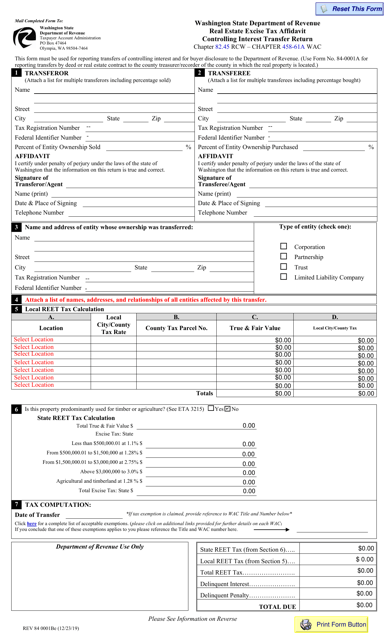

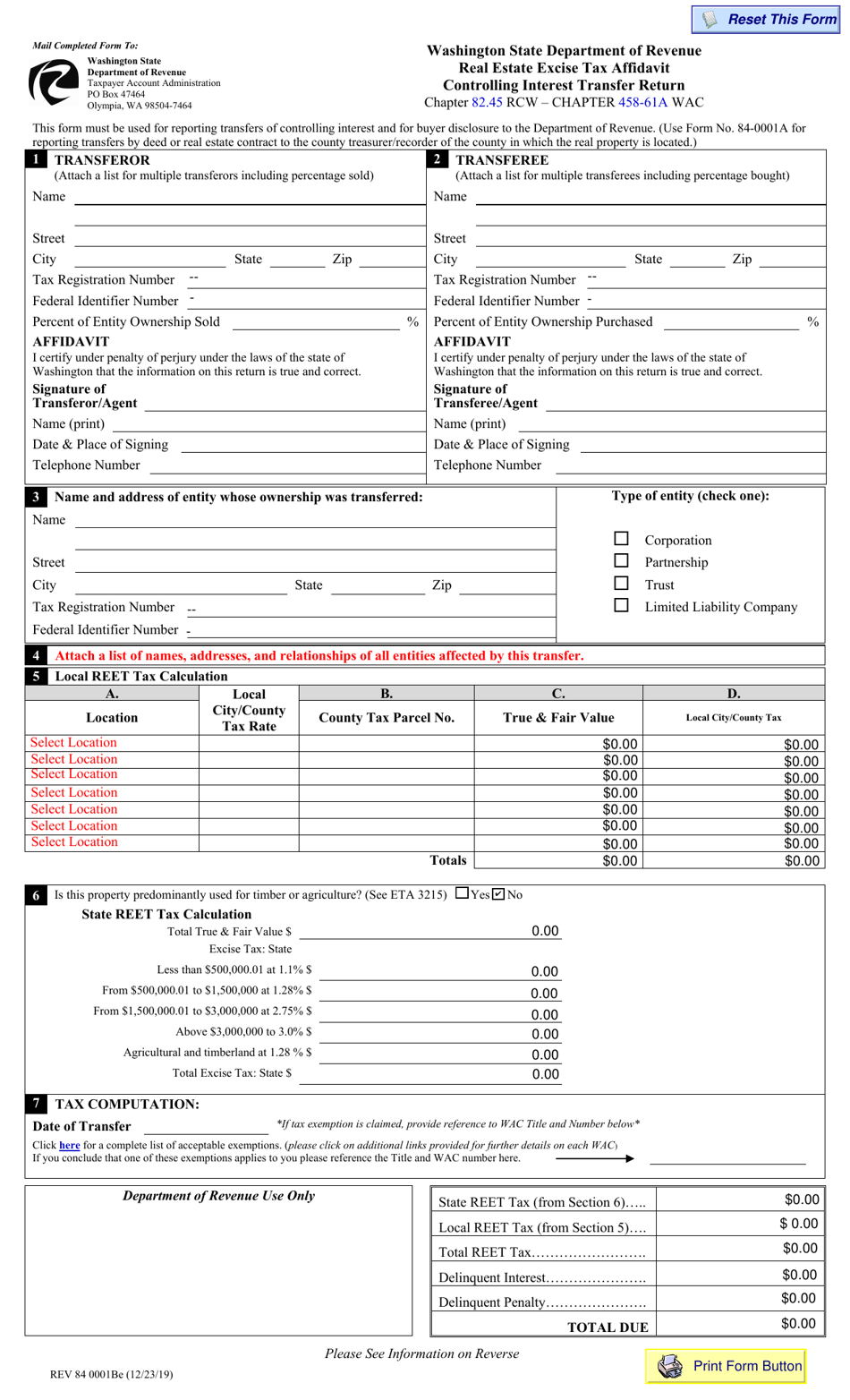

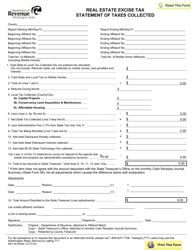

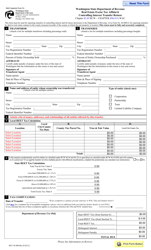

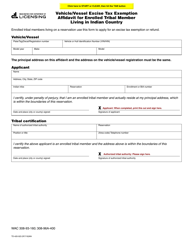

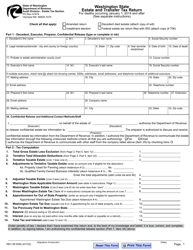

Form REV84 0001B Real Estate Excise Tax Affidavit - Controlling Interest Transfer Return - Washington

What Is Form REV84 0001B?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

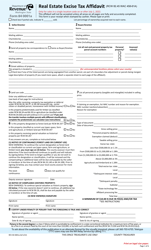

Q: What is Form REV84 0001B?

A: Form REV84 0001B is the Real Estate Excise Tax Affidavit - Controlling Interest Transfer Return in the state of Washington.

Q: What is the purpose of Form REV84 0001B?

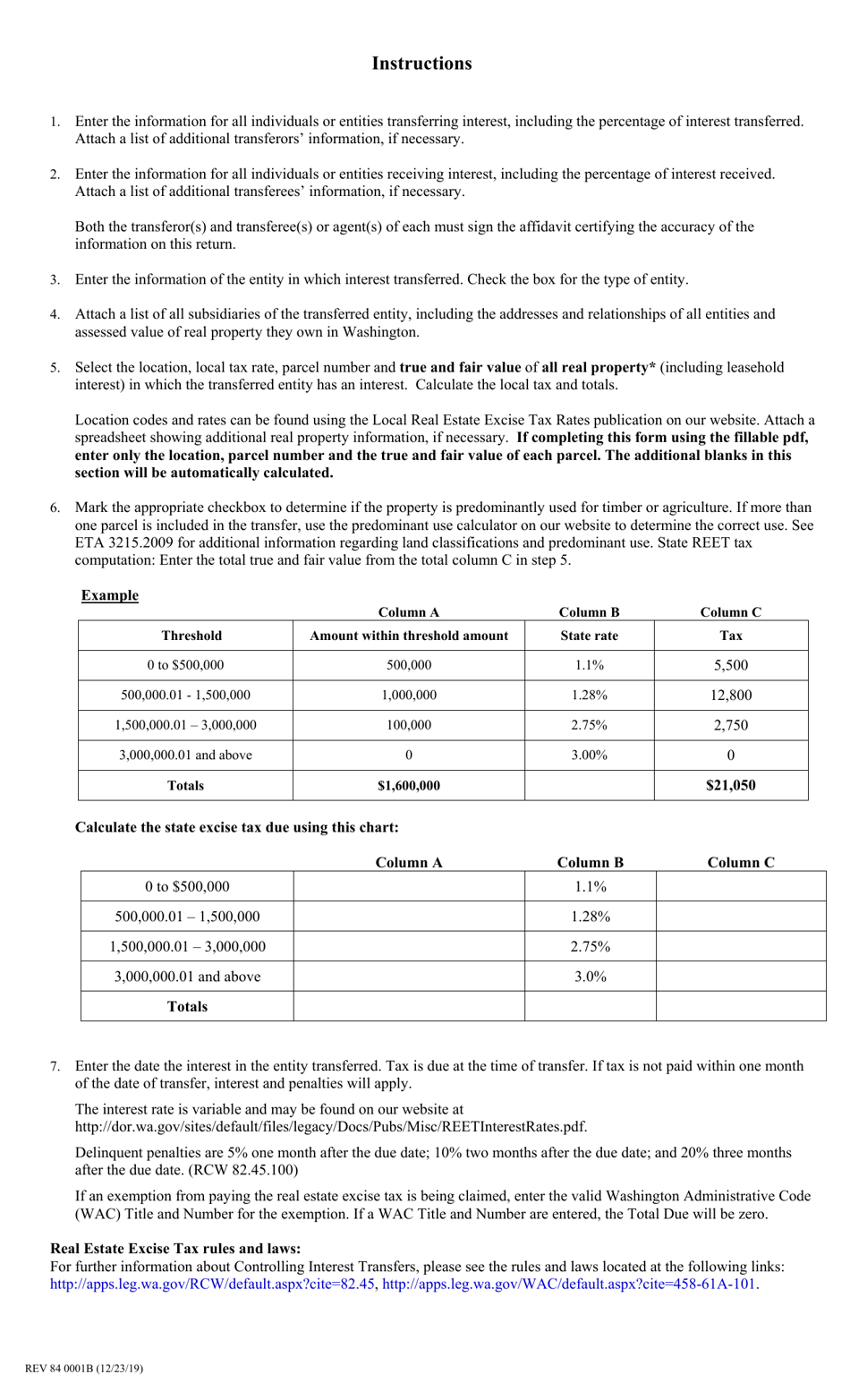

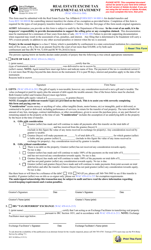

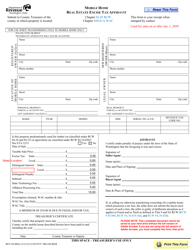

A: The purpose of Form REV84 0001B is to report and pay the real estate excise tax when there is a transfer of controlling interest in real property in Washington.

Q: What is a controlling interest transfer?

A: A controlling interest transfer refers to the transfer of controlling interest in an entity that holds title to real property.

Q: Who needs to fill out Form REV84 0001B?

A: Anyone who is involved in a controlling interest transfer of real property in Washington needs to fill out Form REV84 0001B.

Q: What information is required on Form REV84 0001B?

A: Form REV84 0001B requires information such as the names and addresses of the transferor and transferee, description of the property, and the purchase price.

Q: How and when should Form REV84 0001B be filed?

A: Form REV84 0001B should be filed with the county treasurer within 30 days of the transfer of controlling interest in the property.

Q: Is there a fee for filing Form REV84 0001B?

A: Yes, there is a real estate excise tax fee associated with filing Form REV84 0001B. The fee is based on the value of the controlling interest transferred.

Form Details:

- Released on December 23, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV84 0001B by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.