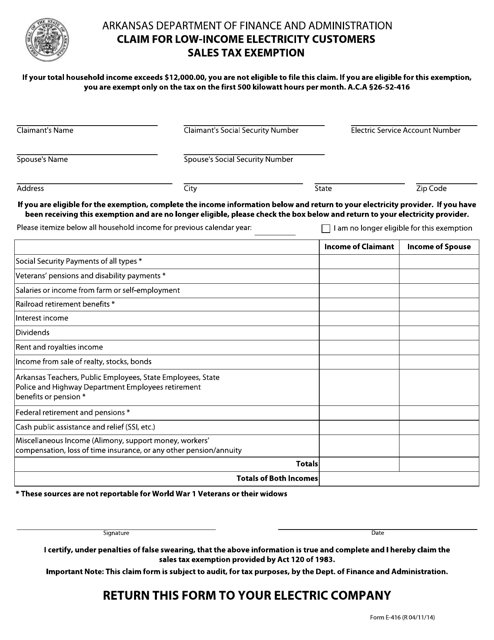

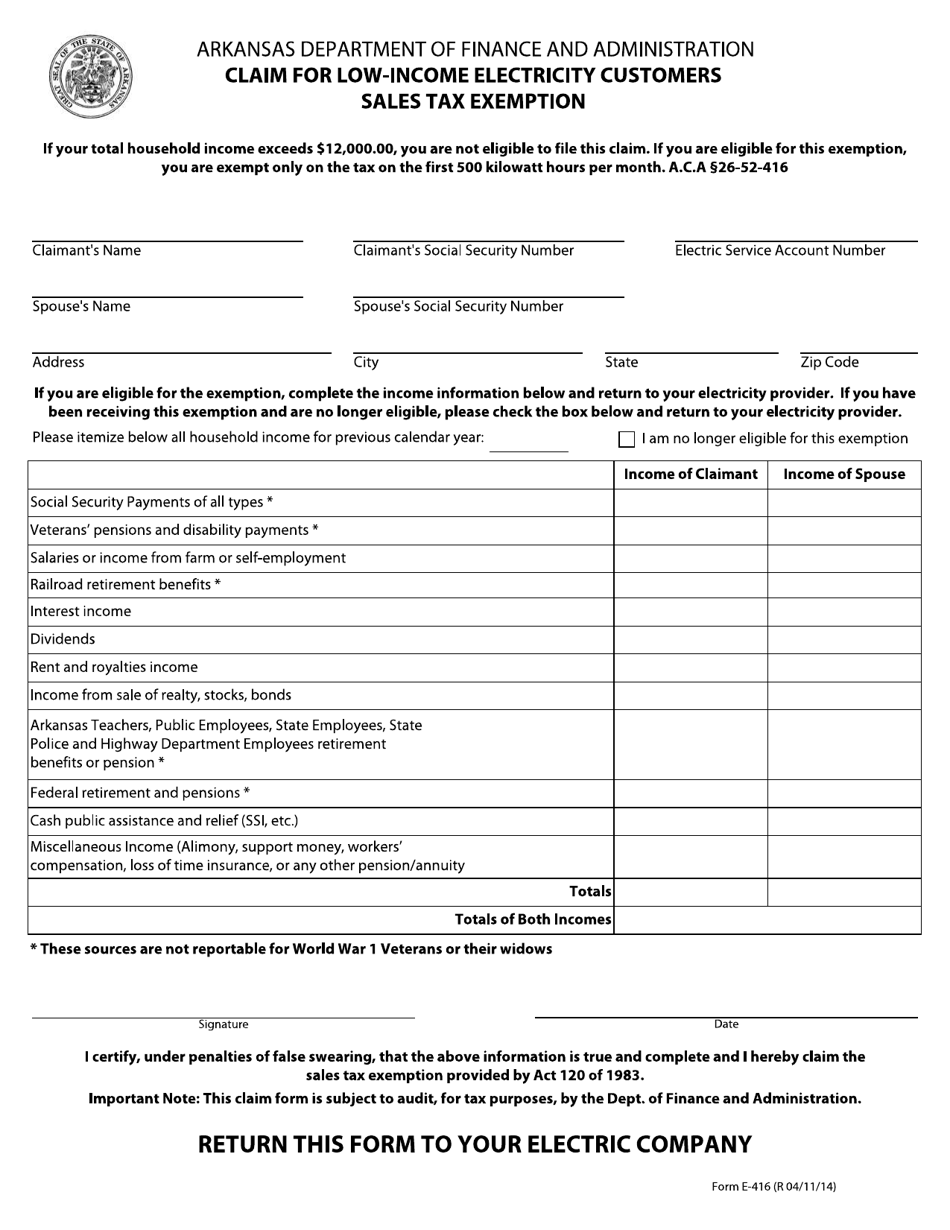

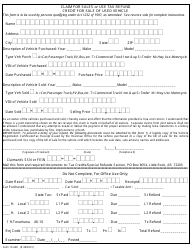

Form E-416 Claim for Low-Income Electricity Customers Sales Tax Exemption - Arkansas

What Is Form E-416?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-416?

A: Form E-416 is a claim for low-income electricity customers sales tax exemption in Arkansas.

Q: Who is eligible for the sales tax exemption?

A: Low-income electricity customers in Arkansas are eligible for the sales tax exemption.

Q: How can I claim the sales tax exemption?

A: You can claim the sales tax exemption by filling out Form E-416.

Q: Are there any supporting documents required for the claim?

A: Yes, you may need to provide proof of income and other supporting documents with your claim.

Q: Is there a deadline to submit the claim?

A: The deadline to submit the claim may vary. Please refer to the instructions on Form E-416 or contact the Arkansas Department of Finance and Administration for more information.

Form Details:

- Released on April 11, 2014;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-416 by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.