This version of the form is not currently in use and is provided for reference only. Download this version of

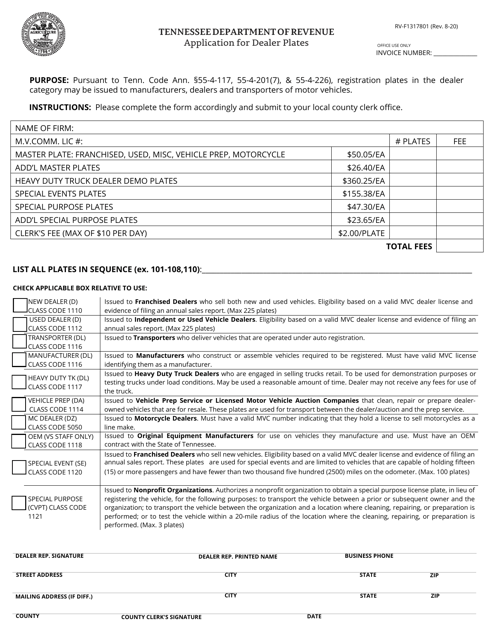

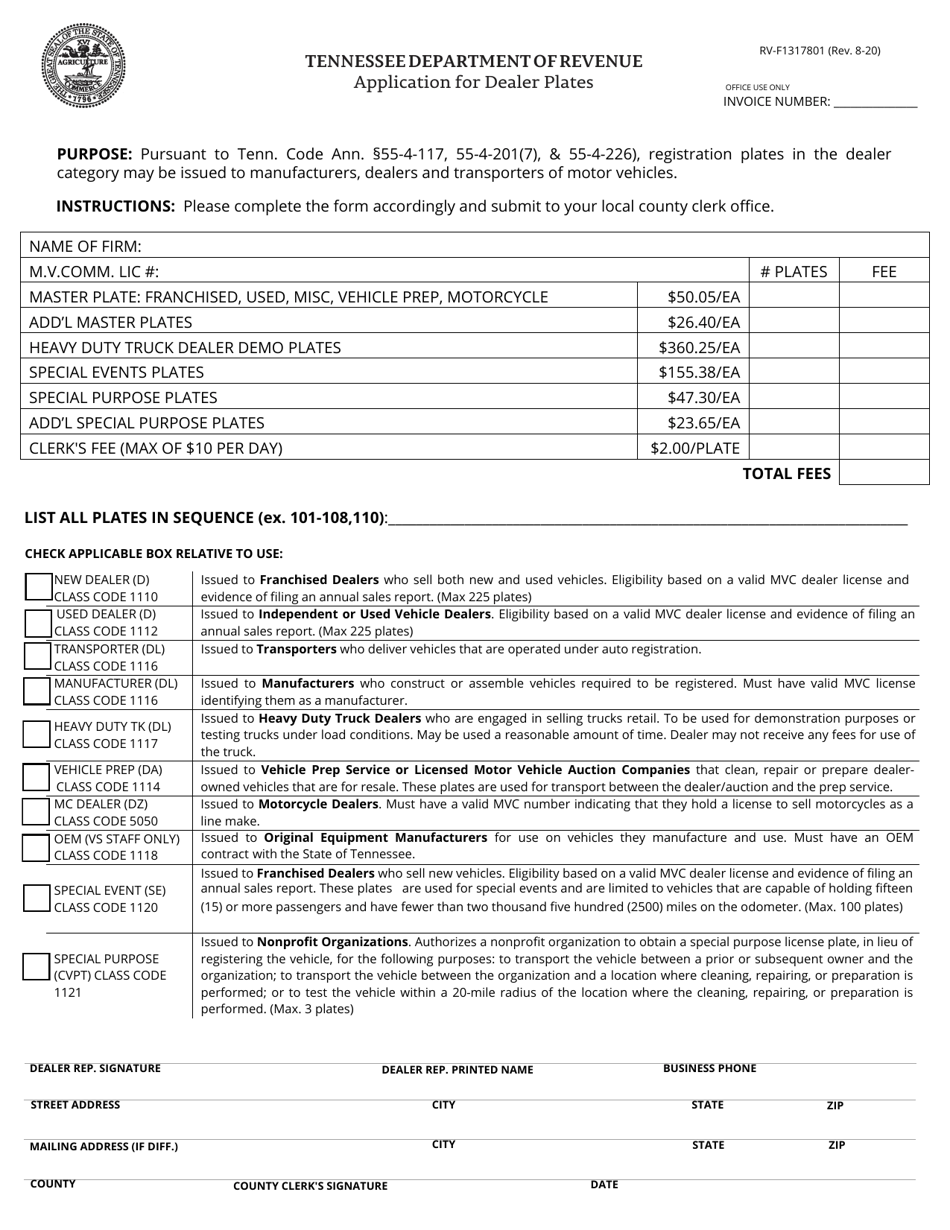

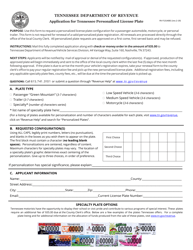

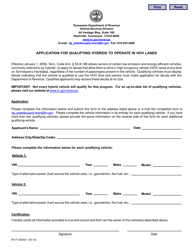

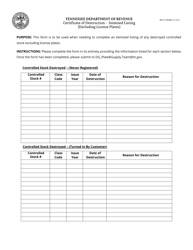

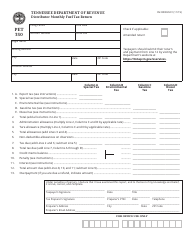

Form RV-F1317801

for the current year.

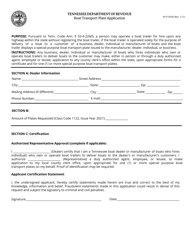

Form RV-F1317801 Application for Dealer Plates - Tennessee

What Is Form RV-F1317801?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form RV-F1317801?

A: Form RV-F1317801 is the application for dealer plates in Tennessee.

Q: Who can use form RV-F1317801?

A: Form RV-F1317801 is intended for dealers who want to apply for dealer plates in Tennessee.

Q: What do I need to include with form RV-F1317801?

A: You will need to provide the required documentation, such as proof of business and liability insurance, along with the completed form RV-F1317801.

Q: How long does it take to process the application for dealer plates in Tennessee?

A: The processing time for the application can vary, so it is best to contact your local county clerk's office for more information.

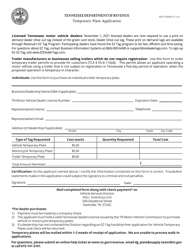

Q: Can I transfer my dealer plates from another state to Tennessee?

A: Yes, you can transfer your dealer plates from another state to Tennessee, but you will need to follow the specific steps outlined by the Tennessee Department of Revenue.

Q: What are the benefits of having dealer plates?

A: Having dealer plates allows you to operate vehicles for sale or lease, including test drives and transportation, without having to register each vehicle individually.

Q: Are dealer plates valid for personal use?

A: No, dealer plates are only valid for use on vehicles that are being held for sale or lease by a licensed dealer.

Q: How long are dealer plates valid for?

A: Dealer plates in Tennessee are typically valid for one year, and you will need to renew them annually.

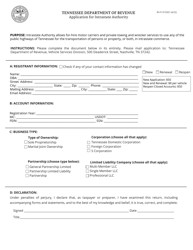

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RV-F1317801 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.