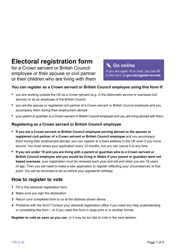

Form P46 Employee Without a Form P45 - United Kingdom

What Is Form P46?

Form P46, Employee Without a Form P45 , is a document completed for new employees to find out the correct amount of income tax to withhold.

Alternate Name:

- P46 Tax Form.

If the employee started their first-ever job, cannot provide their employer with an account of their employment from their previous job, or did not leave their employment and started a new job, this statement is necessary to ensure the employee does not underpay or overpay income tax.

Where Can I Get a P46 Form?

Form P46 helped authorities to figure out whether the individual could have been considered eligible for a tax rebate due to outstanding student loans. It contained a full employment history and established the proper amount of tax and insurance the employee would need to pay from the start of the reporting year until their employment is terminated.

Form P46 is no longer used by employers and employees. The last known version of the form was issued by the United Kingdom HM Revenue & Customs on January 1, 2011 . A printable P46 Form PDF can be downloaded below for reference.

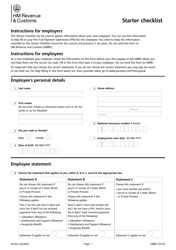

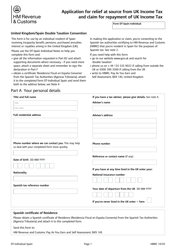

How To Fill In a P46 Form?

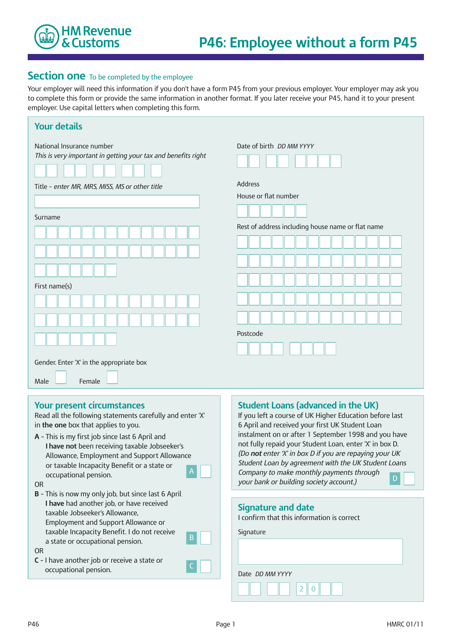

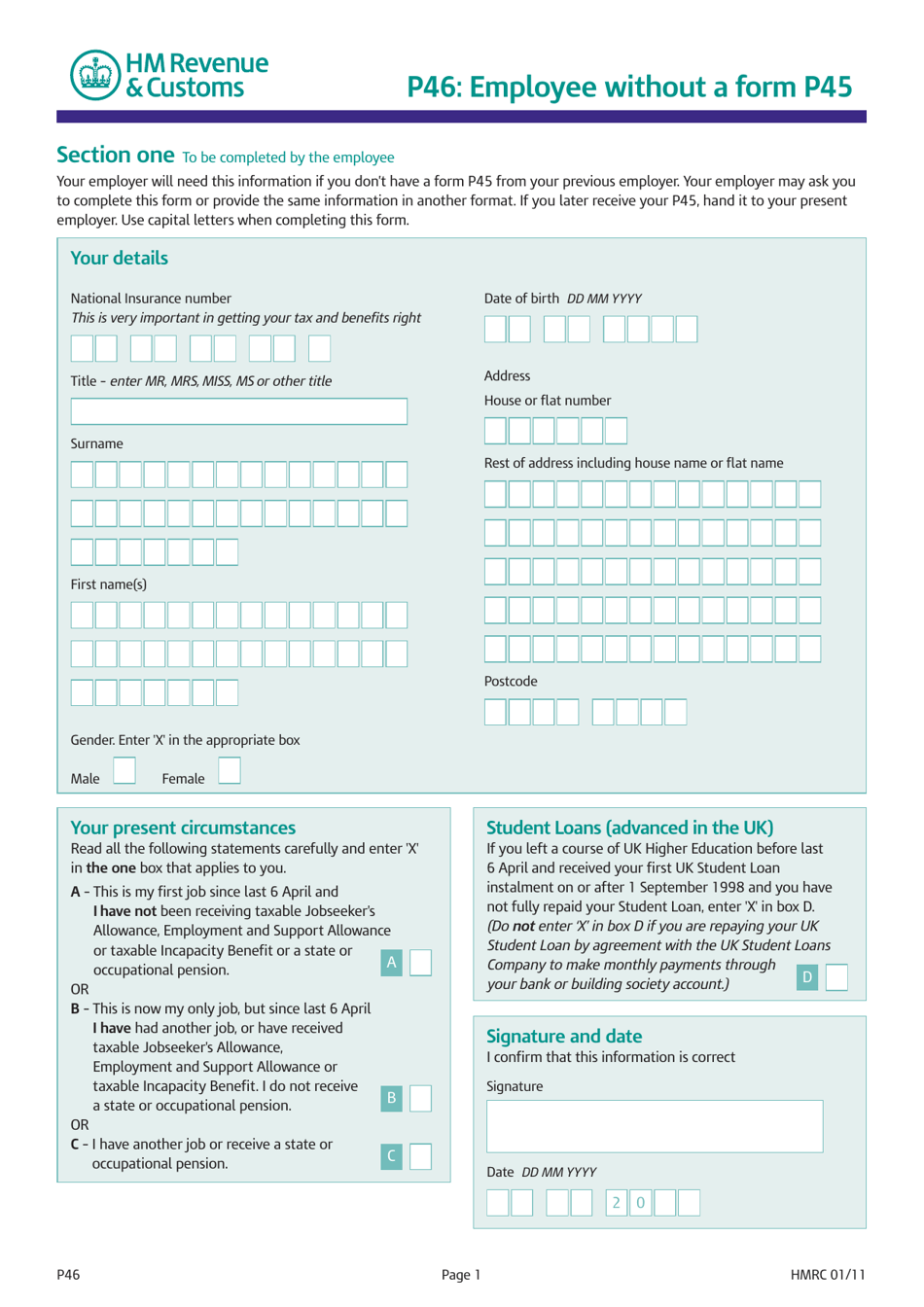

Form P46 consists of two parts: the first section (for the employee) and the second section (for by the employer). The employee would have provided the following information on the first page of the document:

- Their title, full name, gender, date of birth, National Insurance Number, and current mailing address.

- Current employment status.

- Whether or not the employee was paying out student loans (making monthly payments via a building society or bank account).

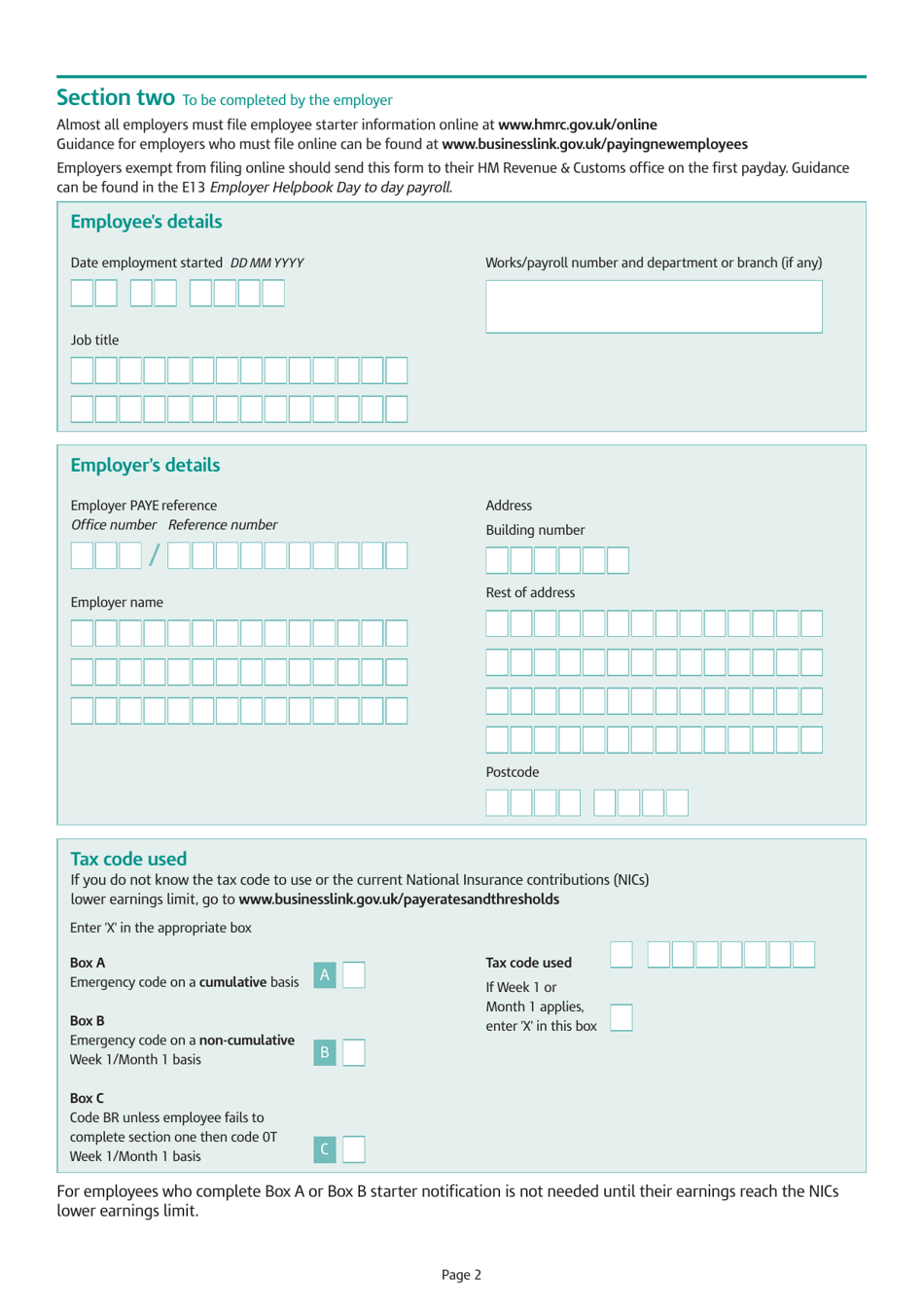

The form was then handed in to the employer who would, in turn, provide the following information:

- Information about the employee (the date they began working, their full job title, department or branch they are a part of, and the payroll or works number).

- The Pay-As-You-Earn office number and reference number, name of the organization, and full mailing address to receive further correspondence.

- The employee's tax code (this would have determined how much income tax should be collected from their pay).

It was then the employer's responsibility to submit it to the tax office online or through traditional mail to let the authorities apply the correct tax code to the employee's account before this person received their first salary.