Form IHT207 Return of Estate Information - United Kingdom

Fill PDF Online

Fill out online for free

without registration or credit card

What Is Form IHT207?

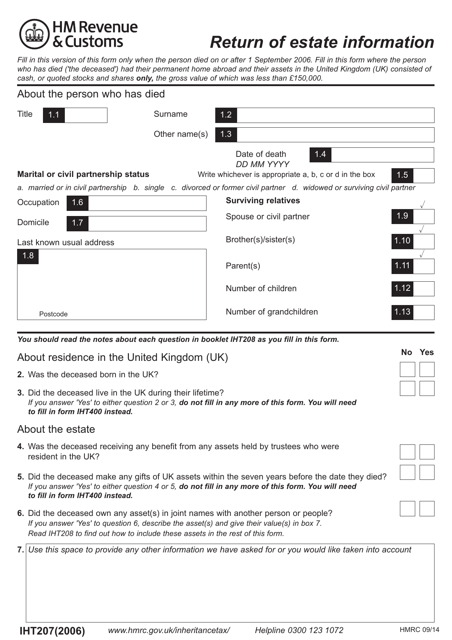

Form IHT207, Return of Estate Information , needs to be completed after a resident or citizen of the United Kingdom passes away and their surviving relatives need to calculate the total assets left behind for tax purposes.

This form is issued by United Kingdom HM Revenue & Customs with the latest edition released on January 1, 2006 . An IHT207 Form is available for download through the link below.

Form IHT207 Instructions

You will need to include the following information on the Return of Estate Information Form:

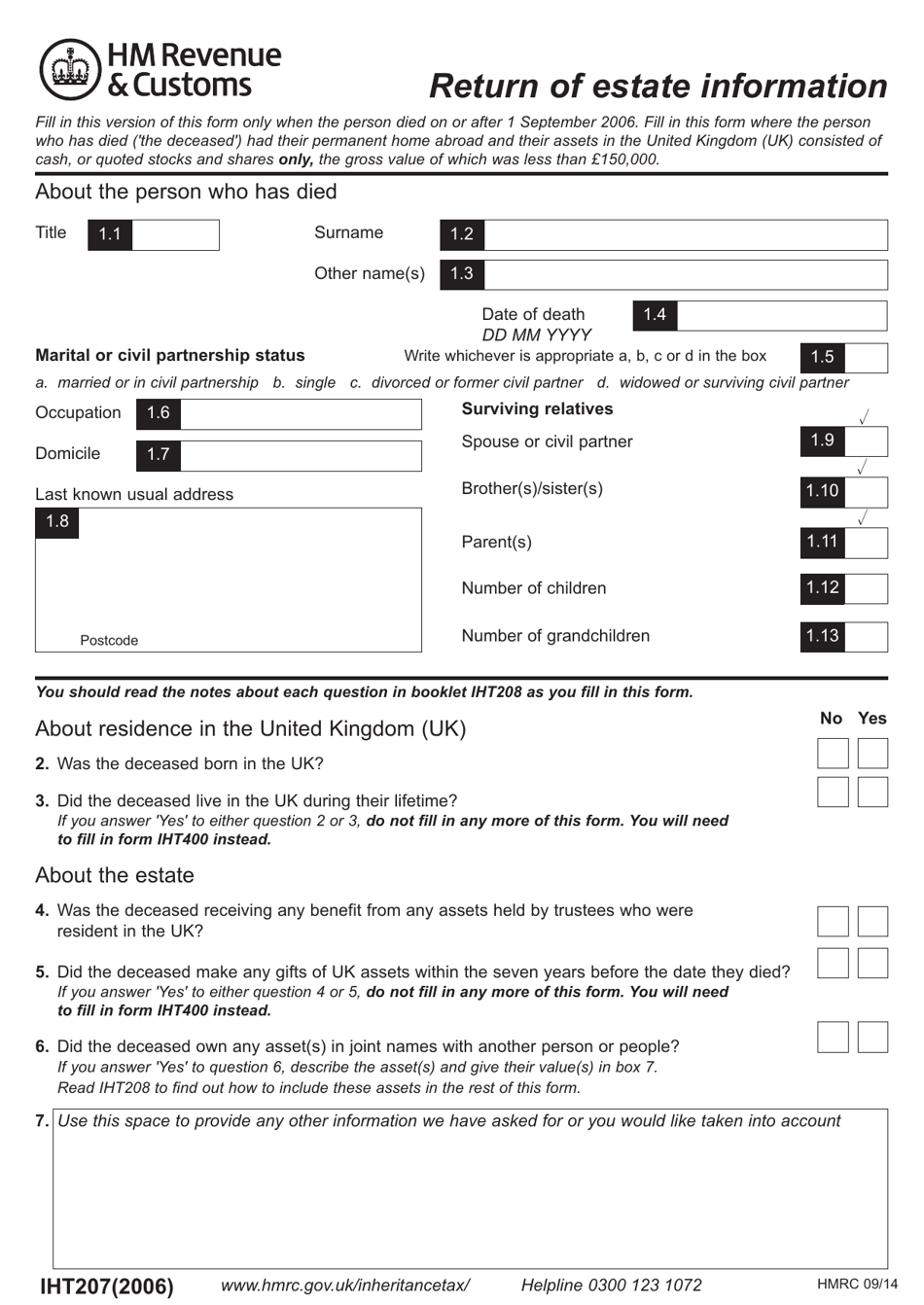

- Provide information about the deceased person. Enter their name, the date of death, marriage or civil partnership status, and last address. List any living relatives.

- Complete the questions about their residency status during their lifetime. Specify whether they were born in the United Kingdom or have lived in the country at any point. Answer the questions about the deceased's estate, if they were receiving any benefits or if part of the estate was managed by a trustee.

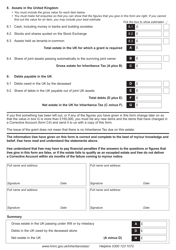

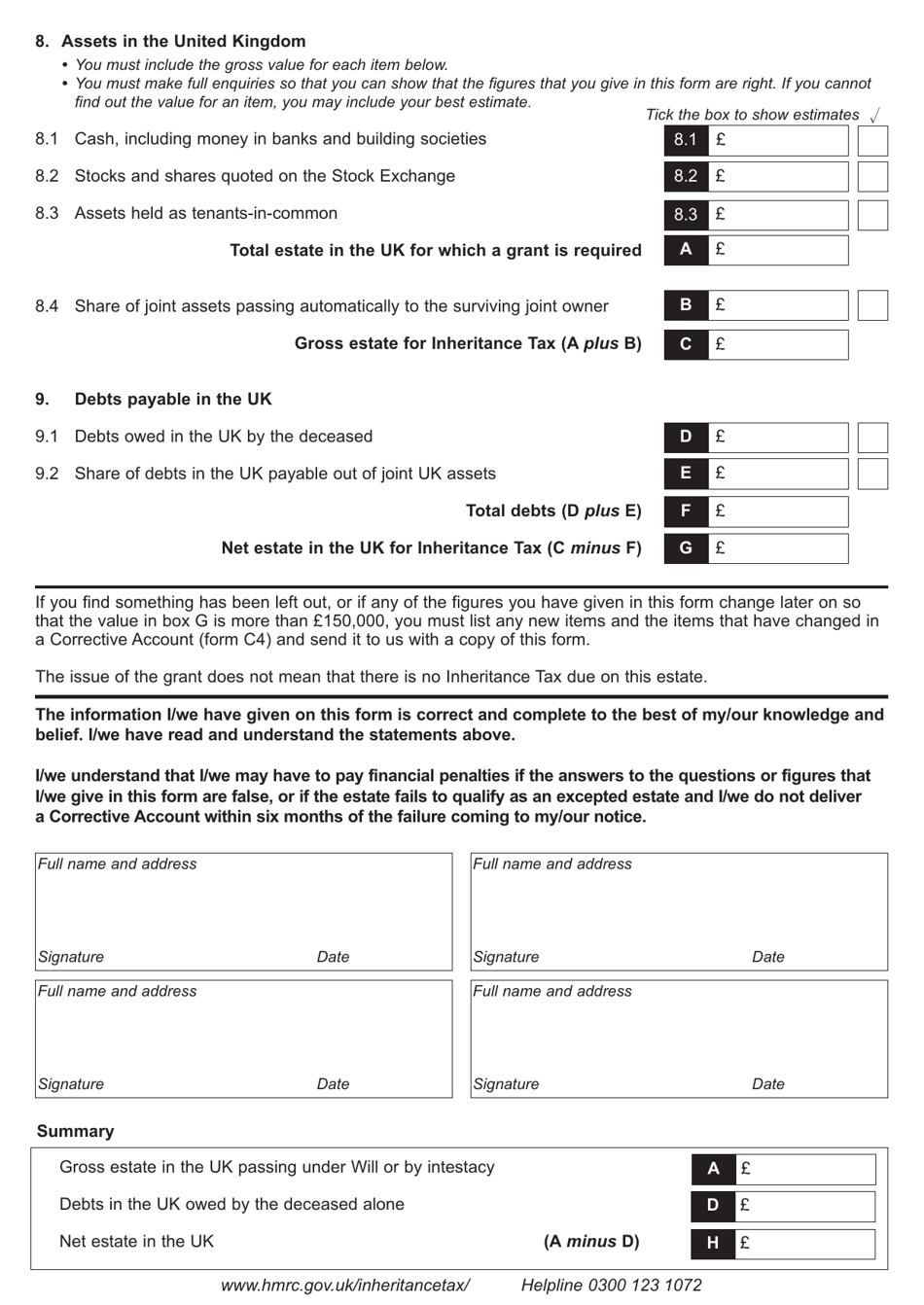

- Include all assets managed within the United Kingdom and the current value of each asset in pounds. If any assets were owned jointly by another person that is still living, calculate the amount due to the living person.

- Calculate the amount of gross assets by totaling the sum of all assets in the United Kingdom with the number of assets given to a joint owner. This will later be used to calculate the inheritance tax.

- If the deceased had any outstanding debts at the time of their passing, include the amount payable, the amount owed, and any debts owed by a joint partnership.

- Once these debts have been calculated, you will subtract this amount from the gross assets total. The remaining amount will then be used to calculate the inheritance tax.

- All persons who are listed as survivors of the deceased will need to sign, date, and provide their address in the signature sections at the bottom of Form IHT207.

- The totals calculated in boxes A, D, and H will also be listed again at the end of the form.