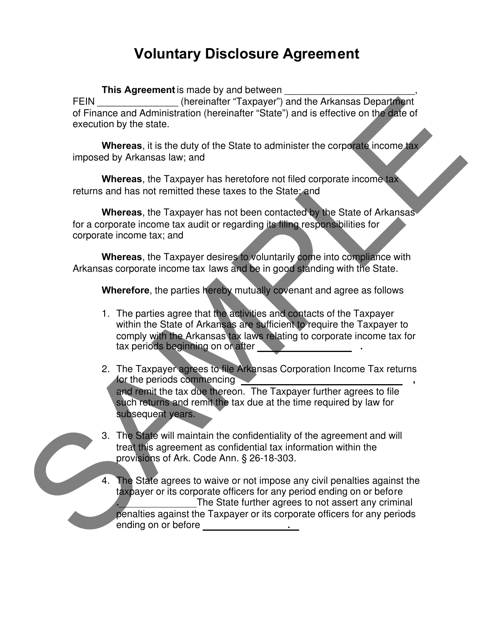

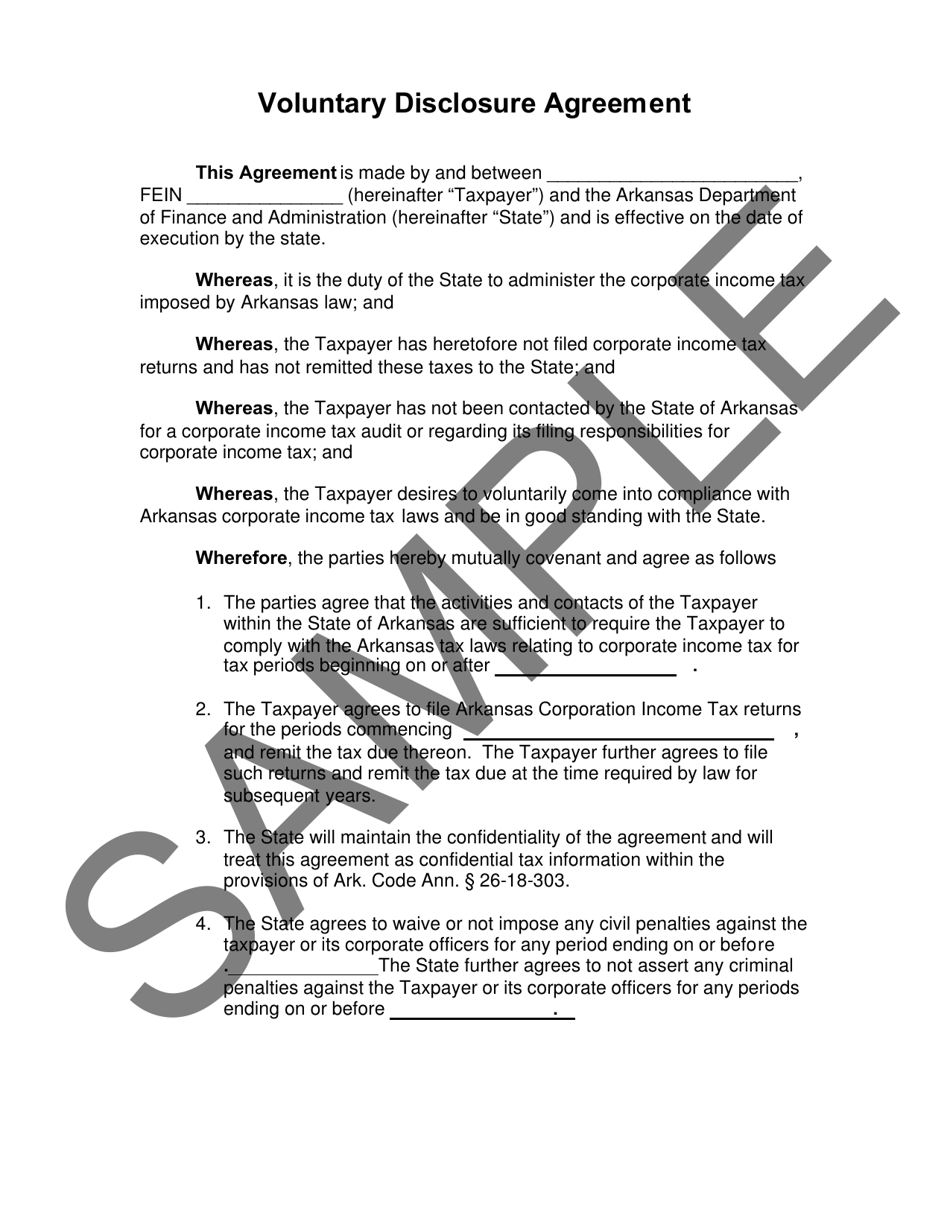

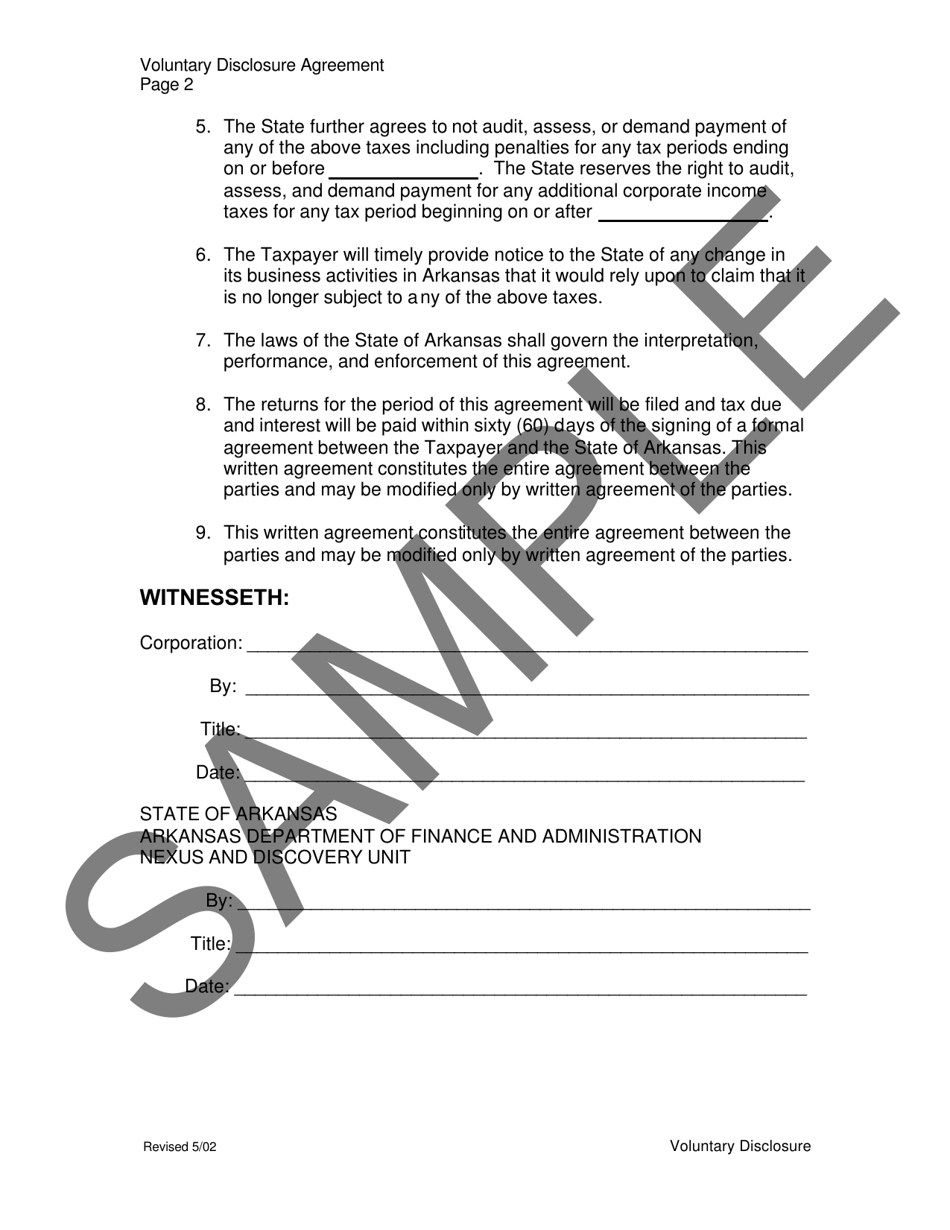

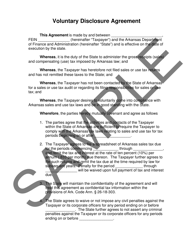

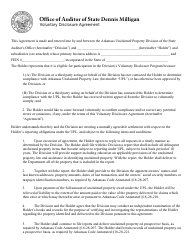

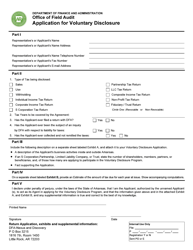

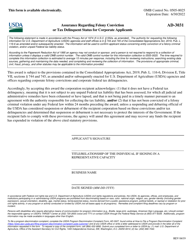

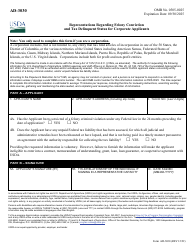

Voluntary Disclosure Agreement for Corporate Tax - Arkansas

Voluntary Disclosure Agreement for Corporate Tax is a legal document that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas.

FAQ

Q: What is a Voluntary Disclosure Agreement (VDA)?

A: A Voluntary Disclosure Agreement is a program offered by the Arkansas Department of Finance and Administration (DFA) that allows taxpayers to come forward and report any previously undisclosed tax liabilities.

Q: Who is eligible to participate in the VDA program in Arkansas?

A: Any taxpayer who has outstanding tax liabilities and has not been contacted by the DFA regarding those liabilities is eligible to participate in the VDA program.

Q: What are the benefits of participating in a VDA?

A: By participating in a VDA, taxpayers may receive a reduction in penalties and potential criminal charges, as well as the opportunity to negotiate a payment plan for their outstanding tax liabilities.

Q: How can I initiate a VDA in Arkansas?

A: To initiate a VDA in Arkansas, taxpayers must submit a written request to the DFA, including all relevant tax information and supporting documents.

Q: Is there a deadline for participating in the VDA program?

A: There is no specific deadline for participating in the VDA program in Arkansas, but taxpayers are encouraged to come forward as soon as possible to avoid further penalties and potential legal action.

Q: Can I participate in the VDA program if I am already under audit or investigation?

A: No, if you are already under audit or investigation by the DFA, you are not eligible to participate in the VDA program.

Form Details:

- Released on May 1, 2002;

- The latest edition currently provided by the Arkansas Department of Finance & Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.