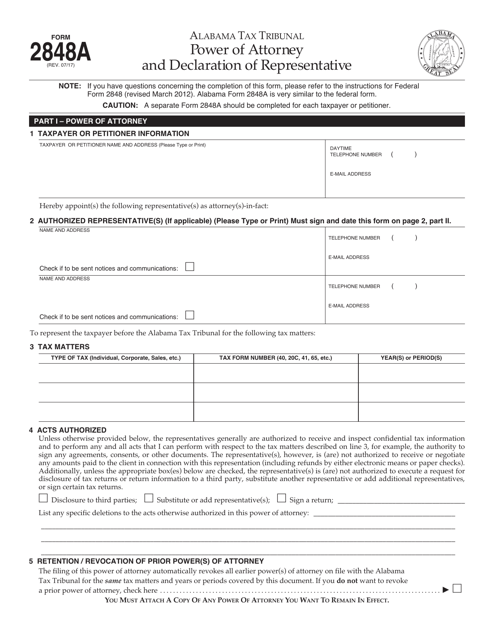

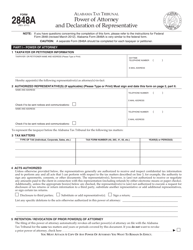

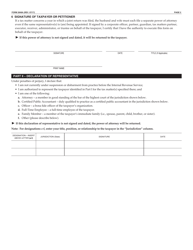

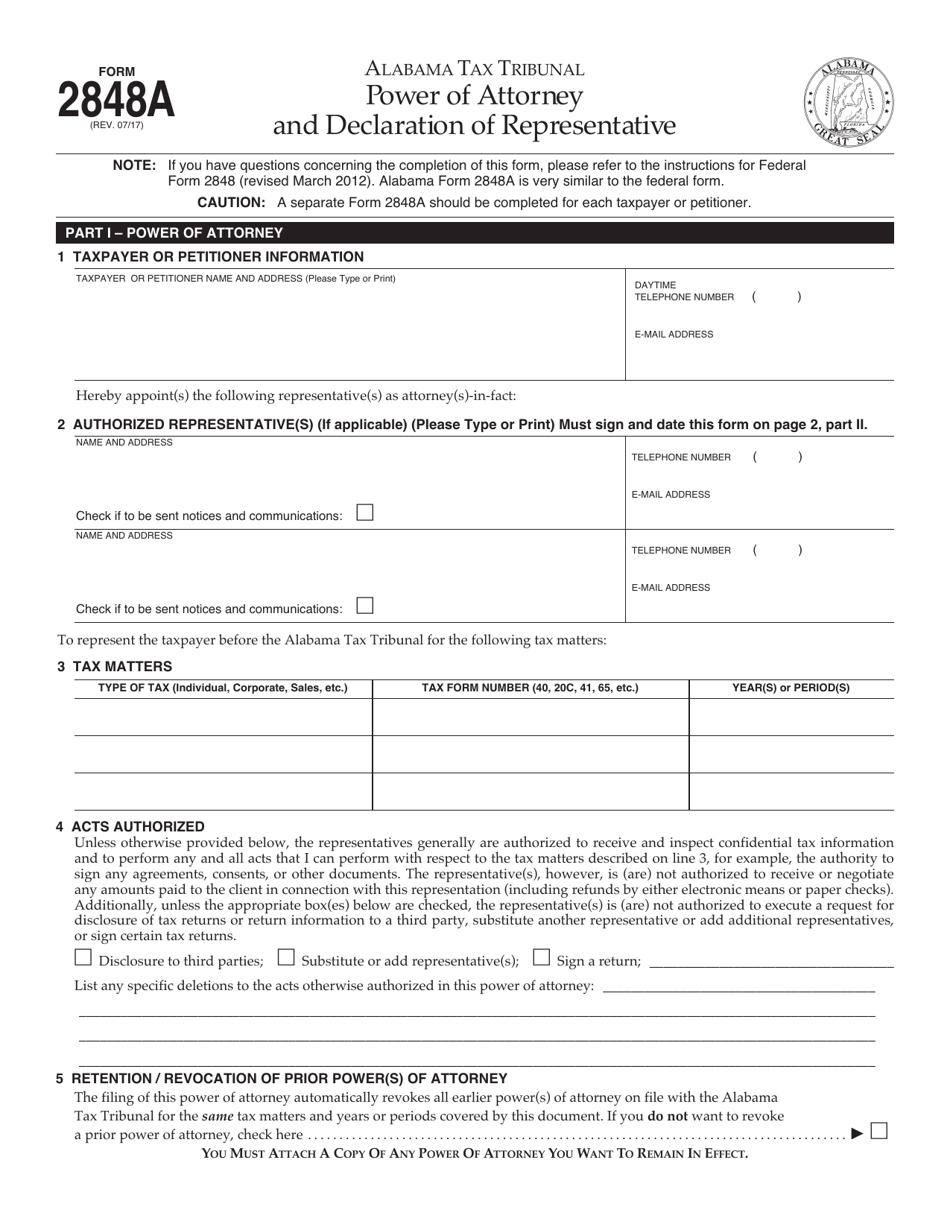

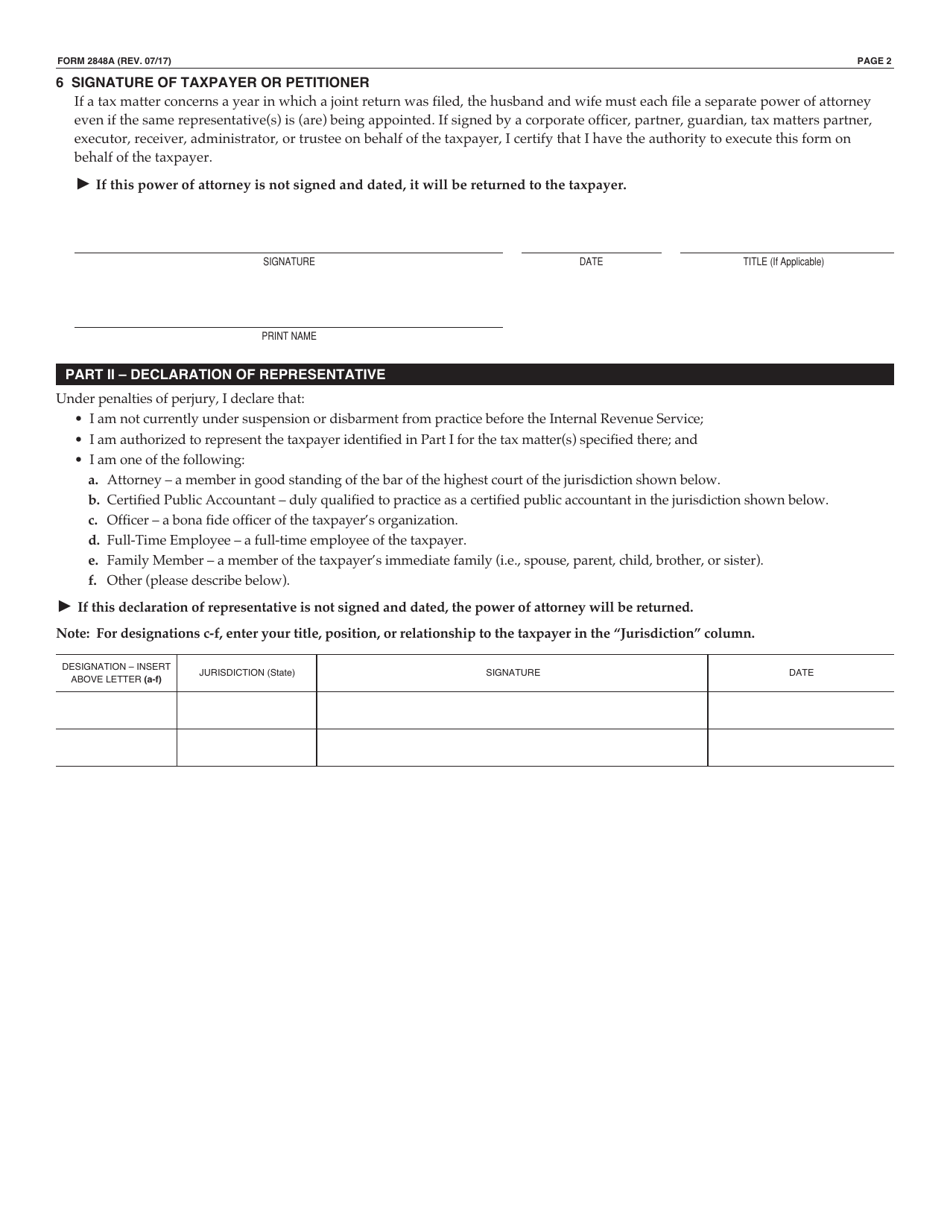

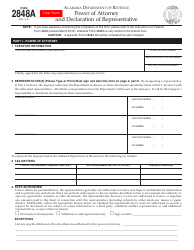

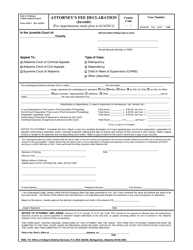

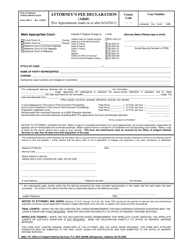

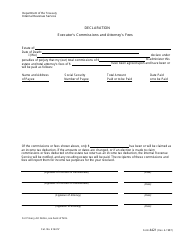

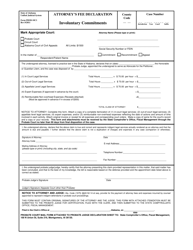

Form 2848A Power of Attorney and Declaration of Representative - Alabama

What Is Form 2848A?

This is a legal form that was released by the Alabama Tax Tribunal - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

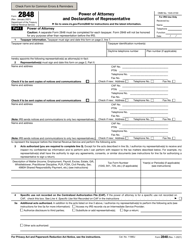

Q: What is Form 2848A?

A: Form 2848A is a Power of Attorney and Declaration of Representative form specifically for Alabama.

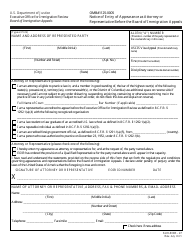

Q: What is the purpose of Form 2848A?

A: Form 2848A is used to appoint a representative to act on your behalf for tax matters in Alabama.

Q: Who can use Form 2848A?

A: Form 2848A can be used by individuals or businesses who want to authorize someone else to handle their tax matters in Alabama.

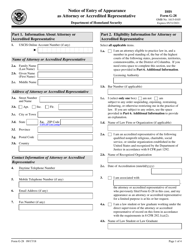

Q: Can I use Form 2848A for federal taxes?

A: No, Form 2848A is only applicable for Alabama state taxes.

Q: Do I need to file Form 2848A every year?

A: No, once you have filed Form 2848A, it remains in effect until it is revoked or you submit a new Power of Attorney form.

Q: Can I appoint multiple representatives on Form 2848A?

A: Yes, you can appoint multiple representatives by attaching additional Form 2848A pages.

Q: Can I use Form 2848A for other states?

A: No, Form 2848A is specific to Alabama. Other states may have their own version of the Power of Attorney form.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Alabama Tax Tribunal;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 2848A by clicking the link below or browse more documents and templates provided by the Alabama Tax Tribunal.