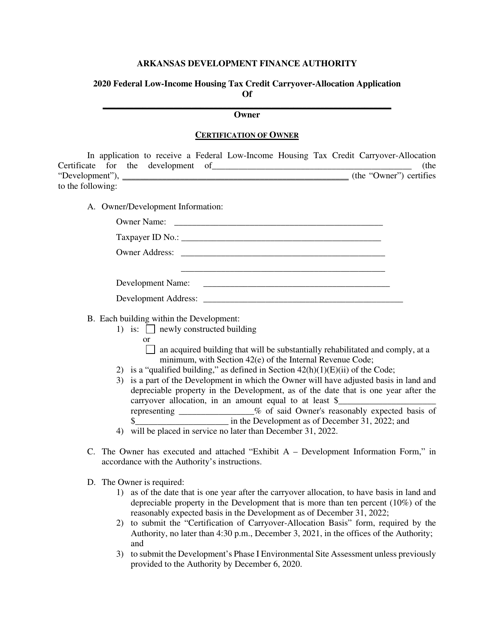

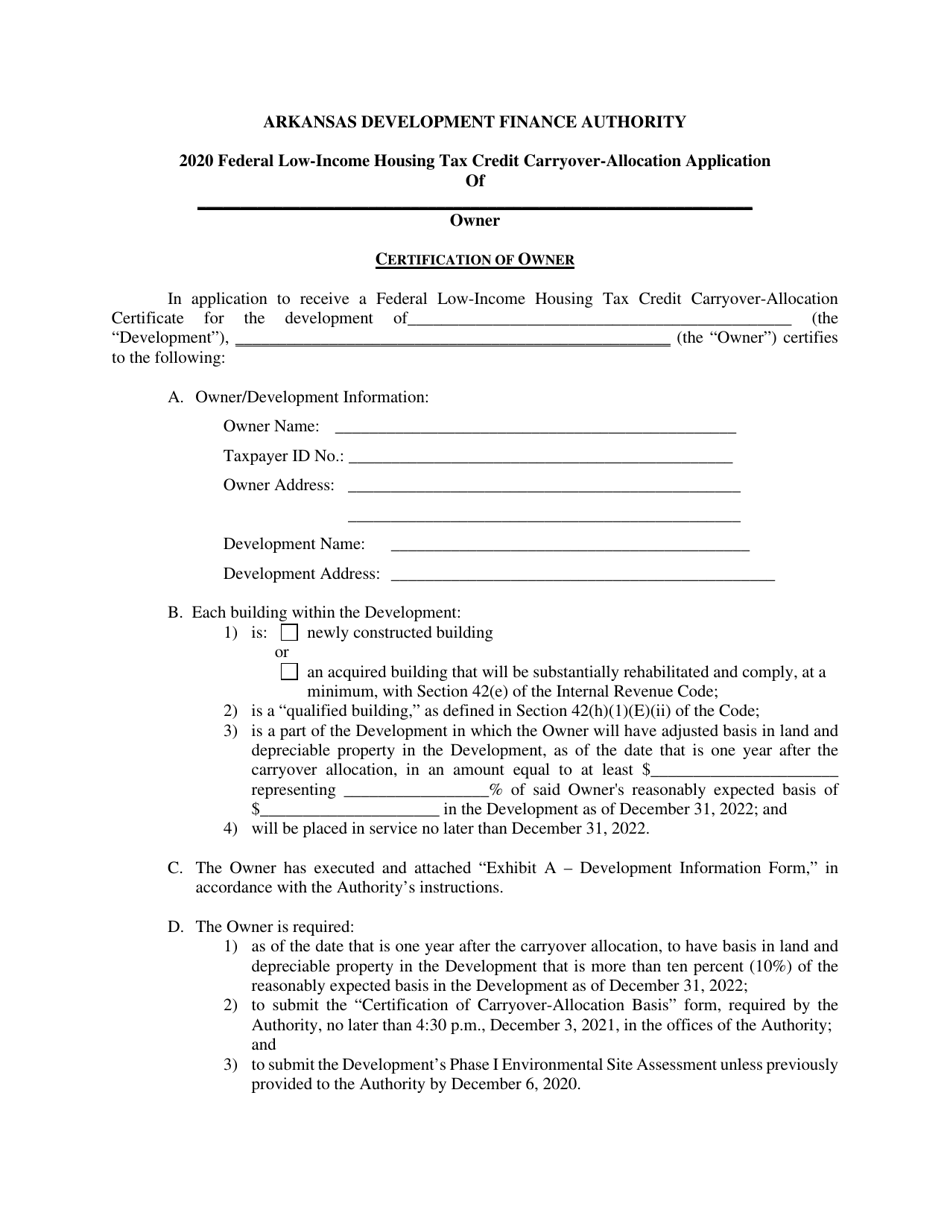

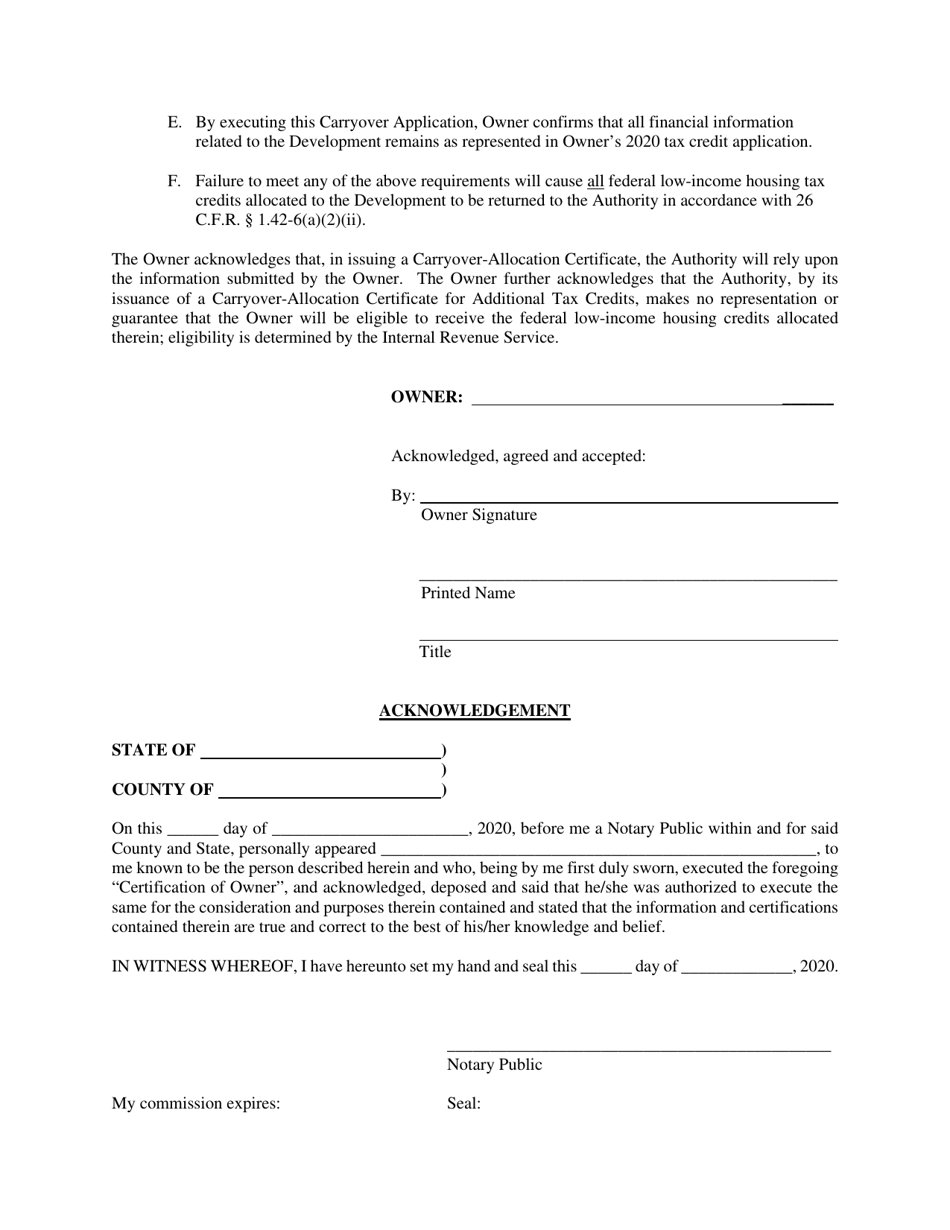

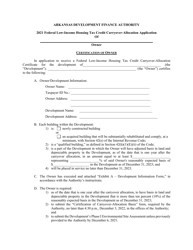

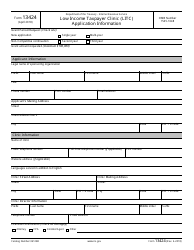

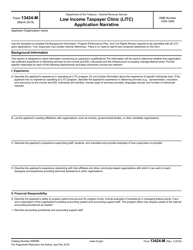

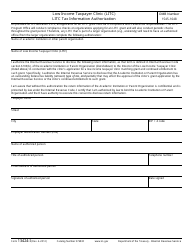

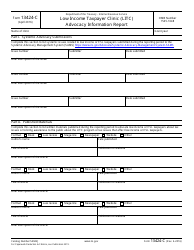

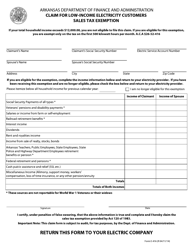

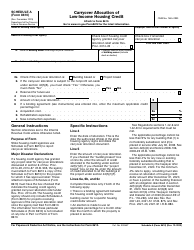

Federal Low-Income Housing Tax Credit Carryover-Allocation Application - Arkansas

Federal Low-Income Housing Tax Credit Carryover-Allocation Application is a legal document that was released by the Arkansas Development Finance Authority - a government authority operating within Arkansas.

FAQ

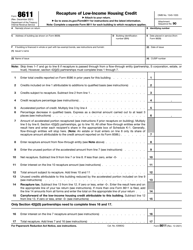

Q: What is the Federal Low-Income Housing Tax Credit Carryover-Allocation Application?

A: It is an application for obtaining federal tax credits for low-income housing in Arkansas.

Q: Who is eligible to apply for the Federal Low-Income Housing Tax Credit Carryover-Allocation?

A: Developers and owners of low-income housing projects in Arkansas are eligible to apply.

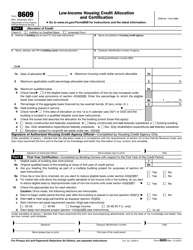

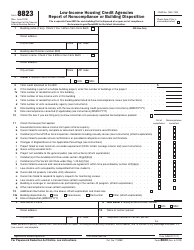

Q: What are the benefits of obtaining a Low-Income Housing Tax Credit?

A: Obtaining a tax credit allows developers to offset their federal tax liability, which helps finance the construction or rehabilitation of affordable housing.

Q: Are there any local requirements or restrictions for low-income housing projects in Arkansas?

A: Yes, local jurisdictions may have their own additional requirements or restrictions for low-income housing projects, so it is important to check with the appropriate local authorities in addition to submitting the application.

Q: How are the tax credits allocated in Arkansas?

A: The Arkansas Development Finance Authority (ADFA) administers the allocation of low-income housing tax credits in the state.

Q: Can for-profit organizations apply for the Federal Low-Income Housing Tax Credit Carryover-Allocation?

A: Yes, both for-profit and nonprofit organizations can apply for the tax credit.

Q: Are there any income limits for tenants of low-income housing projects?

A: Yes, tenants must meet certain income limits in order to qualify for residency in low-income housing projects.

Q: What is the purpose of the Federal Low-Income Housing Tax Credit program?

A: The program aims to increase the availability of affordable housing for low-income individuals and families in the United States.

Form Details:

- The latest edition currently provided by the Arkansas Development Finance Authority;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Development Finance Authority.