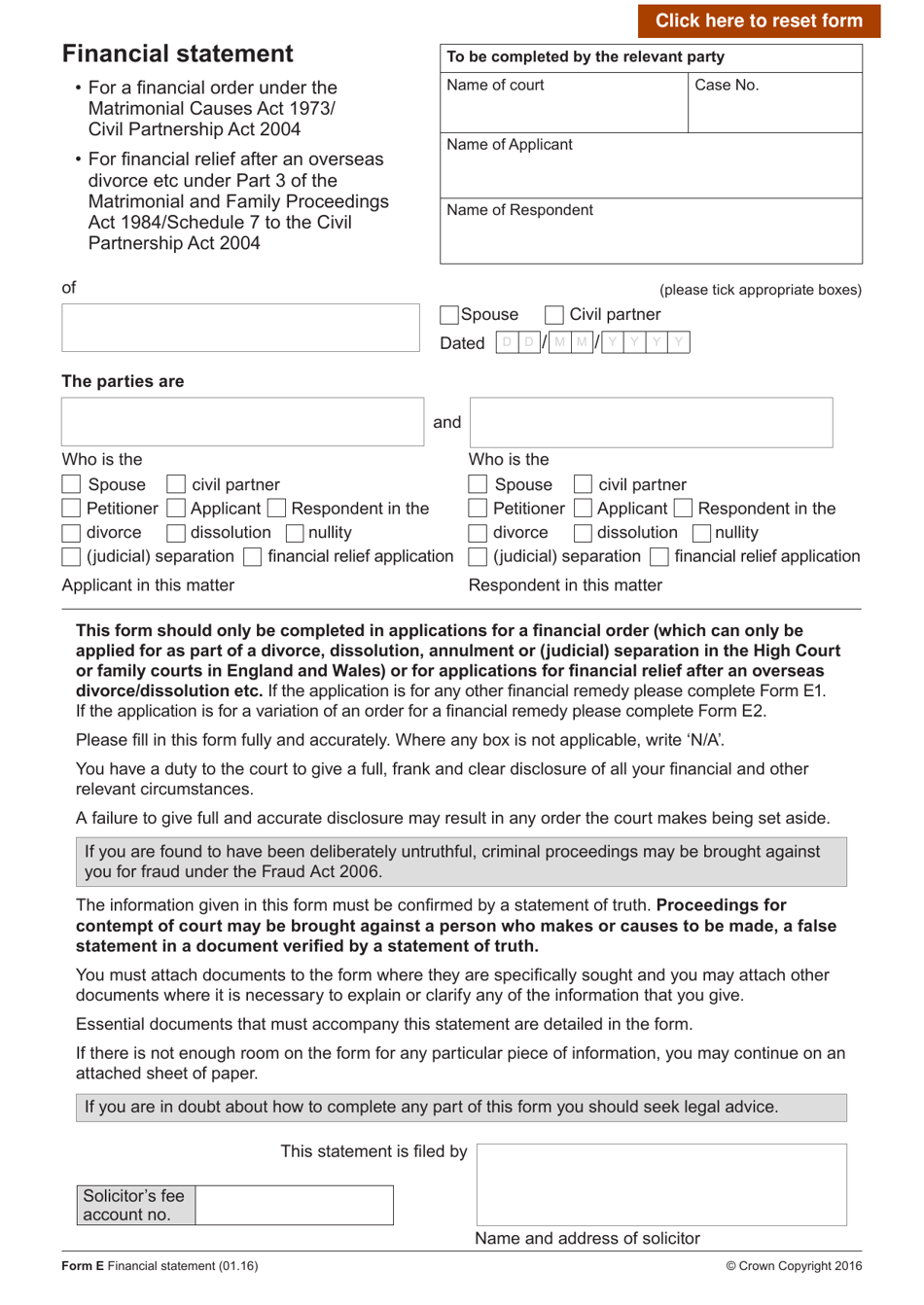

Form E Financial Statement - United Kingdom

What Is Form E?

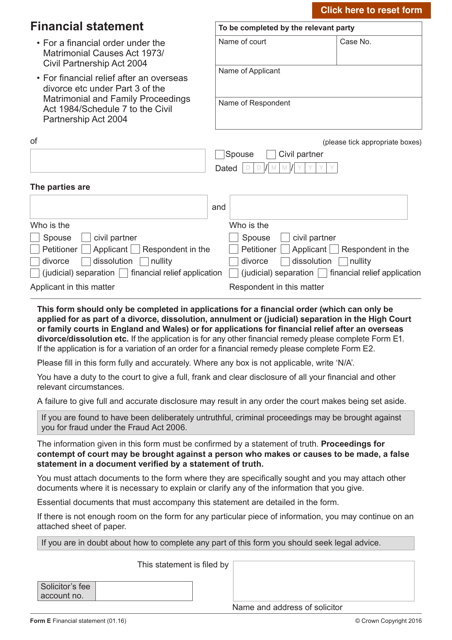

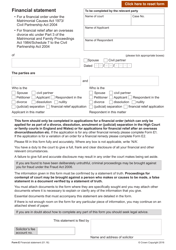

Form E, Financial Statement , is a document that is supposed to be used when individuals apply for a financial order or financial relief. The purpose of the document is to describe in detail the individuals' financial situation and other circumstances connected with it.

Alternate Name:

- Divorce Form E.

This form was issued by the United Kingdom HM Courts & Tribunals Service and was last revised on January 1, 2016 . A fillable Form E is available for download through the link below.

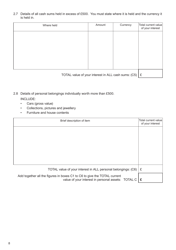

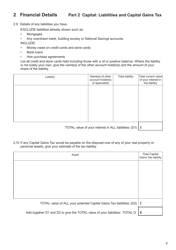

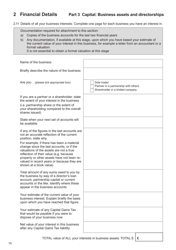

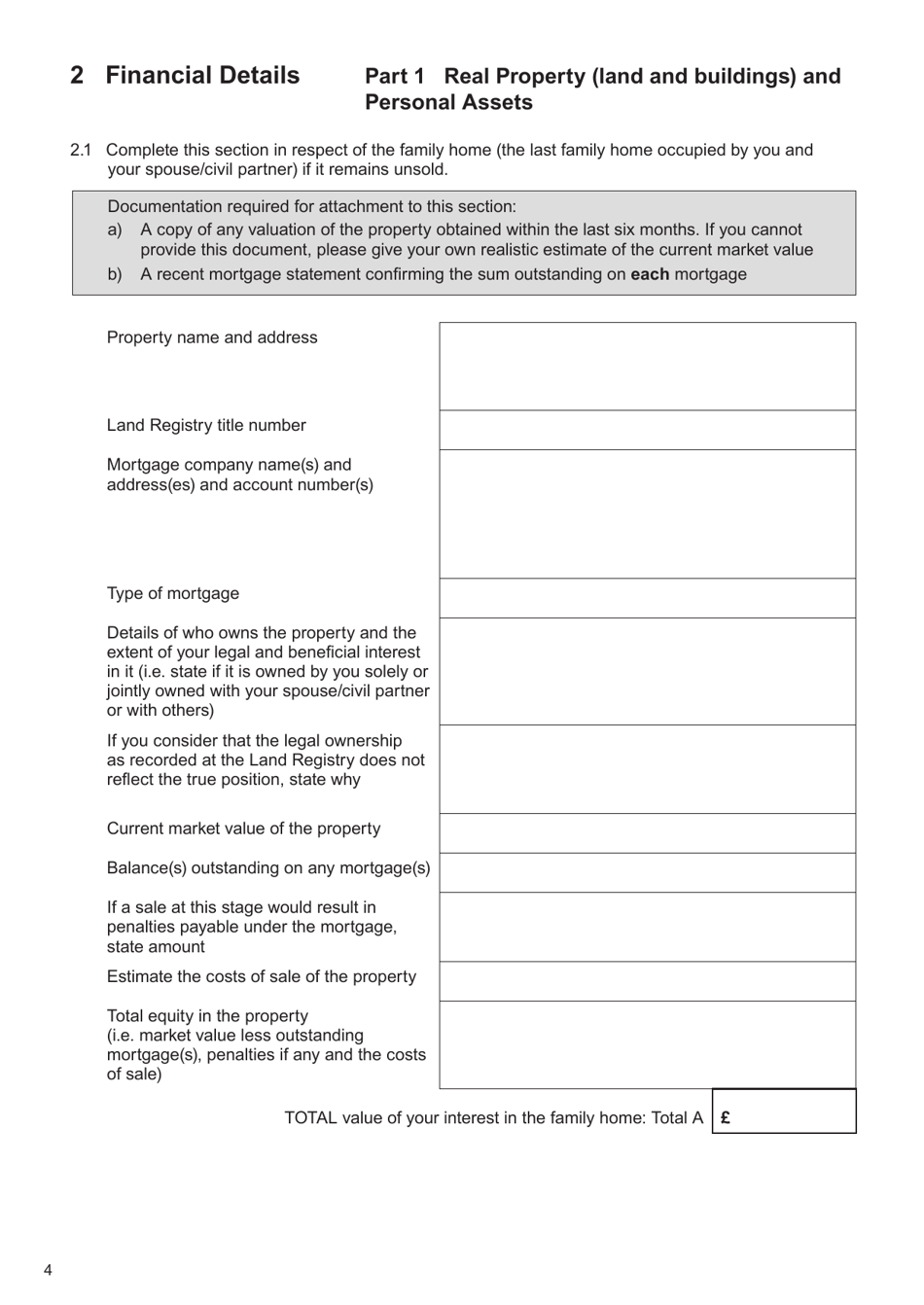

Form E will require the individuals to provide their personal information, information about any real estate they own, their personal assets, liabilities, business assets, pension, and other types of income. The individual is required to give full disclosure of all of their financial and other relevant circumstances.

How to Fill Out Form E?

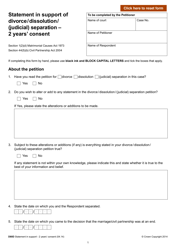

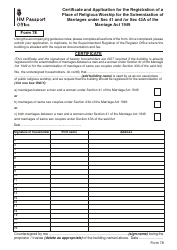

- Introduction. In the first part of the document, the individual must fill in the gaps dedicated to which court this document is supposed to be submitted to, the case number, and the names of the applicant and the respondent. Form E is supposed to be filed at the same court where the individual is applying for a financial order (as a part of a divorce, annulment, or else) or financial relief.

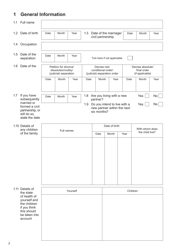

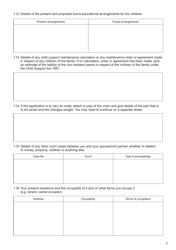

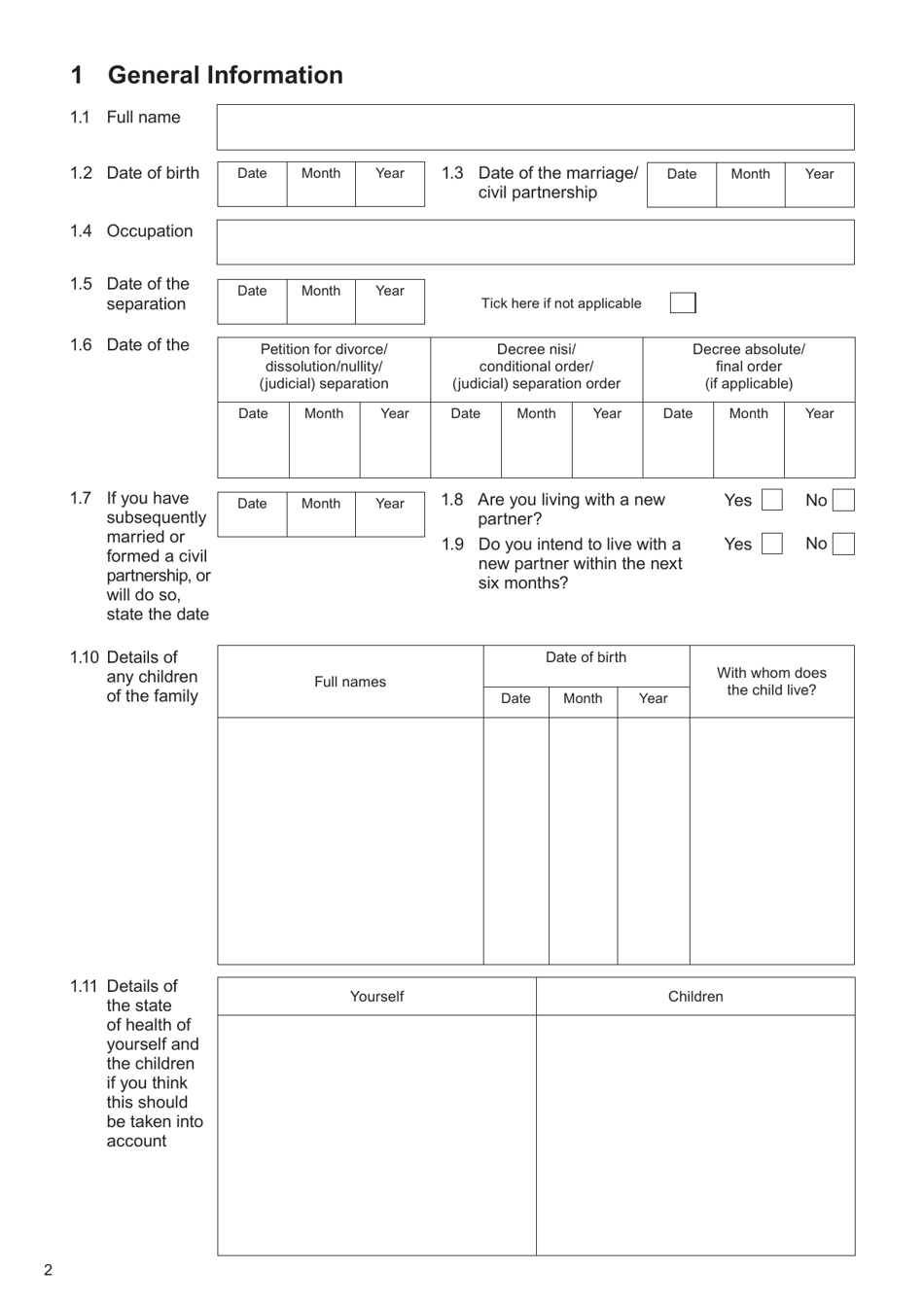

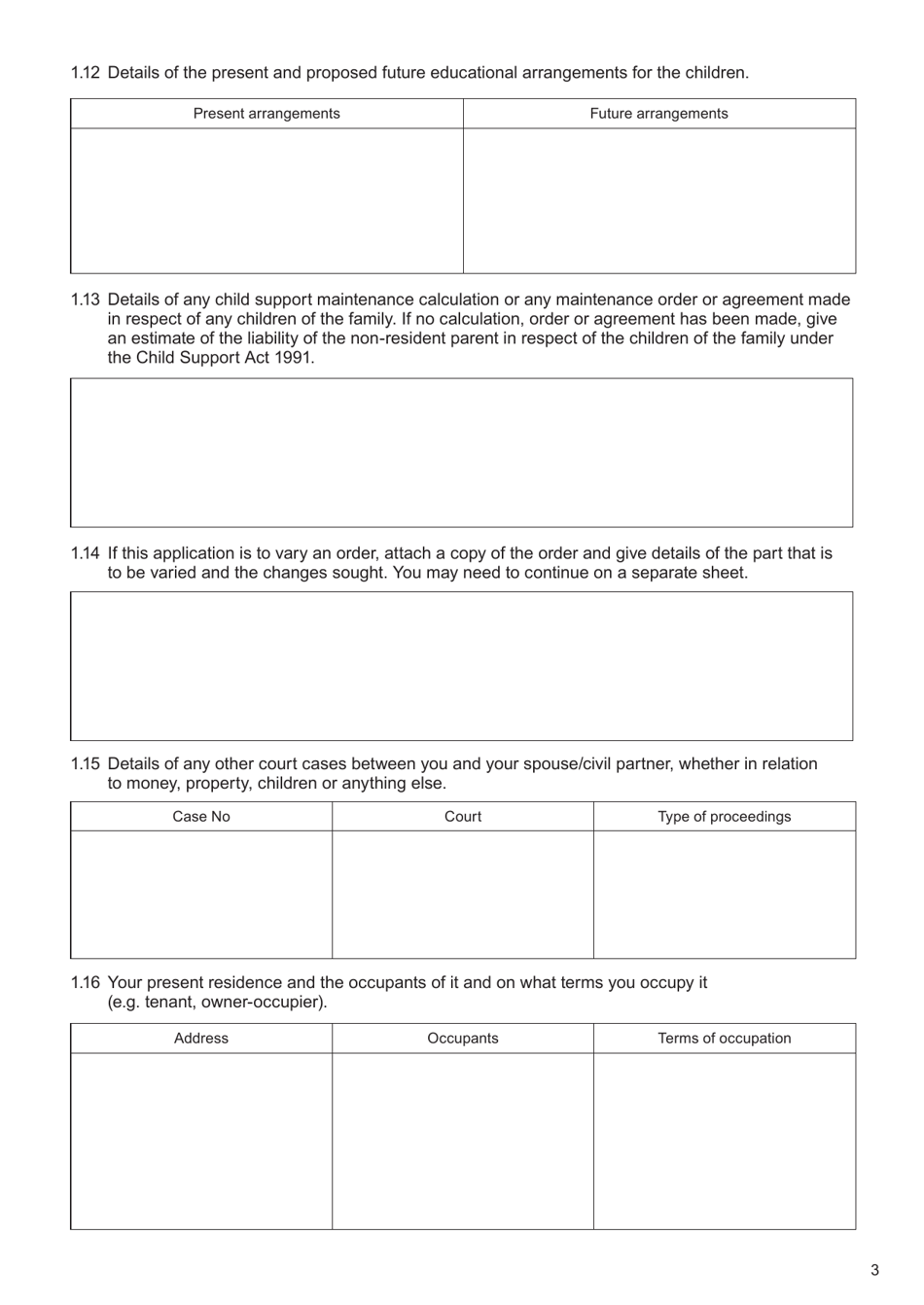

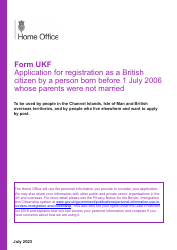

- General Information. Individuals can use this part of the document to designate their personal information, which includes their full name, date of birth, and occupation. Additionally, they must provide details about their marriage (or civil partnership), separation, children, state of health, and other circumstances connected with the situation.

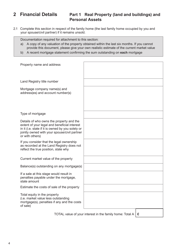

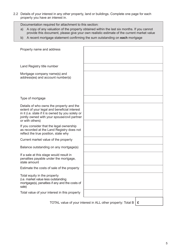

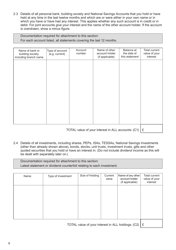

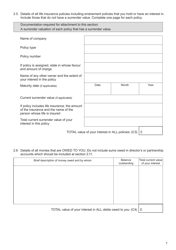

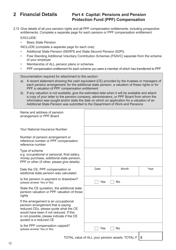

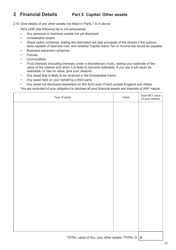

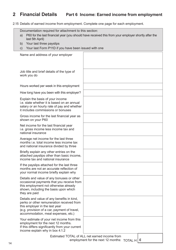

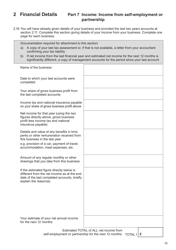

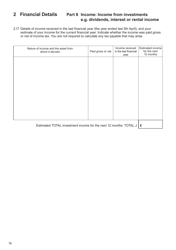

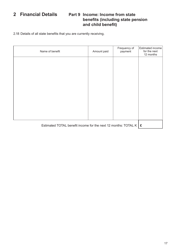

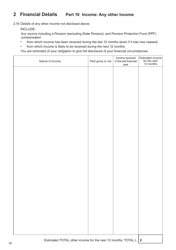

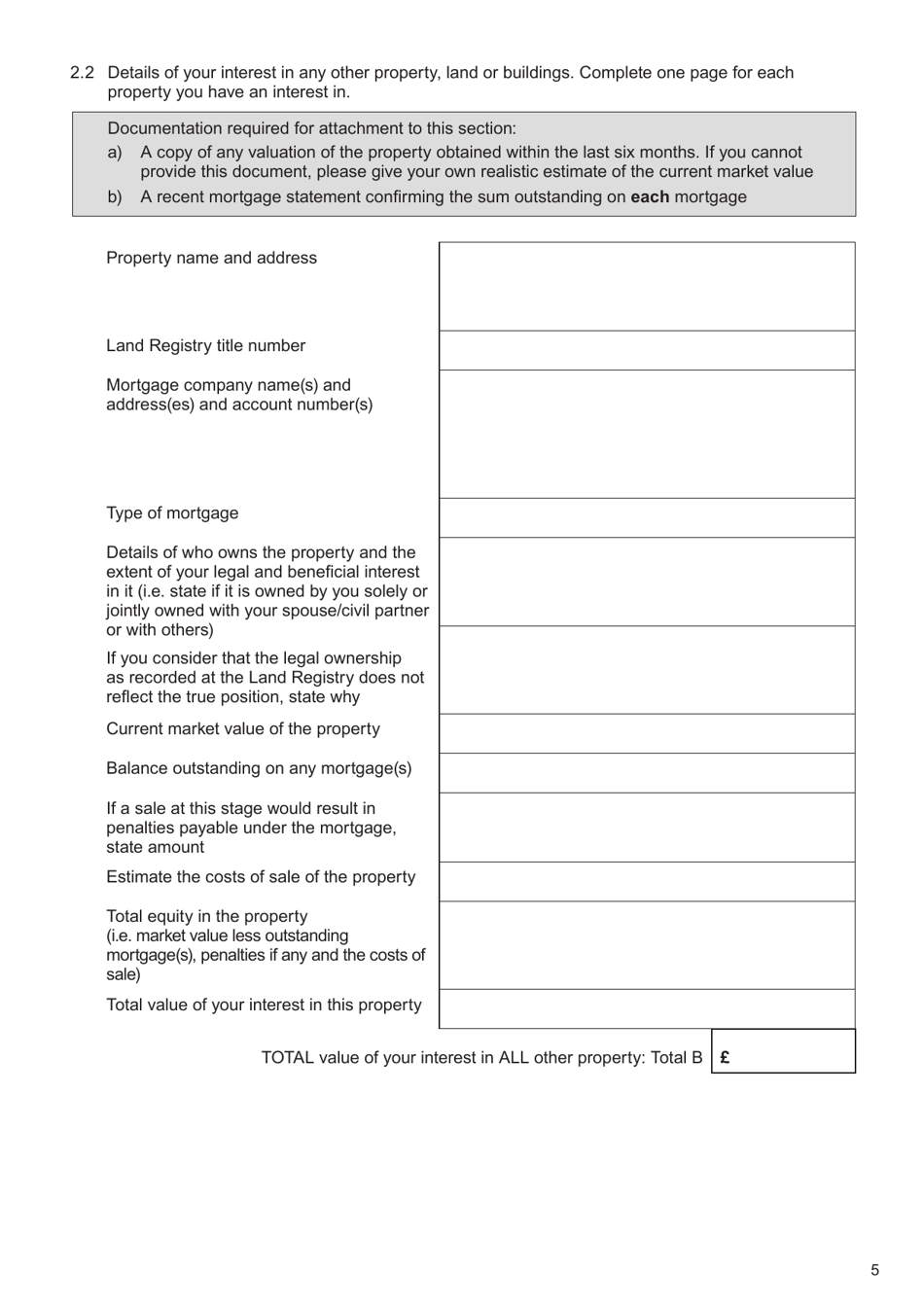

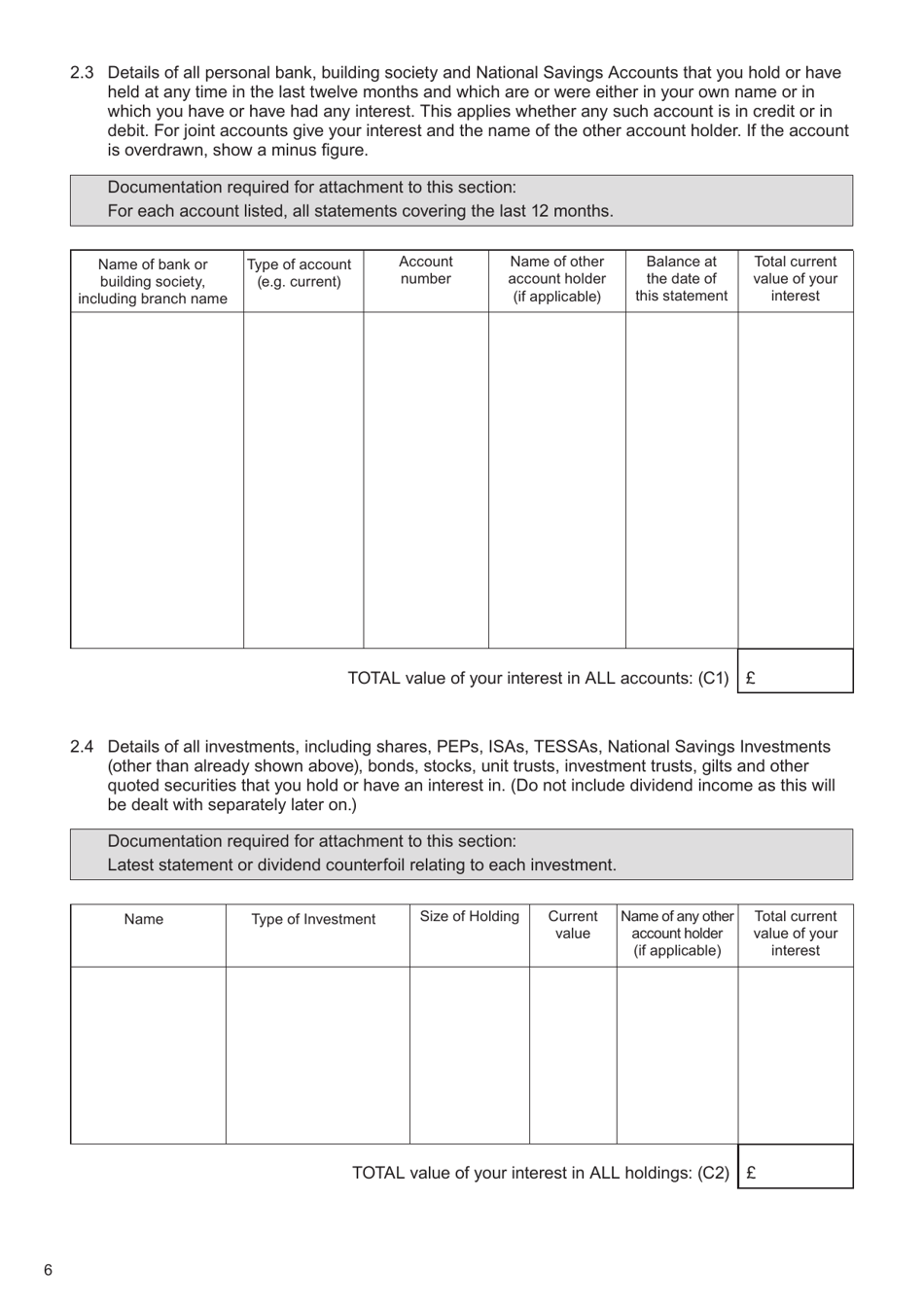

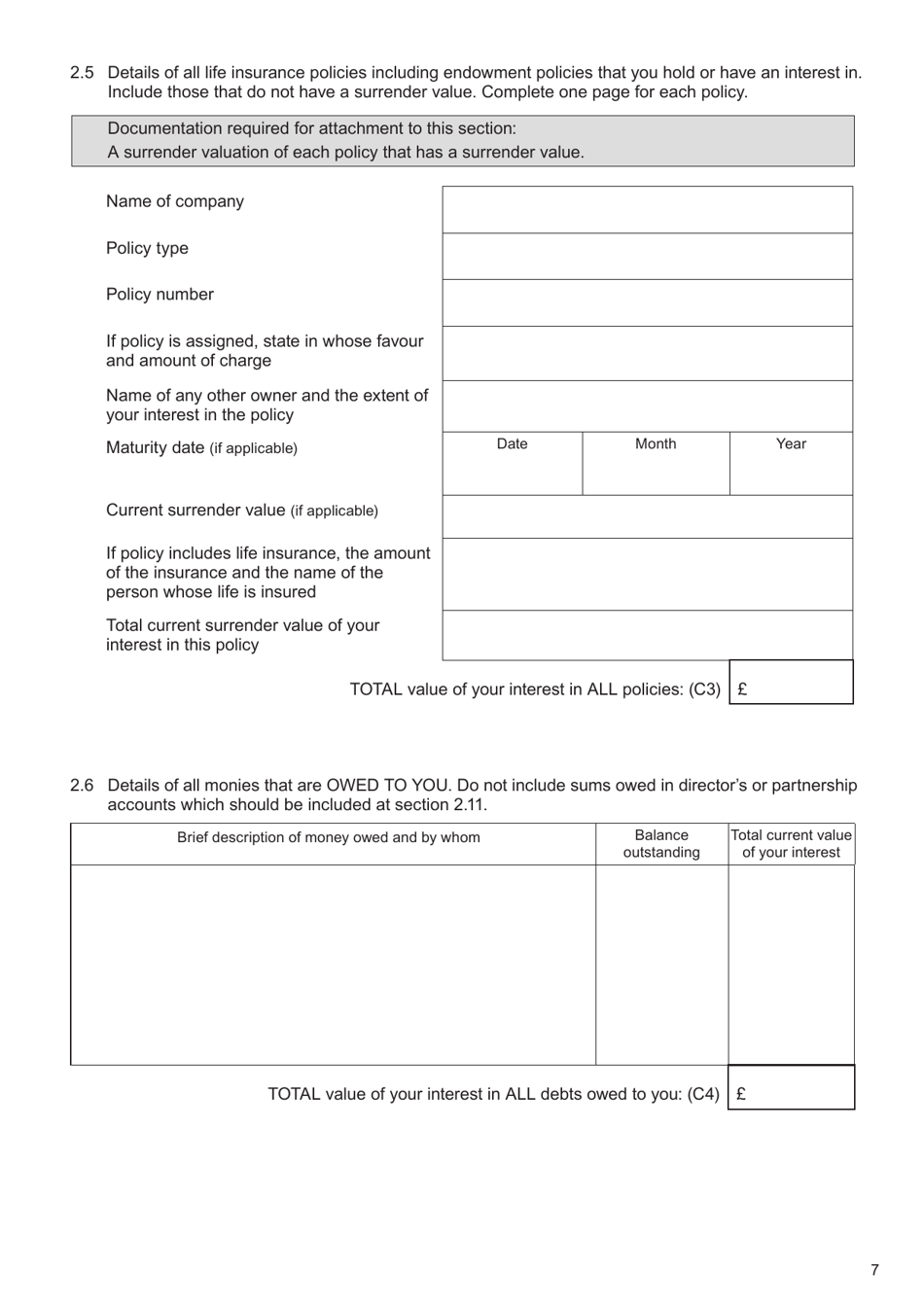

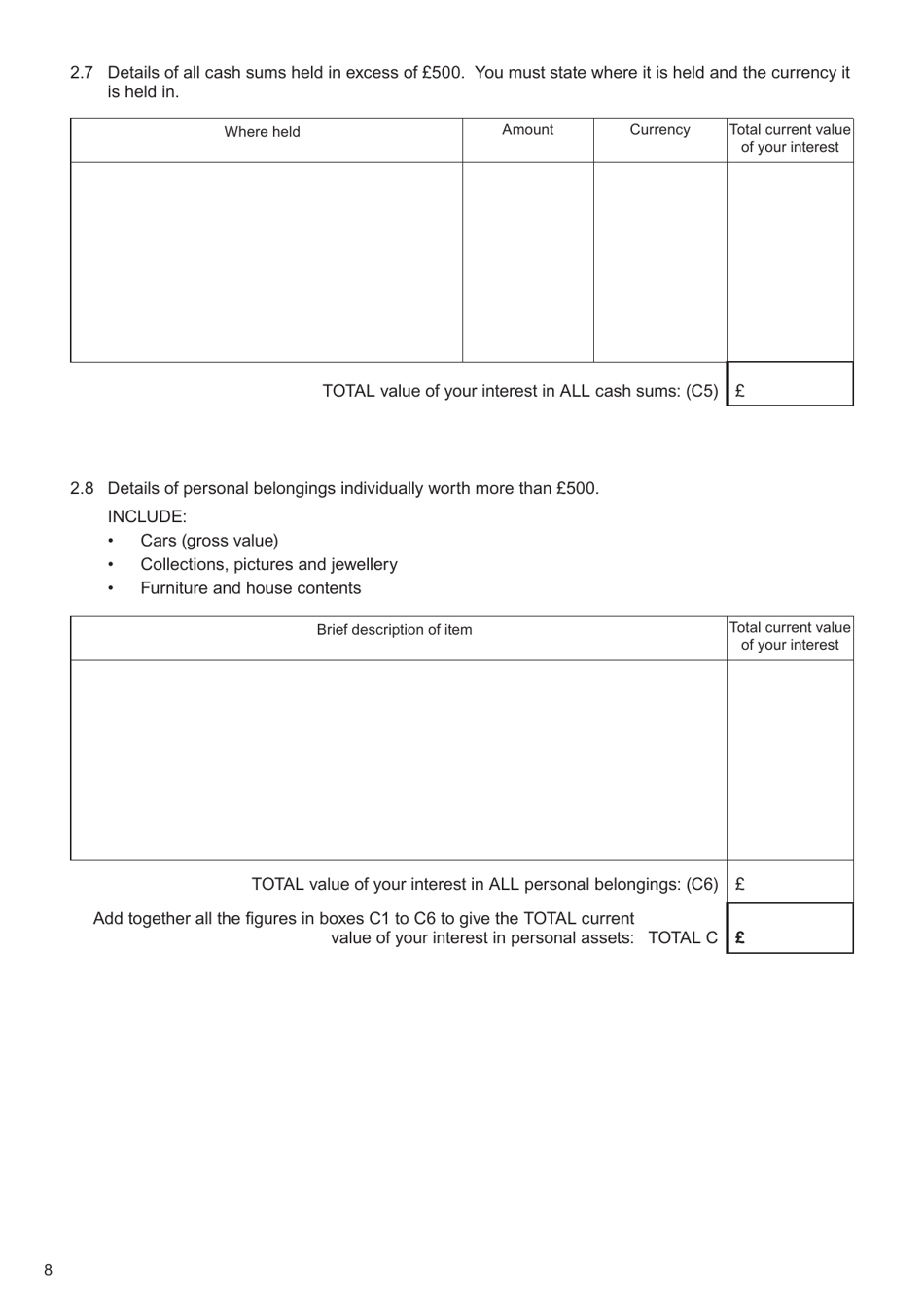

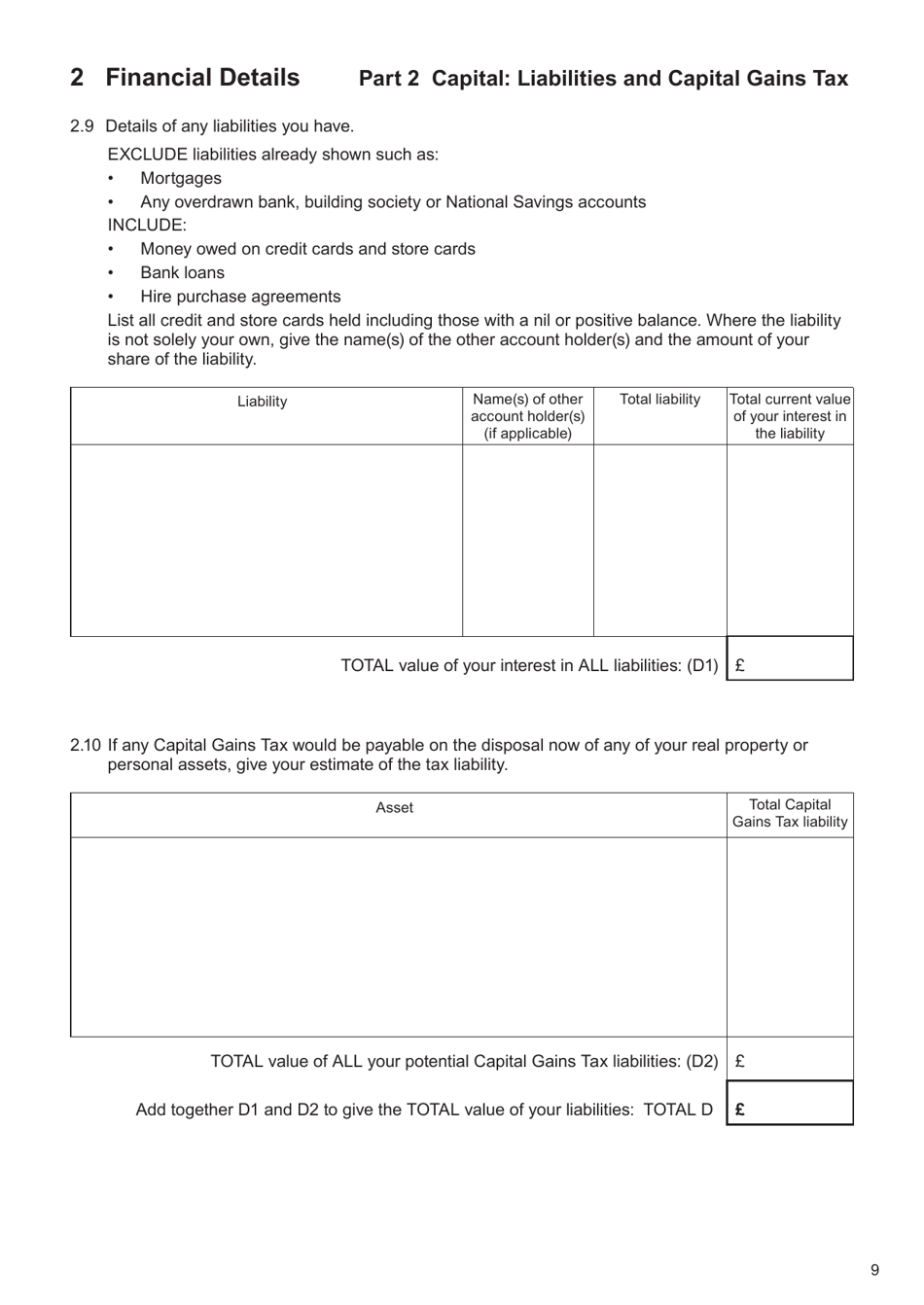

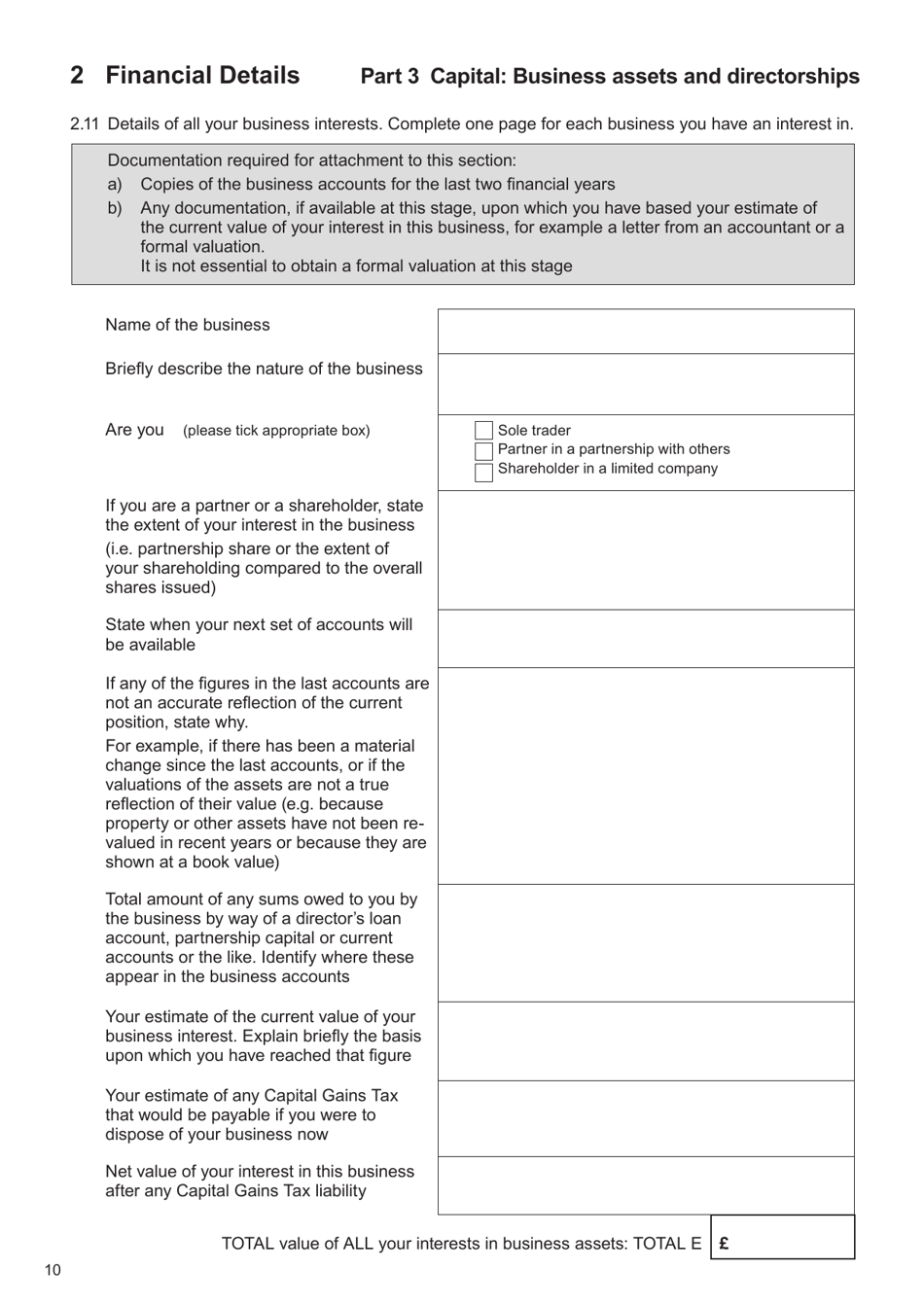

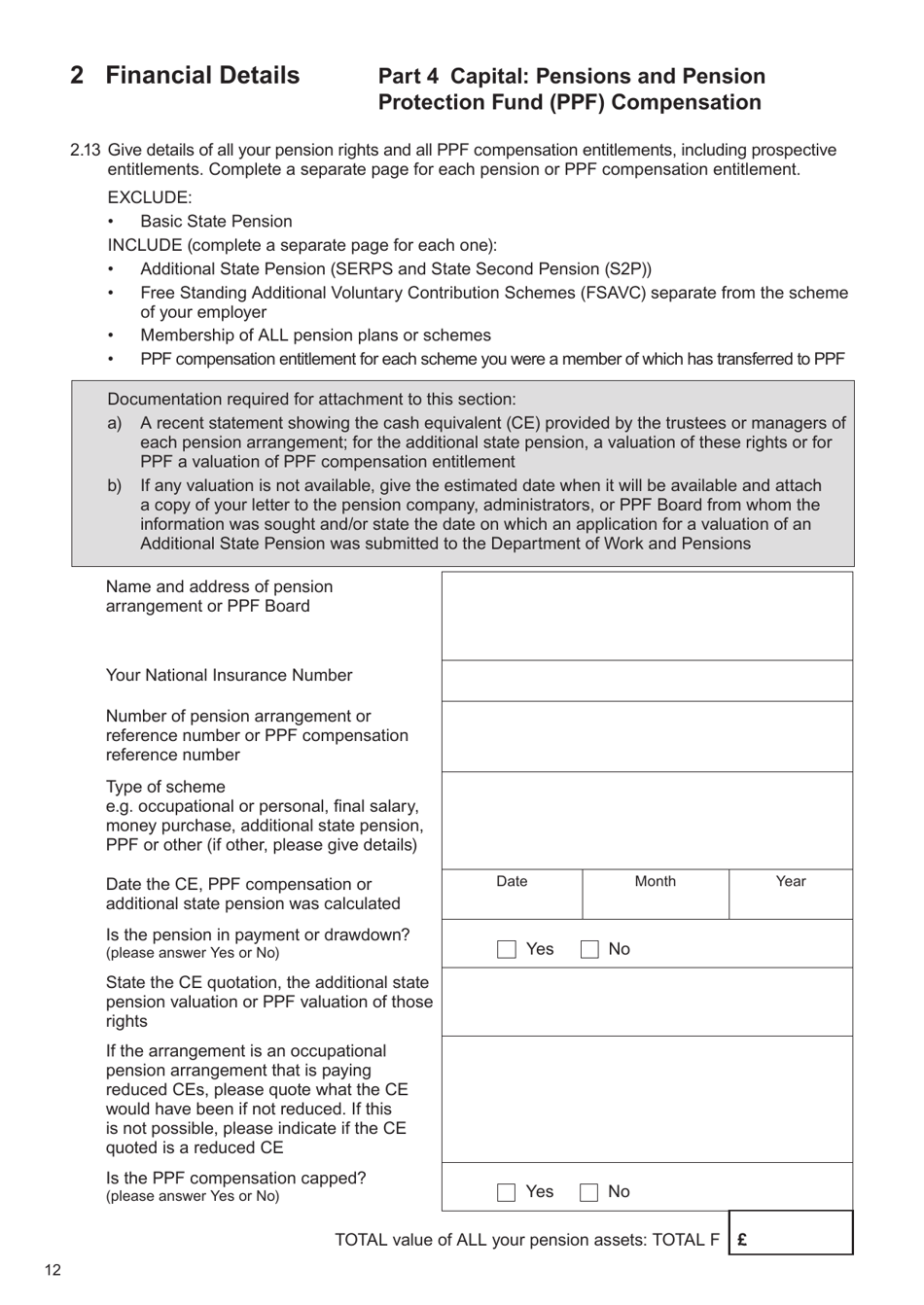

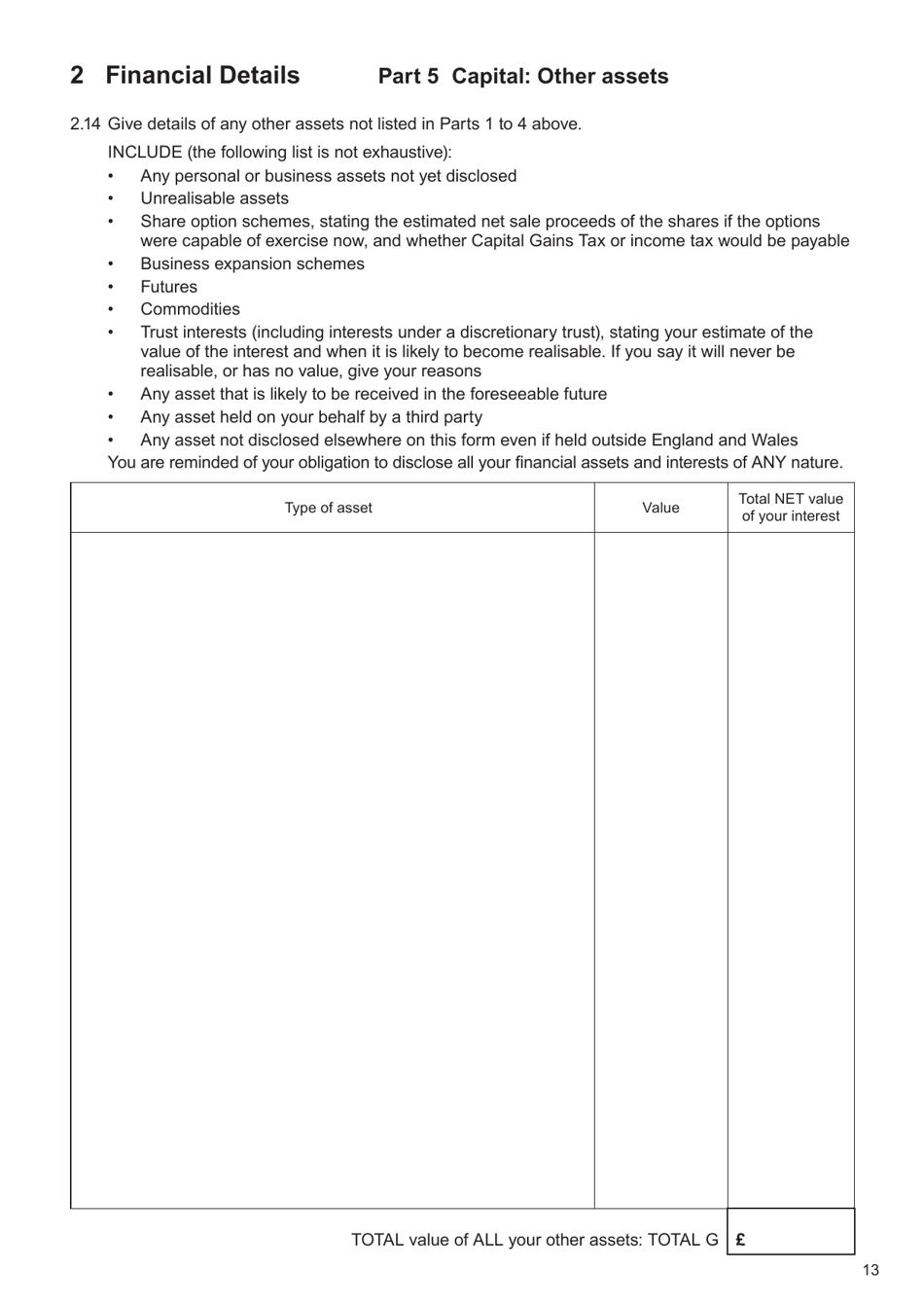

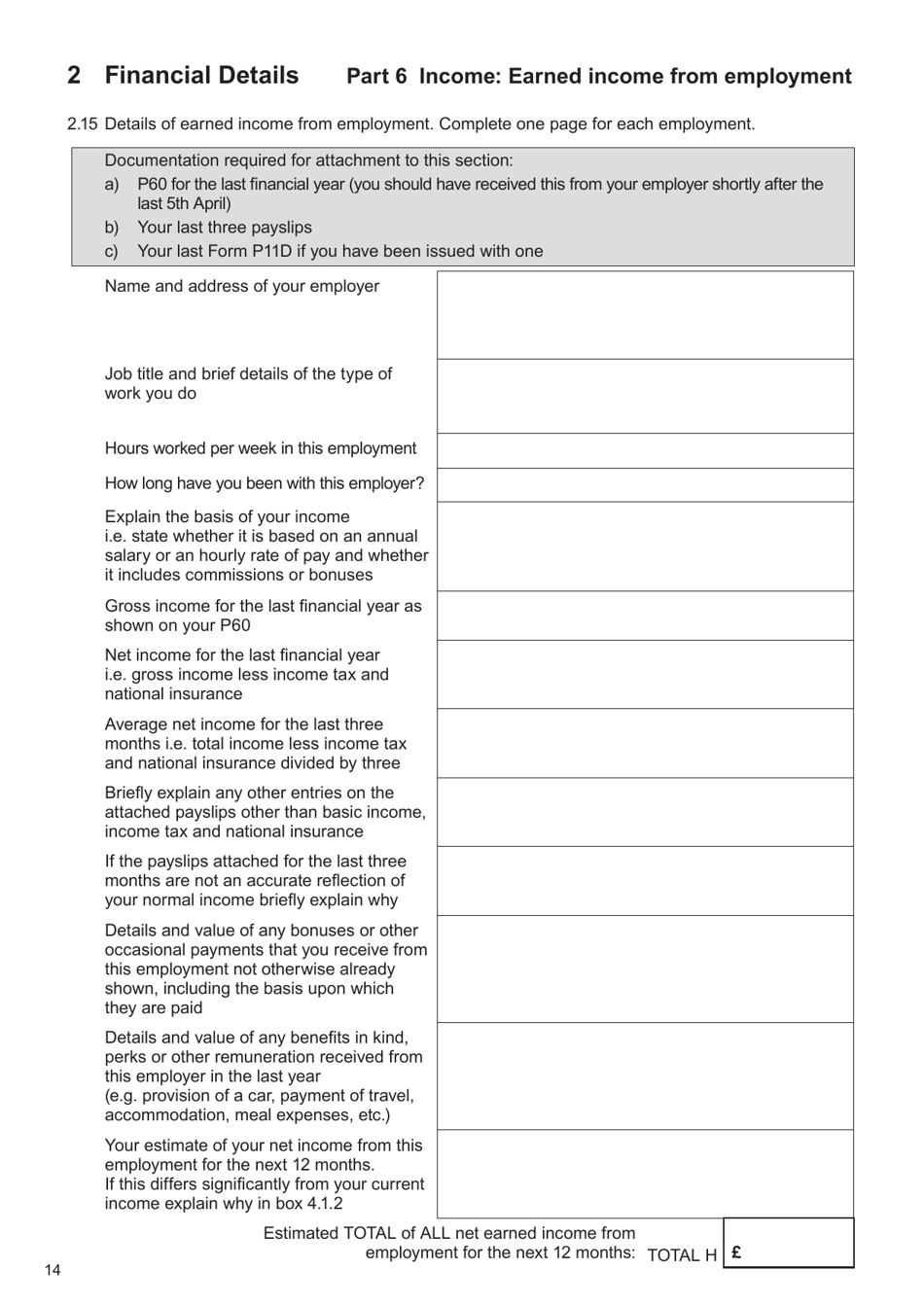

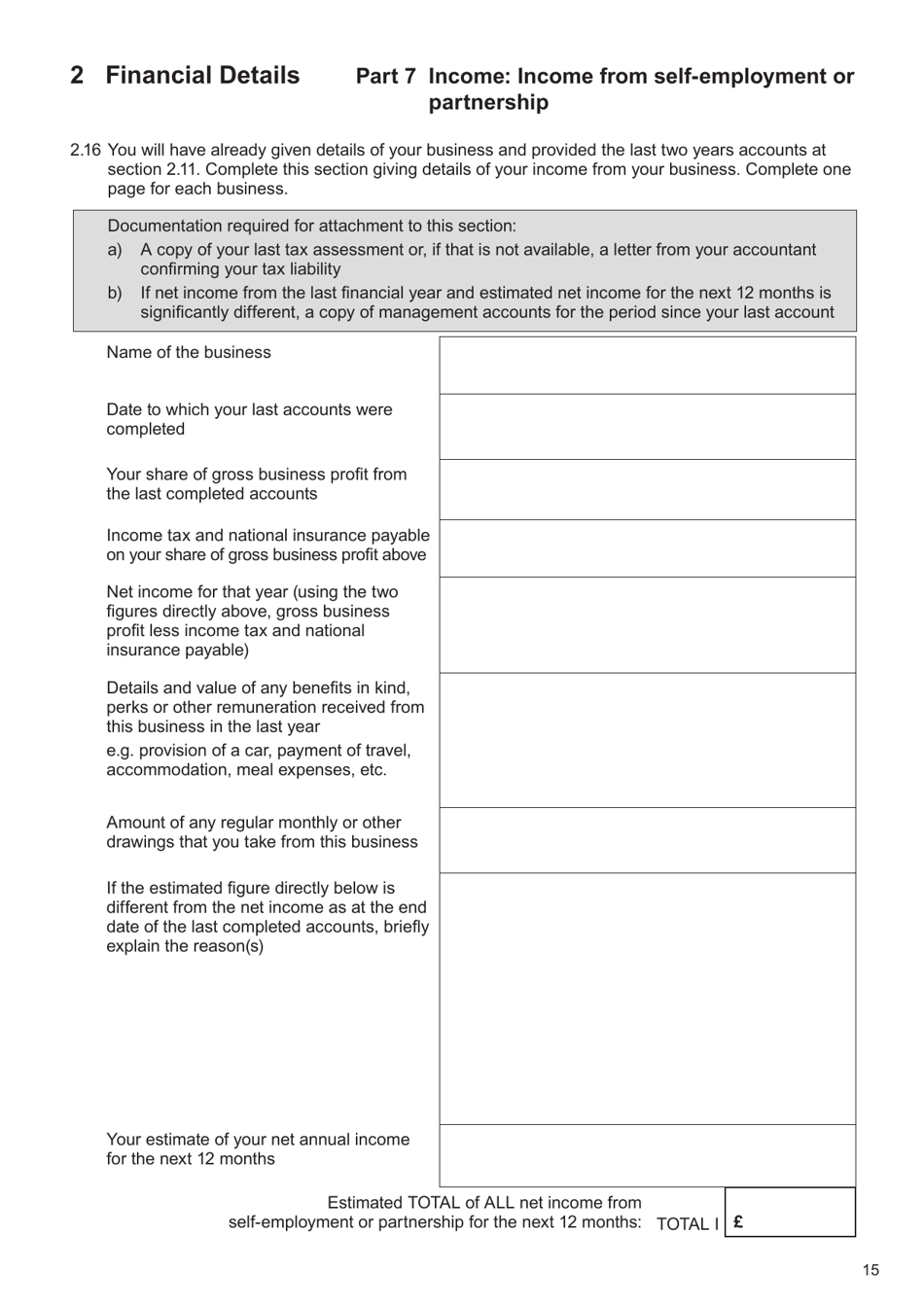

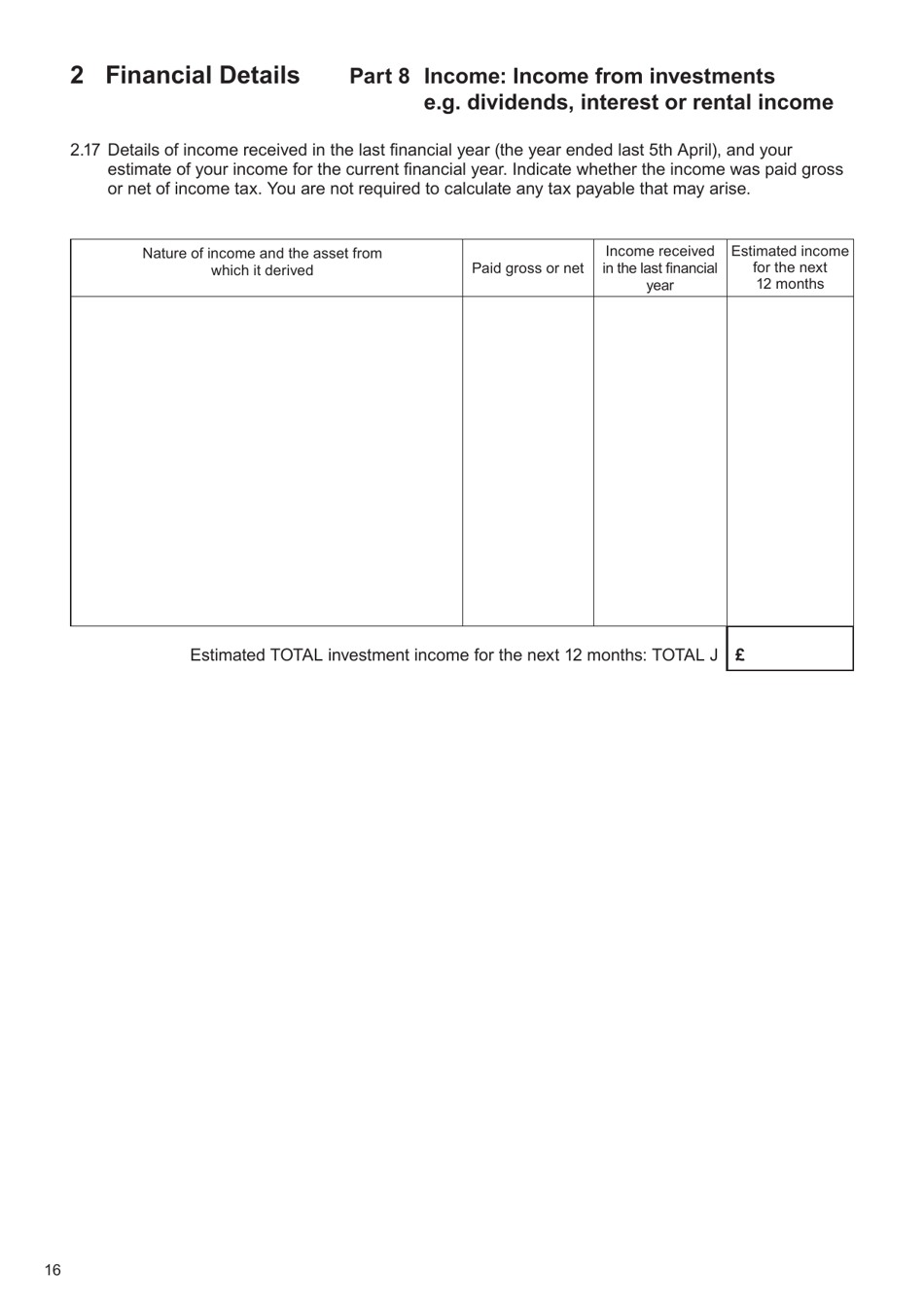

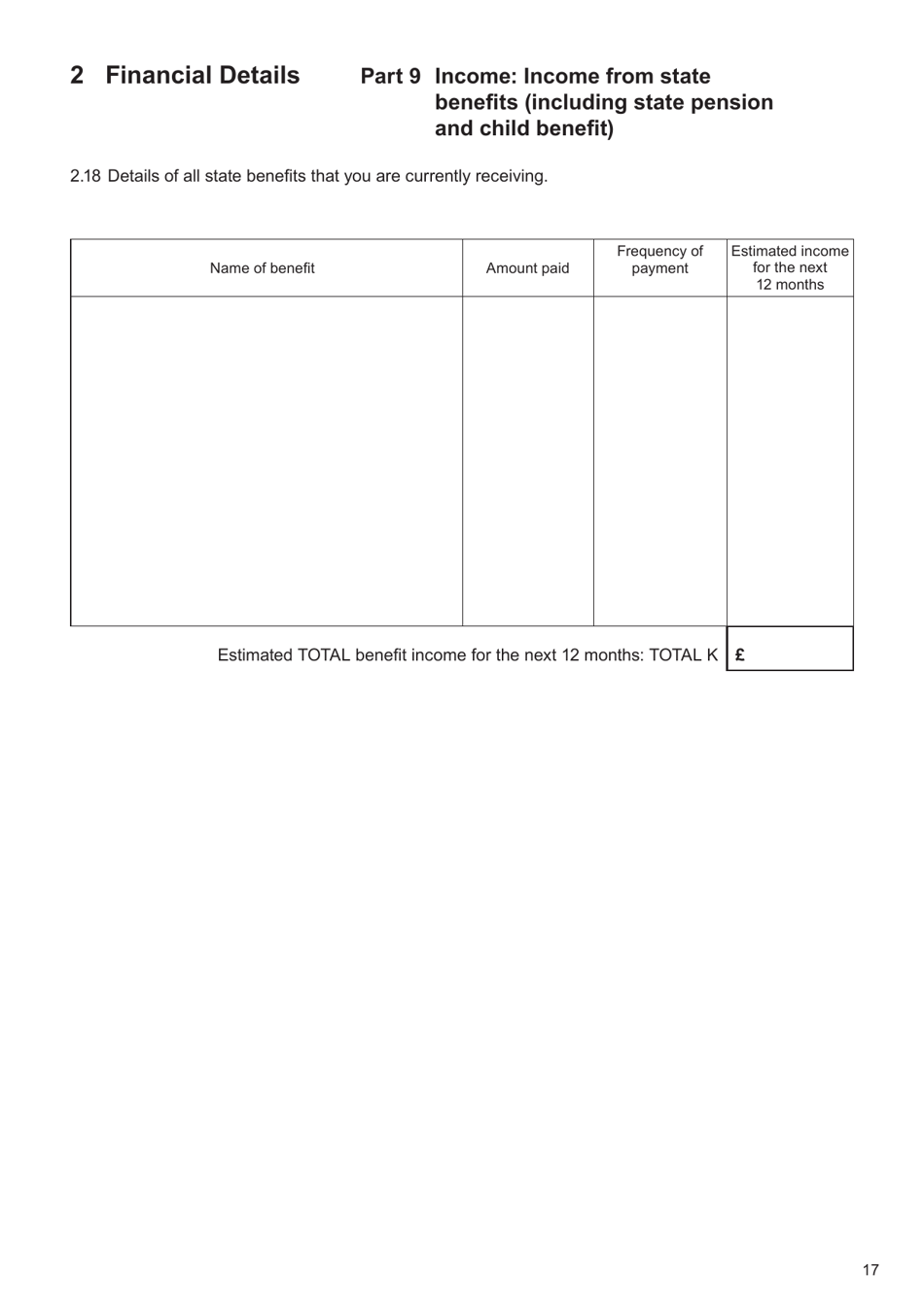

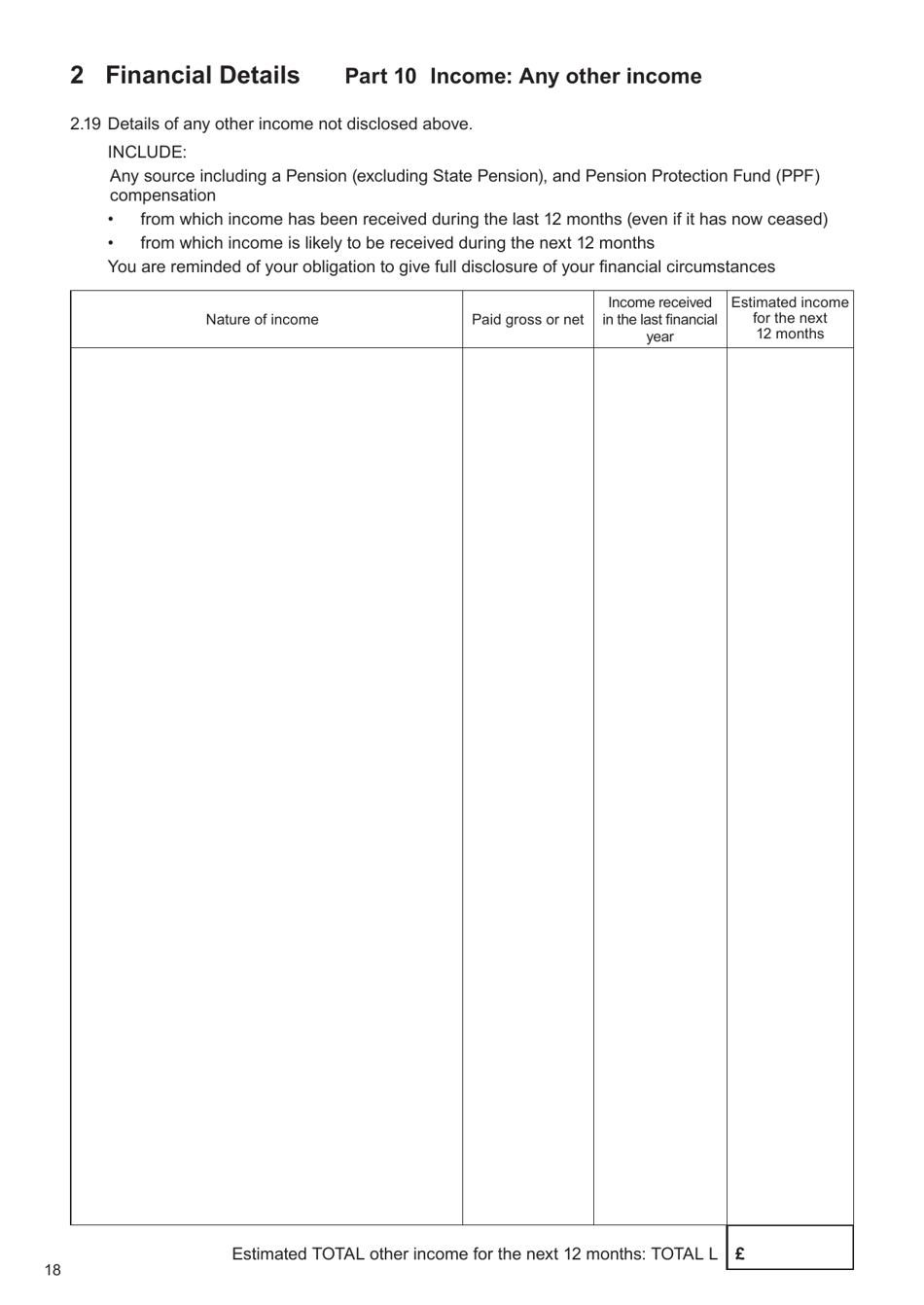

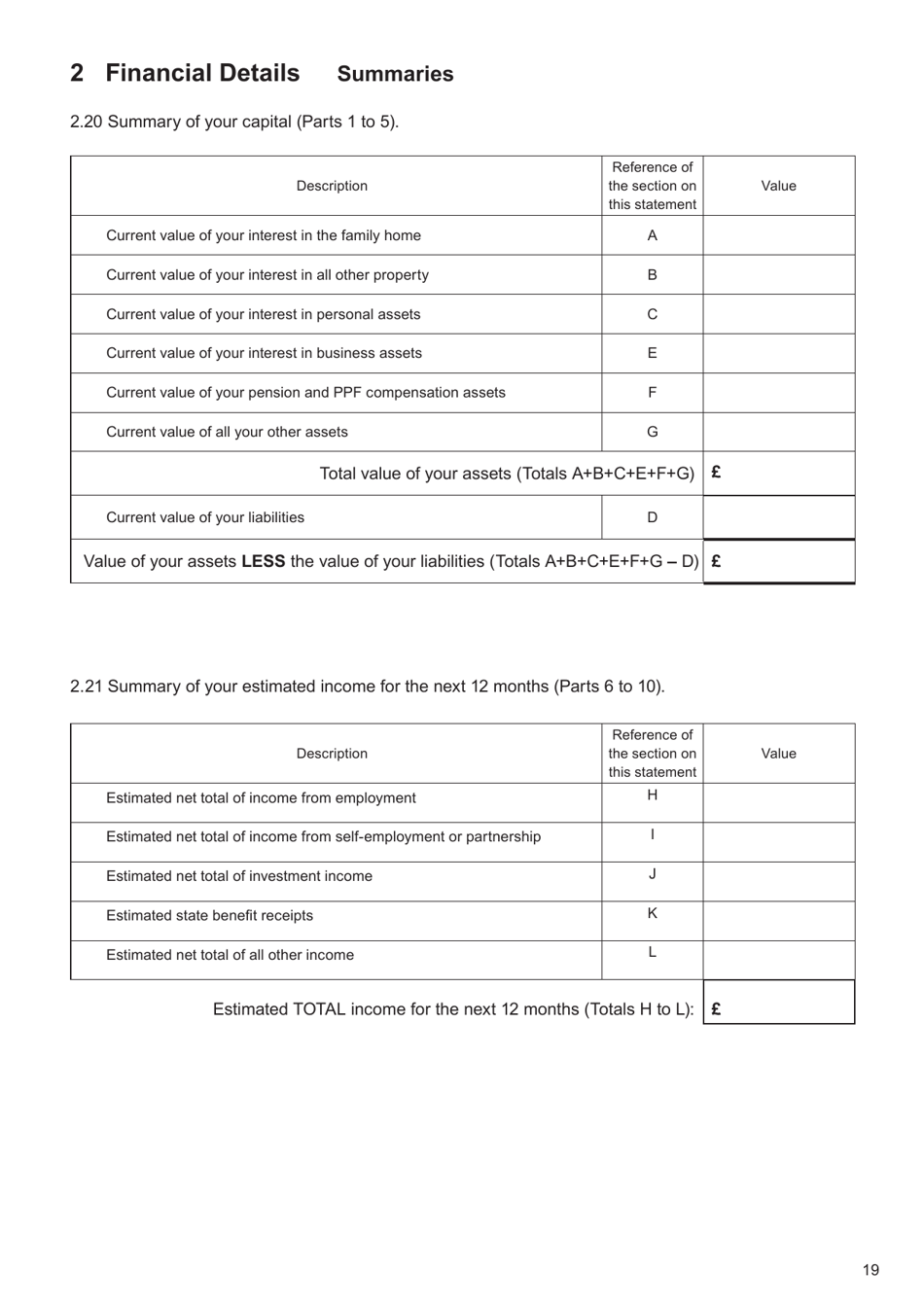

- Financial Details. Here, the individual is supposed to describe their financial situation. This part of the form is divided into 11 sections, each one of them is dedicated to certain types of assets the individual owns, and to certain types of income they receive. The individual must state information about their capital gains tax, directorships, income from their employment, income from partnerships and investments, and so on.

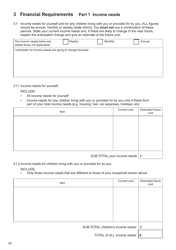

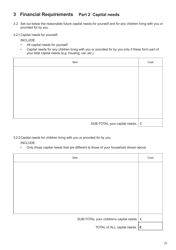

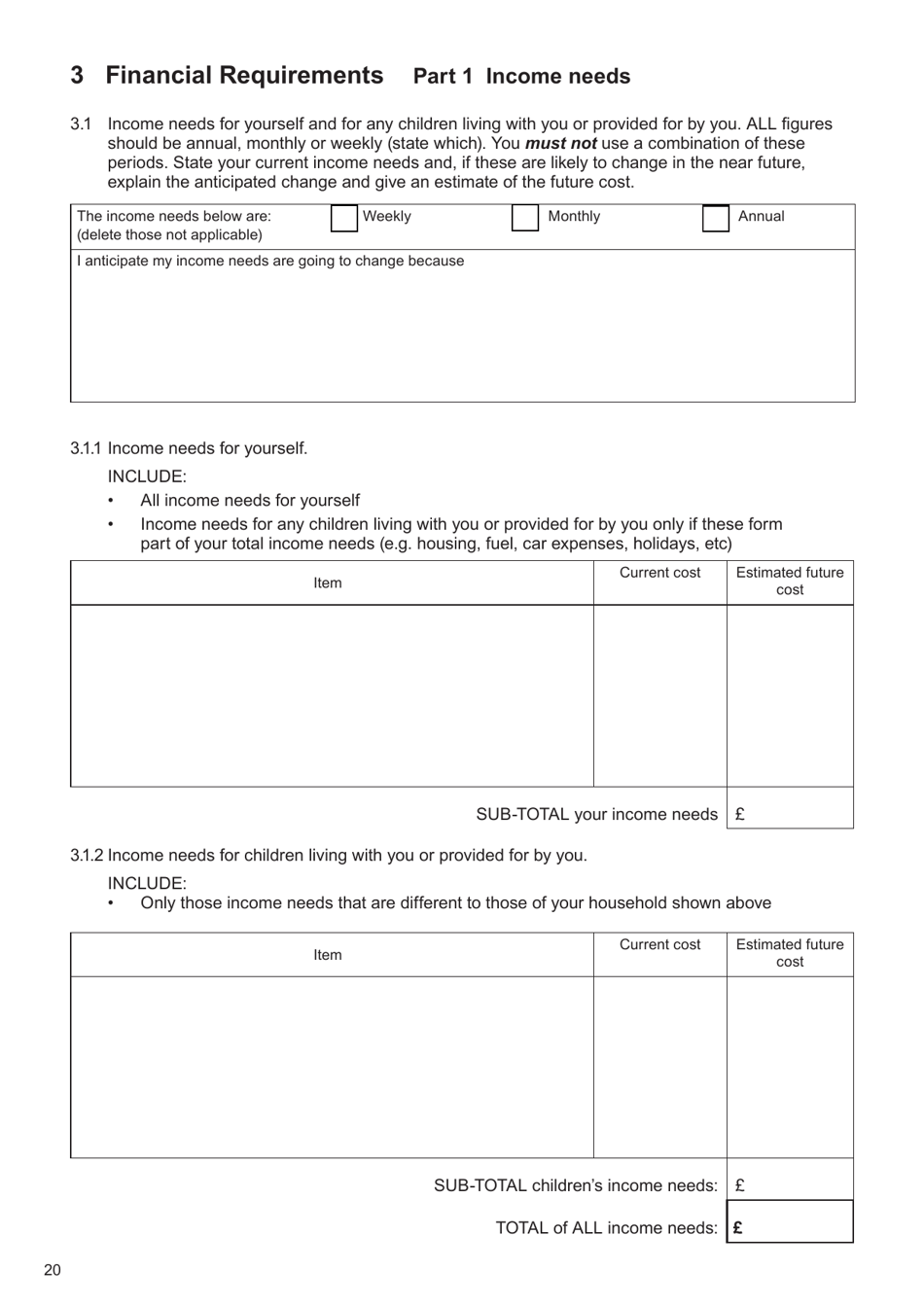

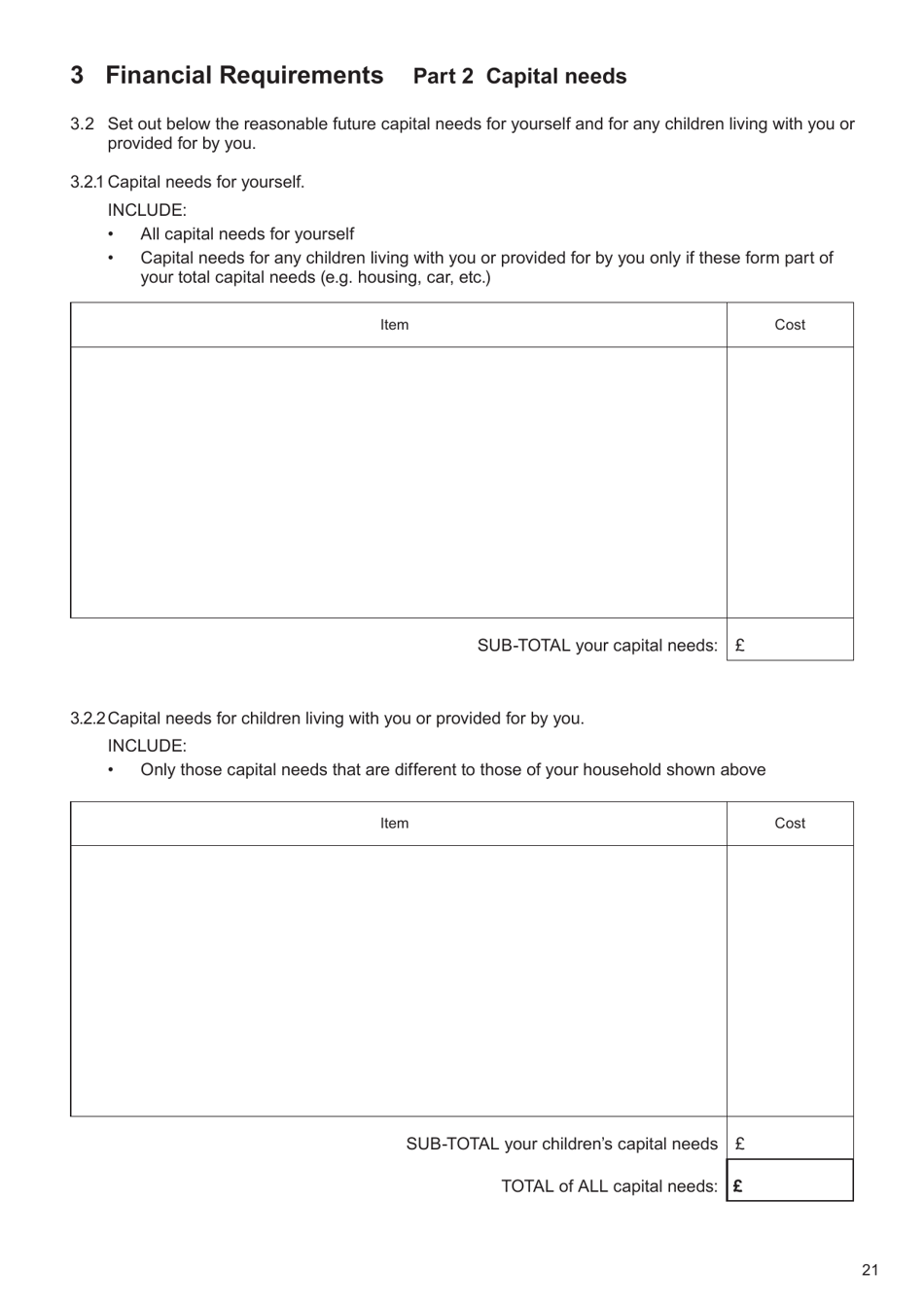

- Financial Requirements. The individual must use this part of the document to indicate their financial requirements. This part of the form is divided into two sections: income needs and capital needs. Both sections must include information about the needs of the individual and their children that live with them or are provided for by them.

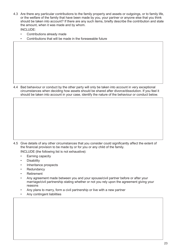

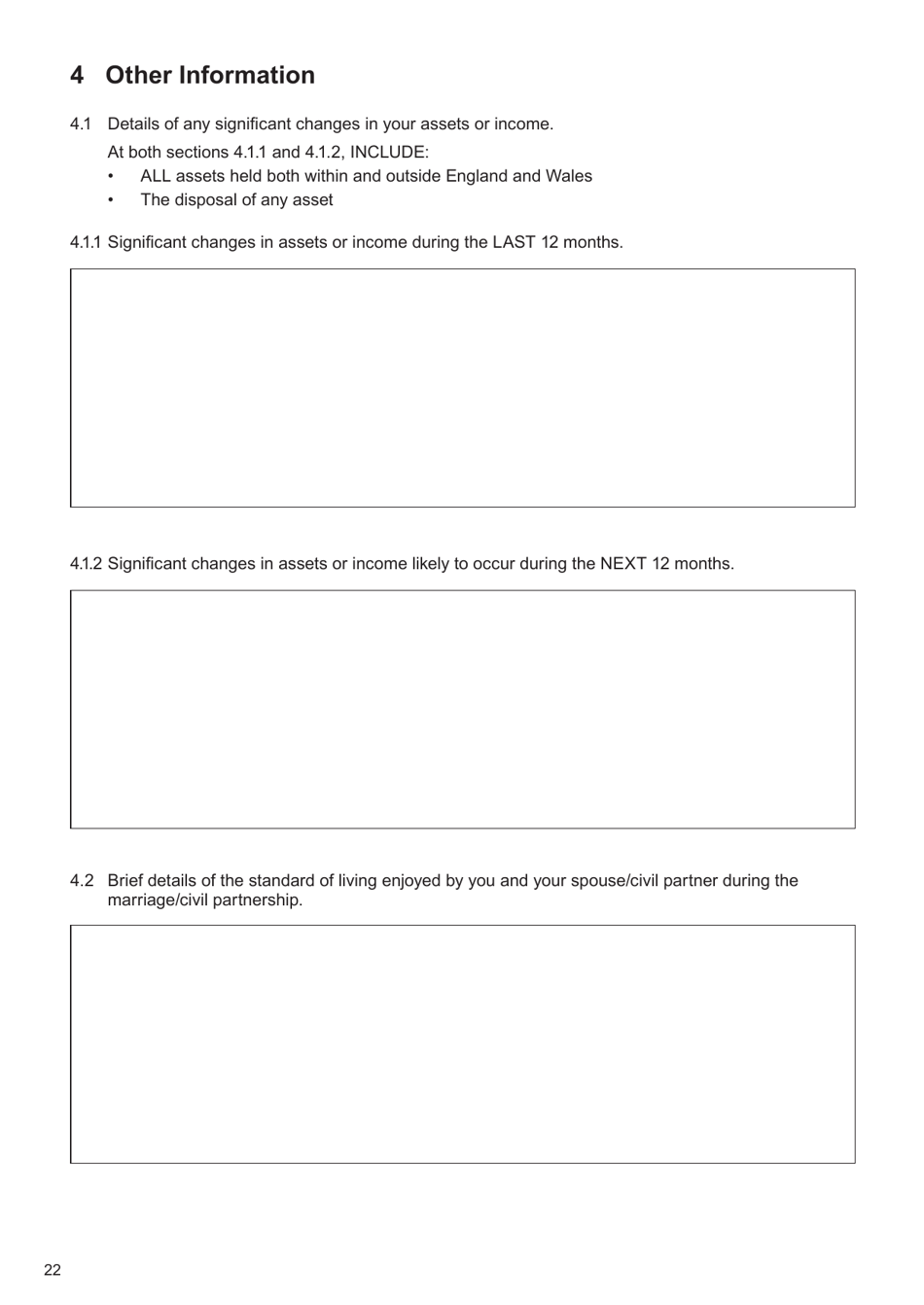

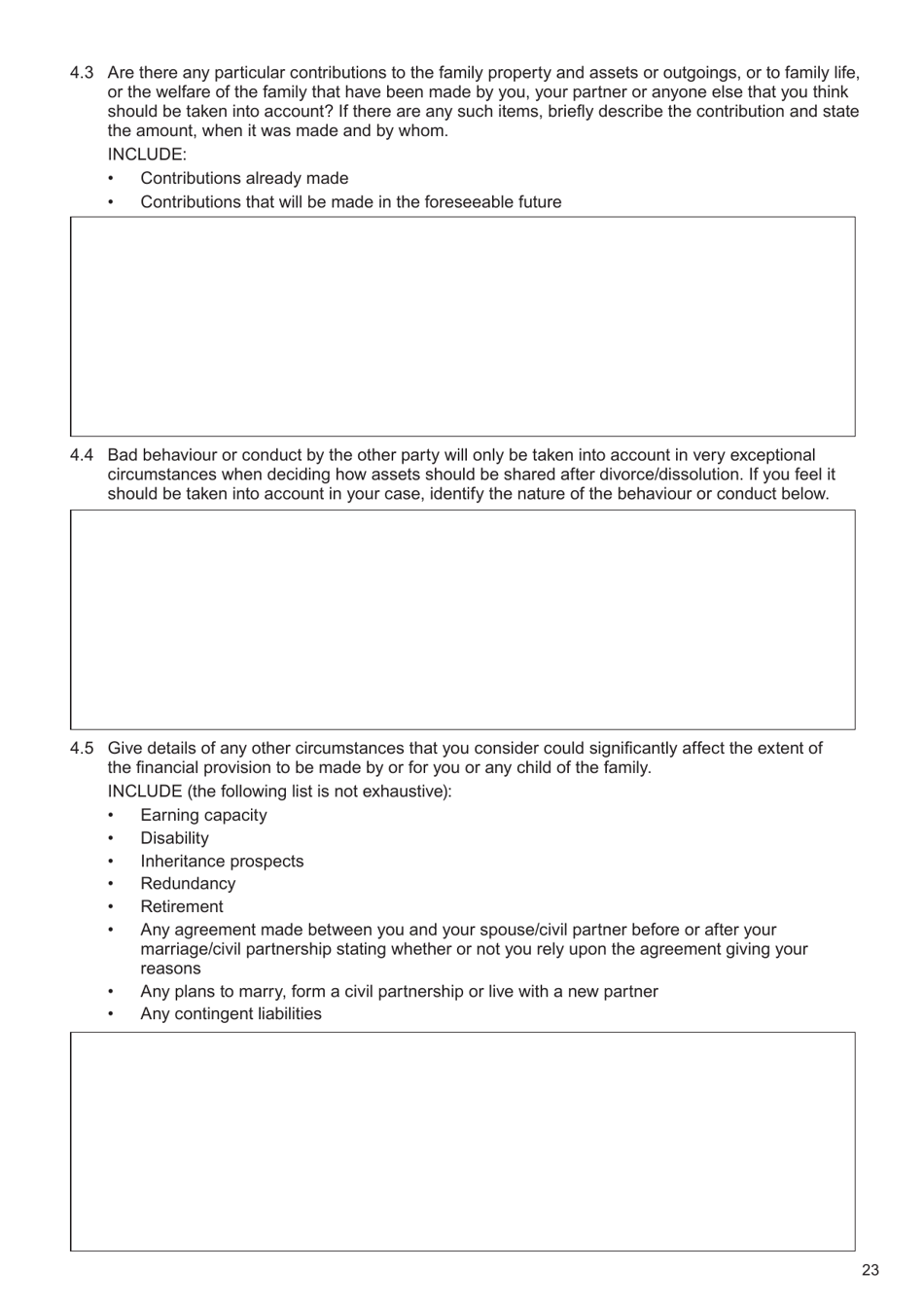

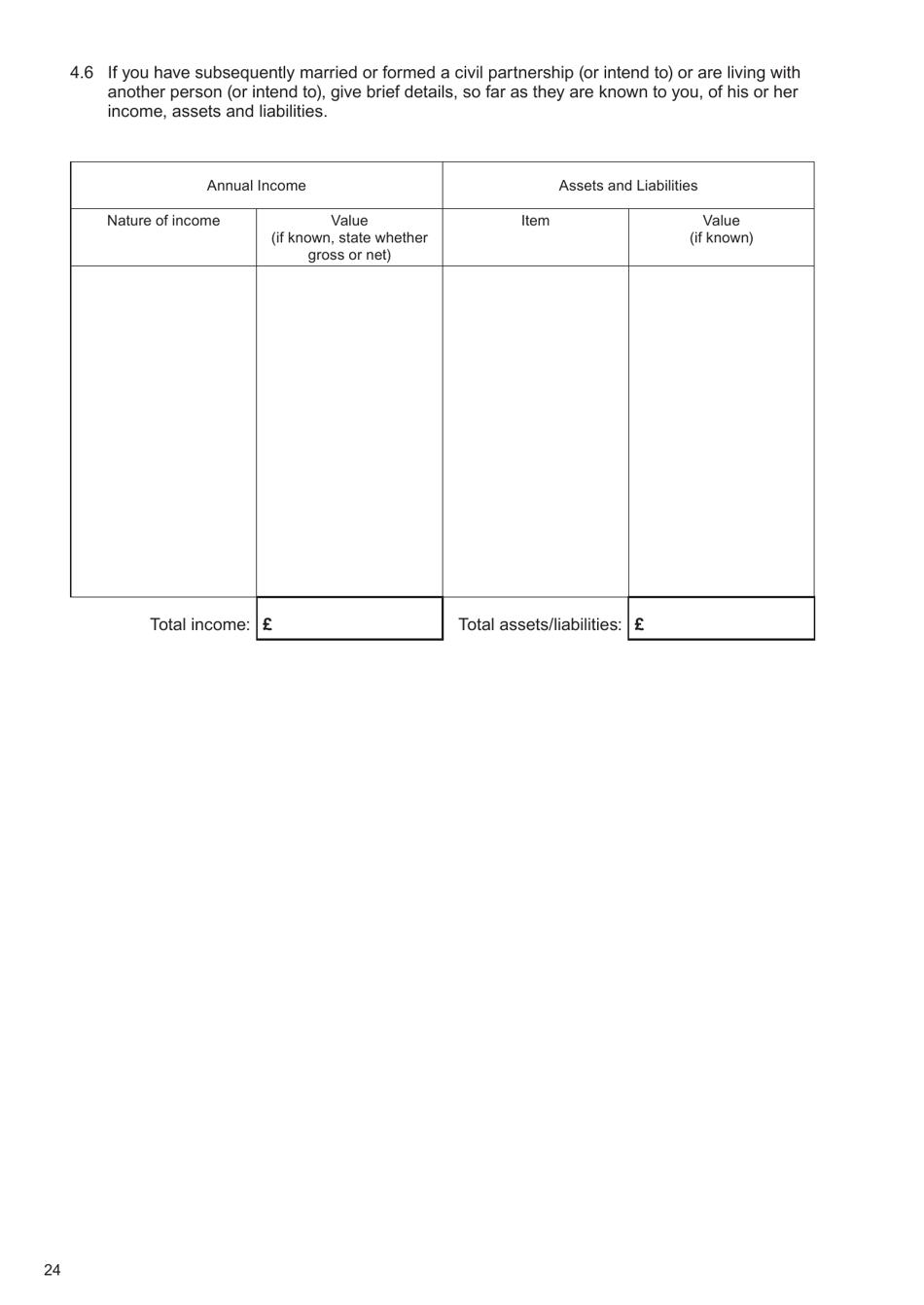

- Other Information. If the individual knows about any significant changes that can happen to their assets (income) within the next 12 months (or that had happened during the last 12 months) they must report them in this part of the form. Besides that, the individual must provide relevant details and particularities that should be taken into account.

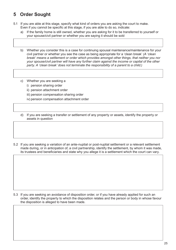

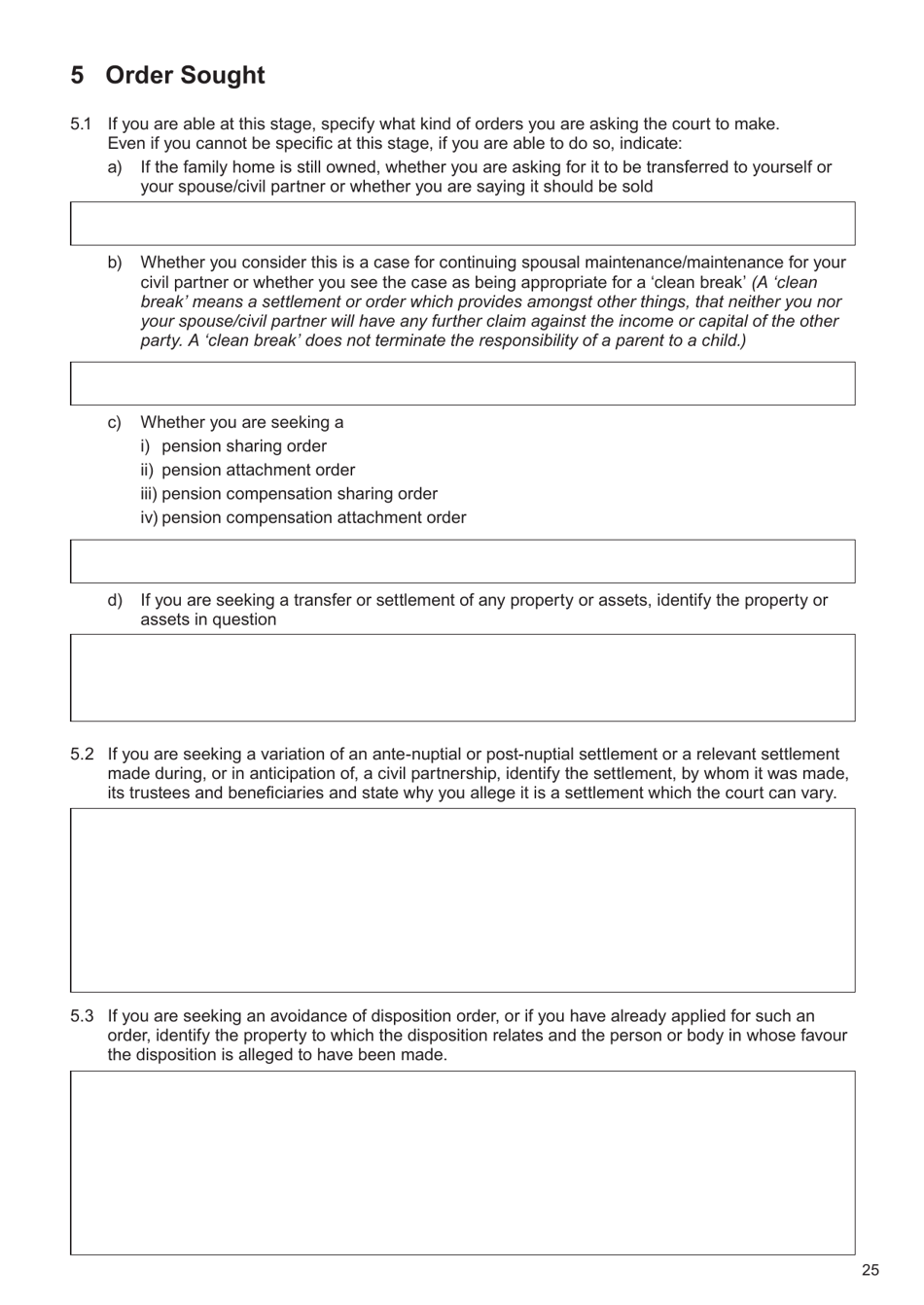

- Order Sought. This part of the document can be used to indicate what kind of order the individual is asking the court to make. If they do not know yet, they can answer the questions presented here.

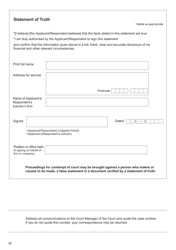

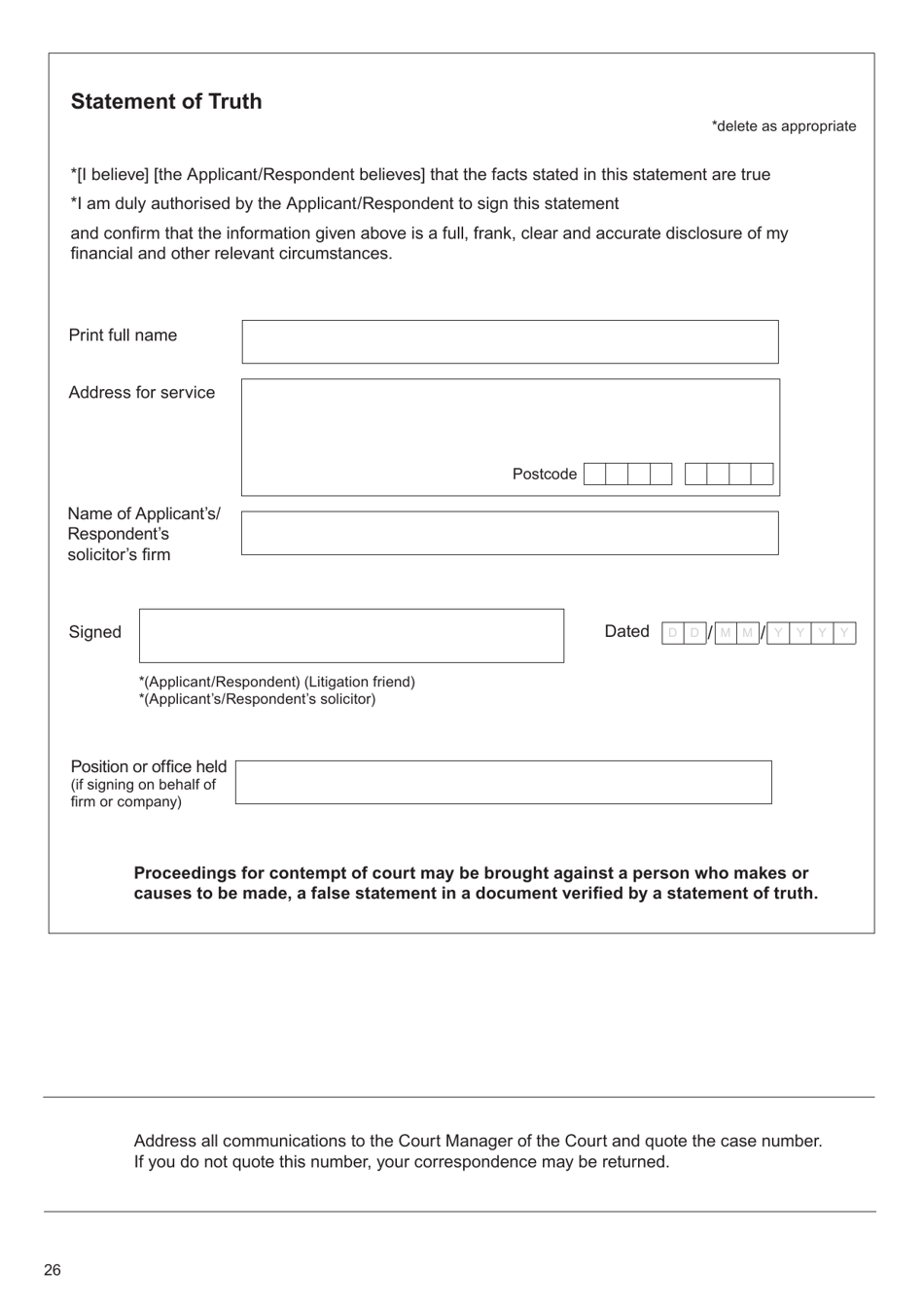

- Statement of Truth. The individual must certify that all information they presented in the form is true and correct. Here they must also put their name, signature, and date when they completed the form.

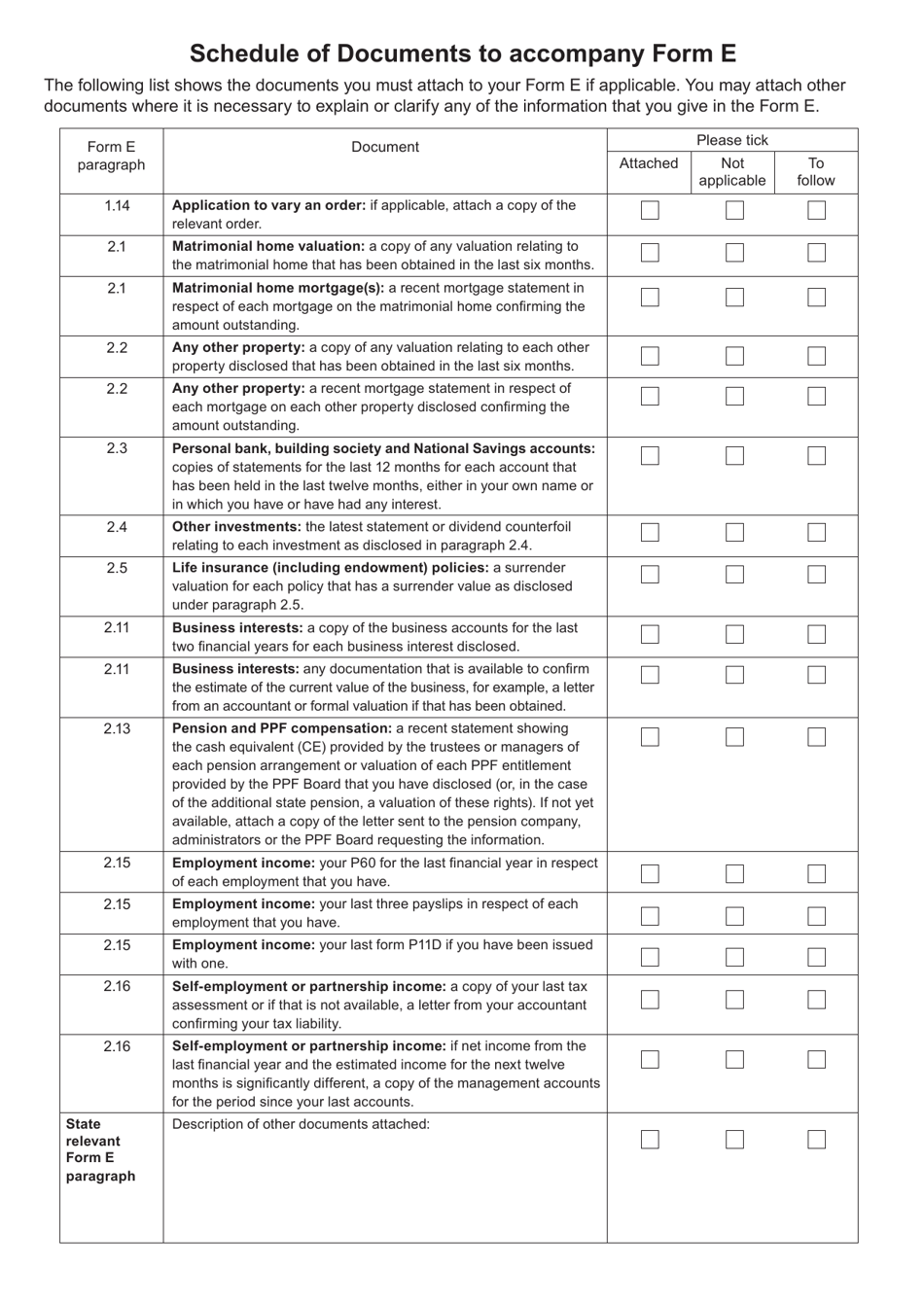

- Schedule of Documents to Accompany Form E. Individuals can use this schedule to figure out which documents they are supposed to attach to their form. The documents can be attached to explain or clarify any information in the form (if applicable).

What Happens After Form E Is Exchanged?

After the involved parties have sent copies of their forms to the court and exchanged them with each other, they can start getting ready for the hearing. Courts help dispute resolution hearings, during which the parties have an opportunity to achieve an agreement that will be acceptable for both parties. If the parties failed to reach a settlement, the court will hold a final hearing. The parties can provide evidence that will support their side of the situation, and the court will make a decision based on the evidence they were presented with.