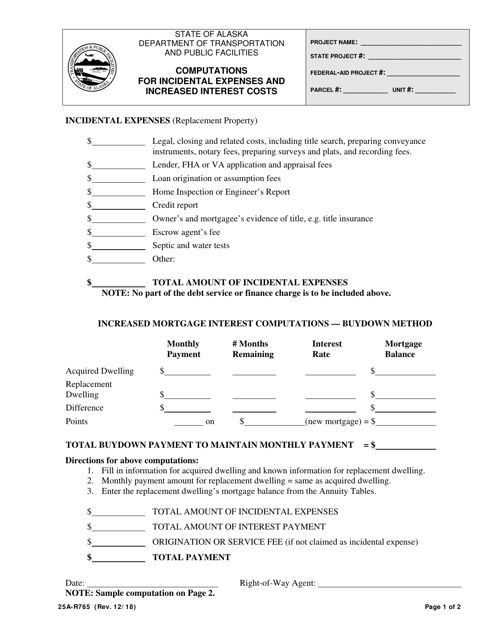

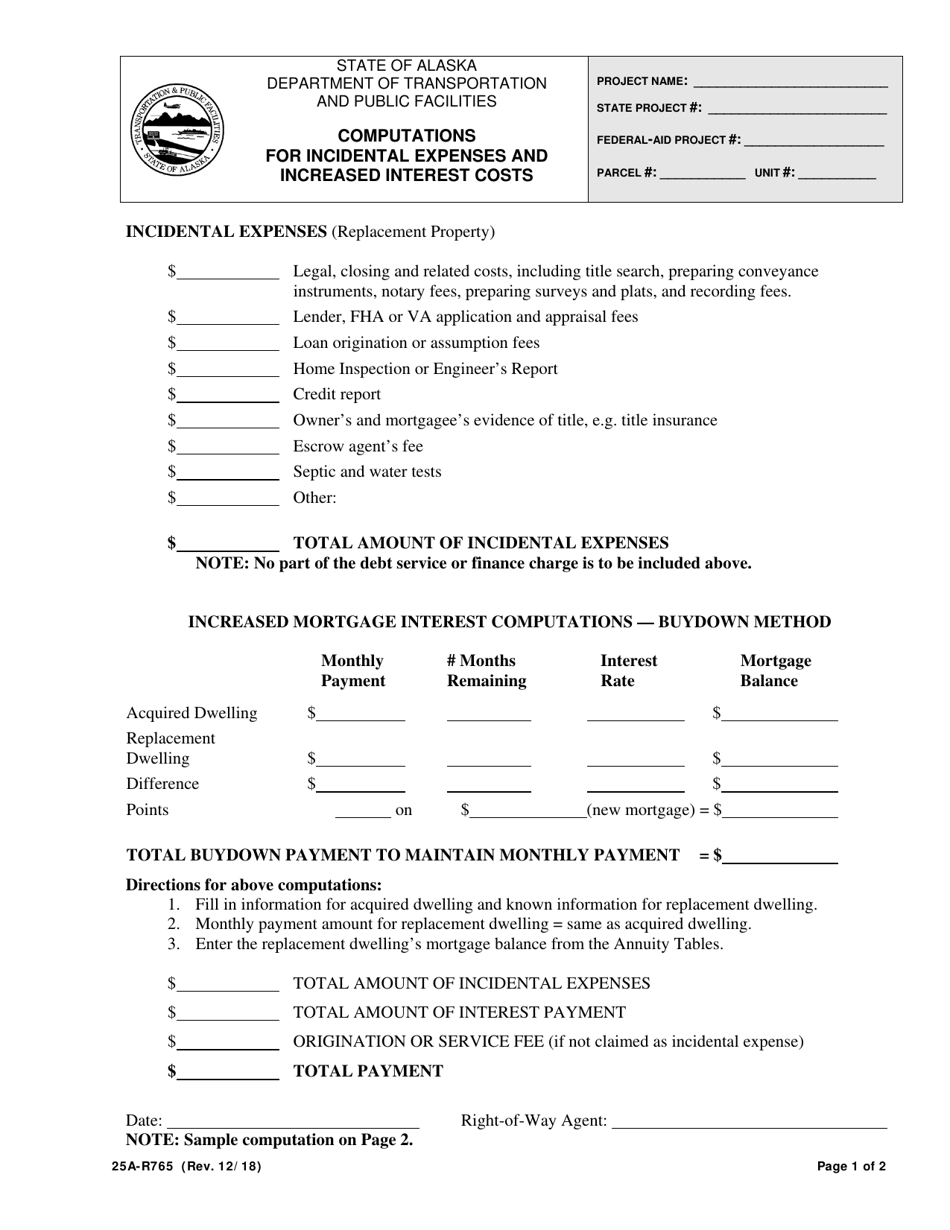

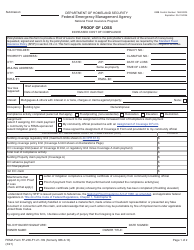

Form 25A-R765 Computations for Incidental Expenses and Increased Interest Costs - Alaska

What Is Form 25A-R765?

This is a legal form that was released by the Alaska Department of Transportation and Public Facilities - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 25A-R765?

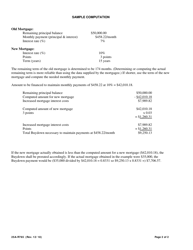

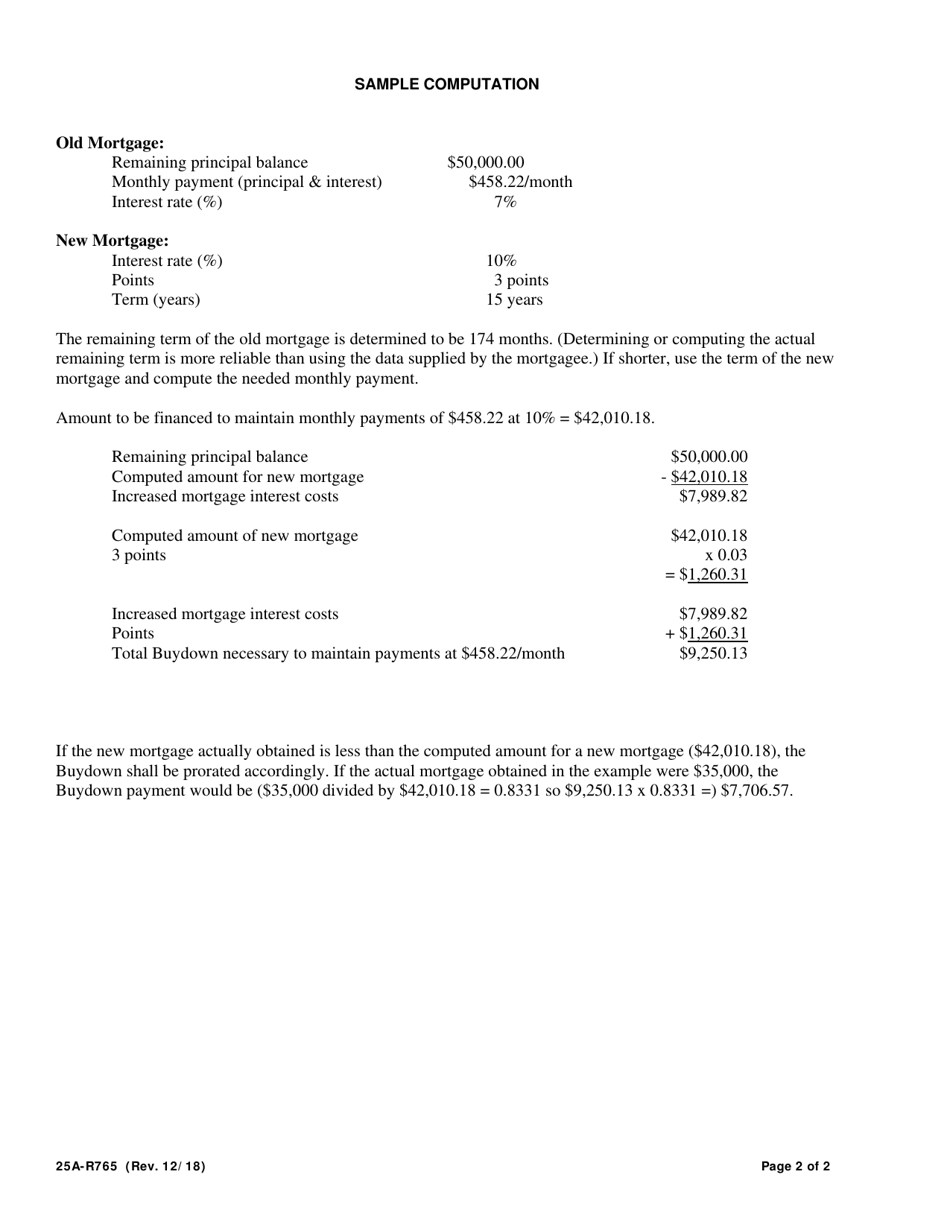

A: Form 25A-R765 is a document used to compute incidental expenses and increased interest costs in Alaska.

Q: Who uses Form 25A-R765?

A: This form is used by individuals and businesses in Alaska.

Q: What are incidental expenses?

A: Incidental expenses refer to additional costs incurred in relation to an activity or project.

Q: What are increased interest costs?

A: Increased interest costs pertain to additional interest payments or charges.

Q: Why do I need to compute incidental expenses and increased interest costs?

A: Calculating these costs is necessary for certain purposes, such as tax deductions or expense reimbursement.

Q: Are there any specific requirements for filling out this form?

A: Yes, you may need to provide supporting documents like receipts, invoices, or loan agreements.

Q: Can I claim incidental expenses and increased interest costs for any activity?

A: No, these costs are specific to certain activities or projects as determined by the relevant regulations or guidelines.

Q: What should I do if I have questions or need assistance with Form 25A-R765?

A: You can contact the Alaska Department of Revenue or consult a tax professional for guidance.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Alaska Department of Transportation and Public Facilities;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 25A-R765 by clicking the link below or browse more documents and templates provided by the Alaska Department of Transportation and Public Facilities.