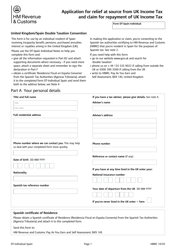

Form CT600 Company Tax Return - United Kingdom

Fill PDF Online

Fill out online for free

without registration or credit card

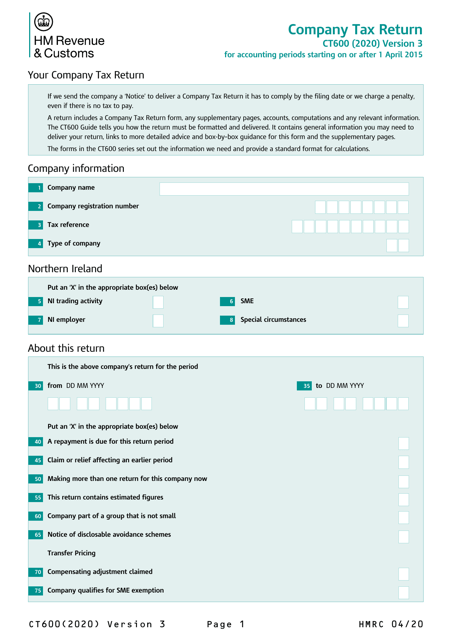

What Is Form CT600?

Form CT600, Company Tax Return , is used by specific businesses based in the United Kingdom that are required to submit a corporation tax return. This corporation tax return will be submitted alongside company documentation showing the year's profits and losses.

Alternate Names:

- Corporation Tax Form CT600;

- Corporation Tax Return Form.

Form CT600 is issued by United Kingdom HM Revenue & Customs and was last updated on @@form-rev@@ . An up-to-date and fillable Form CT600 is available for download through the link below.

How to Fill In Form CT600?

You will need to include the following information when completing Form CT600:

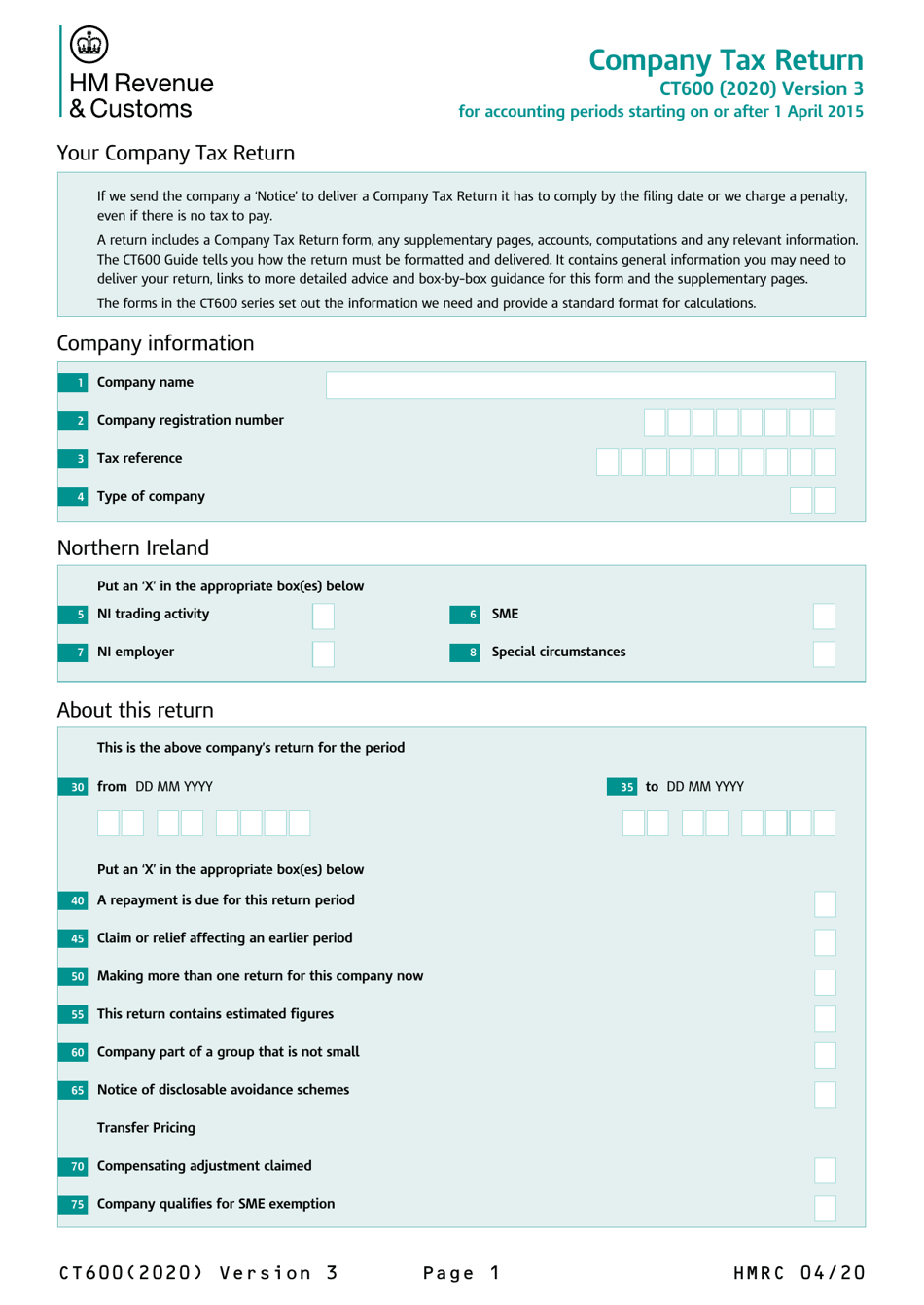

- General information about the company (including its name, tax and company identification numbers, and type of organization) and additional supplementary information (namely, if the company is based in Northern Ireland or employs workers from Northern Ireland).

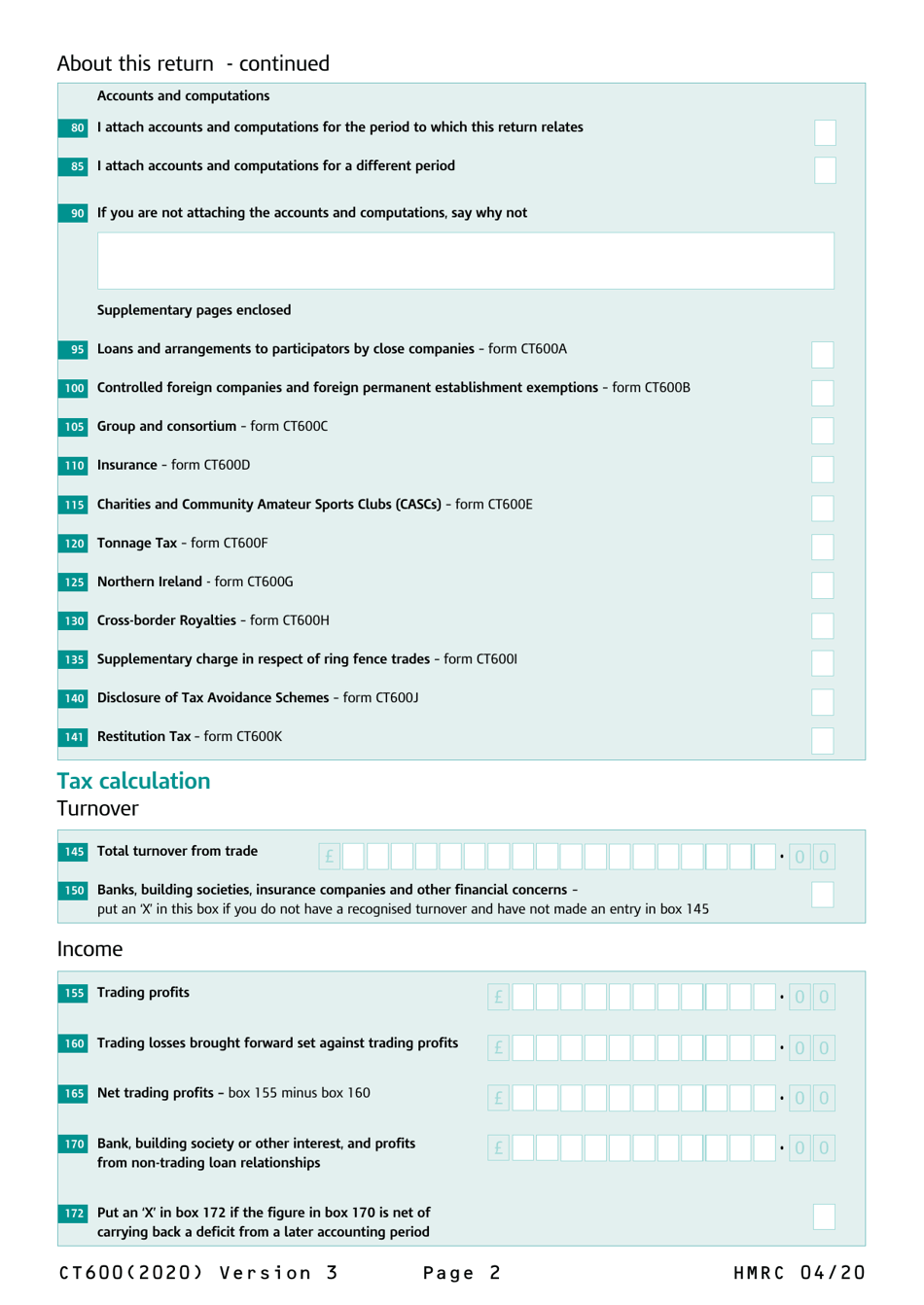

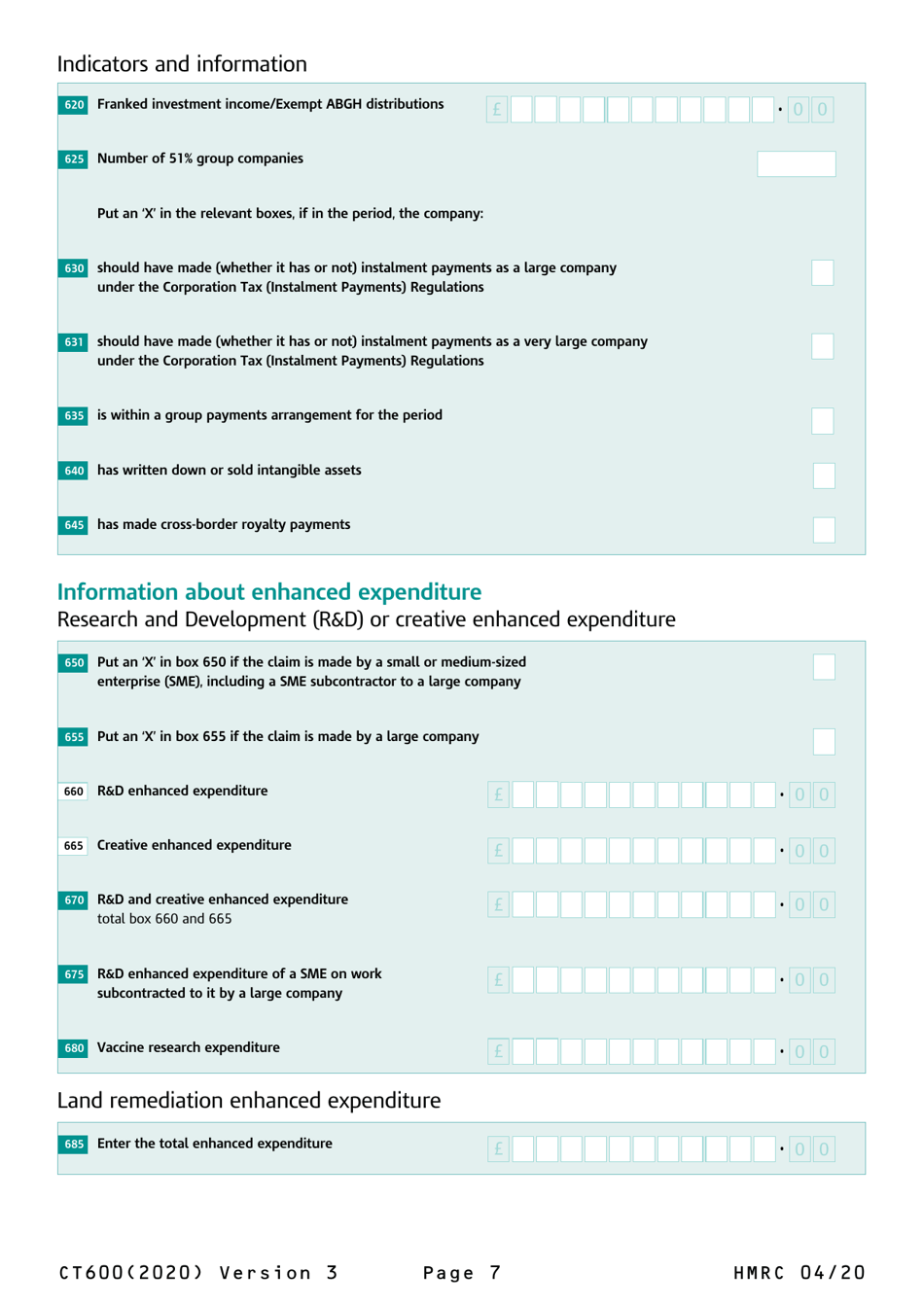

- Information about the tax return itself (including its time period, if the company will be submitting a payment, relief claim, exemption, or other addenda to the form). Additional information about the return, including additional forms that will be submitted, account information connected to the business in question, current or past financial calculations, charitable donations made, or reimbursements received.

- If the profits from your business are based on the turnover of inventory you will need to calculate the total turnover conducted during the time period listed on the form and any other financial institutions connected to your organization.

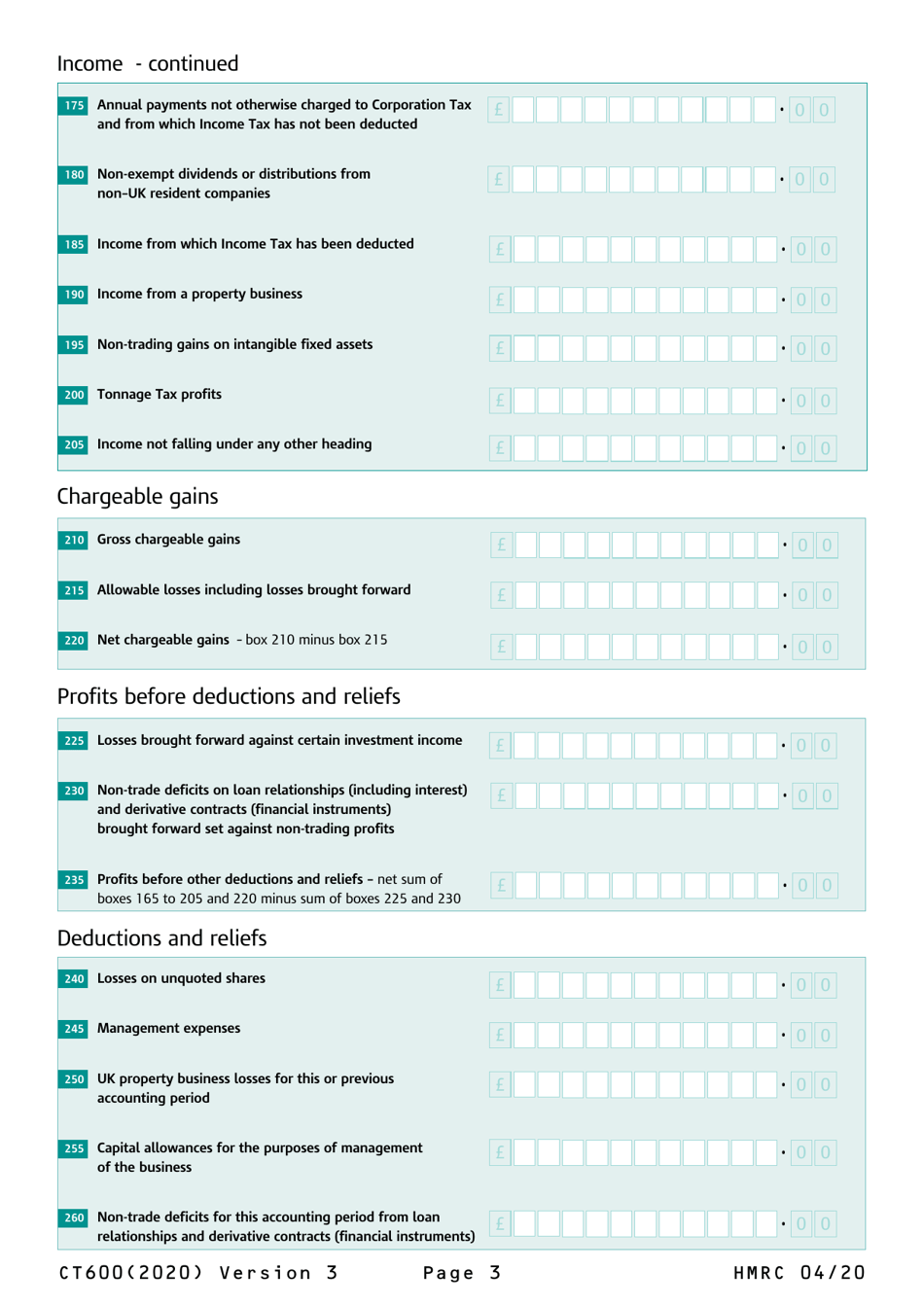

- All figures related to income from the business. This will include profits made from trading, interest accumulated in banking accounts, property, or fixed assets. All profit listings in this section will include net earnings.

- Corporation tax for any chargeable gains made in the time period listed on Form CT600.

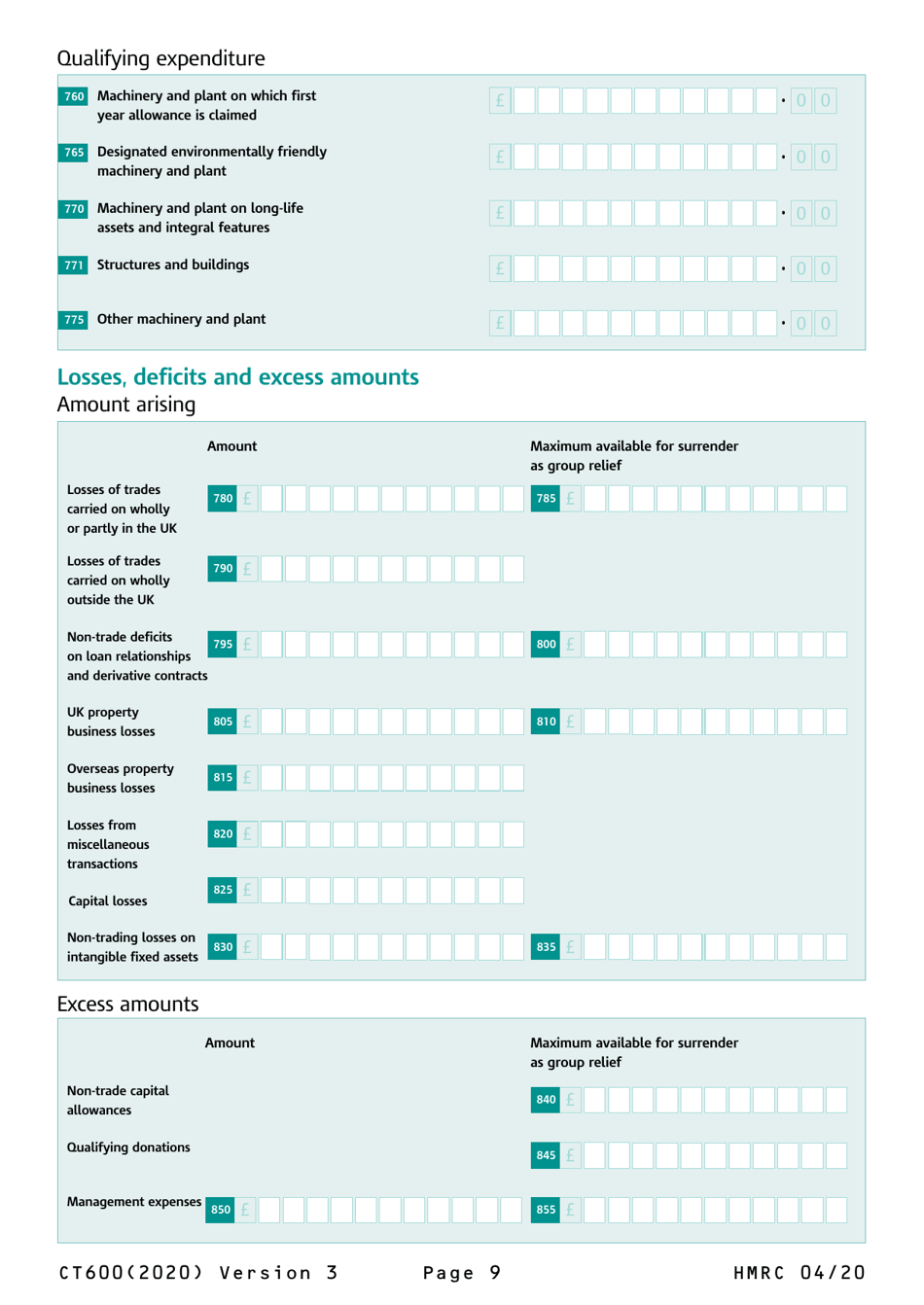

- Include the total calculations for any losses against the business or loans taken out during the time period.

- You will then total all profits and all losses that do not include deductions or other financial reliefs separately and will subtract these two totals from one another to find the total amount of profits made during the tax year.

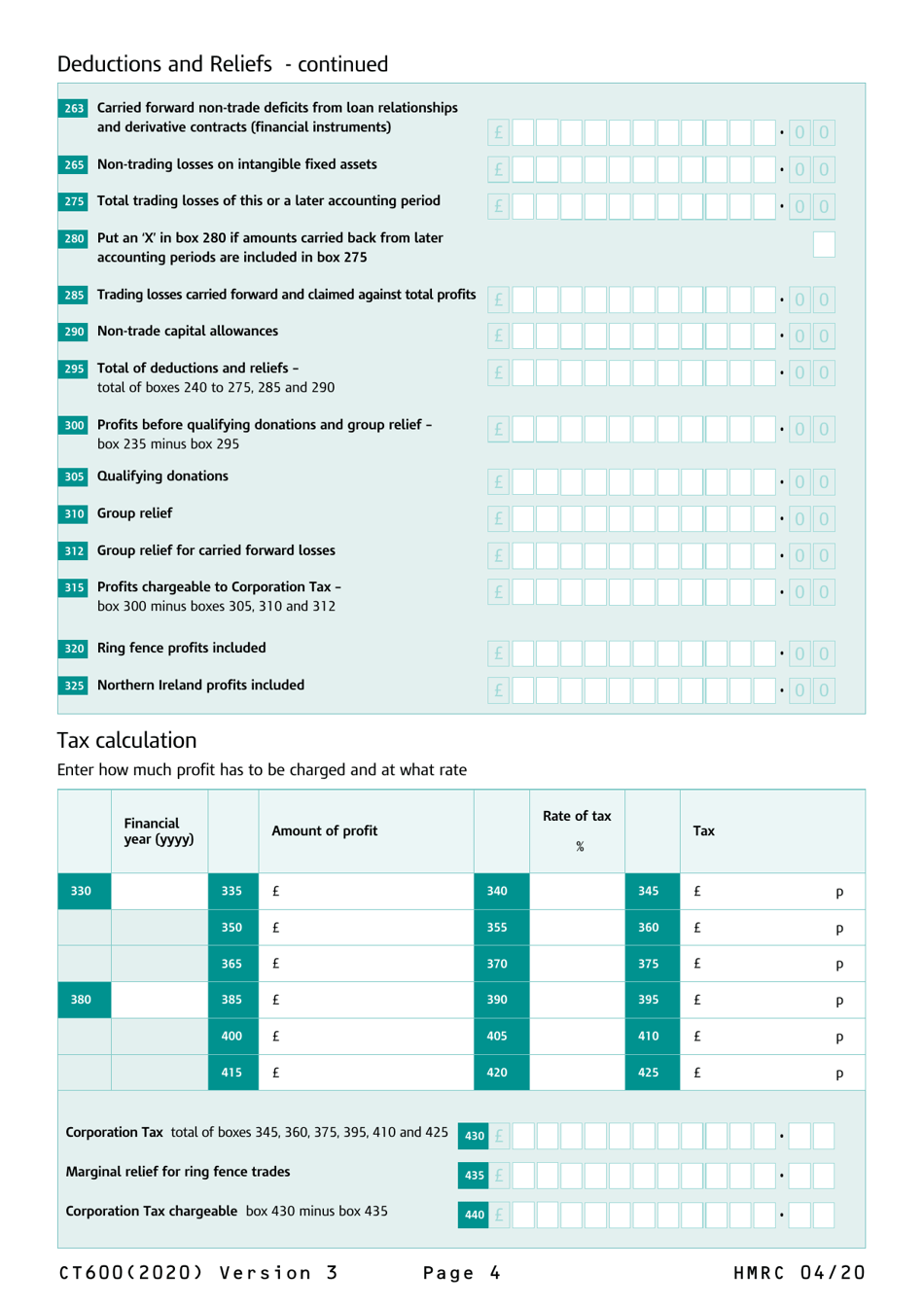

- Next, you will calculate all deductions available for your organization. Note this is separate from the section concerning profit losses or loans.

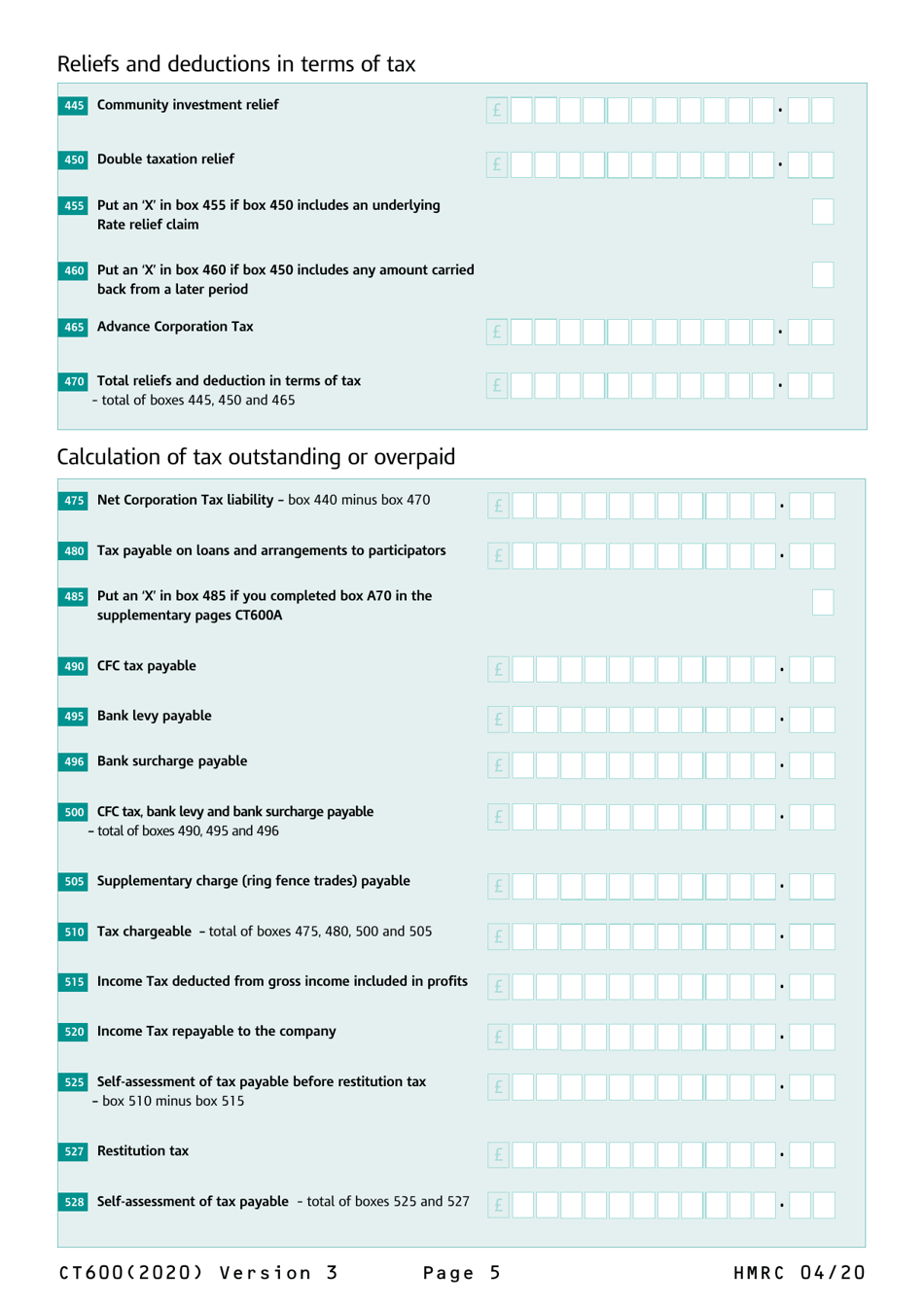

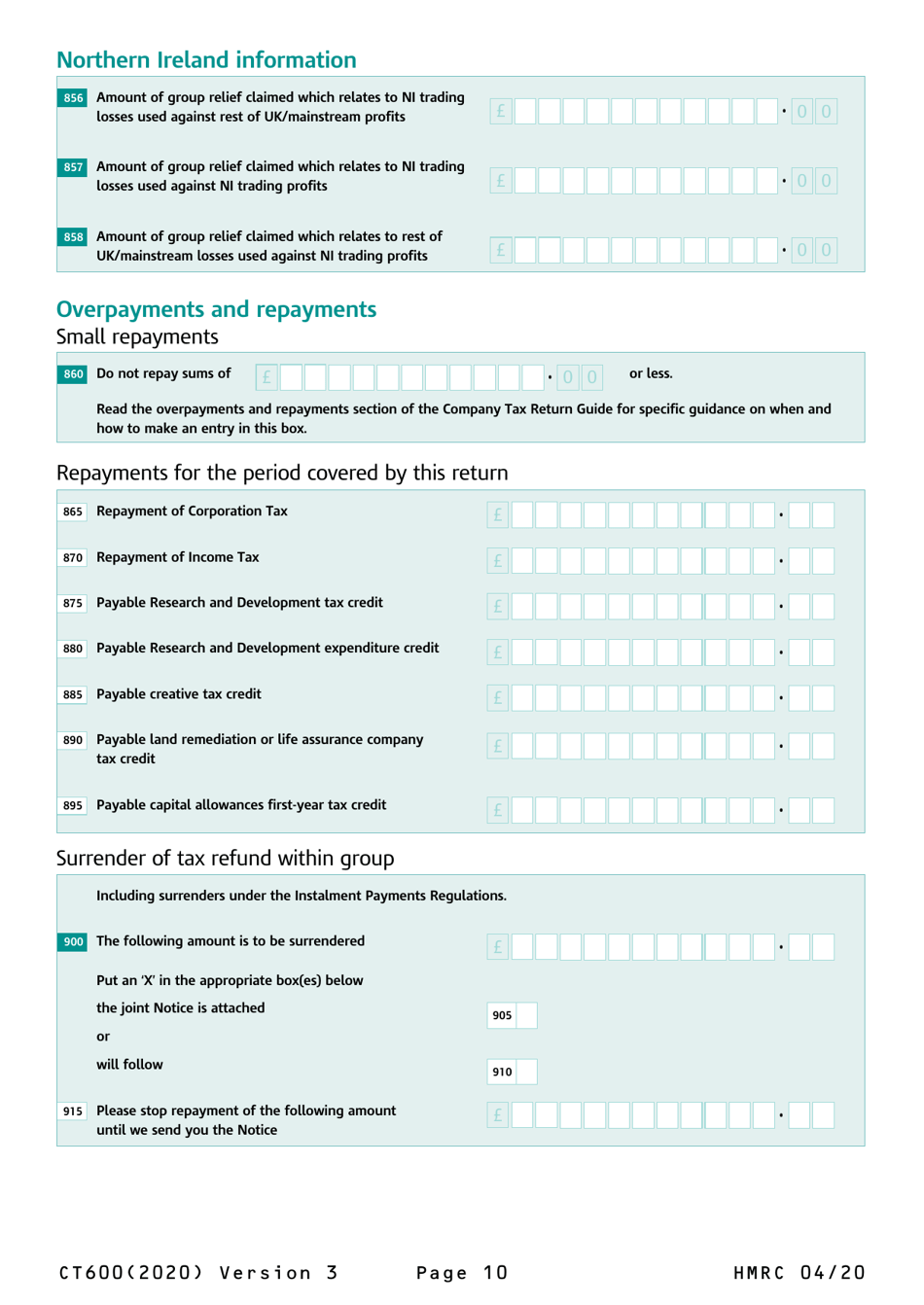

- Calculations for any taxes that may have been overpaid or reconciled with instructions for calculating each total depending on the type of expense (such as tax, surcharge, levy, etc).

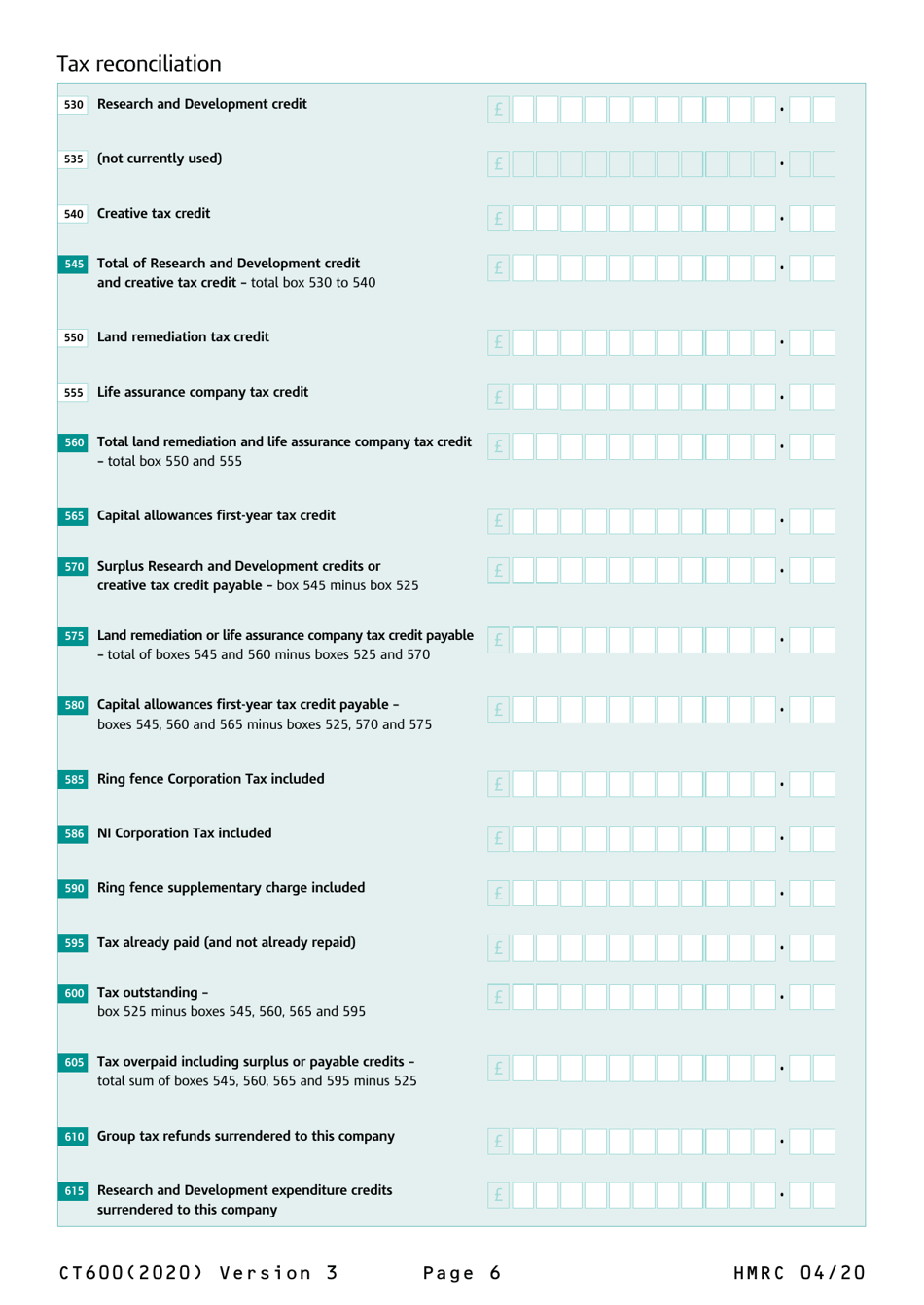

- Total calculations for taxes related to land use, life assurance, ring-fence expenses, and taxes that have already been paid for this time period. Any expenses related to research and development conducted by the company, or expenses incurred from vaccine development.

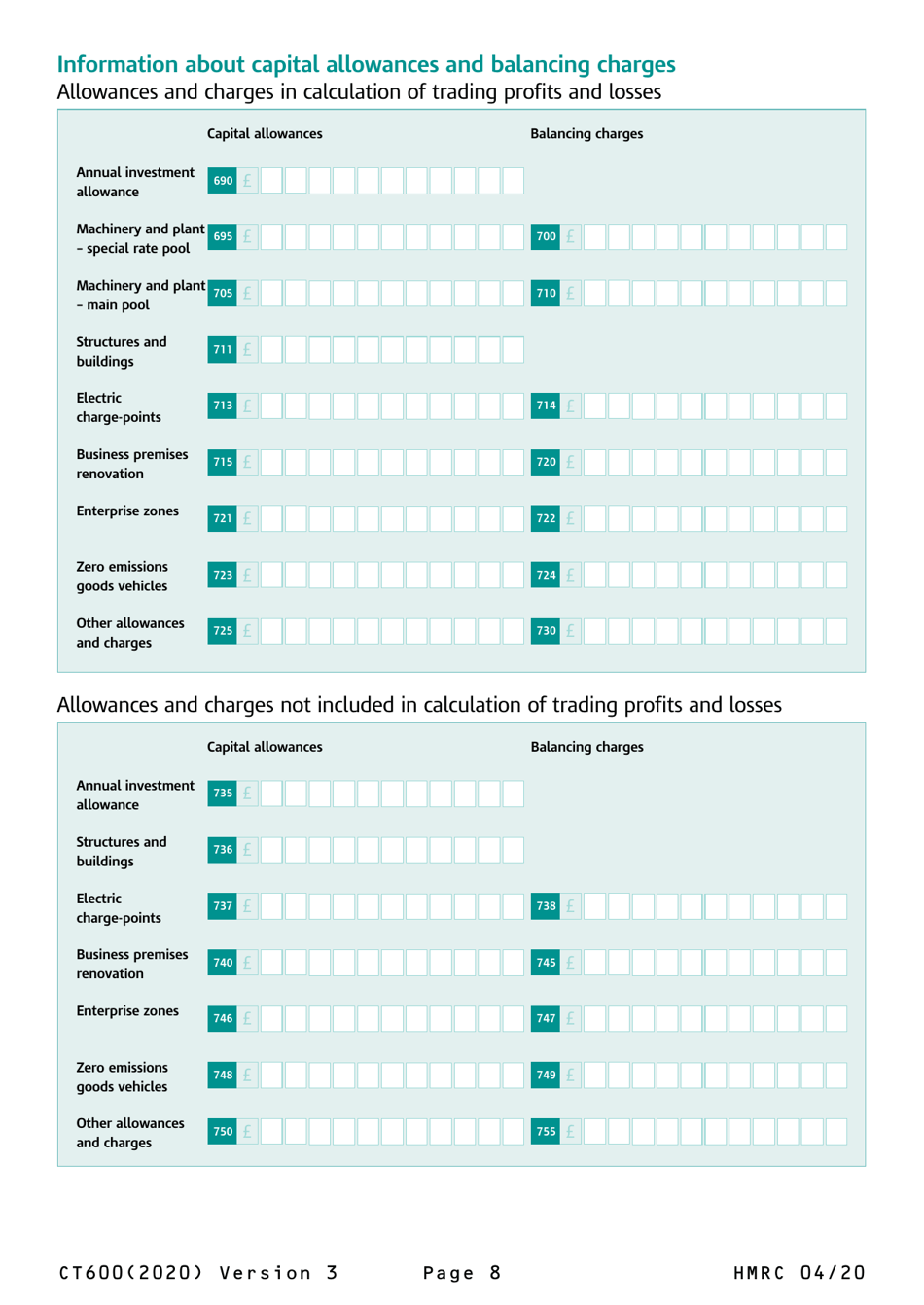

- Final sections for additional expenses that did not qualify for the previous sections, such as zero-emissions vehicles, environmentally friendly machinery, or costs associated with building maintenance.

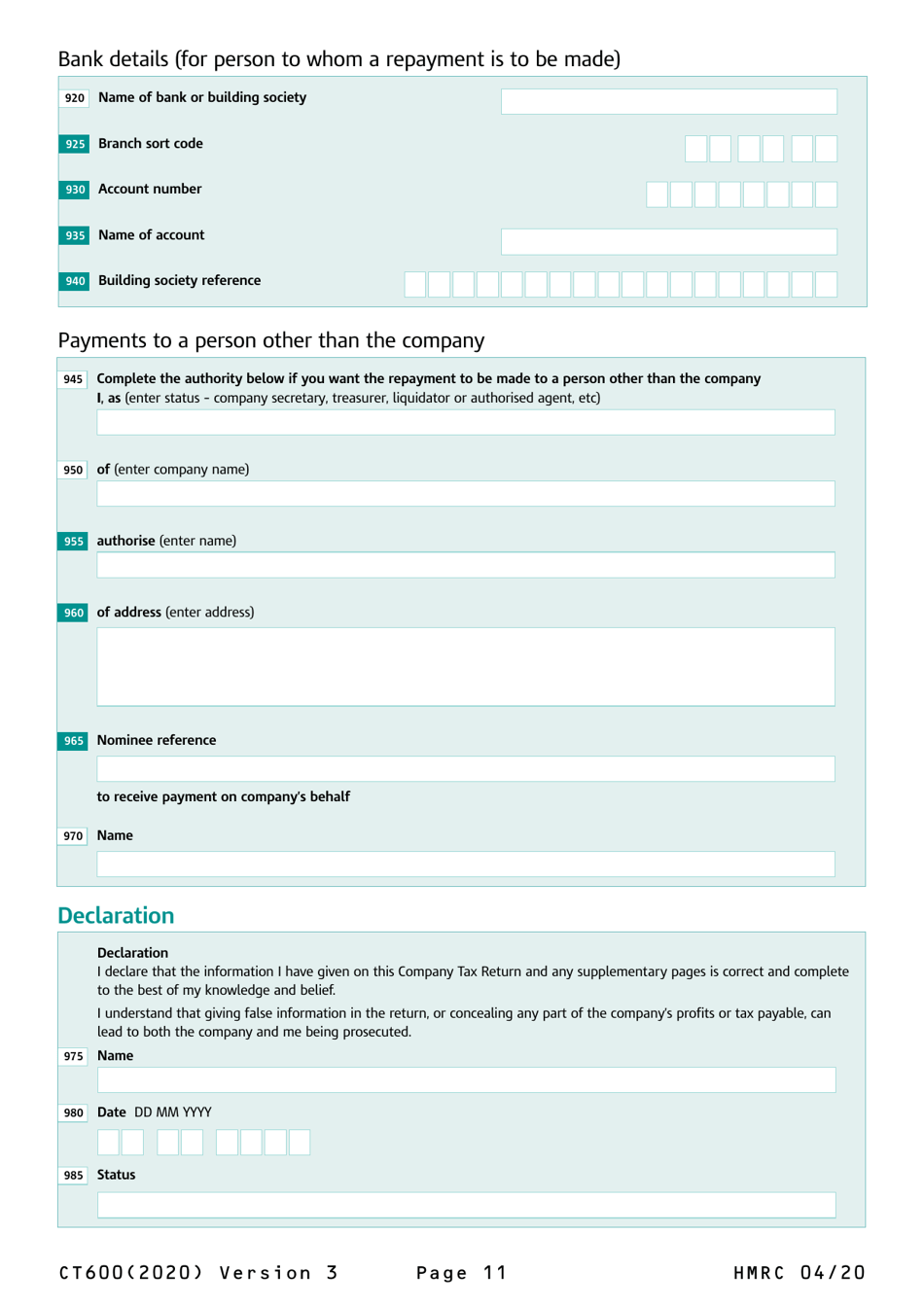

- Bank account information where a return can be sent to or a personal bank account number (if the return will be sent to an individual).