This version of the form is not currently in use and is provided for reference only. Download this version of

Form MJ20-8092

for the current year.

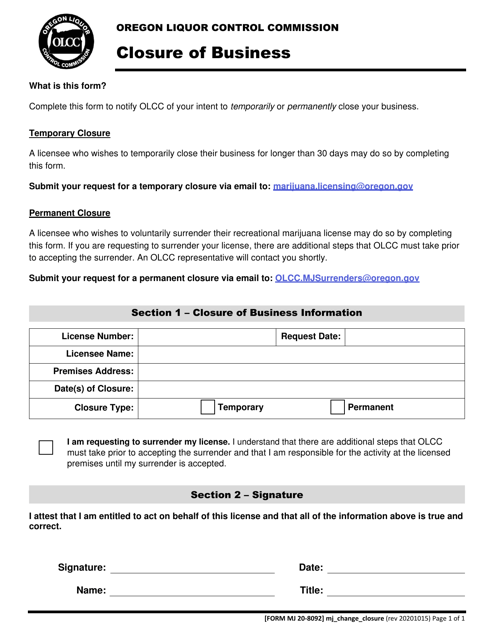

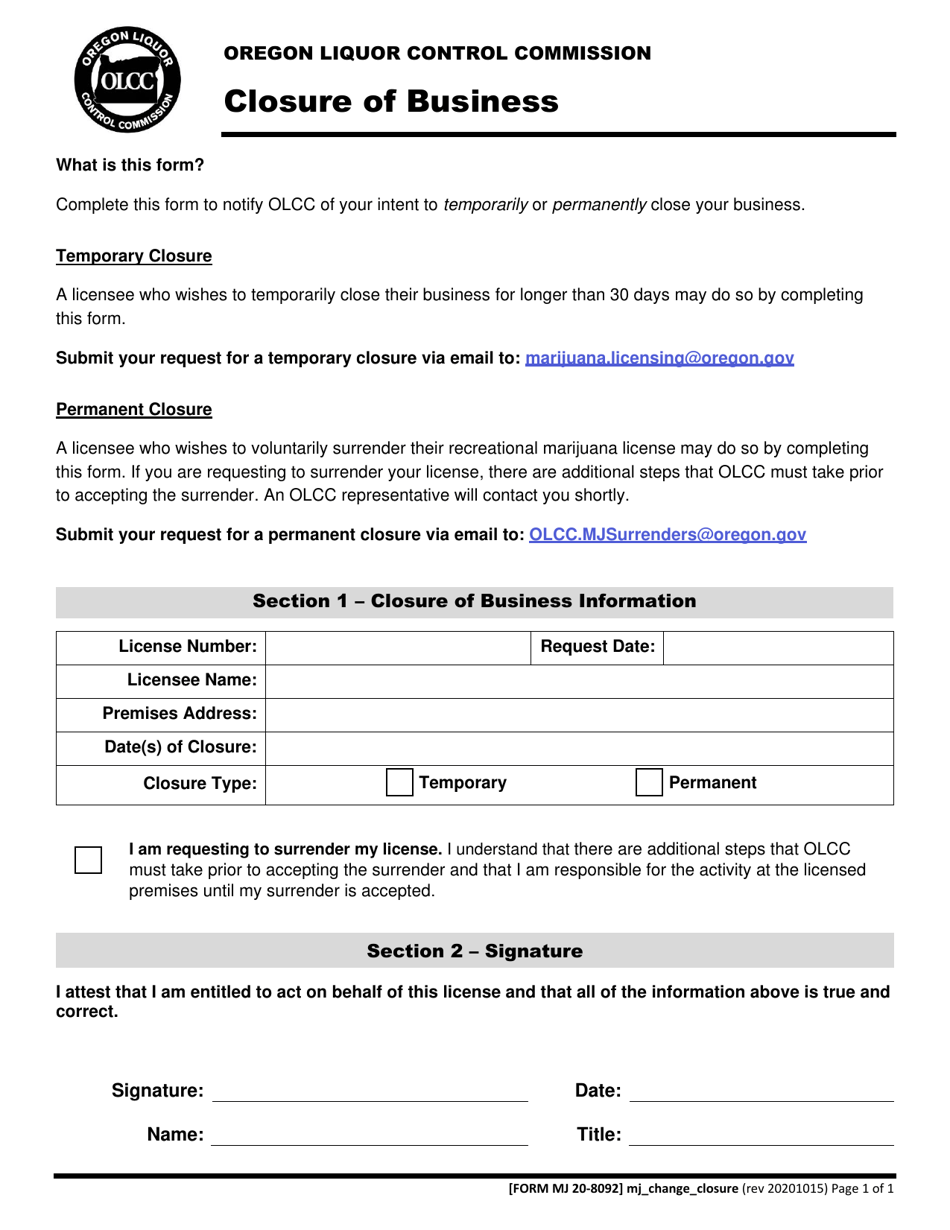

Form MJ20-8092 Closure of Business - Oregon

What Is Form MJ20-8092?

This is a legal form that was released by the Oregon Liquor and Cannabis Commission - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form MJ20-8092?

A: Form MJ20-8092 is a closure of business form for Oregon.

Q: What does the form MJ20-8092 entail?

A: The form MJ20-8092 is used to officially close a business in Oregon.

Q: Who is required to fill out form MJ20-8092?

A: Business owners who are closing their business in Oregon are required to fill out form MJ20-8092.

Q: Are there any fees associated with filing form MJ20-8092?

A: No, there are no fees associated with filing form MJ20-8092.

Q: What information is required on form MJ20-8092?

A: Form MJ20-8092 requires information about the business, including the date of closure, final gross sales, and any outstanding taxes or liabilities.

Q: What should I do with form MJ20-8092 once it is filled out?

A: After filling out form MJ20-8092, you should submit it to the Oregon Department of Revenue.

Q: Is there a deadline for submitting form MJ20-8092?

A: Yes, form MJ20-8092 should be submitted within 30 days of closing the business.

Q: What happens after I submit form MJ20-8092?

A: Once form MJ20-8092 is submitted, the Oregon Department of Revenue will process the closure and update the business records accordingly.

Form Details:

- Released on October 15, 2020;

- The latest edition provided by the Oregon Liquor and Cannabis Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MJ20-8092 by clicking the link below or browse more documents and templates provided by the Oregon Liquor and Cannabis Commission.