This version of the form is not currently in use and is provided for reference only. Download this version of

Form E-536R

for the current year.

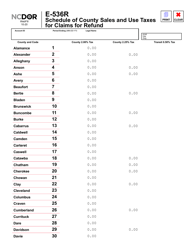

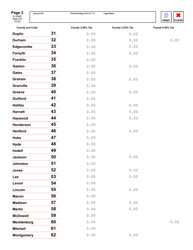

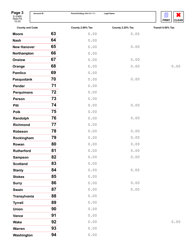

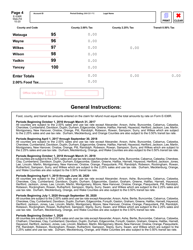

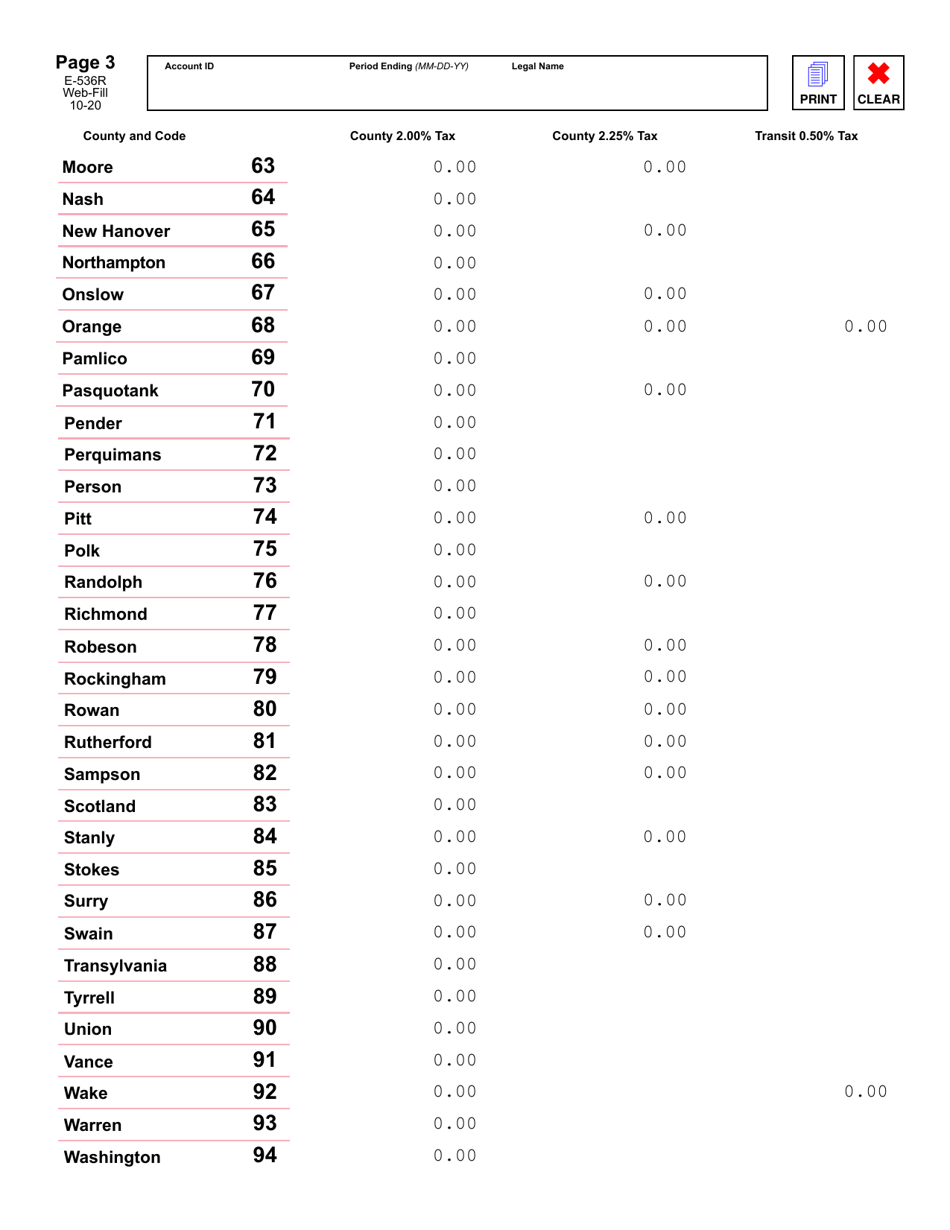

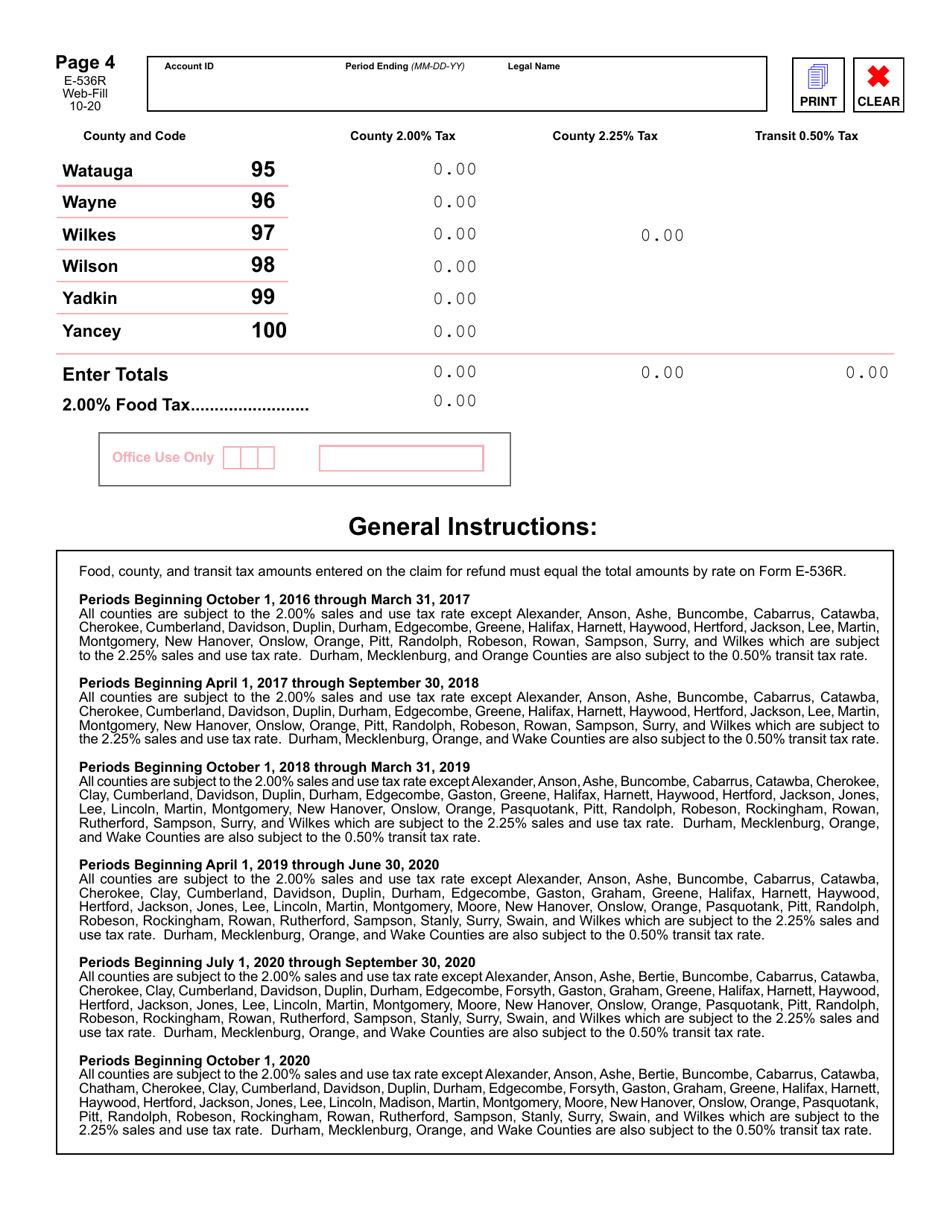

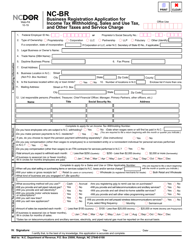

Form E-536R Schedule of County Sales and Use Taxes for Claims for Refund - North Carolina

What Is Form E-536R?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-536R?

A: Form E-536R is a schedule used in North Carolina to report county sales and use taxes for claims for refund.

Q: What is the purpose of Form E-536R?

A: The purpose of Form E-536R is to report and claim a refund for overpaid county sales and use taxes in North Carolina.

Q: Who needs to file Form E-536R?

A: Anyone who has overpaid county sales and use taxes in North Carolina and wants to claim a refund needs to file Form E-536R.

Q: When is the deadline for filing Form E-536R?

A: The deadline for filing Form E-536R is determined by the North Carolina Department of Revenue and may vary.

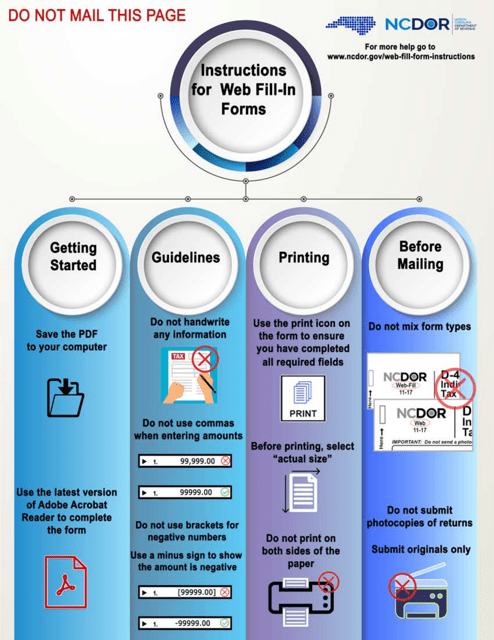

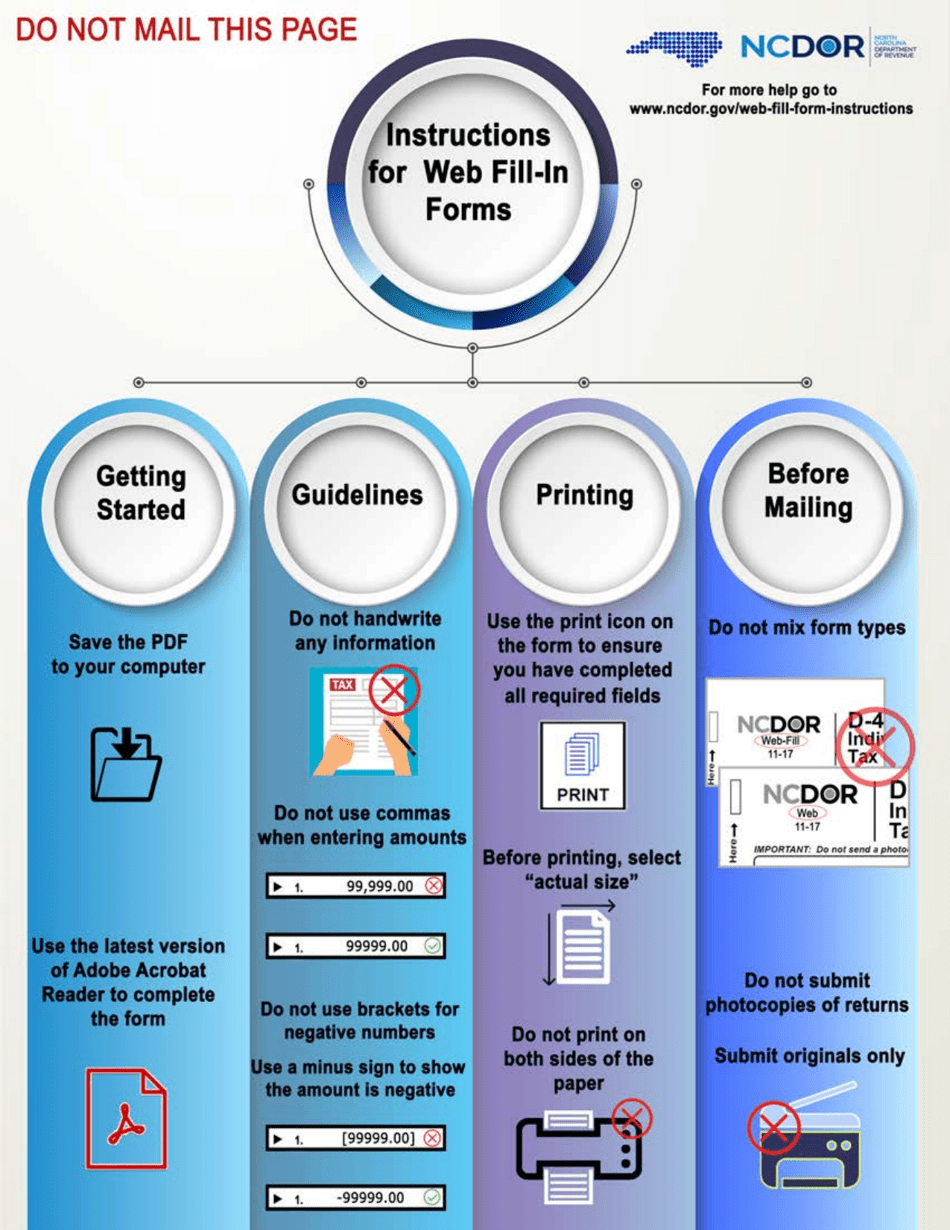

Q: Are there any specific instructions for completing Form E-536R?

A: Yes, the North Carolina Department of Revenue provides instructions for completing Form E-536R that should be followed carefully.

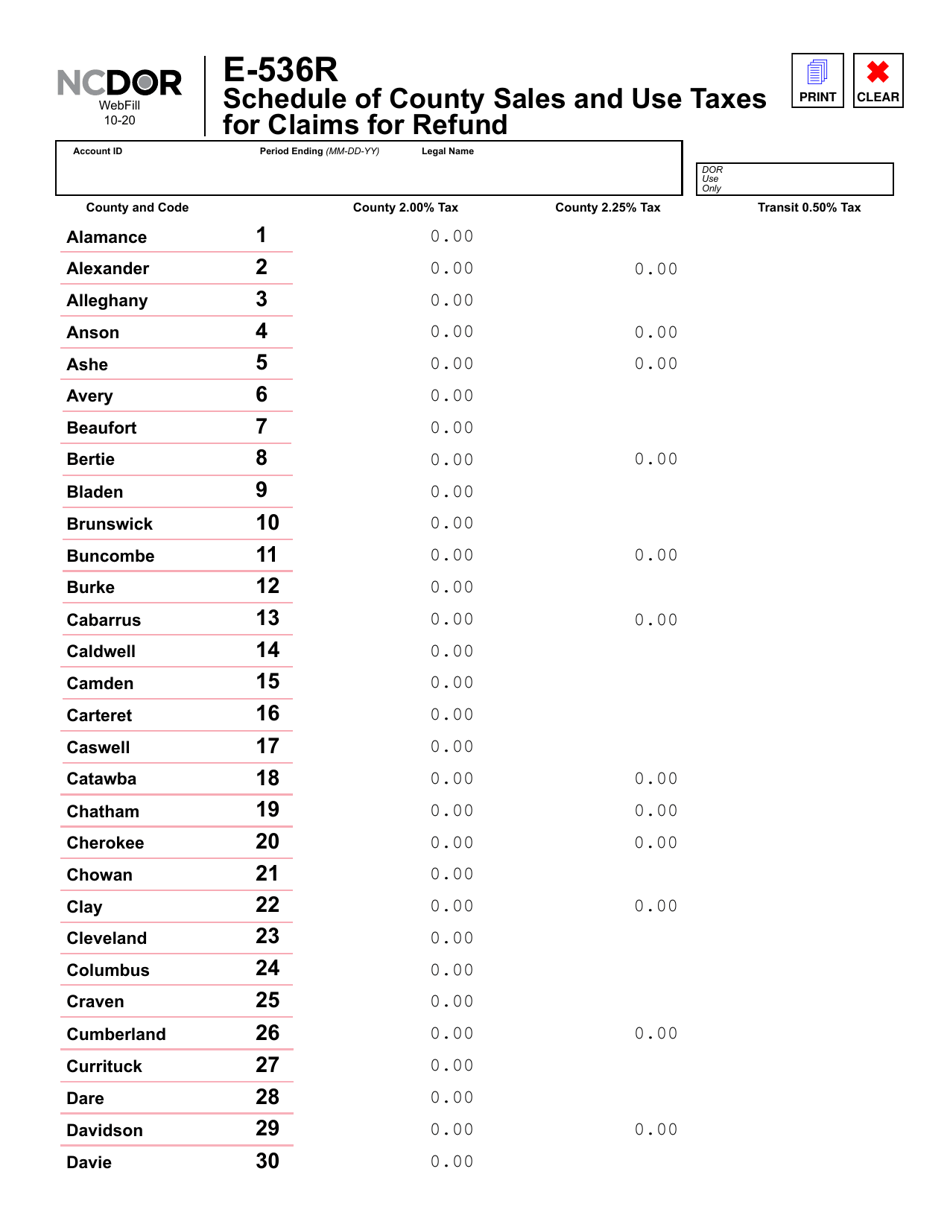

Q: Can I claim a refund for county sales and use taxes paid in multiple counties?

A: Yes, Form E-536R allows you to report and claim a refund for county sales and use taxes paid in multiple counties in North Carolina.

Q: What supporting documents should be included with Form E-536R?

A: You may be required to include supporting documents such as payment receipts, invoices, and other relevant records with Form E-536R.

Q: How long does it take to receive a refund after filing Form E-536R?

A: The processing time for refunds claimed on Form E-536R may vary, and it is best to contact the North Carolina Department of Revenue for more information.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-536R by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.