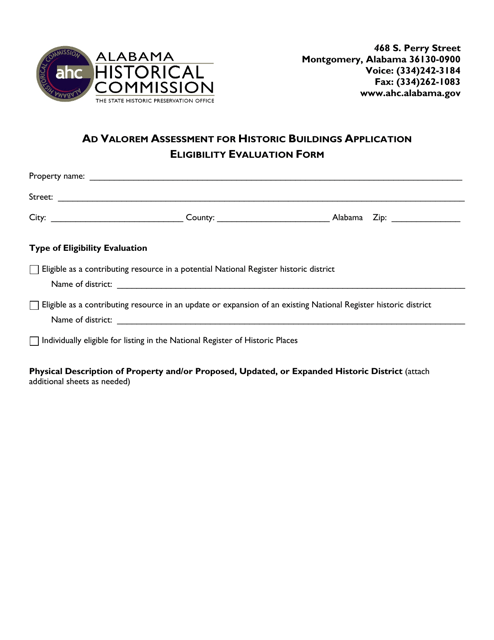

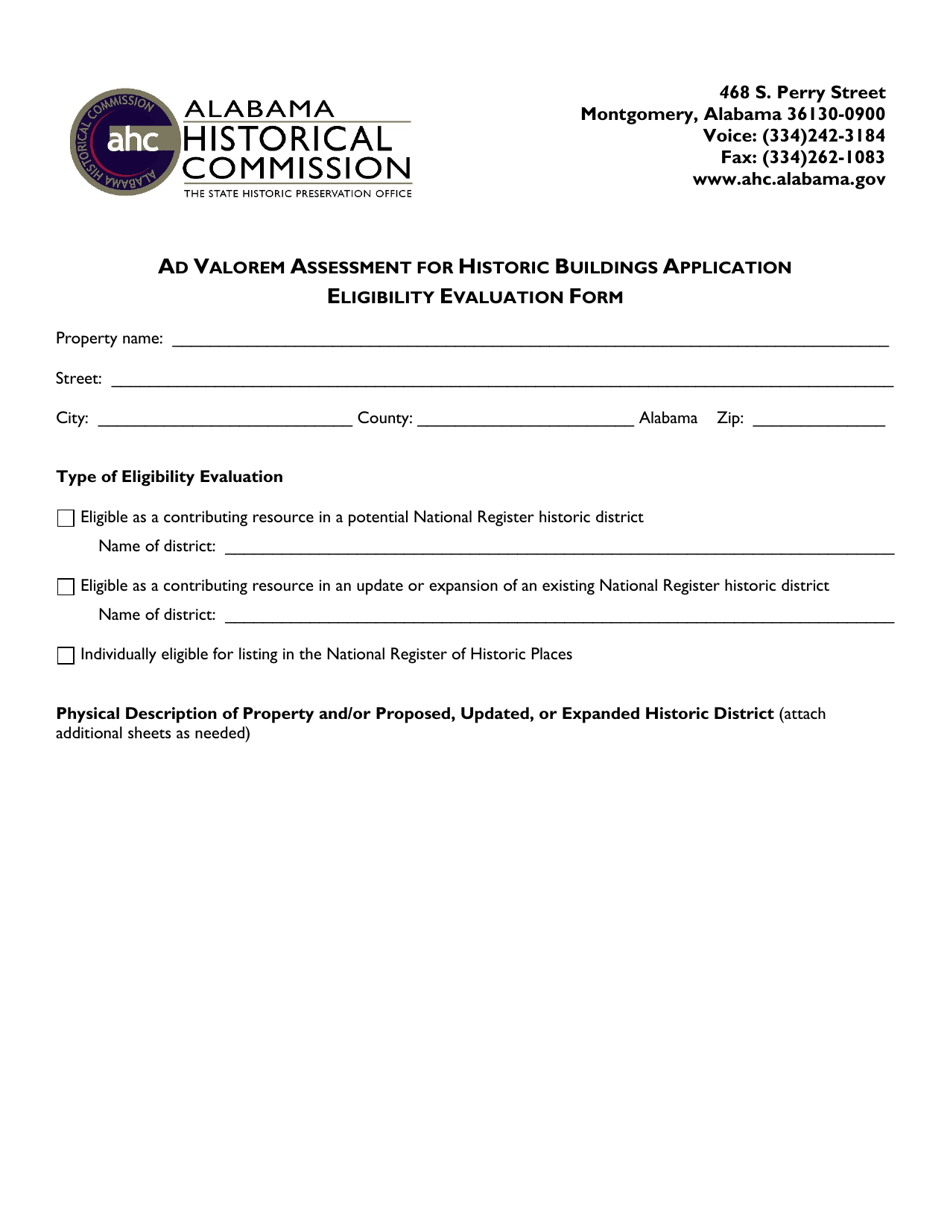

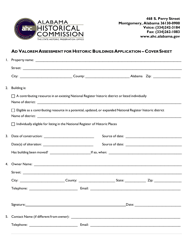

Ad Valorem Assessment for Historic Buildings Application Eligibility Evaluation Form - Alabama

Ad Valorem Assessment for Historic Buildings Application Eligibility Evaluation Form is a legal document that was released by the Alabama Historical Commission - a government authority operating within Alabama.

FAQ

Q: What is the Ad Valorem Assessment for Historic Buildings?

A: The Ad Valorem Assessment for Historic Buildings is a program in Alabama that provides property tax exemptions for qualifying historic buildings.

Q: Who is eligible for the Ad Valorem Assessment for Historic Buildings program?

A: Property owners of historic buildings in Alabama are eligible for the program.

Q: What is the purpose of the Application Eligibility Evaluation Form?

A: The Application Eligibility Evaluation Form is used to determine if a historic building meets the eligibility criteria for the Ad Valorem Assessment program.

Q: How can I obtain the Application Eligibility Evaluation Form?

A: You can obtain the form by contacting your local tax assessor's office in Alabama.

Q: What information is required on the Application Eligibility Evaluation Form?

A: The form typically requires information about the property owner, building details, and documentation of the building's historical significance.

Q: What is the deadline for submitting the Application Eligibility Evaluation Form?

A: The deadline for submitting the form may vary, so it's best to contact your local tax assessor's office for specific information.

Q: Are there any fees associated with the application process?

A: There may be processing fees associated with the application process. Contact your local tax assessor's office for more information.

Q: What happens after submitting the Application Eligibility Evaluation Form?

A: After submitting the form, the tax assessor's office will review the application and determine if the historic building meets the eligibility criteria.

Q: What are the benefits of the Ad Valorem Assessment program?

A: The program provides property tax exemptions, allowing eligible historic buildings to be taxed at a reduced rate or be exempt from property taxes.

Q: Do I need to renew my eligibility for the program each year?

A: In Alabama, once a historic building is approved for the Ad Valorem Assessment program, the eligibility carries over from year to year. However, it's important to comply with any reporting requirements or updates requested by the tax assessor's office.

Form Details:

- The latest edition currently provided by the Alabama Historical Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Historical Commission.