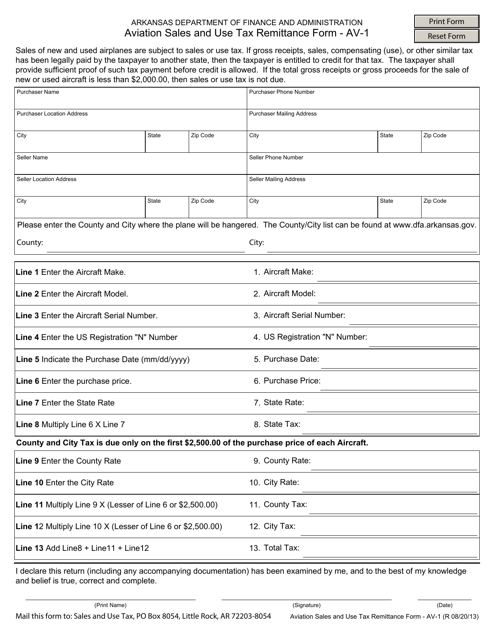

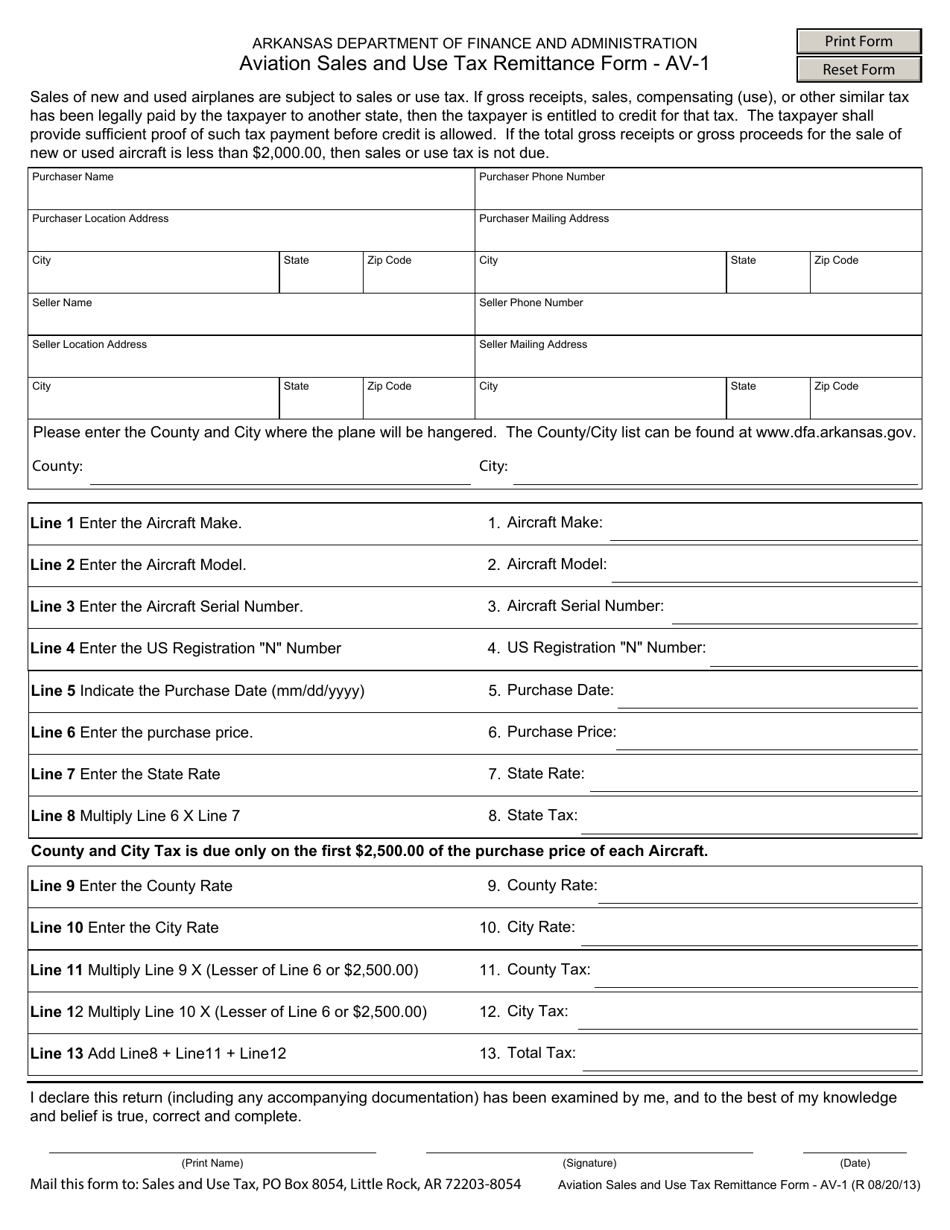

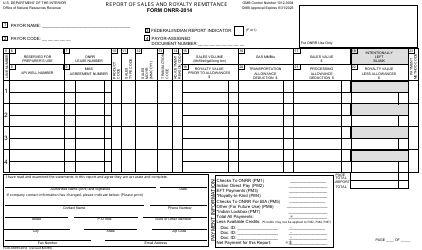

Form AV-1 Aviation Sales and Use Tax Remittance Form - Arkansas

What Is Form AV-1?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AV-1 used for?

A: Form AV-1 is used to report and remit sales and use tax on aviation fuel and aircraft in Arkansas.

Q: Who needs to file Form AV-1?

A: Aircraft owners, operators, fuel suppliers, and aircraft dealers who sell or use aviation fuel or aircraft in Arkansas need to file Form AV-1.

Q: When is Form AV-1 due?

A: Form AV-1 must be filed and remitted on a monthly basis, and the due date is the 25th day of the following month.

Q: What information is required to complete Form AV-1?

A: Some of the information required includes aircraft or fuel supplier identification, total gallons of fuel sold or used, and the amount of sales and use tax due.

Q: What are the consequences of not filing Form AV-1?

A: Failure to file and remit the aviation sales and use tax may result in penalties, interest, and other enforcement actions by the Arkansas DFA.

Form Details:

- Released on August 20, 2013;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AV-1 by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.