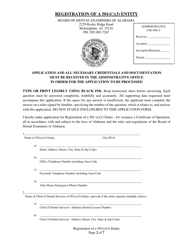

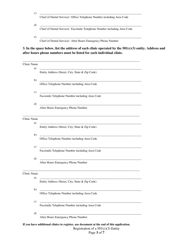

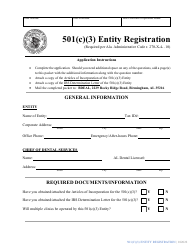

Registration of a 501(C)(3) Entity - Alabama

Registration of a 501(C)(3) Entity is a legal document that was released by the Board of Dental Examiners of Alabama - a government authority operating within Alabama.

FAQ

Q: What is a 501(c)(3) entity?

A: A 501(c)(3) entity is a tax-exempt nonprofit organization.

Q: Why would I want to register a 501(c)(3) entity?

A: Registering as a 501(c)(3) entity allows you to receive tax-deductible donations and have certain tax advantages.

Q: How do I register a 501(c)(3) entity in Alabama?

A: To register a 501(c)(3) entity in Alabama, you need to complete and submit the appropriate forms to the Alabama Department of Revenue and the IRS.

Q: What forms do I need to complete to register a 501(c)(3) entity in Alabama?

A: You will need to complete IRS Form 1023 or 1023-EZ, as well as the Alabama Form CN-1.

Q: Are there any fees associated with registering a 501(c)(3) entity in Alabama?

A: Yes, there is a fee for filing the Alabama Form CN-1. The fee amount may vary.

Q: How long does the registration process for a 501(c)(3) entity in Alabama take?

A: The registration process can take several months, so it's important to plan ahead and submit your application well in advance.

Q: What are the ongoing requirements for a registered 501(c)(3) entity in Alabama?

A: Once registered, you must file annual reports with the Alabama Secretary of State and maintain proper financial records.

Q: Can a registered 501(c)(3) entity engage in political activities?

A: 501(c)(3) entities are restricted from engaging in certain political activities, such as endorsing or opposing candidates for public office.

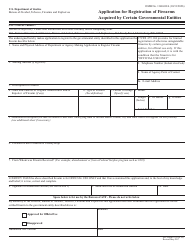

Form Details:

- The latest edition currently provided by the Board of Dental Examiners of Alabama;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Board of Dental Examiners of Alabama.