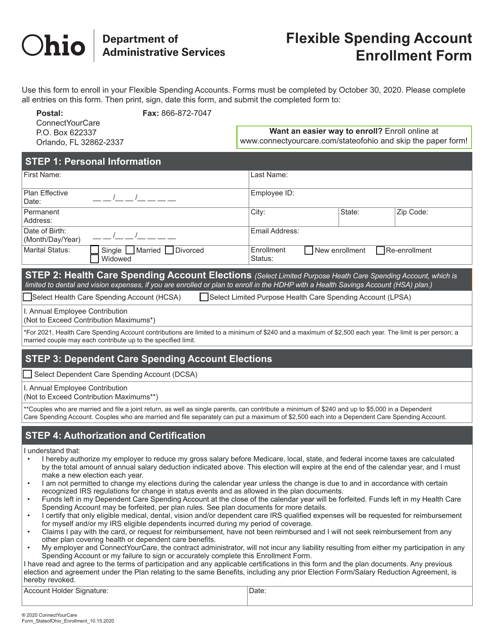

Flexible Spending Account Enrollment Form - Ohio

Flexible Spending Account Enrollment Form is a legal document that was released by the Ohio Department of Administrative Services - a government authority operating within Ohio.

FAQ

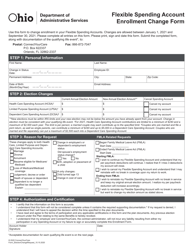

Q: What is a Flexible Spending Account?

A: A Flexible Spending Account (FSA) is an employer-sponsored benefit that allows employees to set aside pre-tax dollars to pay for qualified medical expenses.

Q: How does a Flexible Spending Account work?

A: Money is deducted from your paycheck before taxes and placed into your FSA. You can use the funds in your FSA to pay for eligible medical expenses throughout the year.

Q: What expenses can be paid with a Flexible Spending Account?

A: Qualified medical expenses such as doctor visits, prescription medications, and certain medical supplies can be paid with funds from a Flexible Spending Account.

Q: Can I use FSA funds for over-the-counter medications?

A: As of 2020, you can only use FSA funds for over-the-counter medications with a prescription.

Q: What happens if I don't use all the funds in my FSA?

A: Any money left in your FSA at the end of the plan year is typically forfeited, so it's important to estimate your expenses carefully.

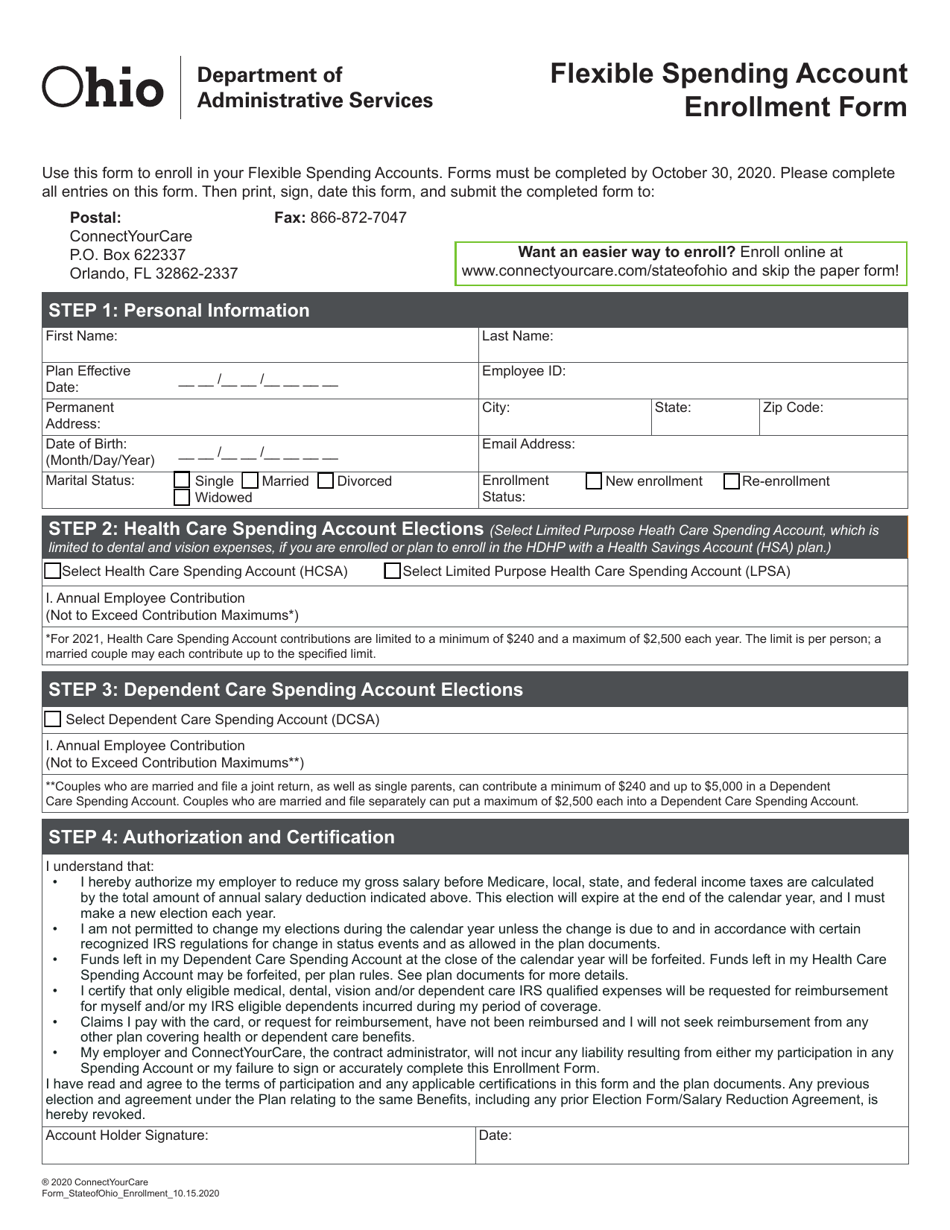

Q: Can I change my FSA contribution amount during the year?

A: In most cases, you can only make changes to your FSA contribution amount during your company's open enrollment period or if you experience a qualifying life event.

Form Details:

- Released on October 15, 2020;

- The latest edition currently provided by the Ohio Department of Administrative Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Department of Administrative Services.