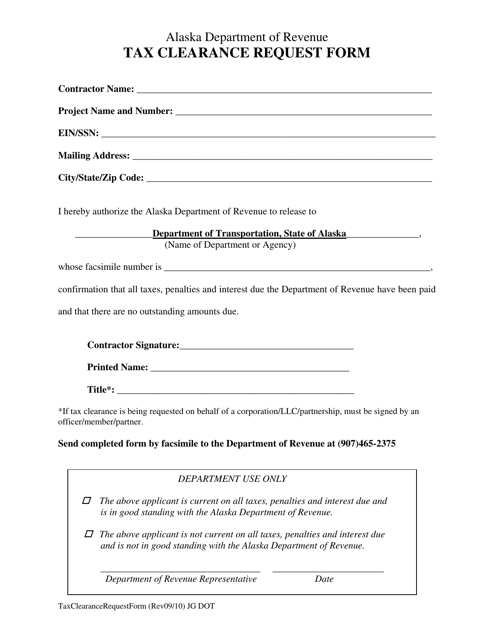

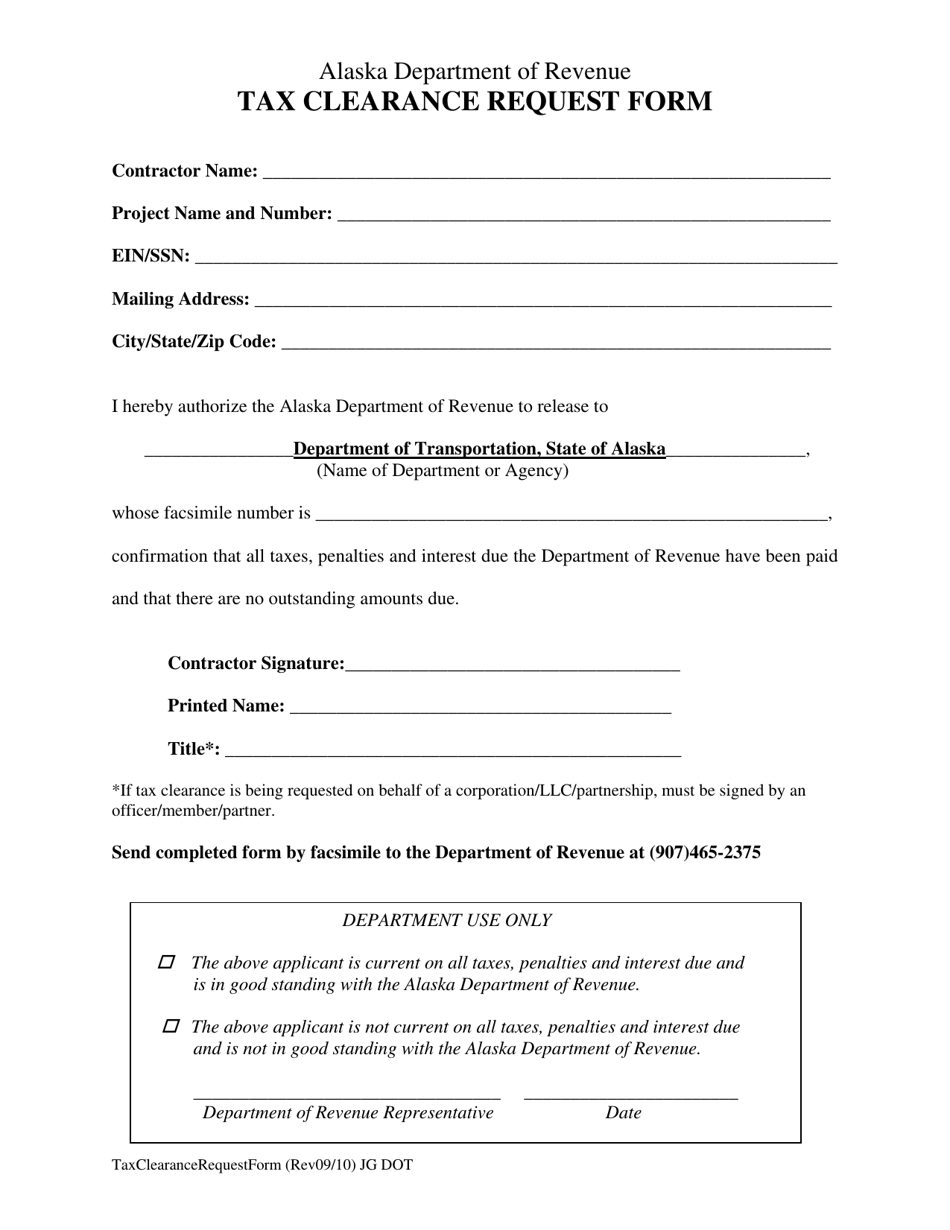

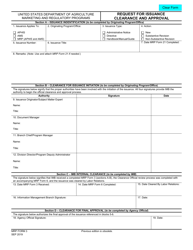

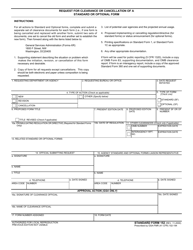

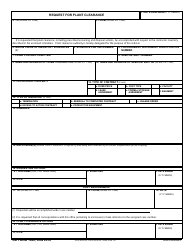

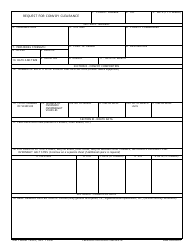

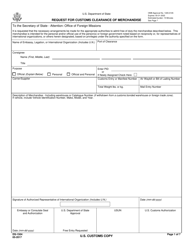

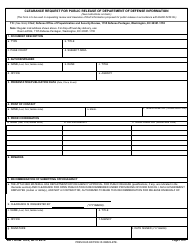

Tax Clearance Request Form - Alaska

Tax Clearance Request Form is a legal document that was released by the Alaska Department of Transportation and Public Facilities - a government authority operating within Alaska.

FAQ

Q: How do I obtain a tax clearance request form in Alaska?

A: You can obtain a tax clearance request form in Alaska by contacting the Alaska Department of Revenue.

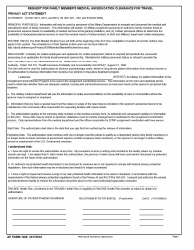

Q: What is a tax clearance request form?

A: A tax clearance request form is a document used to request verification of tax compliance from the state.

Q: Why would I need a tax clearance?

A: You may need a tax clearance if you are selling a business, transferring ownership, or applying for certain licenses or permits.

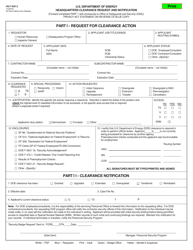

Q: How can I submit my tax clearance request form?

A: You can submit your tax clearance request form by mail or electronically, depending on the instructions provided by the Alaska Department of Revenue.

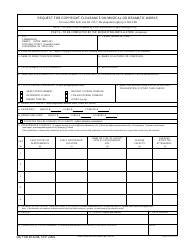

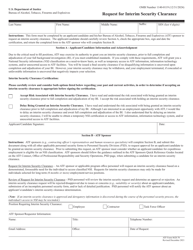

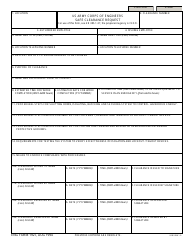

Q: What information do I need to provide on the tax clearance request form?

A: You will likely need to provide your business information, such as your name, address, and tax identification number.

Q: How long does it take to process a tax clearance request?

A: The processing time for a tax clearance request can vary, but it is typically a few weeks. It is best to submit your request well in advance of any deadlines.

Q: Is there a fee for obtaining a tax clearance?

A: There may be a fee associated with obtaining a tax clearance. You should check with the Alaska Department of Revenue for the current fee schedule.

Q: Can I check the status of my tax clearance request?

A: Yes, you can typically check the status of your tax clearance request by contacting the Alaska Department of Revenue.

Q: What do I do if my tax clearance request is denied?

A: If your tax clearance request is denied, you should contact the Alaska Department of Revenue for guidance on how to resolve the issue.

Form Details:

- Released on September 1, 2010;

- The latest edition currently provided by the Alaska Department of Transportation and Public Facilities;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Alaska Department of Transportation and Public Facilities.