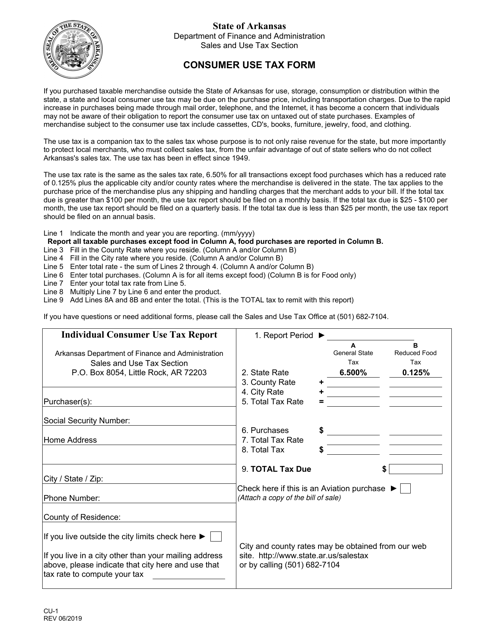

Form CU-1 Consumer Use Tax Form - Arkansas

What Is Form CU-1?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CU-1?

A: Form CU-1 is the Consumer Use Tax Form in Arkansas.

Q: Who needs to file Form CU-1?

A: Any individual or business in Arkansas that has purchased taxable goods or services from out-of-state sellers and did not pay sales tax at the time of purchase needs to file Form CU-1.

Q: What is the purpose of Form CU-1?

A: The purpose of Form CU-1 is to report and pay the consumer use tax on goods or services purchased from out-of-state sellers.

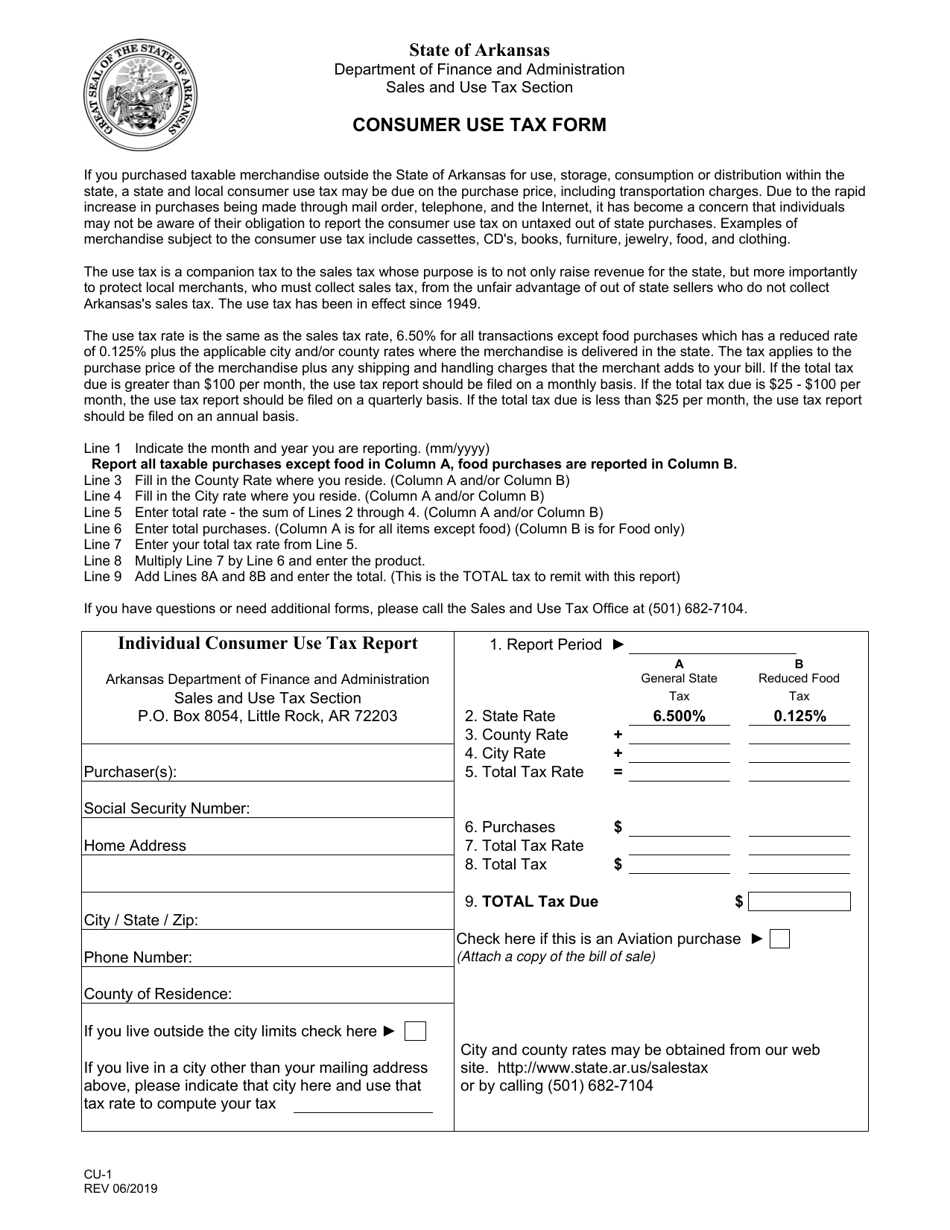

Q: What information is required on Form CU-1?

A: Form CU-1 requires information such as the name and address of the purchaser, description and value of the goods or services purchased, and the amount of use tax due.

Q: When is Form CU-1 due?

A: Form CU-1 is due on the 20th day of the month following the month in which the purchase was made.

Q: Are there any penalties for not filing Form CU-1?

A: Yes, failure to file Form CU-1 or underreporting the consumer use tax may result in penalties and interest.

Q: Can I e-file Form CU-1?

A: Yes, Form CU-1 can be filed electronically through the Arkansas Taxpayer Access Point (ATAP) system.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CU-1 by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.