This version of the form is not currently in use and is provided for reference only. Download this version of

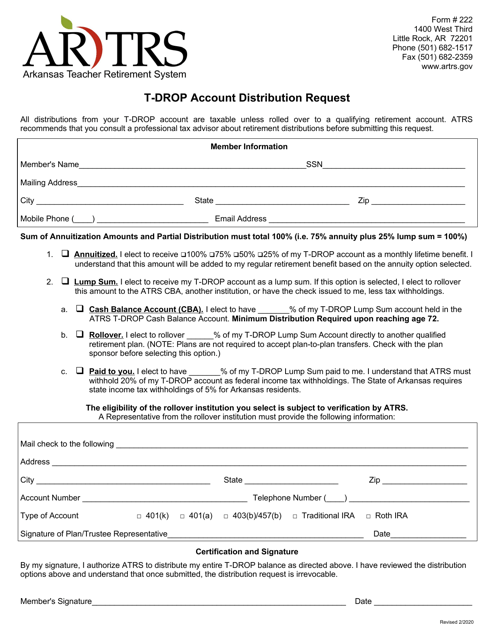

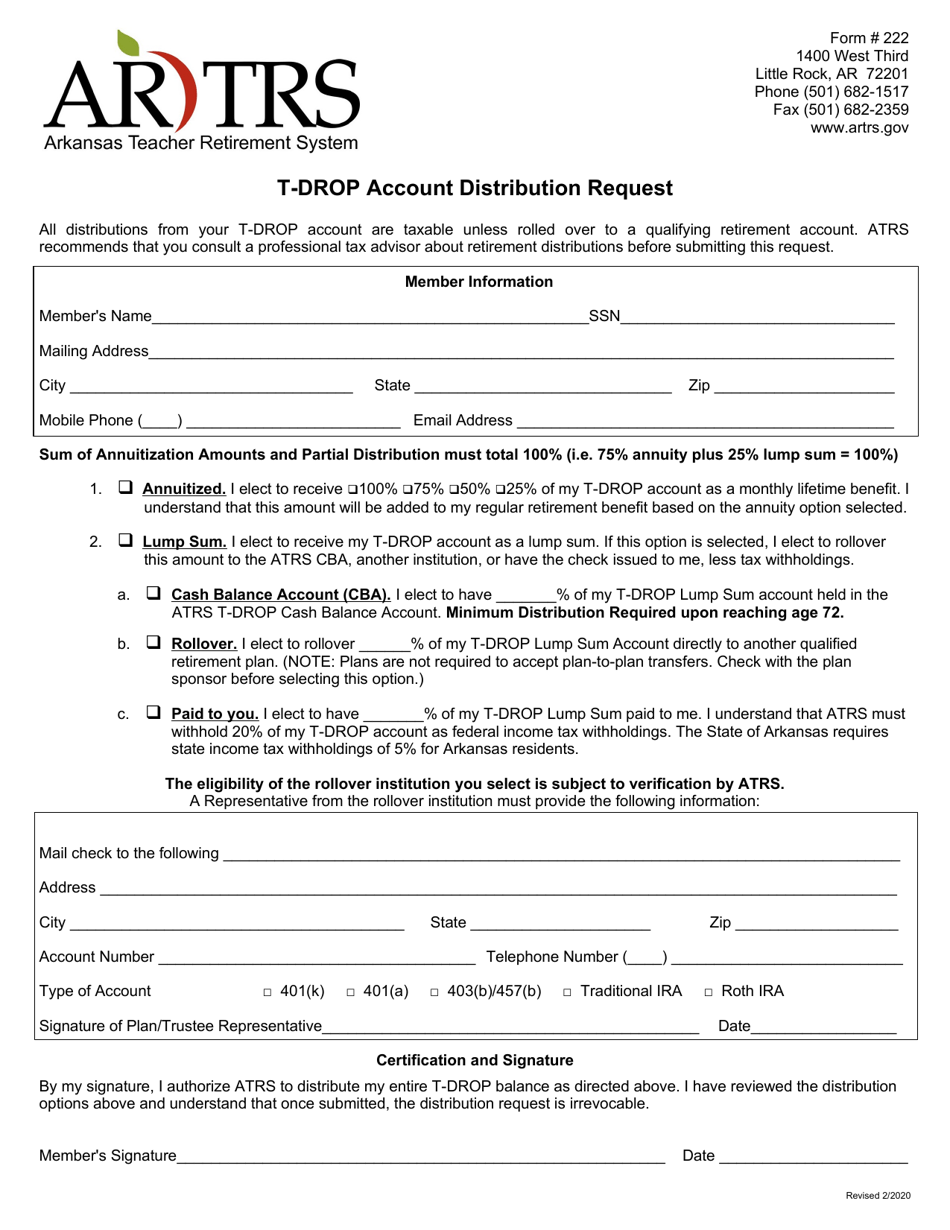

Form 222

for the current year.

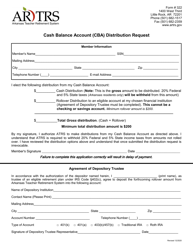

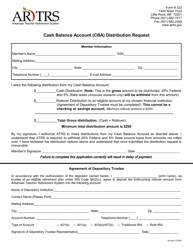

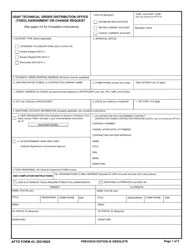

Form 222 T-Drop Account Distribution Request - Arkansas

What Is Form 222?

This is a legal form that was released by the Arkansas Teacher Retirement System - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 222 T-Drop?

A: Form 222 T-Drop is a specific form for requesting a distribution from a T-Drop account.

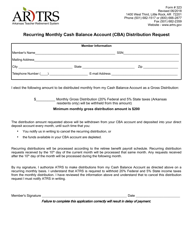

Q: What is a T-Drop account?

A: A T-Drop account is a tax-deferred retirement savings account.

Q: Who can request a distribution from a T-Drop account?

A: The account owner or their designated beneficiary can request a distribution from a T-Drop account.

Q: What is the purpose of a distribution request?

A: The purpose of a distribution request is to withdraw funds from a T-Drop account for specific purposes, such as retirement income.

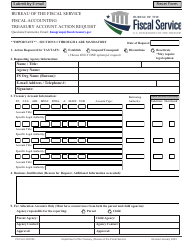

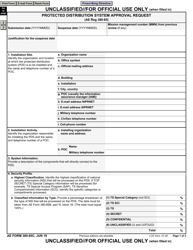

Q: Are there any requirements for submitting Form 222 T-Drop?

A: Yes, there are certain requirements, such as providing identification, completing the necessary sections of the form, and meeting specific eligibility criteria.

Q: How long does it take to process a distribution request?

A: The processing time for a distribution request may vary, but it is typically processed within a reasonable time after submission.

Q: What are the tax implications of a T-Drop distribution?

A: T-Drop distributions are subject to federal income tax in the year of distribution.

Q: Is there any penalty for early withdrawal from a T-Drop account?

A: Yes, there may be an additional 10% penalty tax for early withdrawals made before the account owner reaches the age of 59 and a half.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Arkansas Teacher Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 222 by clicking the link below or browse more documents and templates provided by the Arkansas Teacher Retirement System.