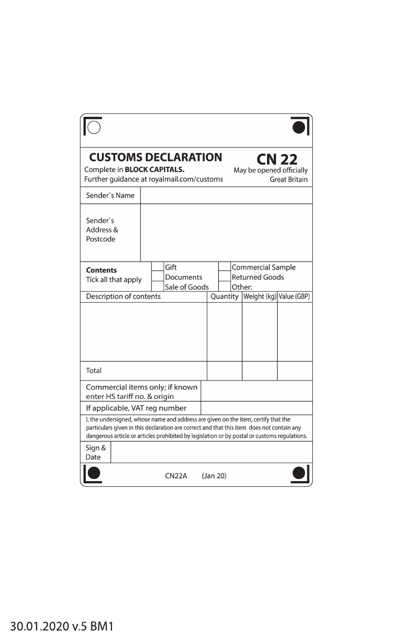

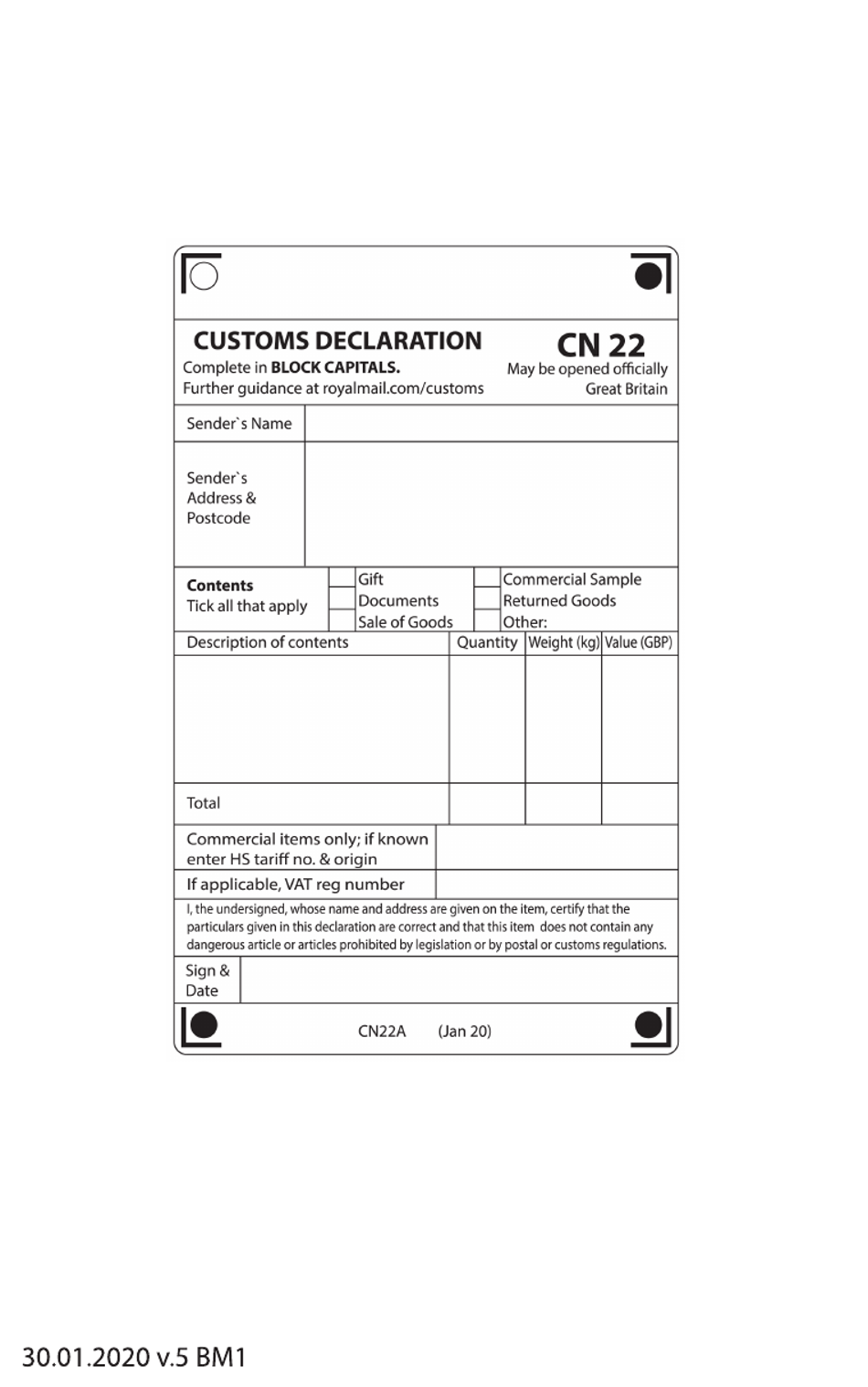

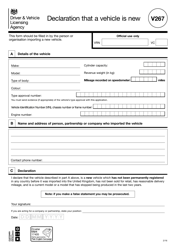

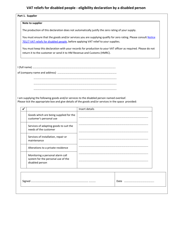

Form CN22 Customs Declaration - United Kingdom

What Is Form CN22?

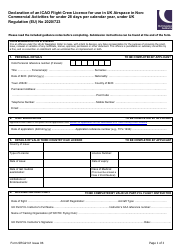

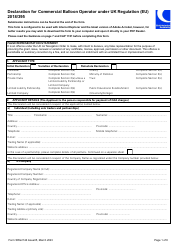

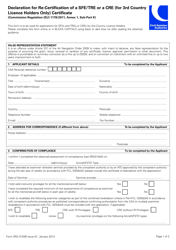

Form CN22, Customs Declaration , is a form that is needed to be used whenever you import items or goods into the United Kingdom with a value of 270 Euros/Great British Pounds (GBP) or greater. This form is used as confirmation with customs officials that goods entering the country are not restricted or banned items. Correct completion of this form is important, as mistakes or errors could result in the imports being delayed or seized.

Alternate Names:

- CN22 Customs Form;

- U.K. Customs Declaration Form.

This form is issued by the United Kingdom Post Office and was last updated on January 1, 2020 . This form can be used by vendors importing items that will be used commercially or for individuals outside of the United Kingdom mailing parcels to family or friends within the United Kingdom. It should also be noted that all mail sent to addresses in the European Union will need to be sent with this form once the United Kingdom has left the European Union. A CN22 Customs Form is available for download below.

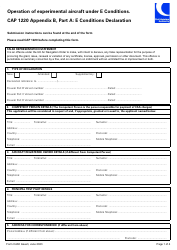

How to Fill Out Form CN22?

To complete a CN22 Form, you will need to include the following information:

-

The sender's name and full address. Complete the list of the items in the parcel.

-

A clear description of each item in the parcel, the quantity of each item, weight (in kilograms), and monetary value of each item (in GBP).

- It is important to complete this step as accurately as possible. If you enter a vague description or intentionally incorrect (such as listing an item with a lower monetary value) you risk having customs open the parcel and rejecting the CN22 Customs Form;

- A description does not need to be lengthy. For instance, if you are shipping five one-kilogram terra cotta pots, you could describe the item as terra cotta pots, its quantity as five, and its weight as five kilograms (for the total weight of your items);

- Be aware, you can only include up to three item descriptions per parcel;

- If you find your shipment will contain more than three different items you will want to make sure they are shipped in separate parcels so that each container does not have more than three unique items.

-

You will then calculate the total amounts of items and the value of the parcel.

-

If you are importing items for commercial reasons, you will need to enter the Harmonised Code and the country where the items were sent from.

- A Harmonised Code is a string of digits that customs uses to categorize the goods in your parcel and apply any necessary fees before they enter the United Kingdom. This code will not include the country of origin.

-

Depending on the items, a VAT registration number may be needed.

-

Final signature of the person sending the parcel and date.

This form must be affixed somewhere on the outside of the parcel in a sleeve to protect it from damage so it can later be reviewed during customs inspection.