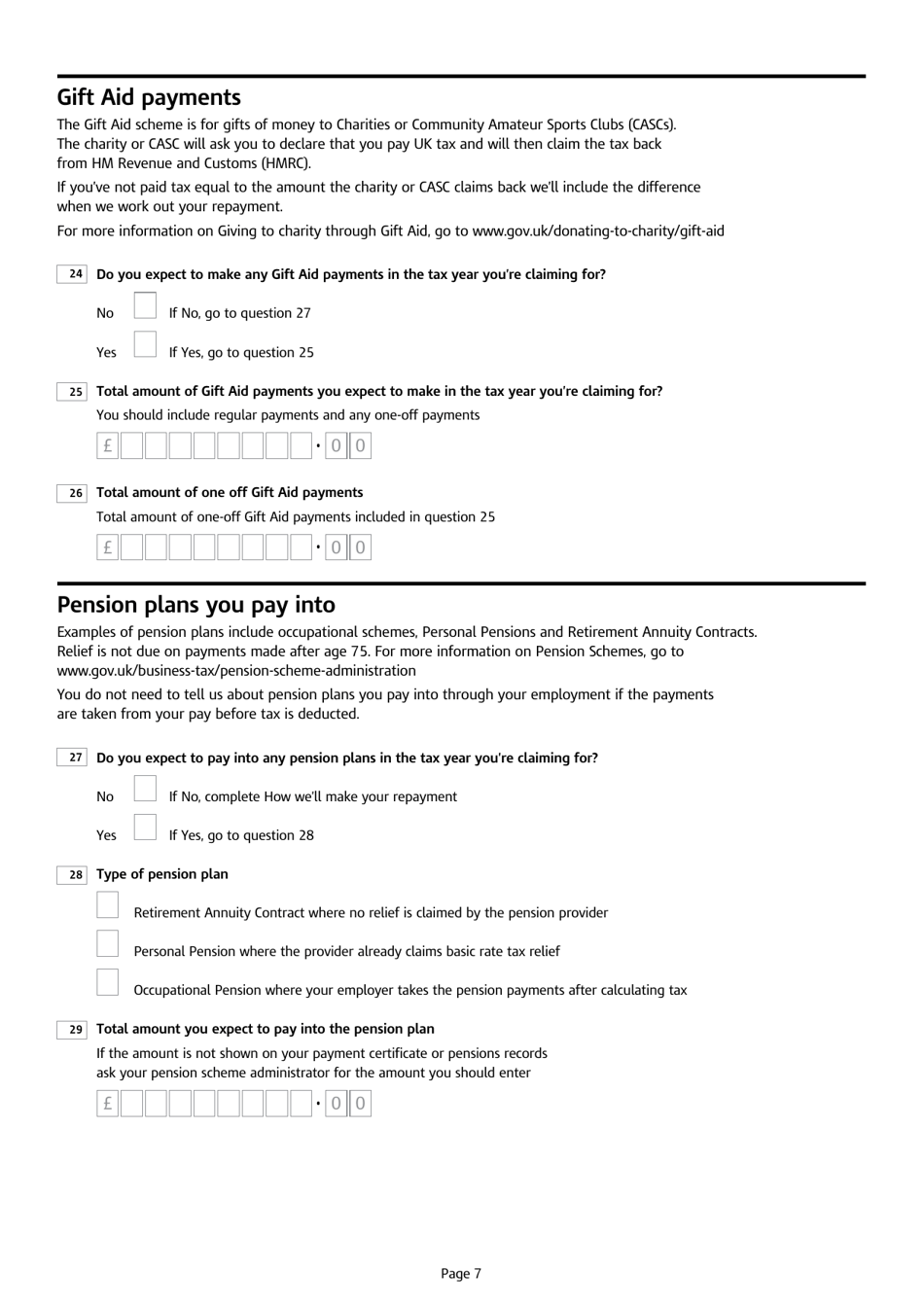

- If you are expecting to make any Gift Aid payments, include their amounts in the claim.

- Select the pension plan you are paying into and the total amount of payment.

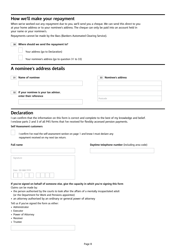

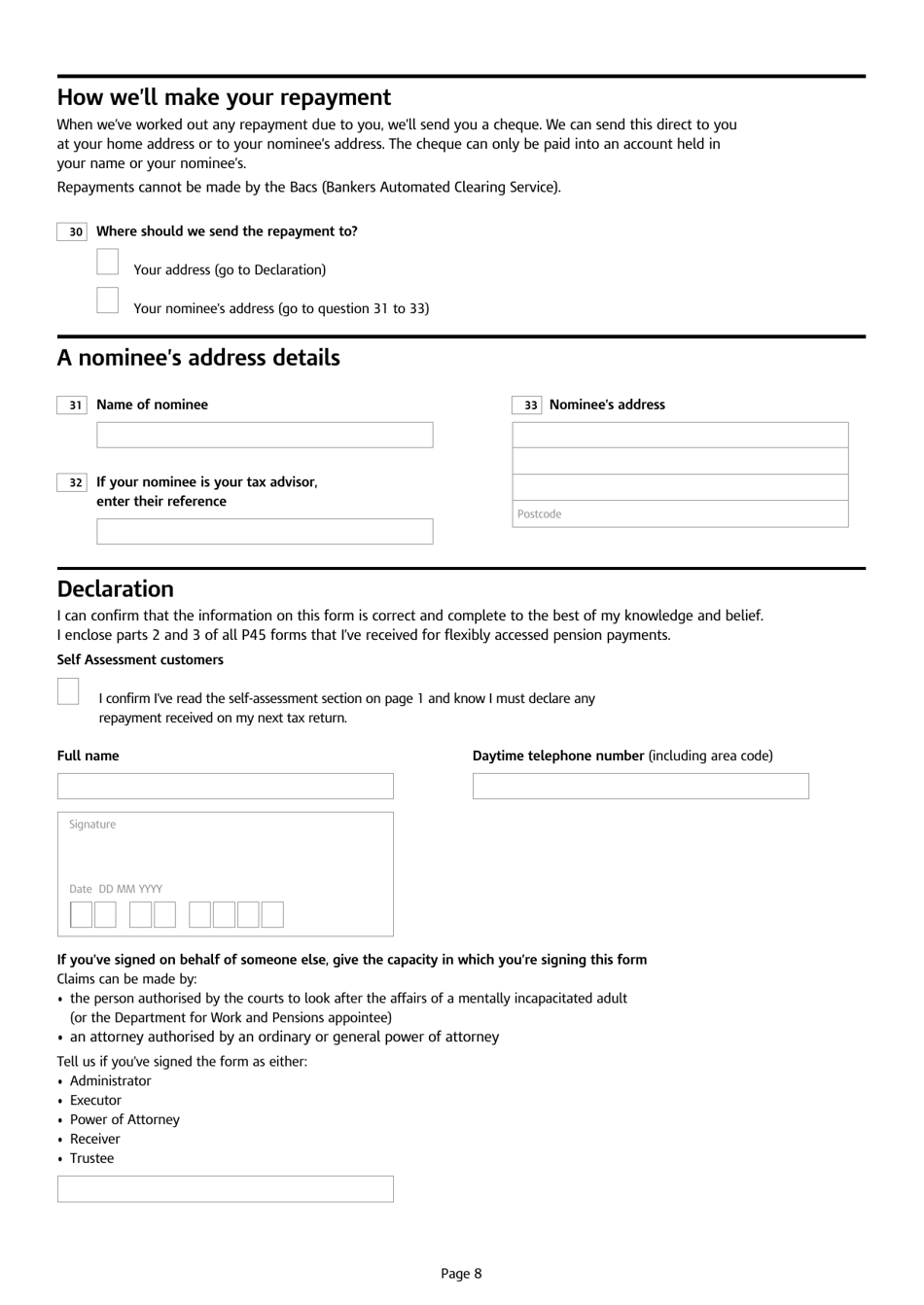

- Indicate the address where the check will be sent. You may name another person who will receive the check on your behalf.

- Confirm all the statements in the form are true and correct. Enter your name and telephone number. Sign and date the document.