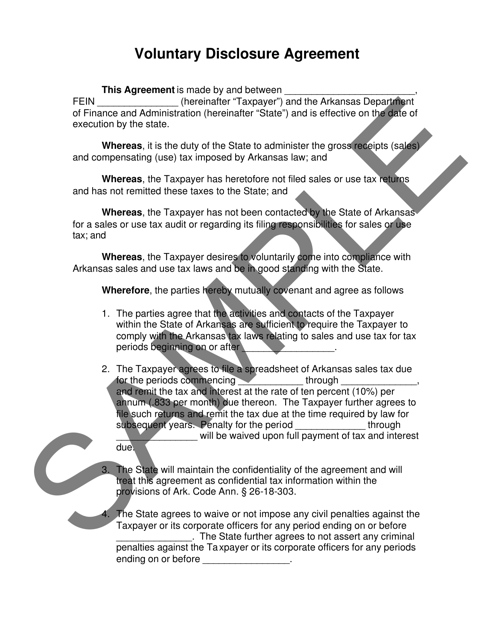

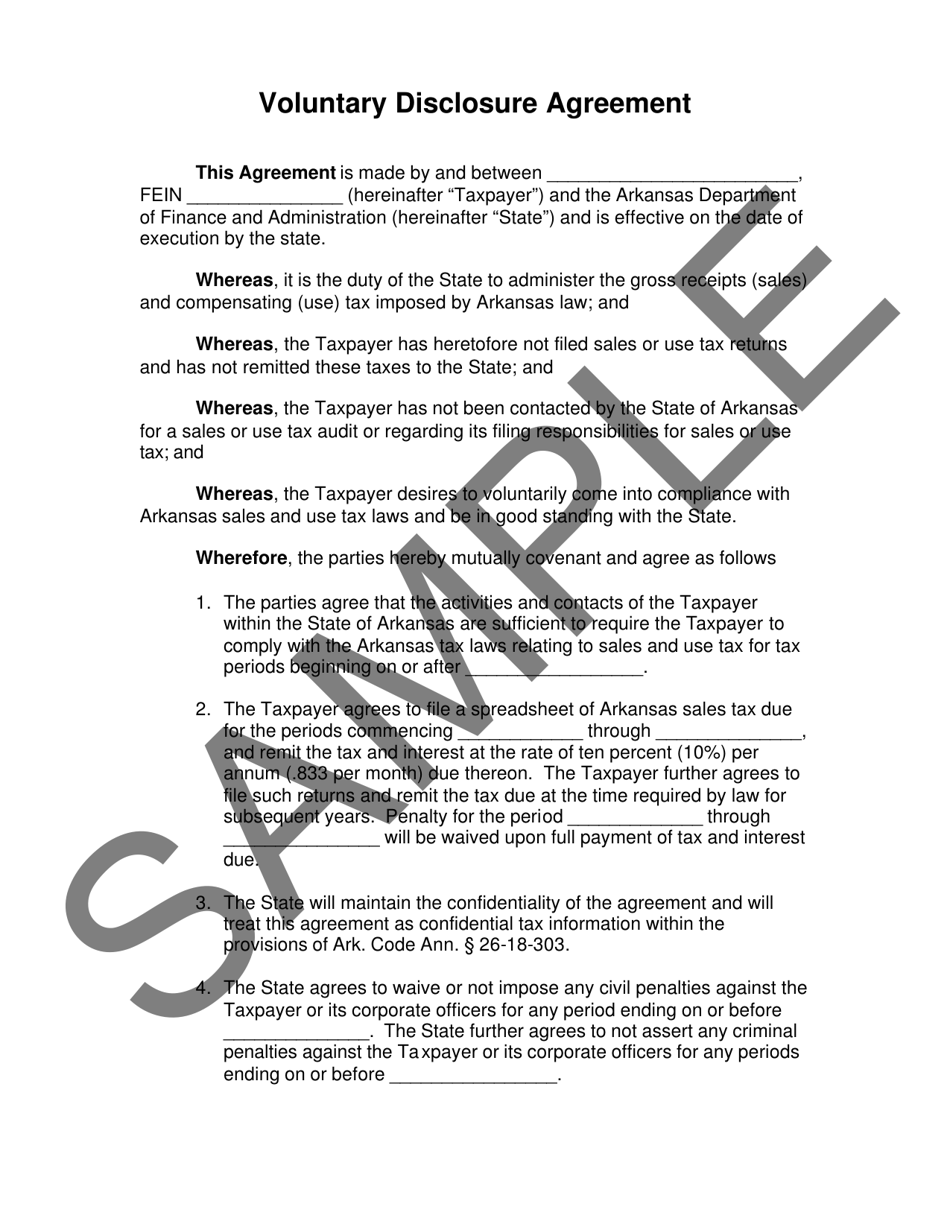

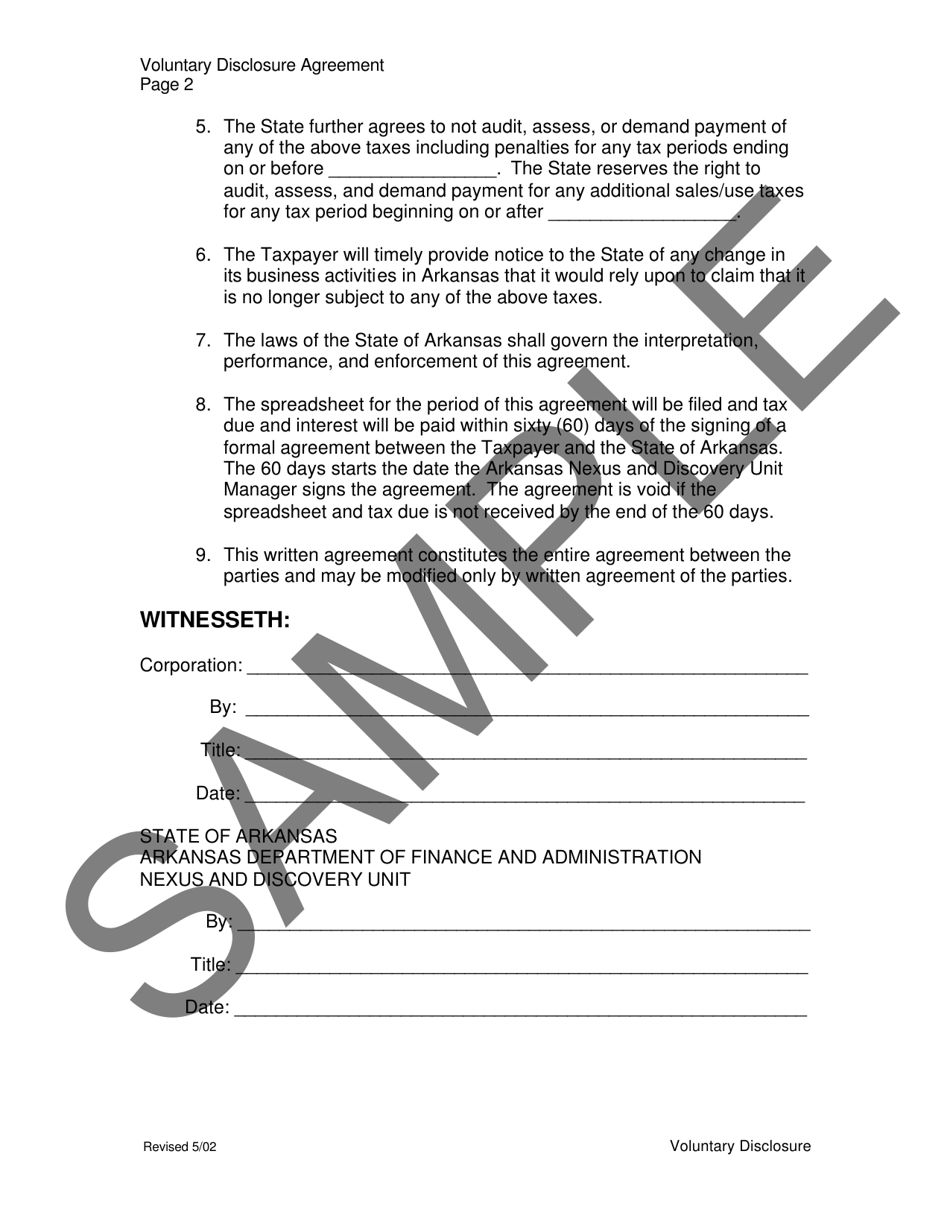

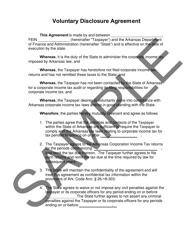

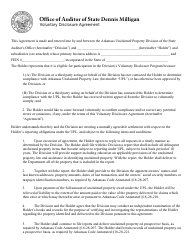

Voluntary Disclosure Agreement for Sales Tax - Arkansas

Voluntary Disclosure Agreement for Sales Tax is a legal document that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas.

FAQ

Q: What is a Voluntary Disclosure Agreement?

A: A Voluntary Disclosure Agreement is a program offered by the state of Arkansas that allows businesses to voluntarily disclose and pay any sales tax they may owe, without penalty or interest.

Q: Who can participate in the Voluntary Disclosure Agreement for Sales Tax in Arkansas?

A: Any business that has not previously registered for sales tax with the state of Arkansas can participate in the Voluntary Disclosure Agreement.

Q: What are the benefits of participating in the Voluntary Disclosure Agreement?

A: The benefits of participating in the Voluntary Disclosure Agreement include waiving penalties and interest on unpaid sales tax liabilities, as well as avoiding potential legal consequences.

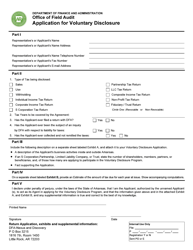

Q: How do I apply for the Voluntary Disclosure Agreement for Sales Tax in Arkansas?

A: To apply for the Voluntary Disclosure Agreement, you can contact the Arkansas Department of Finance and Administration and they will provide you with the necessary forms and instructions.

Q: What information do I need to provide when applying for the Voluntary Disclosure Agreement?

A: When applying for the Voluntary Disclosure Agreement, you will need to provide information about your business, such as your name, address, federal identification number, and a description of the business activities.

Q: Can I participate in the Voluntary Disclosure Agreement if I am already under audit or investigation?

A: No, if you are already under audit or investigation by the Arkansas Department of Finance and Administration, you are not eligible to participate in the Voluntary Disclosure Agreement.

Q: What should I do if I have already registered for sales tax but have unpaid liabilities?

A: If you have already registered for sales tax but have unpaid liabilities, you should contact the Arkansas Department of Finance and Administration to discuss your options, as the Voluntary Disclosure Agreement may not be applicable in your situation.

Q: Is the Voluntary Disclosure Agreement available for other types of taxes?

A: Yes, the Voluntary Disclosure Agreement is available for various types of taxes in Arkansas, including sales tax, use tax, and income tax.

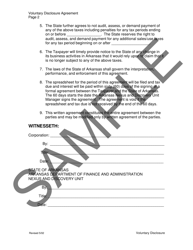

Form Details:

- Released on May 1, 2002;

- The latest edition currently provided by the Arkansas Department of Finance & Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.