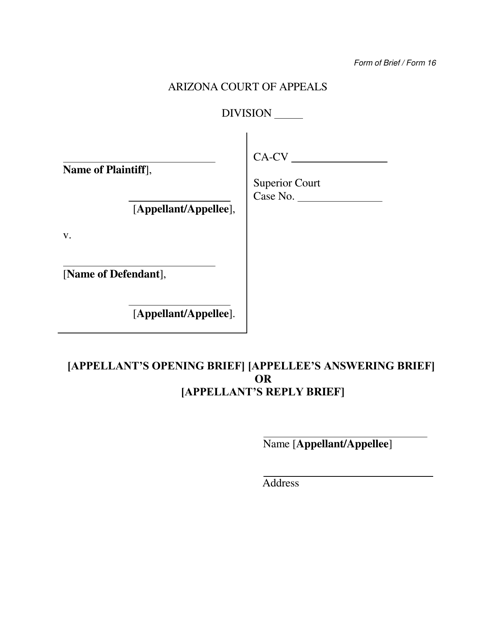

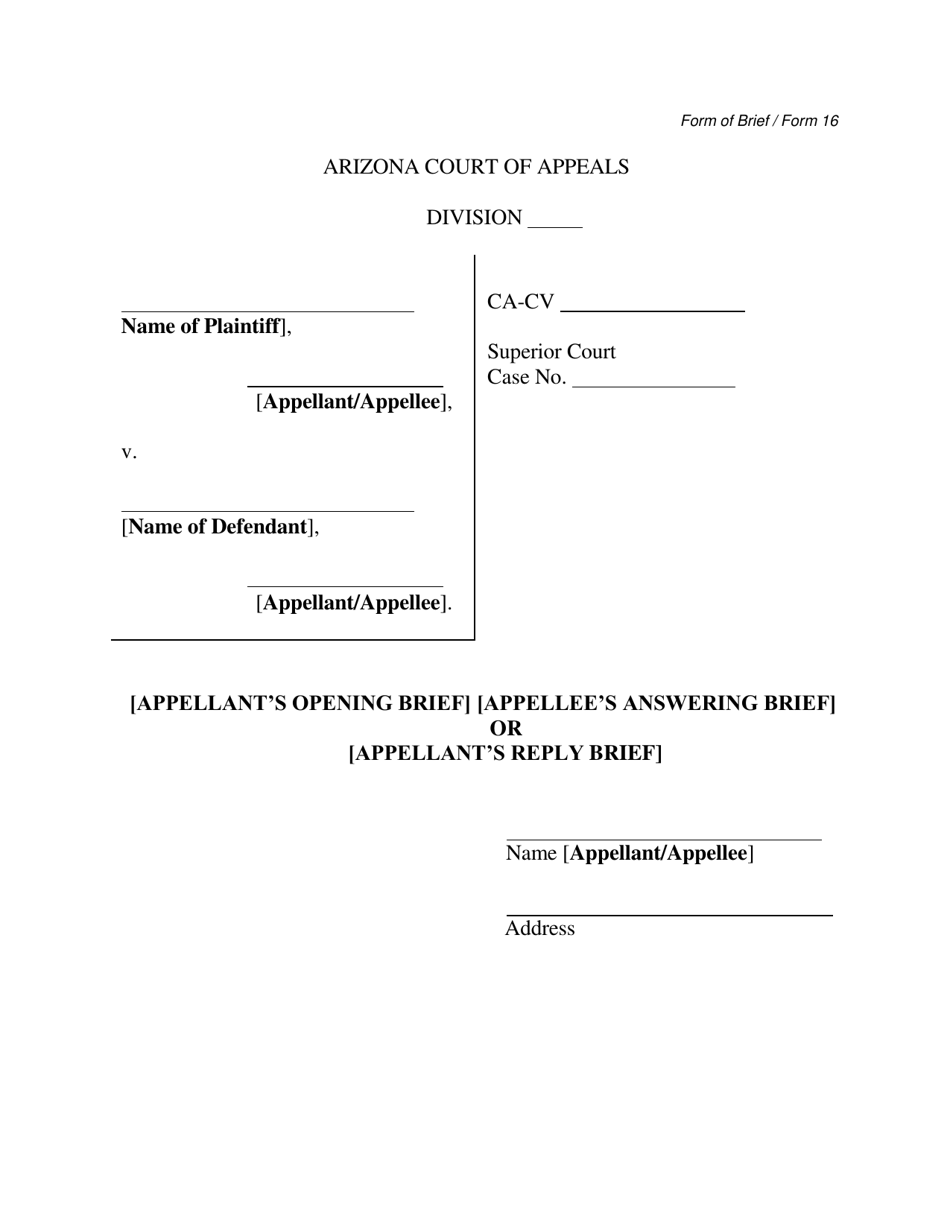

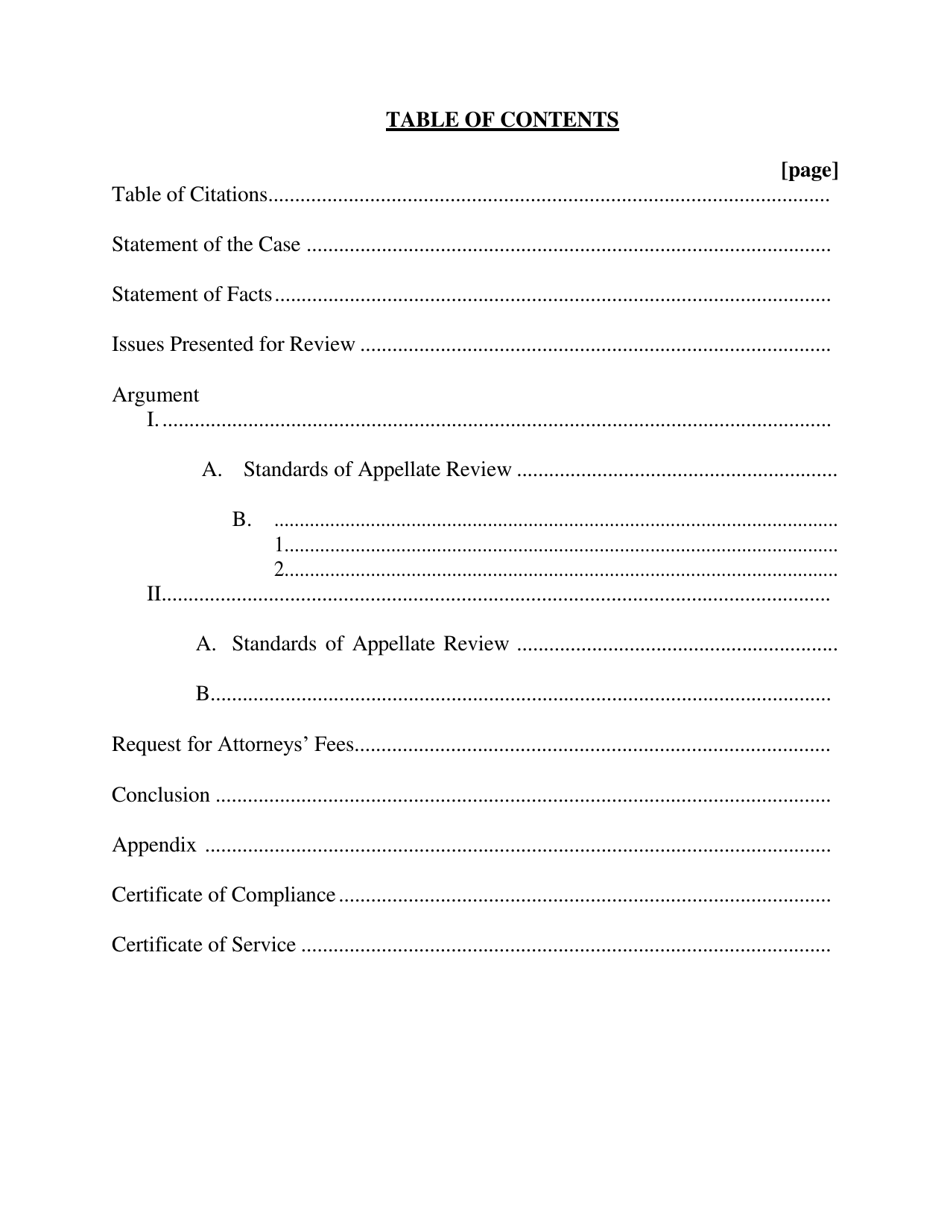

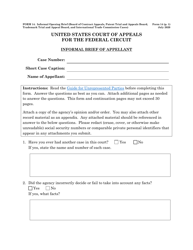

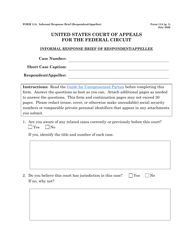

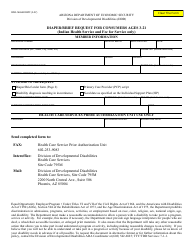

Form 16 Form of Brief - Arizona

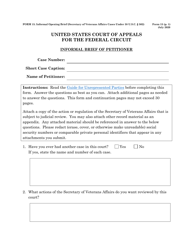

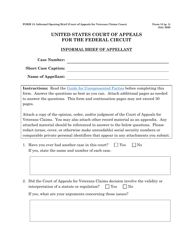

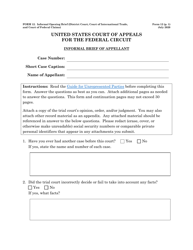

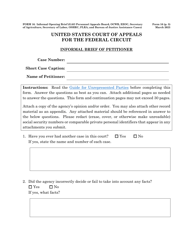

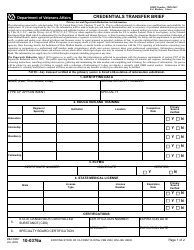

What Is Form 16?

This is a legal form that was released by the Arizona Court of Appeals - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 16?

A: Form 16 is a form used to report income tax withheld from employee salaries in India.

Q: What is the purpose of Form 16?

A: The purpose of Form 16 is to provide employees with information about their salary income, tax deductions, and the tax payable for the financial year.

Q: Who needs to file Form 16?

A: Employers are required to provide Form 16 to their employees who have taxable income and tax has been deducted at source.

Q: What information is mentioned in Form 16?

A: Form 16 includes details of employer and employee, summary of income, deductions under various sections, and the tax computed and deducted.

Q: Is Form 16 mandatory?

A: Yes, it is mandatory for employers to issue Form 16 to their employees who have taxable income and tax has been deducted at source.

Form Details:

- The latest edition provided by the Arizona Court of Appeals;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 16 by clicking the link below or browse more documents and templates provided by the Arizona Court of Appeals.