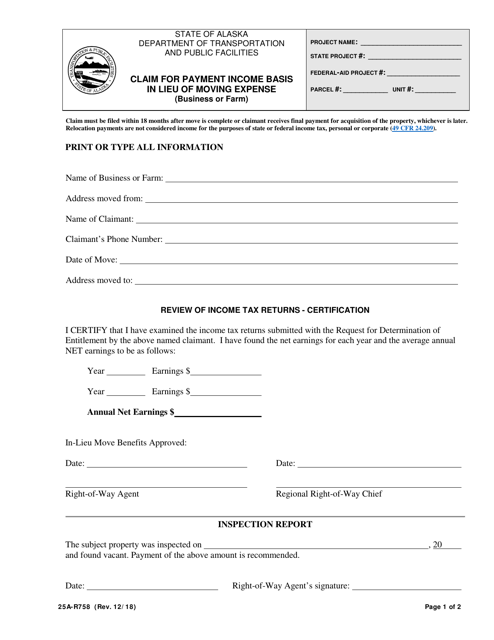

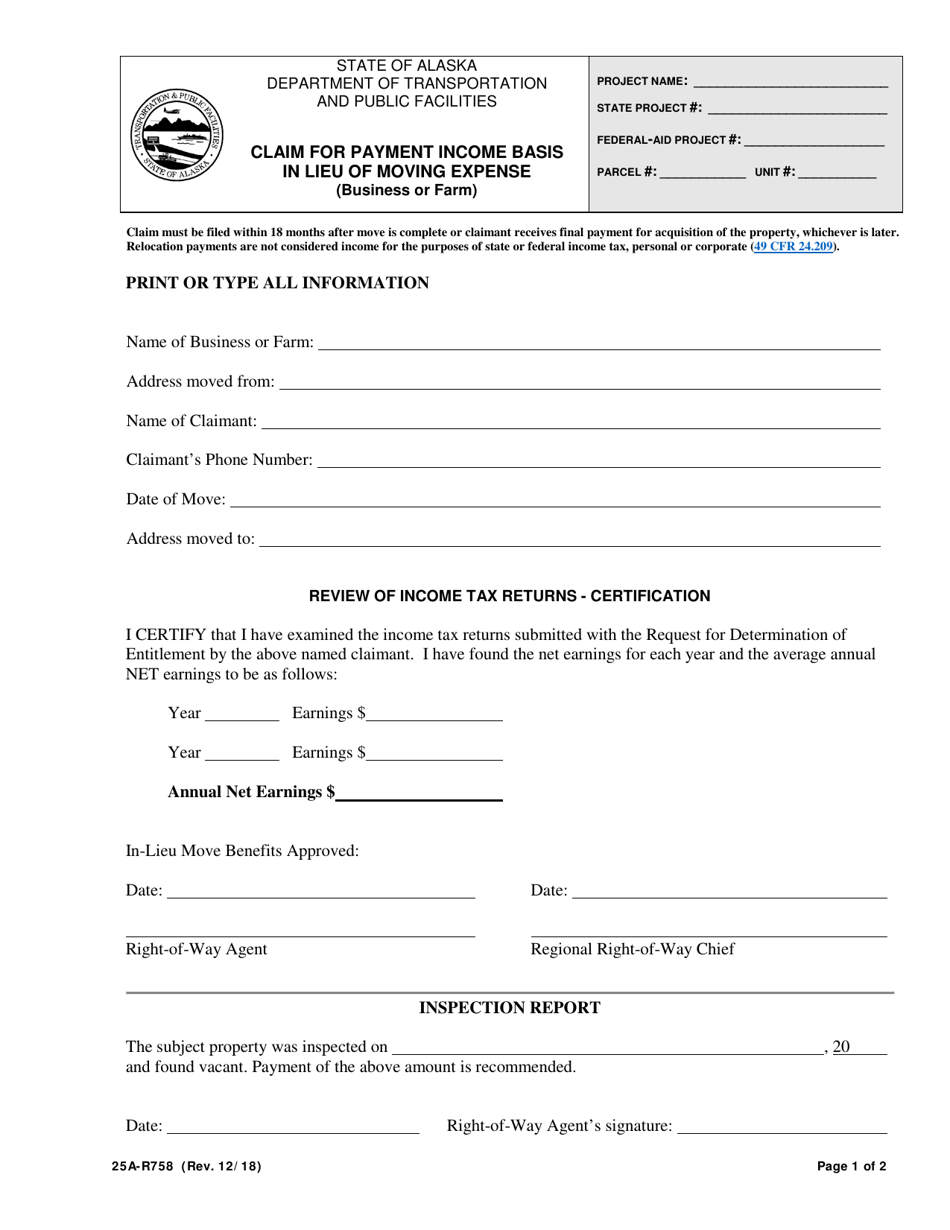

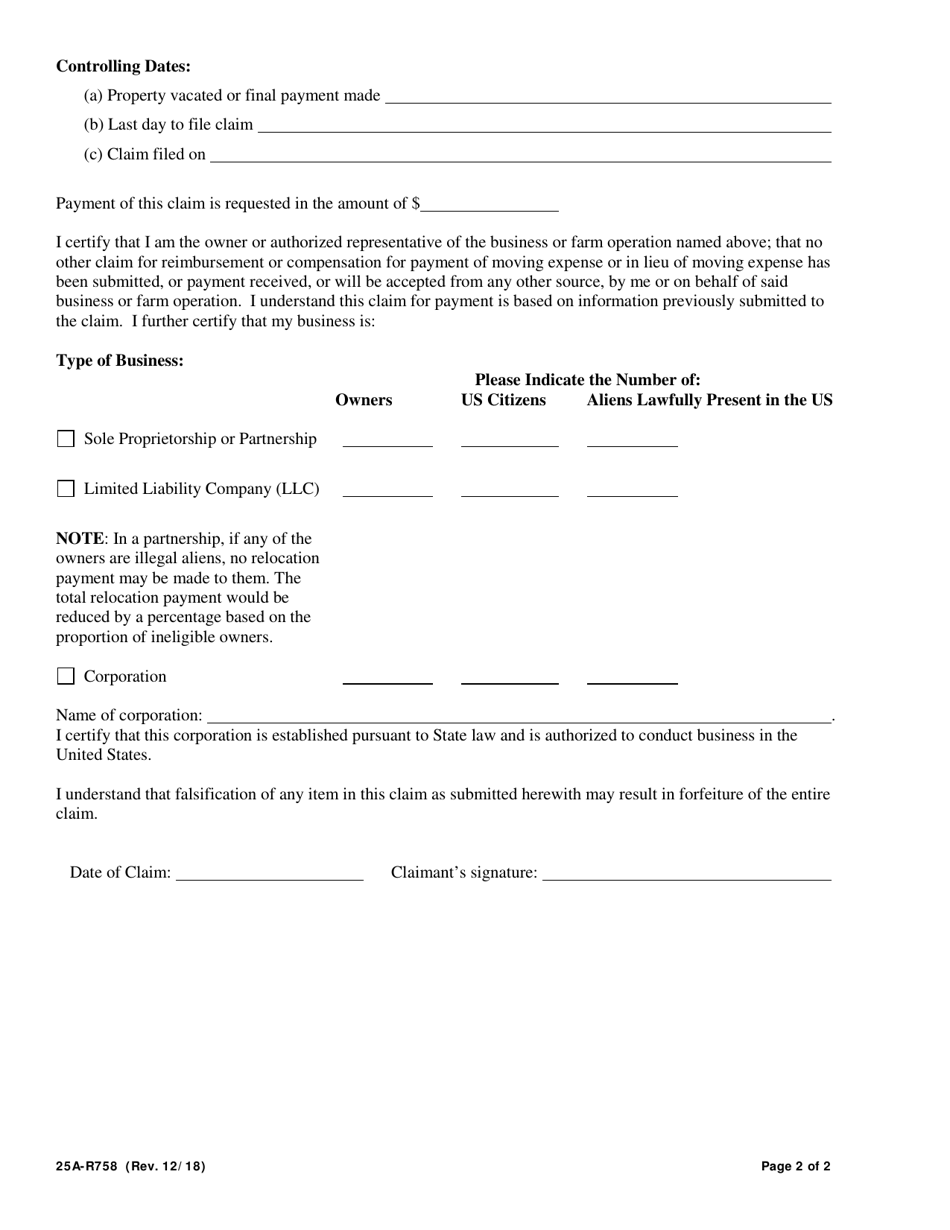

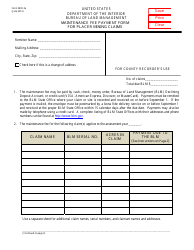

Form 25A-R758 Claim for Payment Income Basis in Lieu of Moving Expense (Business or Farm) - Alaska

What Is Form 25A-R758?

This is a legal form that was released by the Alaska Department of Transportation and Public Facilities - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 25A-R758?

A: Form 25A-R758 is a claim for payment income basis in lieu of moving expense for businesses or farms in Alaska.

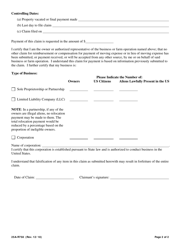

Q: Who can use Form 25A-R758?

A: Businesses or farms in Alaska can use Form 25A-R758.

Q: What is the purpose of Form 25A-R758?

A: The purpose of Form 25A-R758 is to claim payment based on income in lieu of moving expenses for businesses or farms.

Q: When should Form 25A-R758 be filed?

A: Form 25A-R758 should be filed within 60 days after the end of the calendar year in which the expenses were incurred.

Q: What supporting documents are required with Form 25A-R758?

A: Supporting documents such as receipts and proof of income must be included with Form 25A-R758.

Q: Can Form 25A-R758 be filed electronically?

A: No, Form 25A-R758 cannot be filed electronically and must be submitted by mail.

Q: Who should I contact for more information about Form 25A-R758?

A: For more information about Form 25A-R758, you can contact the Alaska Department of Revenue.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Alaska Department of Transportation and Public Facilities;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 25A-R758 by clicking the link below or browse more documents and templates provided by the Alaska Department of Transportation and Public Facilities.