This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

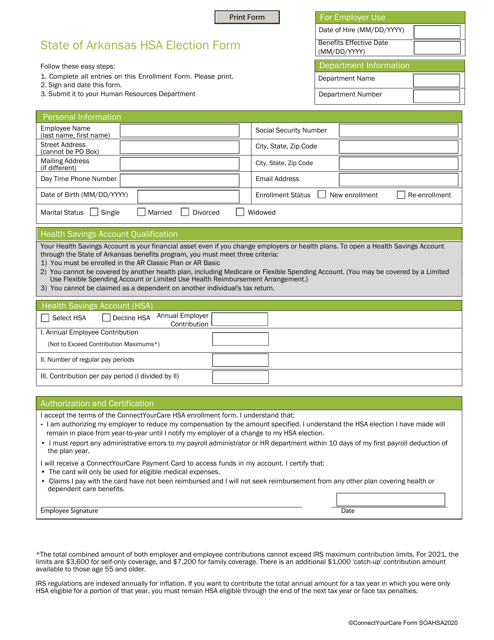

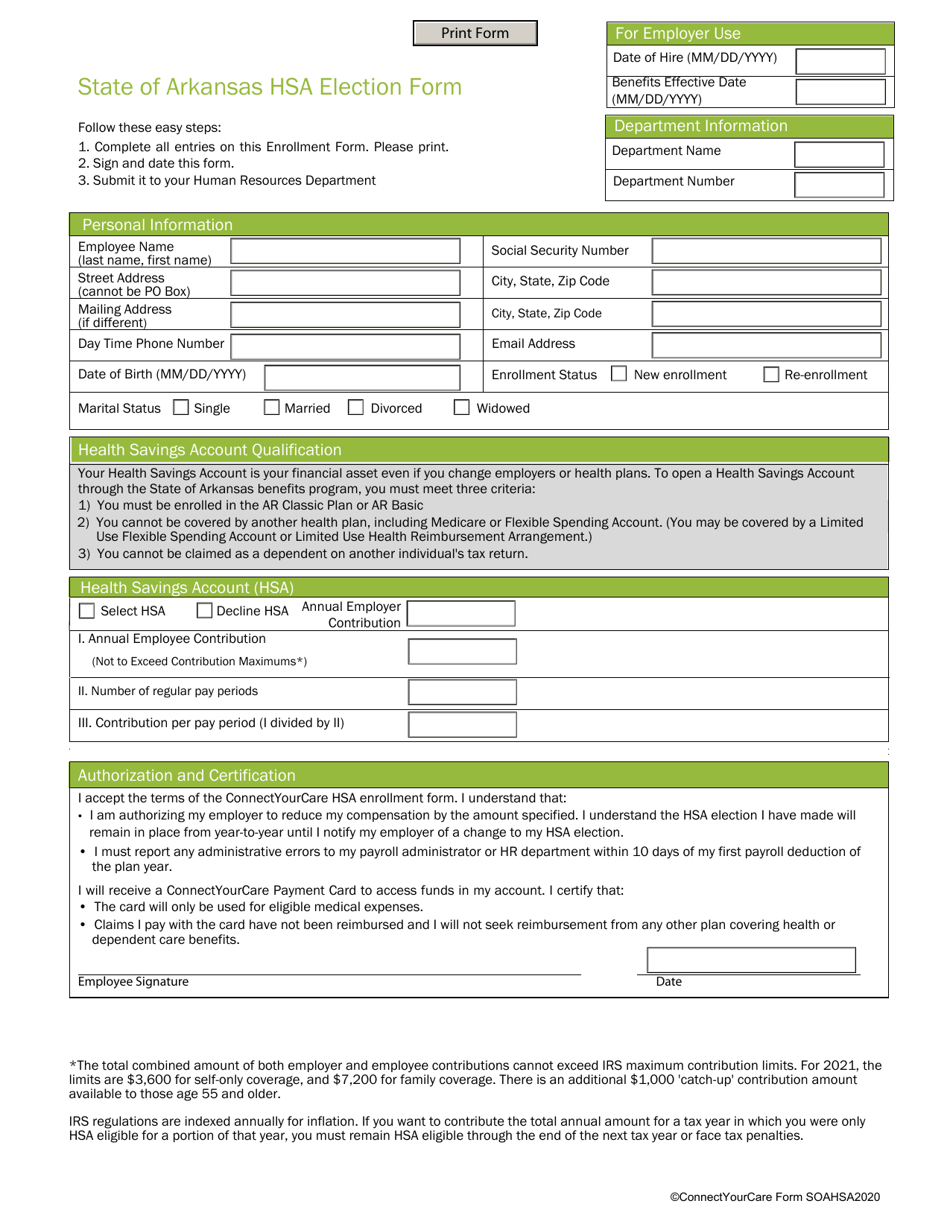

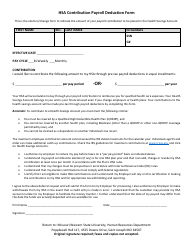

State of Arkansas Hsa Election Form - Arkansas

State of Arkansas Hsa Election Form is a legal document that was released by the Arkansas Department of Transformation and Shared Services - a government authority operating within Arkansas.

FAQ

Q: What is the State of Arkansas HSA Election Form?

A: The State of Arkansas HSA Election Form is a form used for electing to participate in a Health Savings Account (HSA) in the state of Arkansas.

Q: What is a Health Savings Account (HSA)?

A: A Health Savings Account (HSA) is a tax-advantaged savings account that allows individuals with a high-deductible health plan to save money for medical expenses.

Q: Why would someone want to participate in a Health Savings Account (HSA)?

A: Participating in a Health Savings Account (HSA) offers several benefits, including tax advantages, the ability to save for future medical expenses, and flexibility in how the funds are used.

Q: Who is eligible to participate in a Health Savings Account (HSA) in Arkansas?

A: To be eligible for a Health Savings Account (HSA) in Arkansas, you must have a high-deductible health plan and meet other IRS requirements.

Q: What information is required on the State of Arkansas HSA Election Form?

A: The State of Arkansas HSA Election Form requires information such as your name, address, social security number, employer information, and election details.

Q: When should I submit the State of Arkansas HSA Election Form?

A: You should submit the State of Arkansas HSA Election Form during your employer's open enrollment period or as instructed by your employer.

Q: Can I change my HSA election in the future?

A: Yes, you can change your HSA election in the future during your employer's open enrollment period or due to a qualifying life event.

Q: Are there any restrictions on how I can use the funds in my HSA?

A: Funds in a Health Savings Account (HSA) can be used for qualified medical expenses, such as doctor visits, prescription medications, and medical procedures.

Q: What are the tax advantages of a Health Savings Account (HSA)?

A: Contributions to a Health Savings Account (HSA) are tax-deductible, the earnings in the account grow tax-free, and withdrawals for qualified medical expenses are tax-free.

Form Details:

- Released on January 1, 2020;

- The latest edition currently provided by the Arkansas Department of Transformation and Shared Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Department of Transformation and Shared Services.