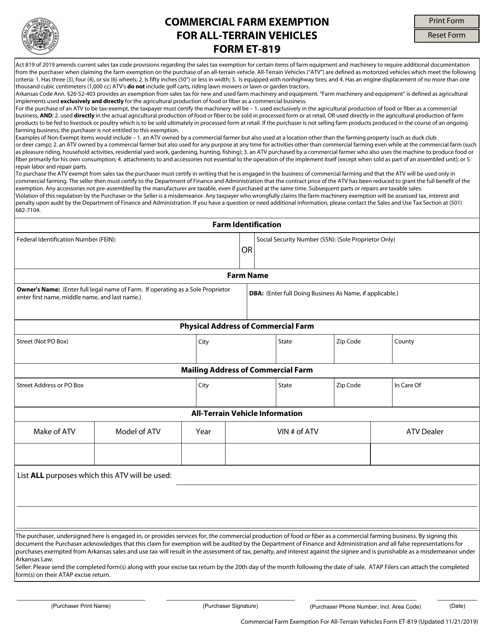

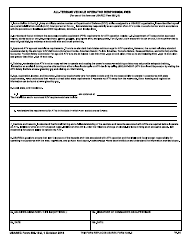

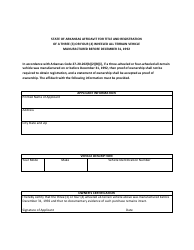

Form ET-819 Commercial Farm Exemption for All-terrain Vehicles - Arkansas

What Is Form ET-819?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET-819?

A: Form ET-819 is the Commercial Farm Exemption form for All-terrain Vehicles (ATVs) in Arkansas.

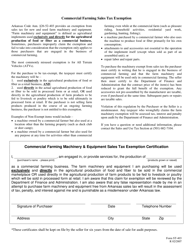

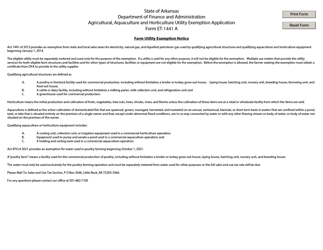

Q: What is the purpose of Form ET-819?

A: The purpose of Form ET-819 is to apply for a commercial farm exemption for using ATVs on public roads in Arkansas.

Q: Who needs to fill out Form ET-819?

A: Farmers in Arkansas who want to use ATVs on public roads for agricultural purposes need to fill out Form ET-819.

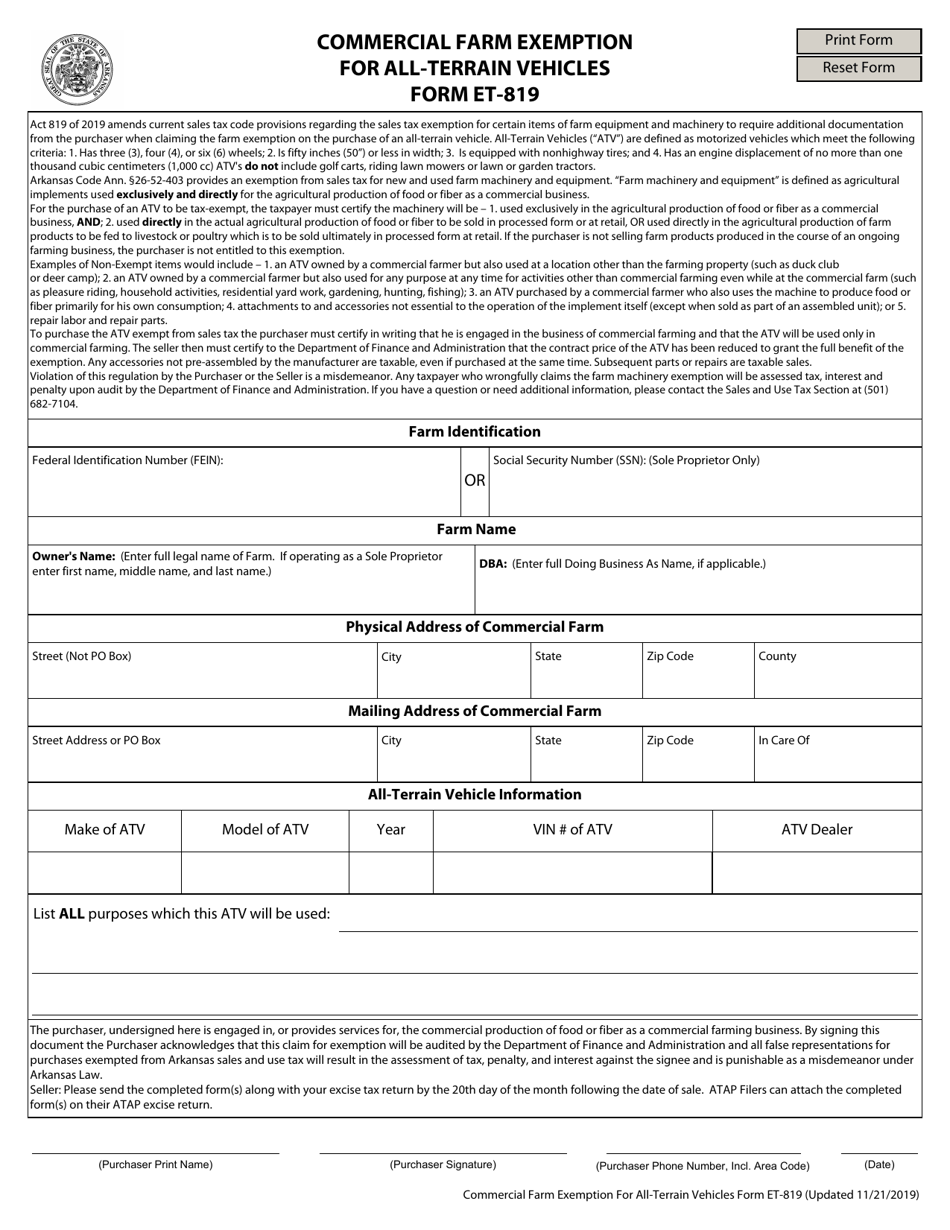

Q: What are the requirements for qualifying for the commercial farm exemption?

A: To qualify for the commercial farm exemption, you must have a valid driver's license, a vehicle identification number (VIN) for the ATV, and use the ATV solely for agricultural purposes.

Q: Are there any fees for filing Form ET-819?

A: There are no fees for filing Form ET-819.

Q: What should I do after filling out Form ET-819?

A: After filling out Form ET-819, you should submit it to the Arkansas Department of Finance and Administration.

Q: How long is the commercial farm exemption valid for?

A: The commercial farm exemption is valid for one year from the date of approval.

Q: Can I use my ATV on public roads without the commercial farm exemption?

A: No, you cannot use your ATV on public roads in Arkansas without the commercial farm exemption.

Q: Can I use the commercial farm exemption for recreational purposes?

A: No, the commercial farm exemption can only be used for agricultural purposes.

Form Details:

- Released on November 21, 2019;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET-819 by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.