This version of the form is not currently in use and is provided for reference only. Download this version of

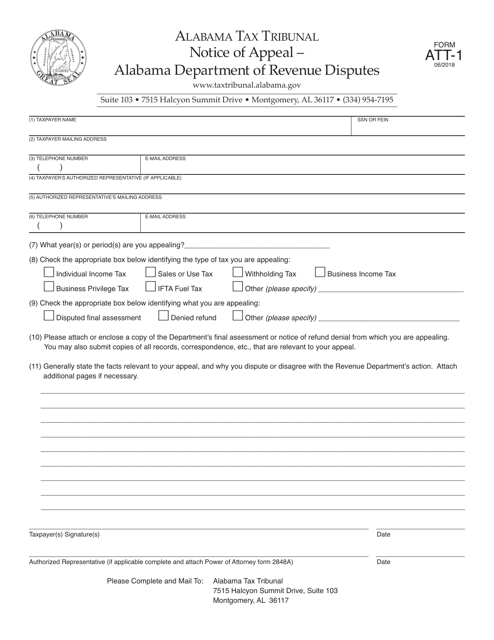

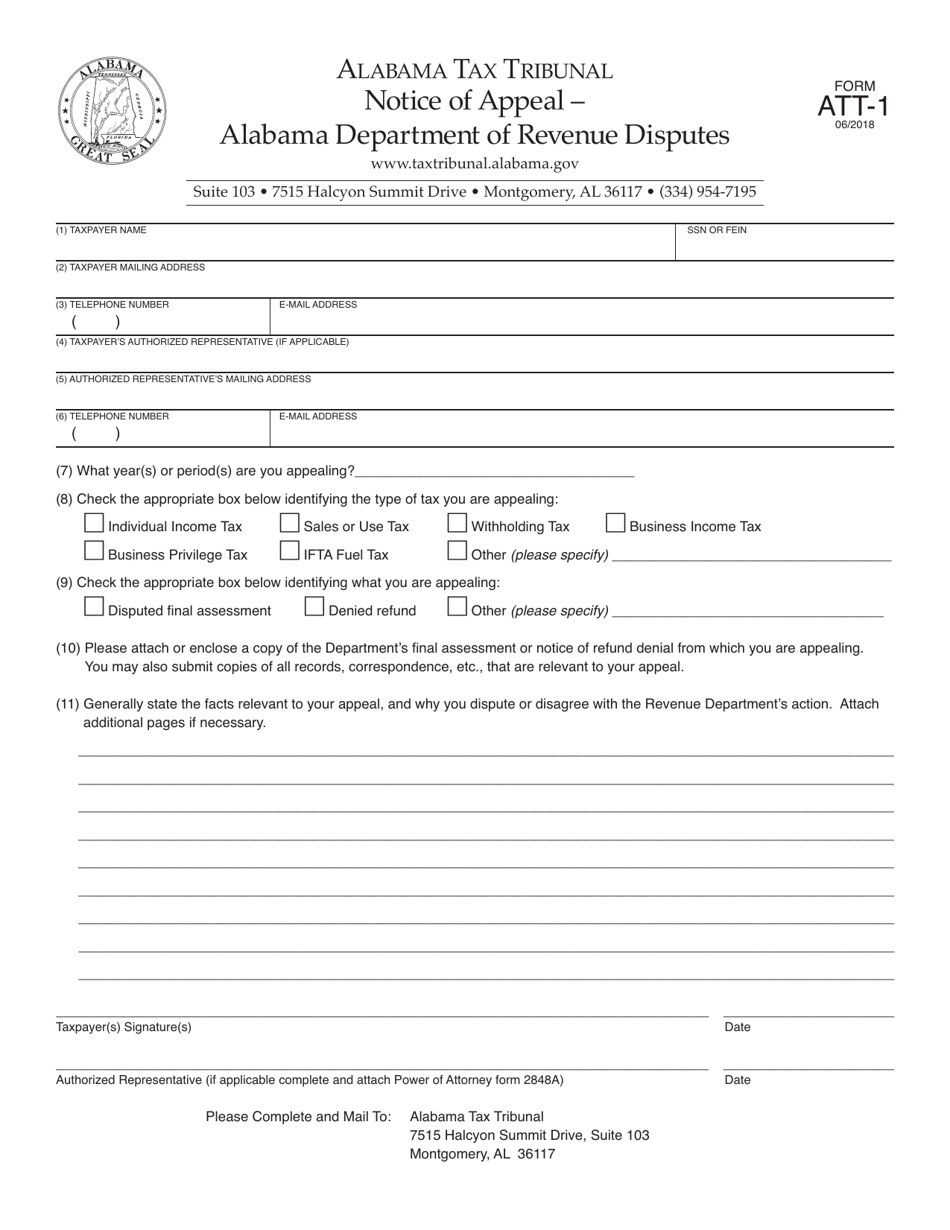

Form ATT-1

for the current year.

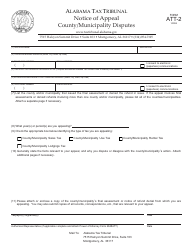

Form ATT-1 Notice of Appeal - Alabama Department of Revenue Disputes - Alabama

What Is Form ATT-1?

This is a legal form that was released by the Alabama Tax Tribunal - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ATT-1?

A: Form ATT-1 is a Notice of Appeal form used in Alabama to dispute a decision made by the Alabama Department of Revenue.

Q: What is the purpose of Form ATT-1?

A: The purpose of Form ATT-1 is to initiate the appeals process to challenge a decision made by the Alabama Department of Revenue regarding a tax dispute.

Q: What information is required to complete Form ATT-1?

A: Form ATT-1 requires information such as the taxpayer's name, address, contact information, a description of the disputed decision, and the desired outcome.

Q: When is Form ATT-1 due?

A: The deadline to submit Form ATT-1 varies depending on the specific tax dispute and is typically stated in the decision or notice issued by the Alabama Department of Revenue.

Q: Is there a fee for filing Form ATT-1?

A: No, there is no fee associated with filing Form ATT-1 to initiate an appeal with the Alabama Department of Revenue.

Q: Can I submit additional documentation with Form ATT-1?

A: Yes, you can and should submit any supporting documentation, evidence, or arguments that can help strengthen your appeal case.

Q: What happens after I submit Form ATT-1?

A: After submitting Form ATT-1, you will receive acknowledgment of receipt from the Alabama Department of Revenue, and your appeal will proceed to the appropriate appeals process.

Q: Who can I contact for assistance with Form ATT-1 or the appeals process?

A: For assistance with Form ATT-1 or the appeals process, you can contact the Alabama Department of Revenue's Appeals Division or consult with a tax attorney or tax advisor.

Q: Is there a time limit to complete the appeals process?

A: Yes, there are time limits to complete the appeals process, and they may vary depending on the type of tax dispute and the specific procedures outlined by the Alabama Department of Revenue.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Alabama Tax Tribunal;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ATT-1 by clicking the link below or browse more documents and templates provided by the Alabama Tax Tribunal.