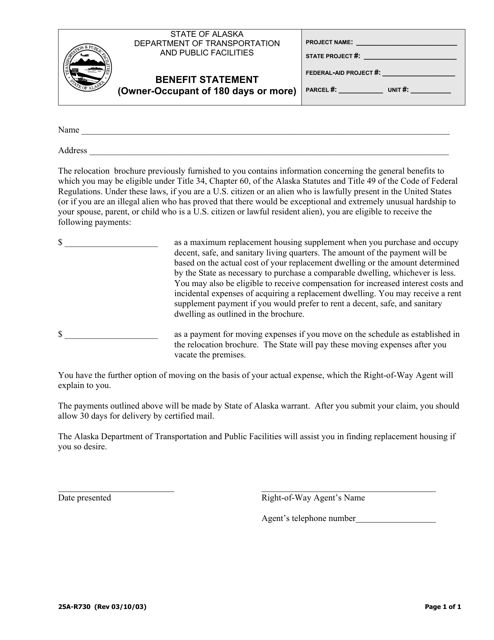

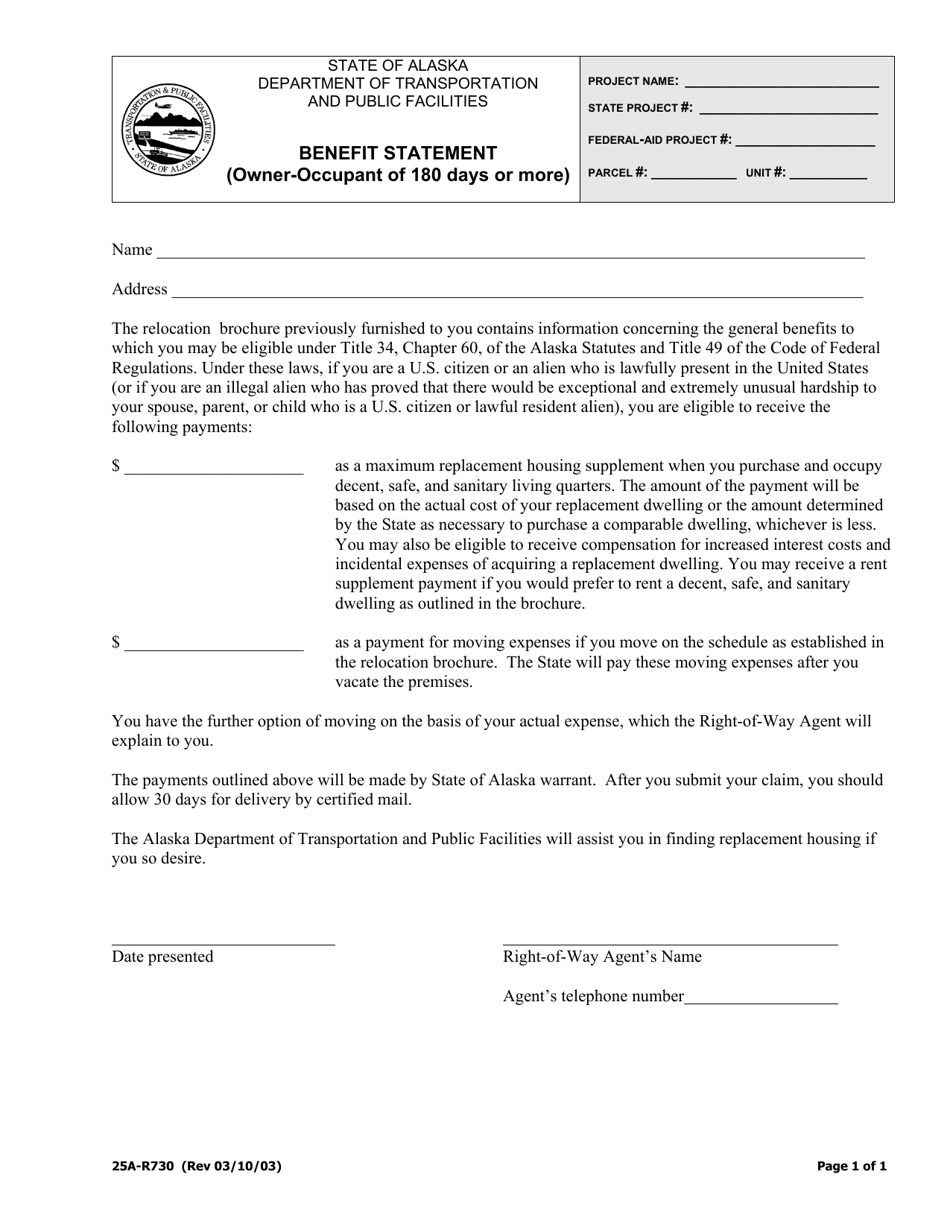

Form 25A-R730 Benefit Statement (Owner-Occupant of 180 Days or More) - Alaska

What Is Form 25A-R730?

This is a legal form that was released by the Alaska Department of Transportation and Public Facilities - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 25A-R730?

A: Form 25A-R730 is a Benefit Statement for Owner-Occupants of 180 Days or More in Alaska.

Q: Who is eligible to use Form 25A-R730?

A: Owner-occupants who have lived in their property for 180 days or more in Alaska are eligible to use Form 25A-R730.

Q: What is the purpose of Form 25A-R730?

A: Form 25A-R730 is used to report the value of your property and determine eligibility for certain benefits in Alaska.

Q: How do I fill out Form 25A-R730?

A: You will need to provide information about your property, including its value, and complete the required sections of the form.

Q: Are there any deadlines for submitting Form 25A-R730?

A: Yes, the form must be filed on or before March 31st of the year following the tax year for which the benefit is claimed.

Q: What happens after I submit Form 25A-R730?

A: The Alaska Department of Revenue will review your form and determine your eligibility for any benefits.

Form Details:

- Released on March 10, 2003;

- The latest edition provided by the Alaska Department of Transportation and Public Facilities;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 25A-R730 by clicking the link below or browse more documents and templates provided by the Alaska Department of Transportation and Public Facilities.