This version of the form is not currently in use and is provided for reference only. Download this version of

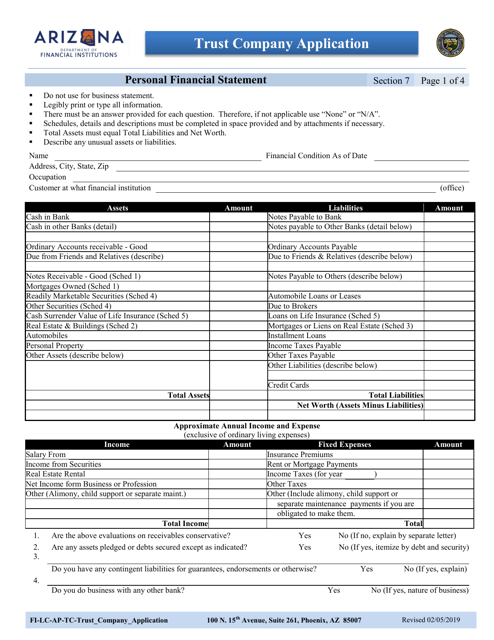

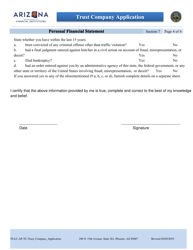

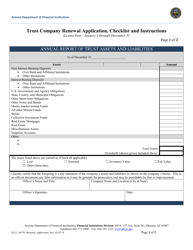

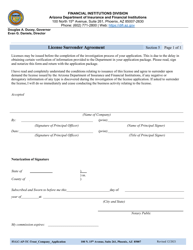

Section 7

for the current year.

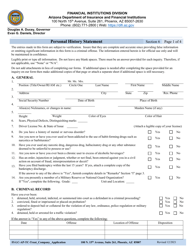

Section 7 Trust Company Application - Personal Financial Statement - Arizona

What Is Section 7?

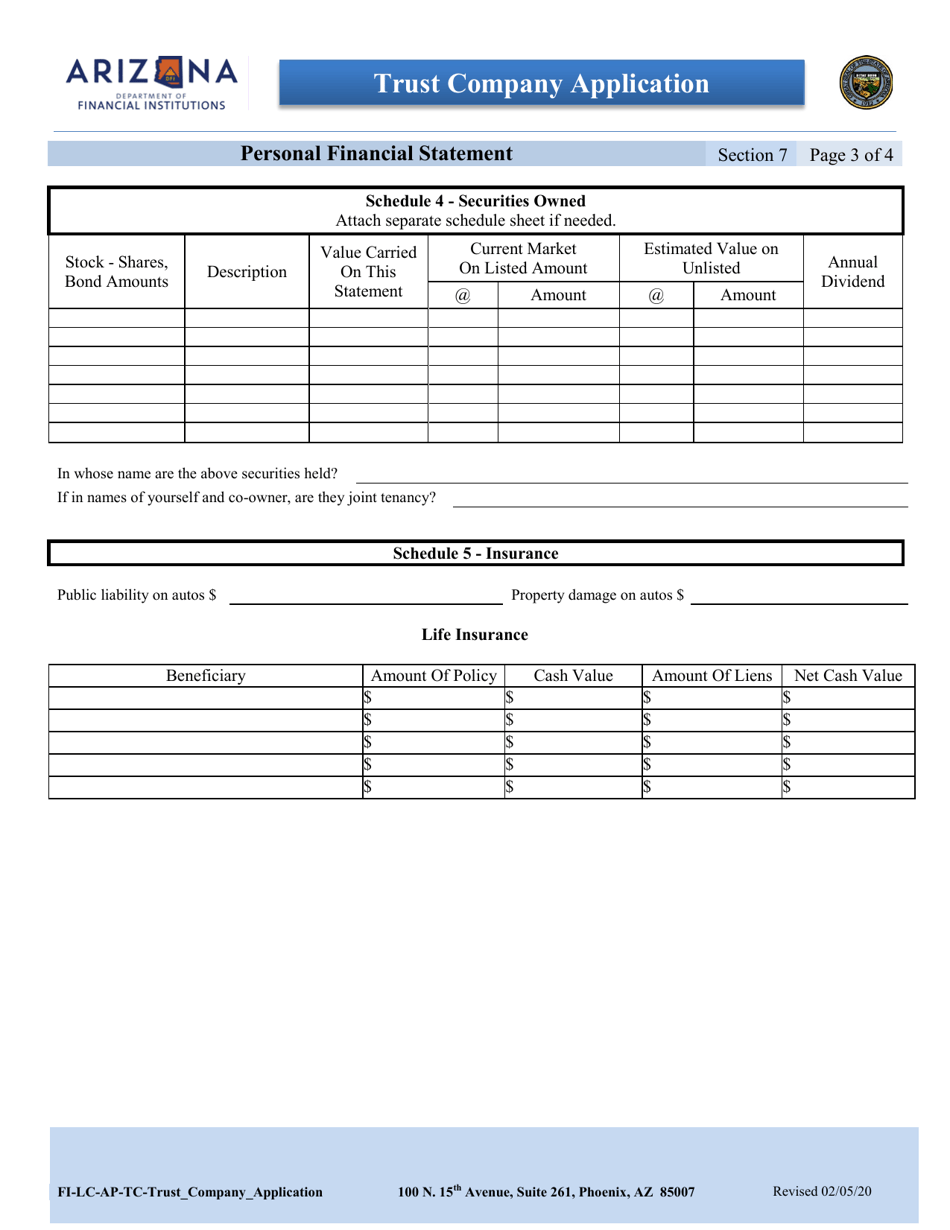

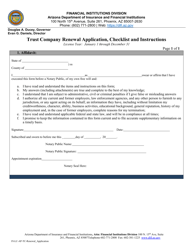

This is a legal form that was released by the Arizona Department of Financial Institutions - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a personal financial statement?

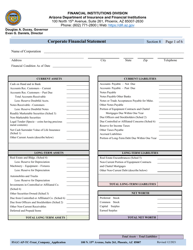

A: A personal financial statement is a document that shows an individual's financial situation, including their assets, liabilities, and net worth.

Q: Why is a personal financial statement required for a trust company application?

A: A personal financial statement is required for a trust company application to assess the individual's financial stability and ability to meet the requirements of running a trust company.

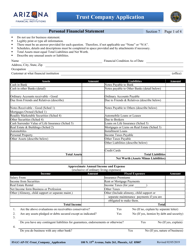

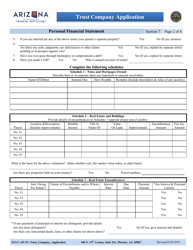

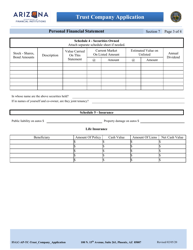

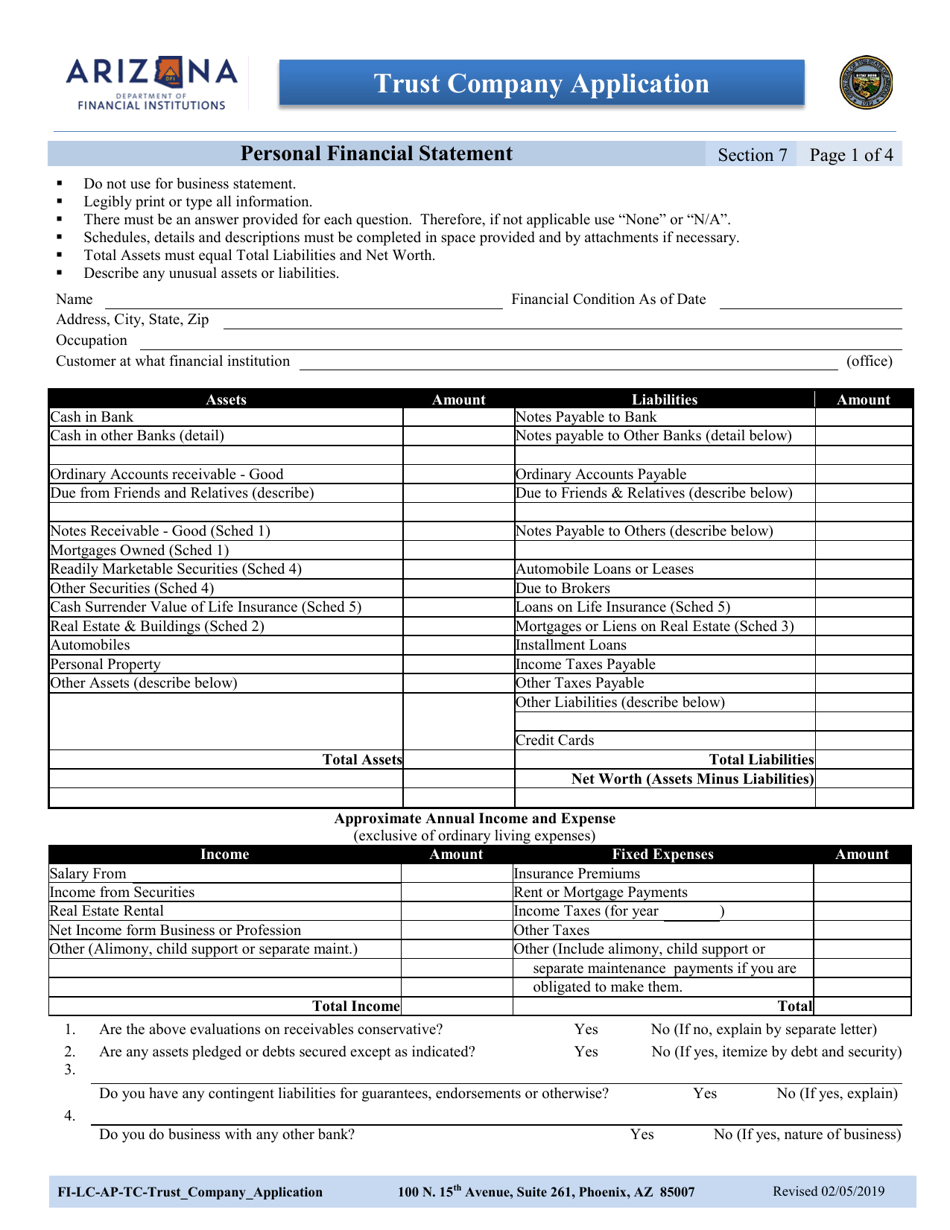

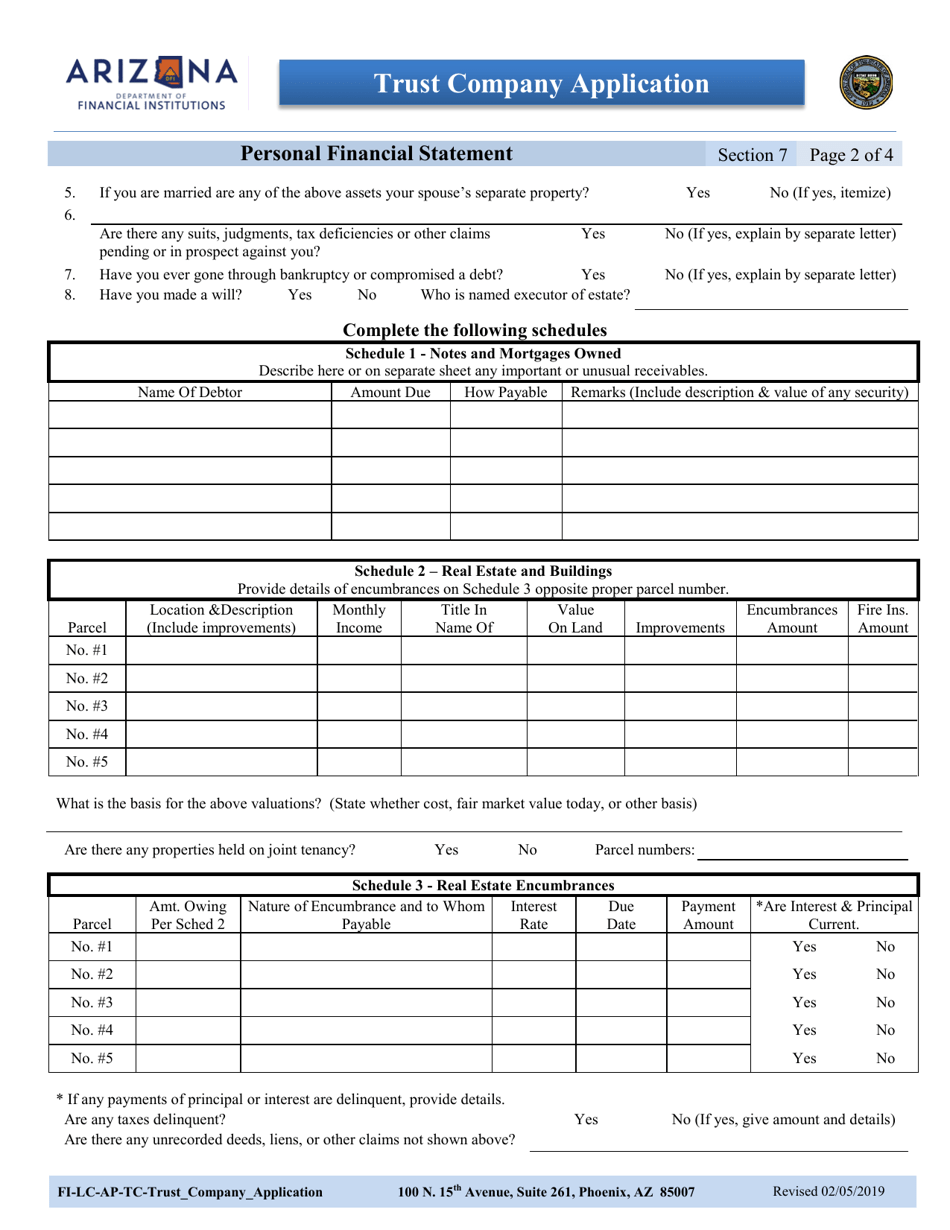

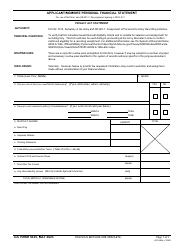

Q: What information is typically included in a personal financial statement?

A: A personal financial statement typically includes information on an individual's income, expenses, assets (such as cash, investments, and real estate), liabilities (such as loans and mortgages), and net worth.

Q: Who needs to complete a personal financial statement for a trust company application?

A: The individual or individuals applying for a trust company license need to complete a personal financial statement as part of the application process.

Q: Are there specific requirements for a personal financial statement in Arizona?

A: Yes, Arizona may have specific requirements for a personal financial statement in the context of a trust company application. It is important to consult the relevant regulations or guidelines for accurate and up-to-date information.

Form Details:

- Released on February 5, 2019;

- The latest edition provided by the Arizona Department of Financial Institutions;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Section 7 by clicking the link below or browse more documents and templates provided by the Arizona Department of Financial Institutions.