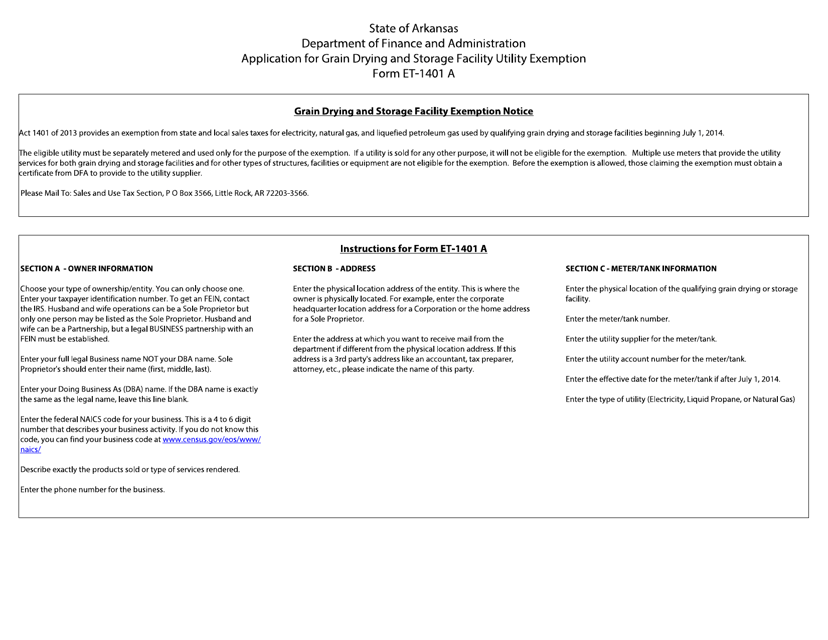

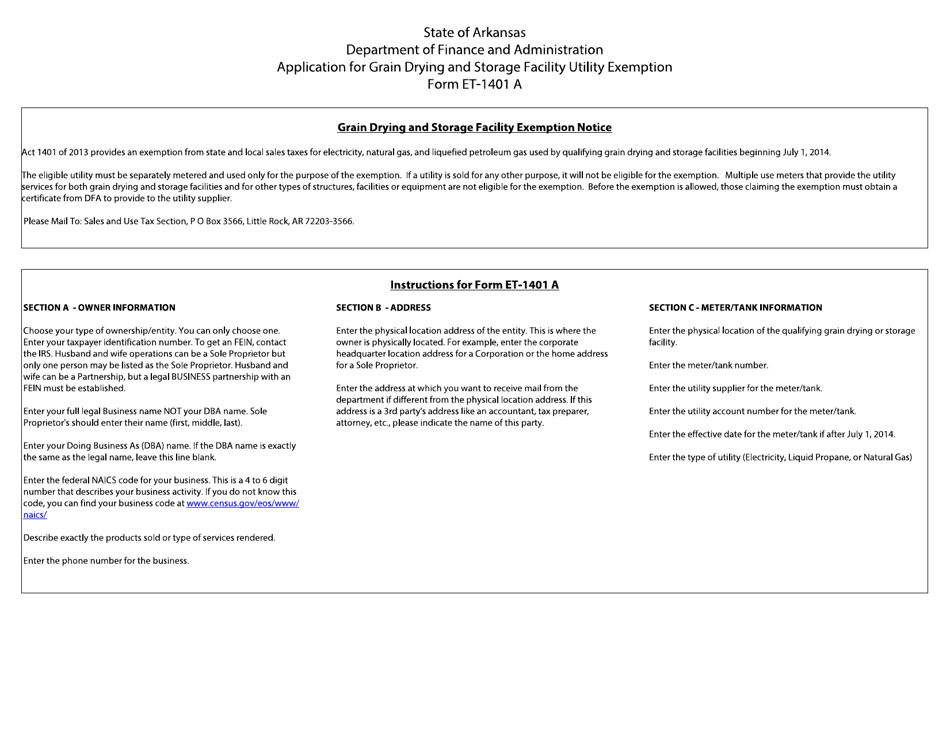

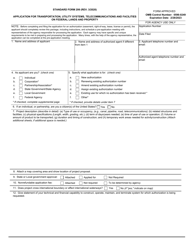

Form ET-1401 A Application for Grain Drying and Storage Facility Utility Exemption - Arkansas

What Is Form ET-1401 A?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET-1401 A?

A: Form ET-1401 A is an application for grain drying and storage facility utility exemption in Arkansas.

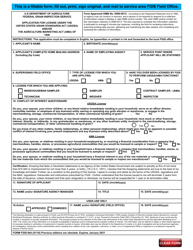

Q: Who needs to fill out Form ET-1401 A?

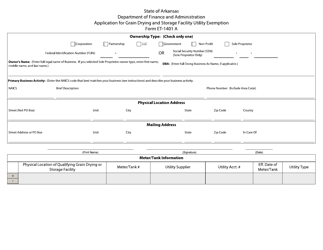

A: Grain drying and storage facility owners in Arkansas need to fill out Form ET-1401 A.

Q: What is the purpose of Form ET-1401 A?

A: The purpose of Form ET-1401 A is to apply for a utility exemption for grain drying and storage facilities in Arkansas.

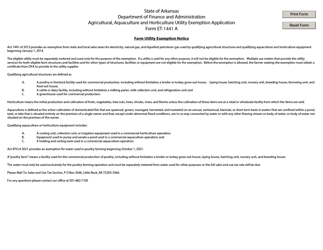

Q: What does the utility exemption entail?

A: The utility exemption allows grain drying and storage facilities to be exempt from certain sales and use taxes on utilities in Arkansas.

Q: Are there any eligibility requirements for the utility exemption?

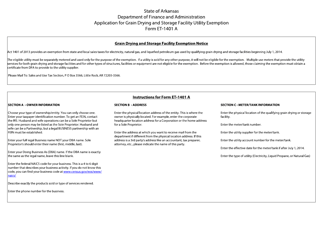

A: Yes, there are eligibility requirements for the utility exemption. These requirements are outlined in the instructions provided with Form ET-1401 A.

Q: When should I submit Form ET-1401 A?

A: Form ET-1401 A should be submitted to the Arkansas Department of Finance and Administration at least 30 days prior to the date the utility exemption is requested to begin.

Q: Is there a fee for submitting Form ET-1401 A?

A: No, there is no fee for submitting Form ET-1401 A.

Q: What should I do if I have questions or need assistance with Form ET-1401 A?

A: If you have questions or need assistance with Form ET-1401 A, you can contact the Arkansas Department of Finance and Administration directly.

Form Details:

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET-1401 A by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.