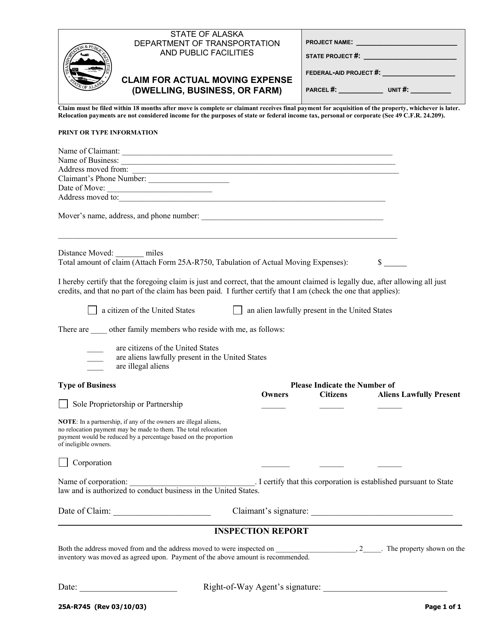

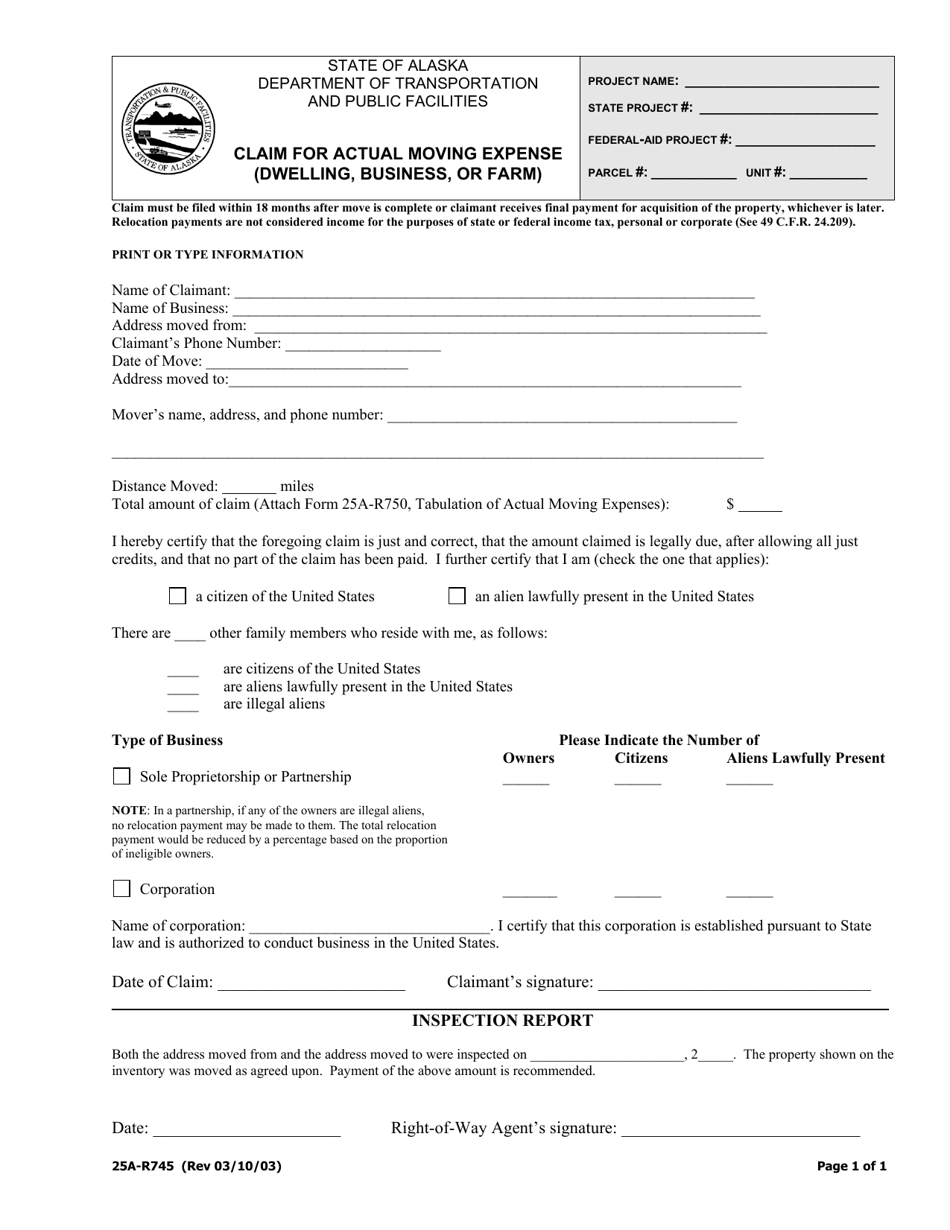

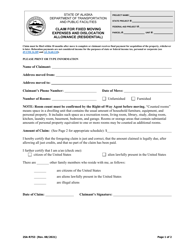

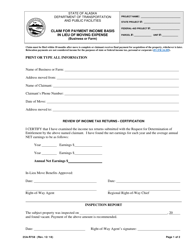

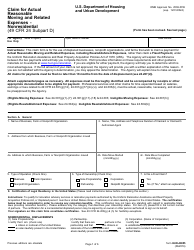

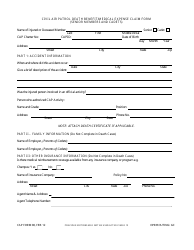

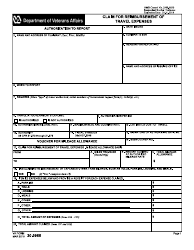

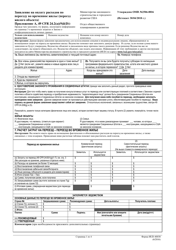

Form 25A-R745 Claim for Actual Moving Expense (Dwelling, Business, or Farm) - Alaska

What Is Form 25A-R745?

This is a legal form that was released by the Alaska Department of Transportation and Public Facilities - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

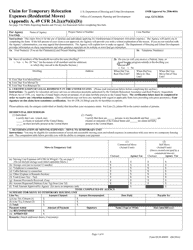

Q: What is Form 25A-R745?

A: Form 25A-R745 is a claim form for actual moving expenses in Alaska.

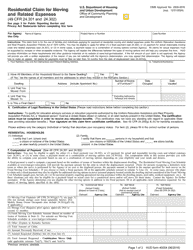

Q: Who can use Form 25A-R745?

A: Residents of Alaska who have incurred moving expenses for their dwelling, business, or farm can use this form.

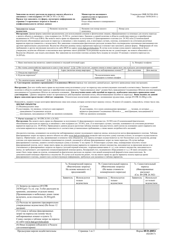

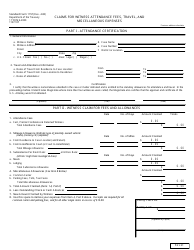

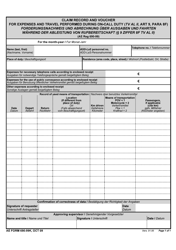

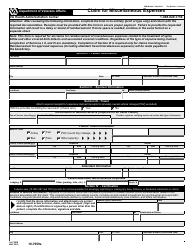

Q: What expenses can be claimed on Form 25A-R745?

A: You can claim actual moving expenses related to your dwelling, business, or farm.

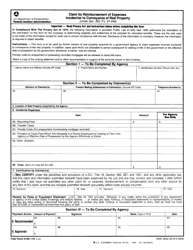

Q: What information is required on Form 25A-R745?

A: You will need to provide your personal information, details about your move, and documentation of your expenses.

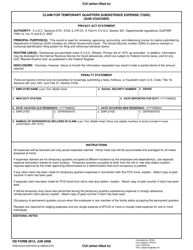

Q: Is there a deadline to submit Form 25A-R745?

A: Yes, you must submit the form within three years from the due date of your tax return for the year of the move.

Q: Are there any limitations on the expenses that can be claimed?

A: Yes, there are certain limitations and exclusions for specific types of expenses. Consult the instructions for Form 25A-R745 for more details.

Q: Can I claim moving expenses for a local move?

A: No, Form 25A-R745 is specifically for moving expenses related to a move within Alaska or from Alaska to another state.

Q: Is there a limit on the amount of expenses that can be claimed?

A: Yes, there is a maximum cap on the amount of expenses that can be claimed. Refer to the instructions for Form 25A-R745 for the current limit.

Form Details:

- Released on March 10, 2003;

- The latest edition provided by the Alaska Department of Transportation and Public Facilities;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 25A-R745 by clicking the link below or browse more documents and templates provided by the Alaska Department of Transportation and Public Facilities.