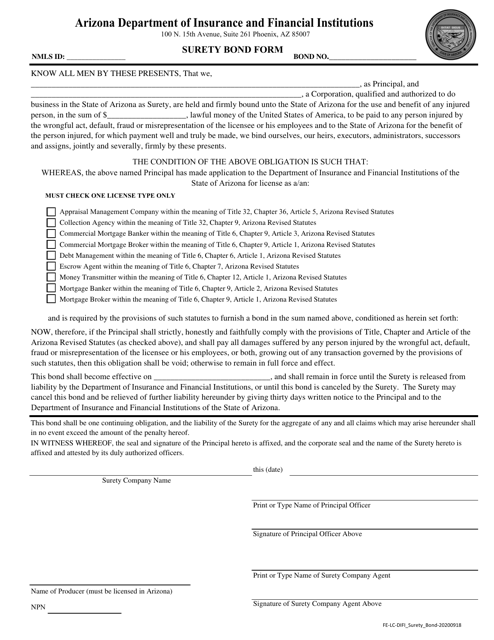

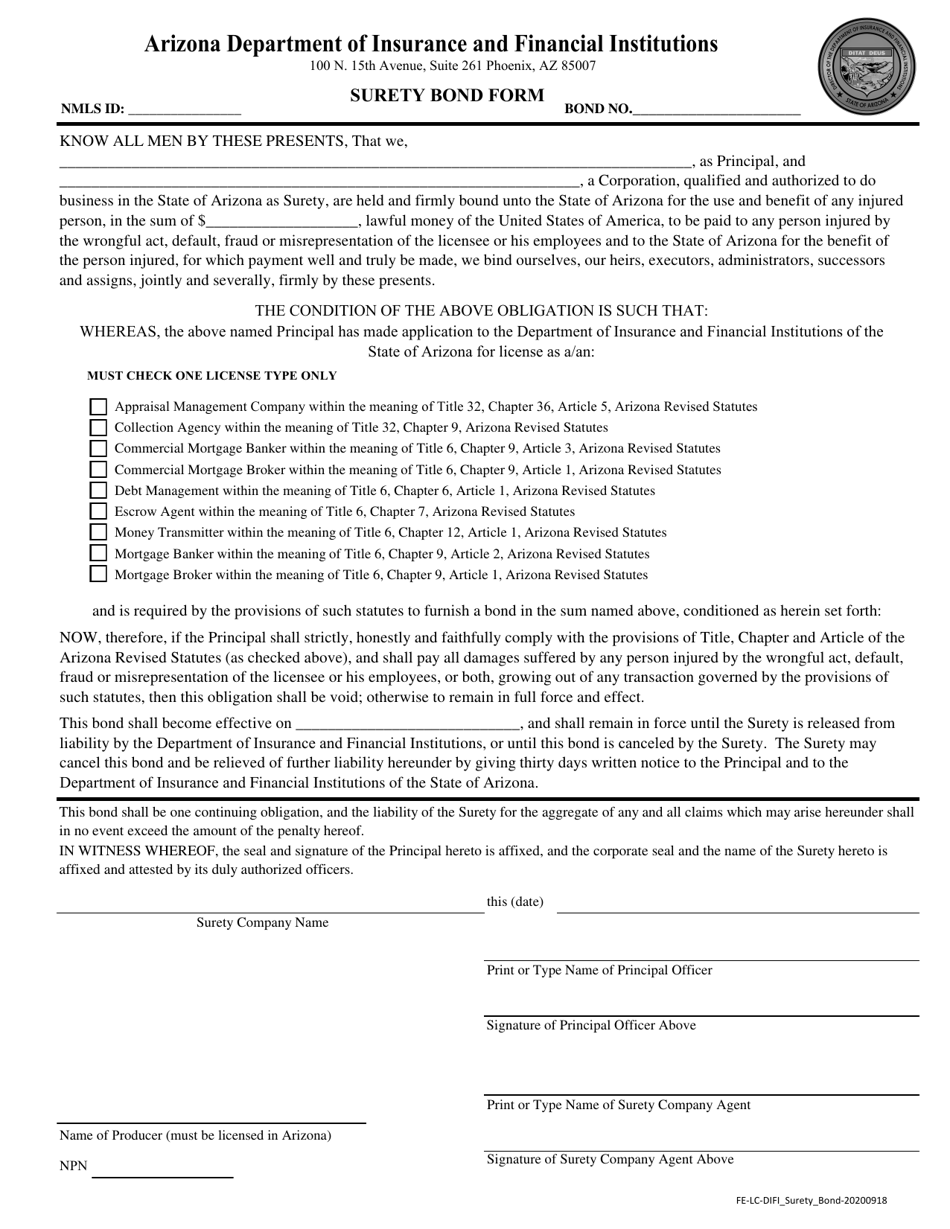

Surety Bond Form - Arizona

Surety Bond Form is a legal document that was released by the Arizona Department of Financial Institutions - a government authority operating within Arizona.

FAQ

Q: What is a surety bond?

A: A surety bond is a legally binding agreement between three parties: the principal (the person or business that needs the bond), the surety (the company providing the bond), and the obligee (the entity requiring the bond).

Q: Why would someone need a surety bond in Arizona?

A: There are many reasons why someone may need a surety bond in Arizona. It could be required for certain professional licenses, construction projects, or to guarantee payment of taxes or other financial obligations.

Q: How do I obtain a surety bond in Arizona?

A: To obtain a surety bond in Arizona, you will need to contact a surety bond company and provide the necessary information and documentation. The surety bond company will then evaluate your application and determine the cost and terms of the bond.

Q: What are the different types of surety bonds available in Arizona?

A: There are various types of surety bonds available in Arizona, including contractor license bonds, performance bonds, payment bonds, notary bonds, and more. The type of bond required will depend on the specific situation.

Q: How much does a surety bond cost in Arizona?

A: The cost of a surety bond in Arizona can vary depending on factors such as the type of bond, the amount of coverage required, and the applicant's credit history. It is best to contact a surety bond company for a quote.

Q: Are surety bonds in Arizona refundable?

A: No, surety bonds in Arizona are generally not refundable. Once the bond is issued and in effect, the premium paid for the bond is non-refundable.

Q: What happens if a claim is made against a surety bond in Arizona?

A: If a claim is made against a surety bond in Arizona, the surety bond company will investigate the claim and, if found valid, compensate the obligee up to the bond's coverage amount. The principal (bond holder) will then be responsible for reimbursing the surety bond company for the amount paid.

Q: How long does a surety bond remain in effect in Arizona?

A: The duration of a surety bond in Arizona can vary depending on the specific bond requirements. Some bonds may be valid for a specific period of time (such as one year), while others may remain in effect until canceled or a specific obligation is fulfilled.

Q: Can I get a surety bond with bad credit in Arizona?

A: Yes, it is possible to get a surety bond with bad credit in Arizona. However, the cost and terms of the bond may be affected, as surety bond companies typically consider an applicant's credit history when determining bond eligibility and pricing.

Q: Is a surety bond the same as insurance in Arizona?

A: No, a surety bond and insurance are not the same in Arizona. While both involve a contract and provide financial protection, insurance is typically designed to protect the policyholder, while a surety bond is designed to protect a third party (the obligee) from financial loss due to the actions of the principal.

Form Details:

- Released on September 18, 2020;

- The latest edition currently provided by the Arizona Department of Financial Institutions;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arizona Department of Financial Institutions.