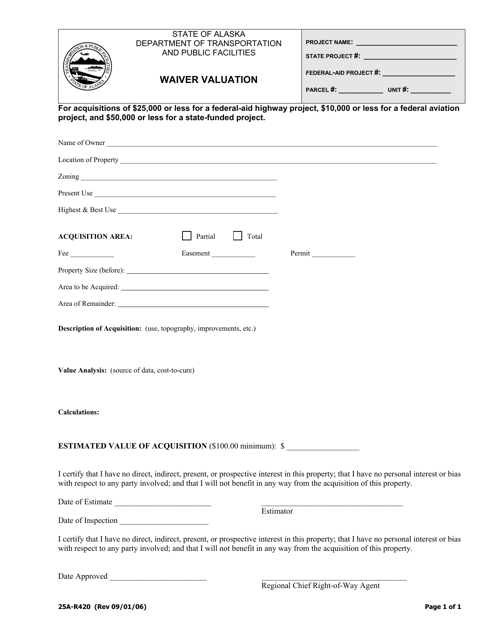

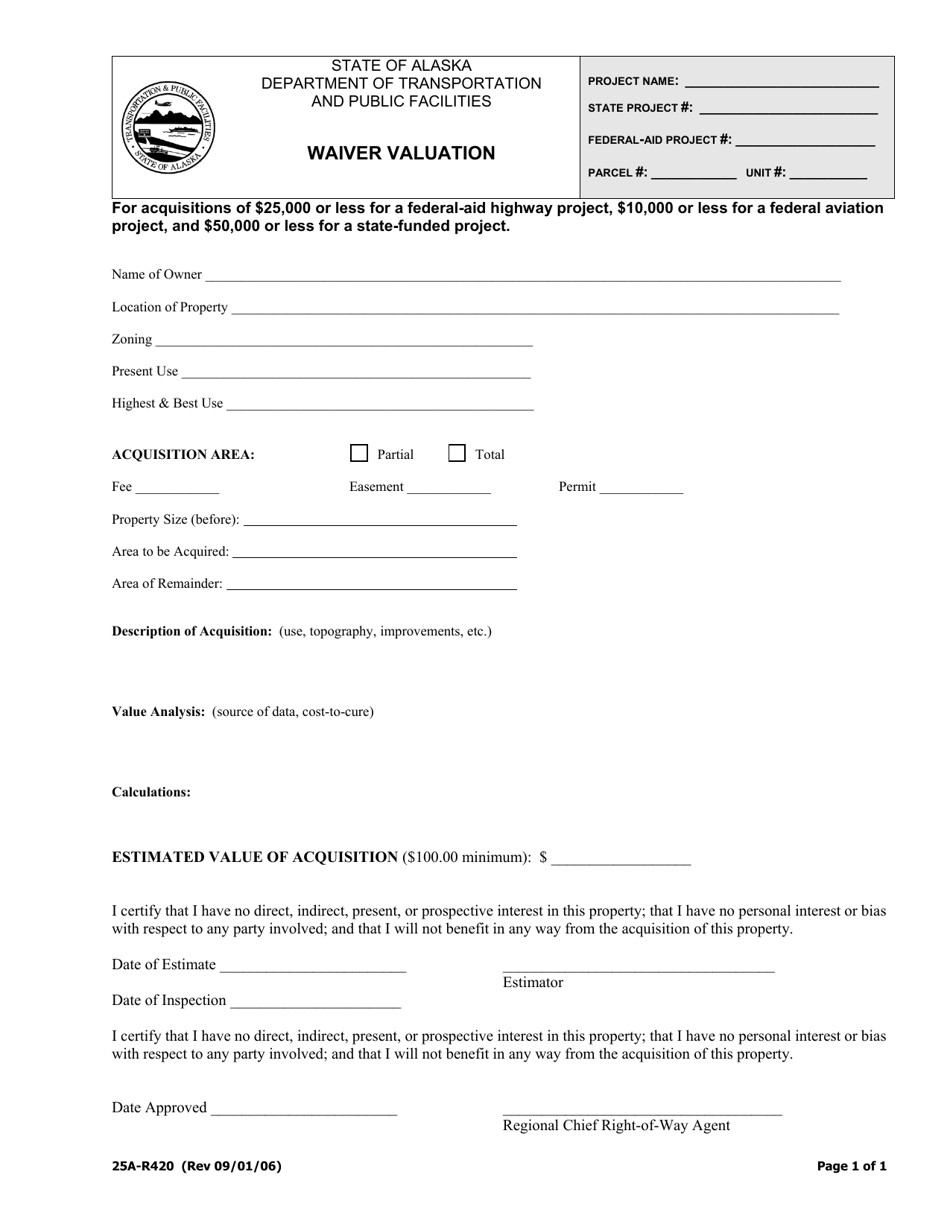

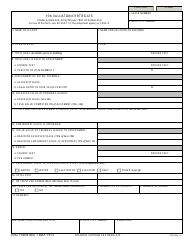

Form 25A-R420 Waiver Valuation - Alaska

What Is Form 25A-R420?

This is a legal form that was released by the Alaska Department of Transportation and Public Facilities - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

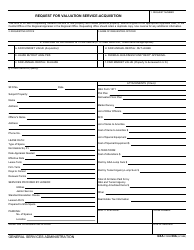

Q: What is a Form 25A-R420 Waiver Valuation?

A: The Form 25A-R420 Waiver Valuation is a document used in Alaska to request a waiver of valuation for certain types of property.

Q: What does the waiver valuation cover?

A: The waiver valuation covers property that is subject to a claim for exemption or deferral.

Q: Who can request a waiver valuation?

A: Property owners in Alaska who meet the requirements for exemption or deferral can request a waiver valuation.

Q: What is the purpose of the waiver valuation?

A: The purpose of the waiver valuation is to determine the value of eligible property for exemption or deferral purposes.

Q: How do I submit a Form 25A-R420 Waiver Valuation?

A: The completed form should be submitted to the Alaska Department of Revenue, Property Tax Division.

Q: Are there any fees associated with the waiver valuation?

A: There may be a fee for the waiver valuation, depending on the type and value of the property.

Q: What happens after submitting the waiver valuation?

A: The Alaska Department of Revenue will review the request and determine the final value of the property for exemption or deferral purposes.

Q: How long does it take to process a waiver valuation request?

A: The processing time can vary, but it typically takes a few weeks to receive a decision on the waiver valuation request.

Form Details:

- Released on September 1, 2006;

- The latest edition provided by the Alaska Department of Transportation and Public Facilities;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 25A-R420 by clicking the link below or browse more documents and templates provided by the Alaska Department of Transportation and Public Facilities.