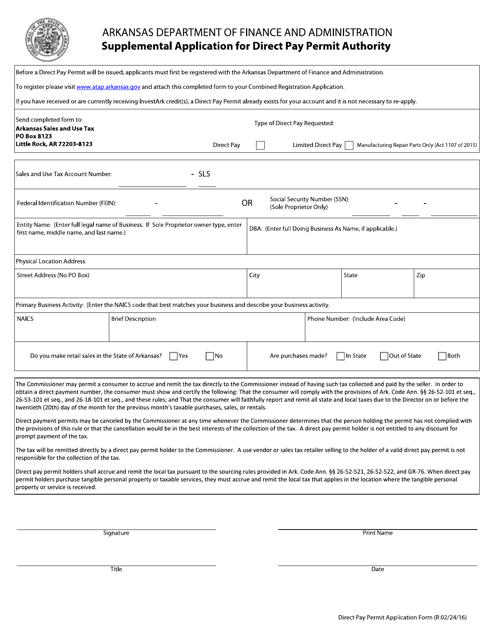

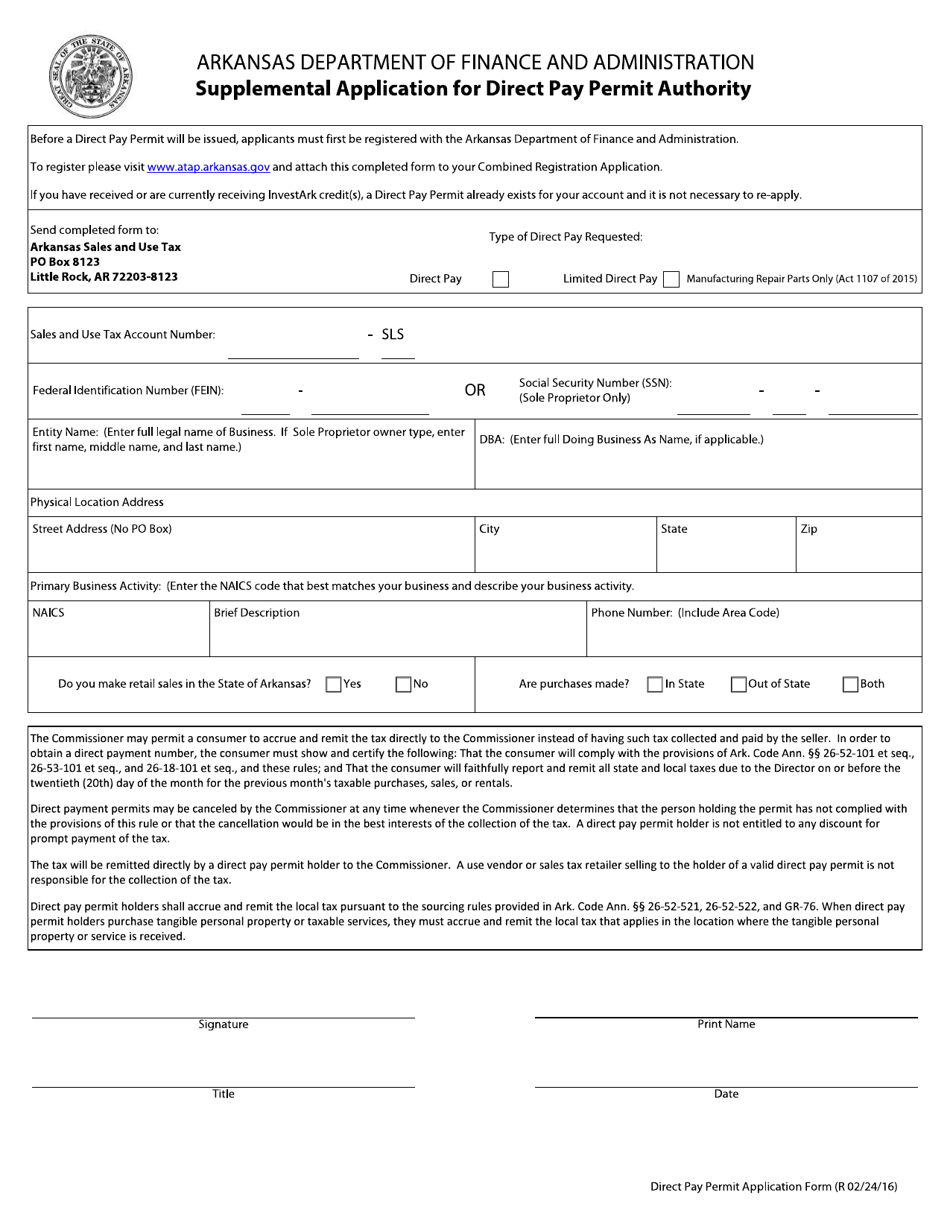

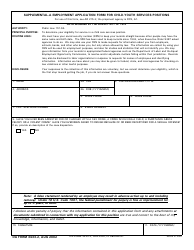

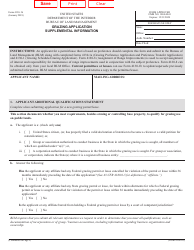

Supplemental Application for Direct Pay Permit Authority - Arkansas

Supplemental Application for Direct Pay Permit Authority is a legal document that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas.

FAQ

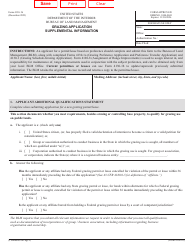

Q: What is a Direct Pay Permit?

A: A Direct Pay Permit is a permit issued by the state of Arkansas that allows businesses to purchase taxable goods and services without paying sales tax at the time of purchase.

Q: Who is eligible to apply for a Direct Pay Permit?

A: Any business engaged in a trade or business in Arkansas and regularly purchasing taxable goods and services may apply for a Direct Pay Permit.

Q: How can I apply for a Direct Pay Permit?

A: To apply for a Direct Pay Permit, you must complete and submit the Supplemental Application for Direct Pay Permit Authority to the Arkansas Department of Finance and Administration.

Q: What are the benefits of having a Direct Pay Permit?

A: Having a Direct Pay Permit allows businesses to avoid paying sales tax at the time of purchase, which can result in cost savings for the business.

Q: Are there any requirements to maintain a Direct Pay Permit?

A: Yes, businesses with a Direct Pay Permit must file monthly and annual reports with the Arkansas Department of Finance and Administration, and must maintain accurate records of all taxable purchases.

Form Details:

- Released on February 24, 2016;

- The latest edition currently provided by the Arkansas Department of Finance & Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.