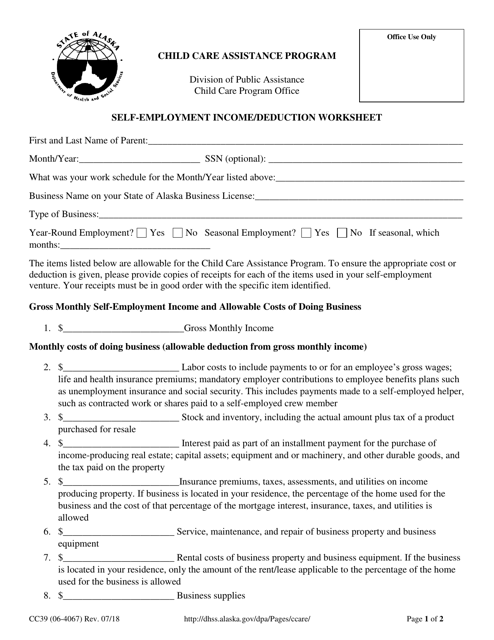

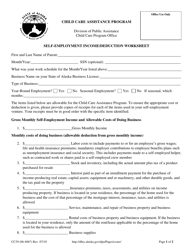

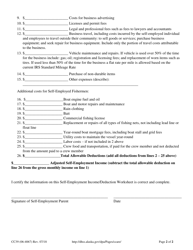

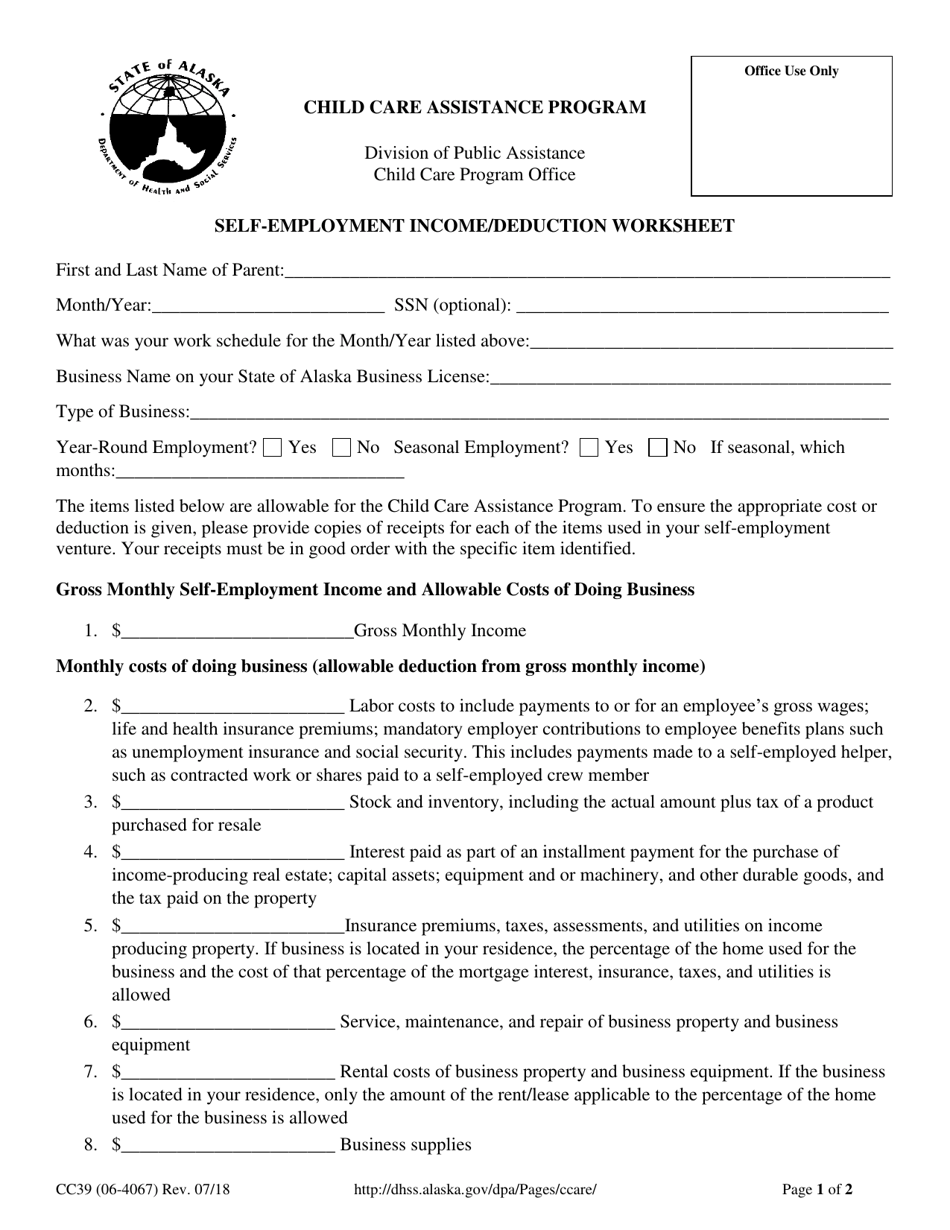

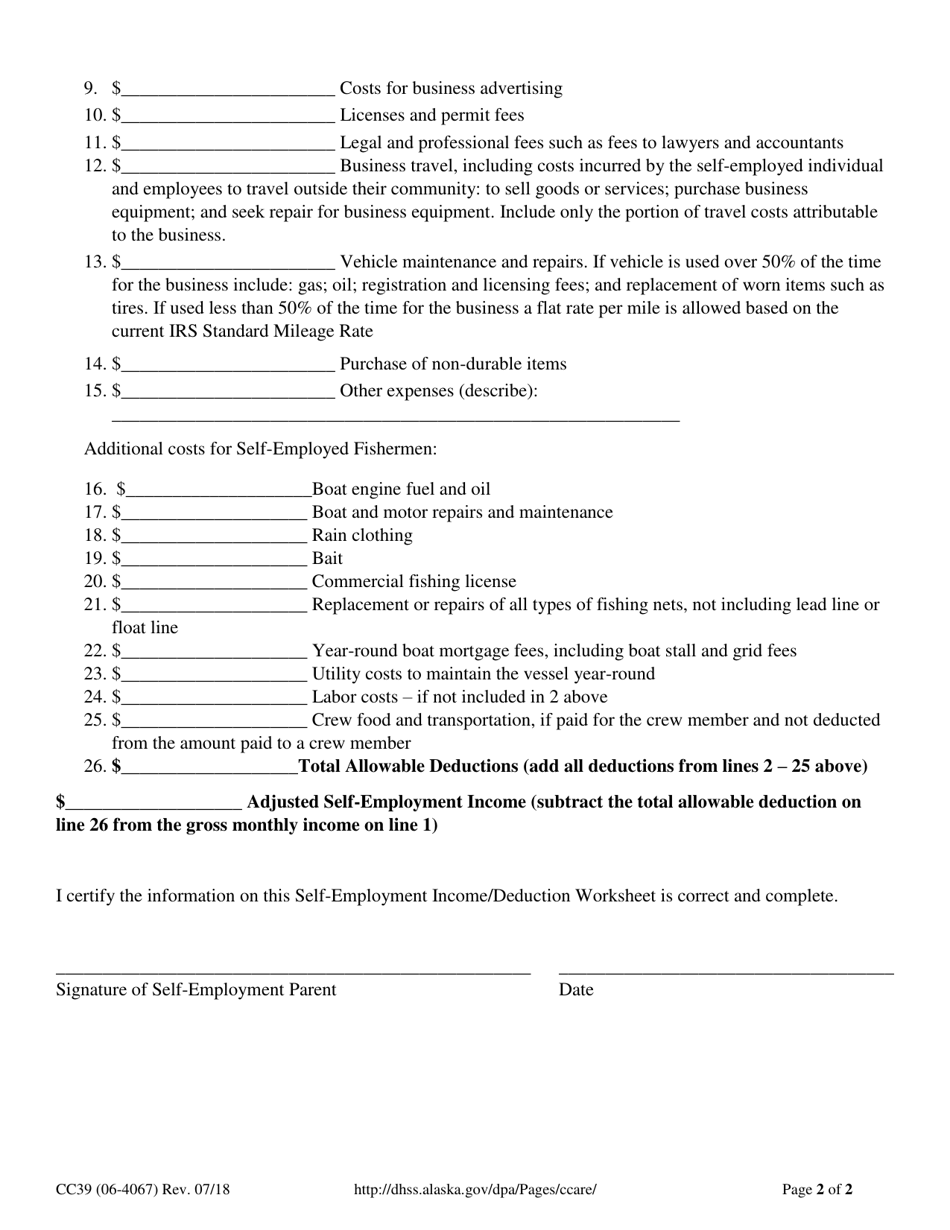

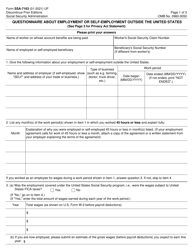

Form CC39 Self-employment Income / Deduction Worksheet - Alaska

What Is Form CC39?

This is a legal form that was released by the Alaska Department of Health and Social Services - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CC39?

A: Form CC39 is the Self-employment Income/Deduction Worksheet specifically for residents of Alaska.

Q: Who should use Form CC39?

A: Form CC39 should be used by self-employed individuals who are residents of Alaska.

Q: What is the purpose of Form CC39?

A: The purpose of Form CC39 is to calculate self-employment income and deductions for residents of Alaska.

Q: Do I need to file Form CC39?

A: Whether you need to file Form CC39 or not depends on your self-employment income and deductions. It is recommended to consult a tax professional or refer to the official guidelines of the Department of Revenue for the State of Alaska.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Alaska Department of Health and Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CC39 by clicking the link below or browse more documents and templates provided by the Alaska Department of Health and Social Services.