This version of the form is not currently in use and is provided for reference only. Download this version of

Form E-536

for the current year.

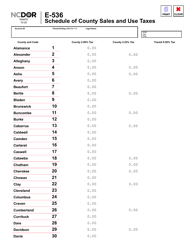

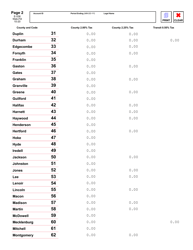

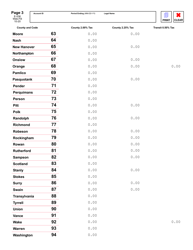

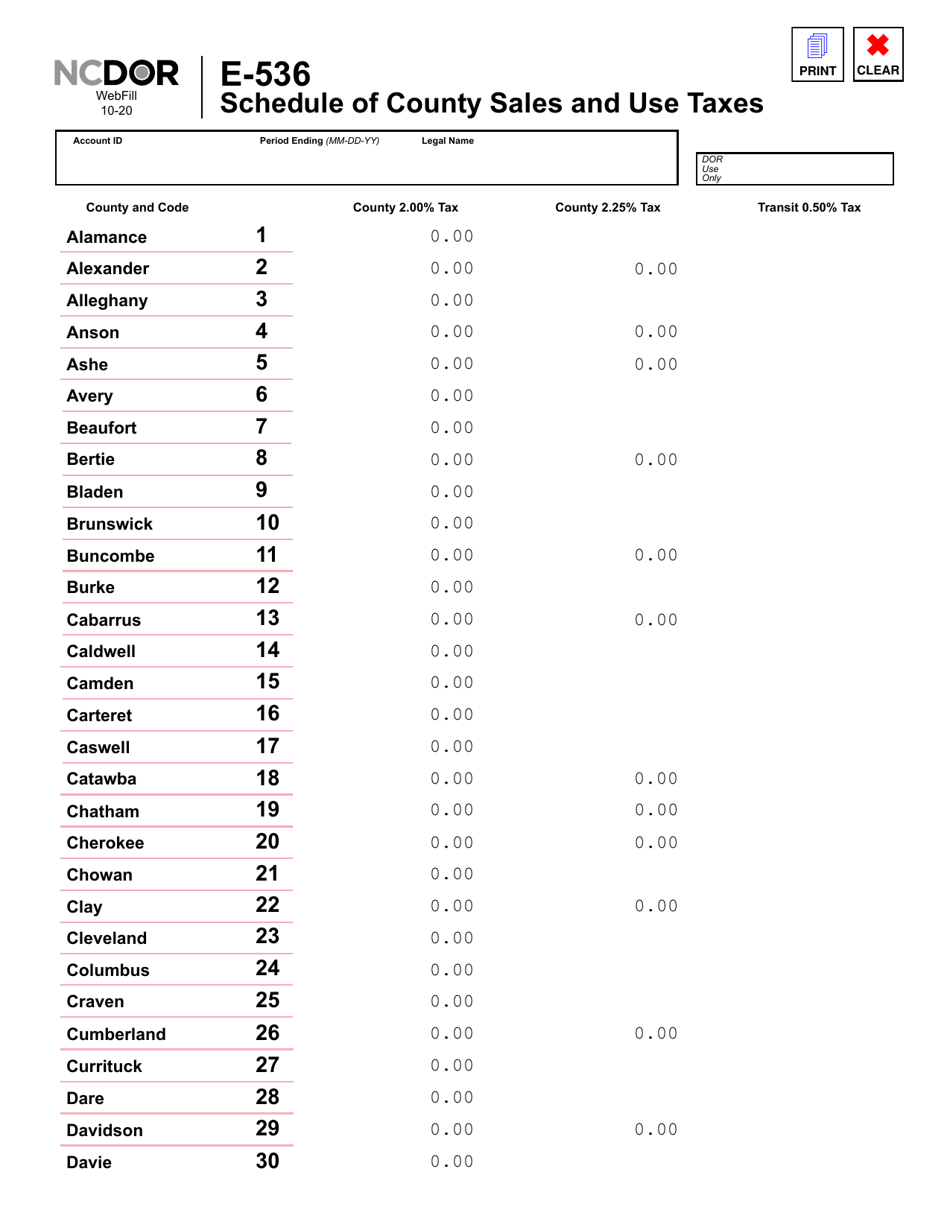

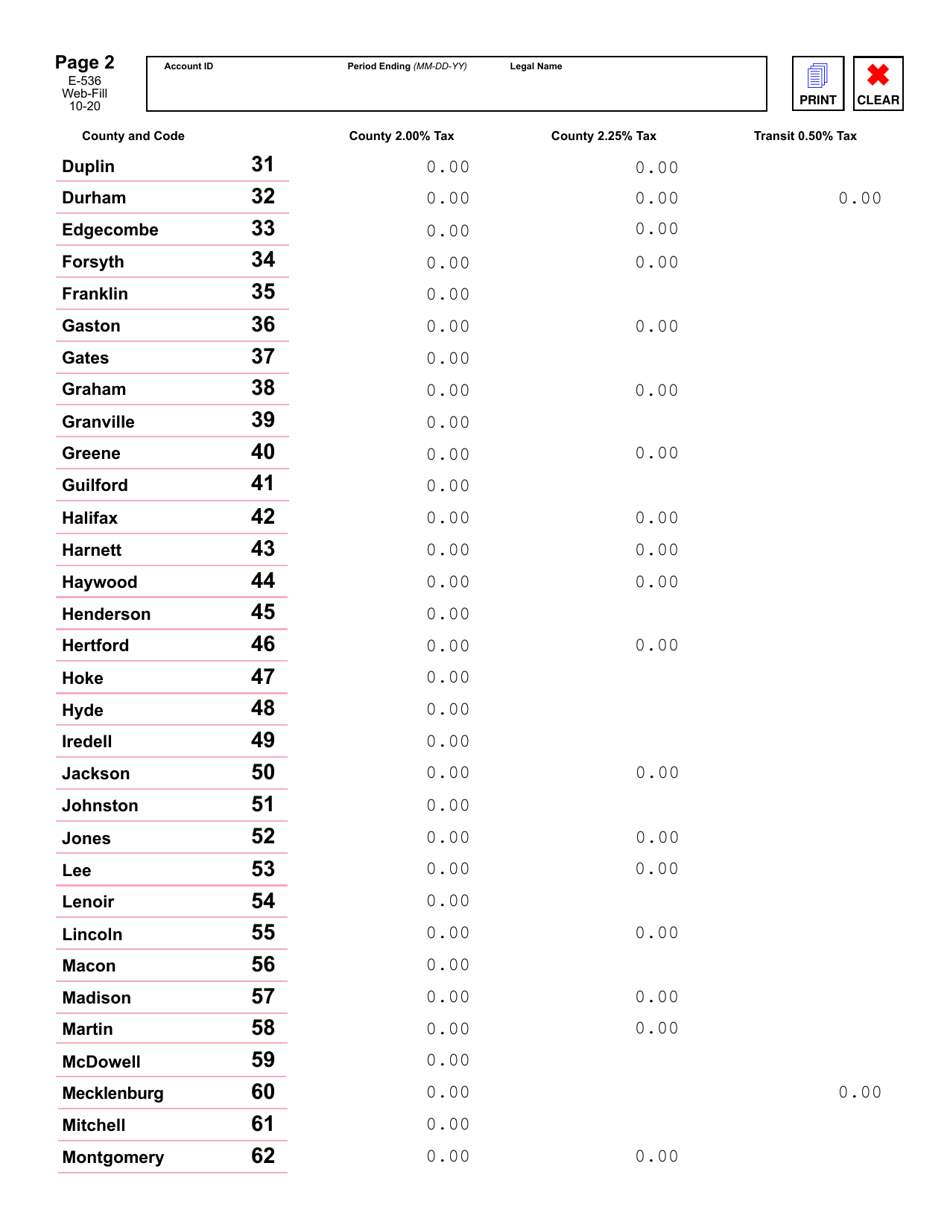

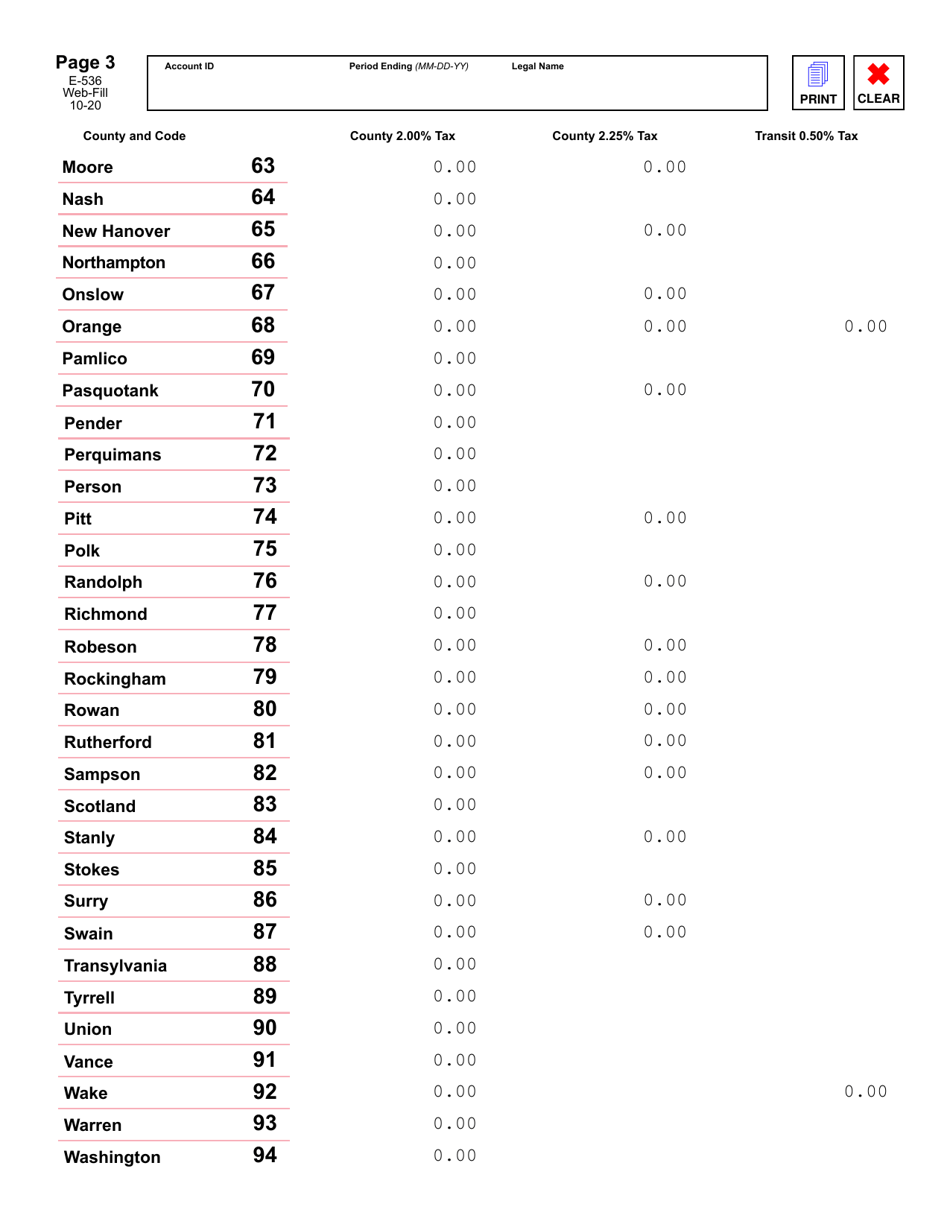

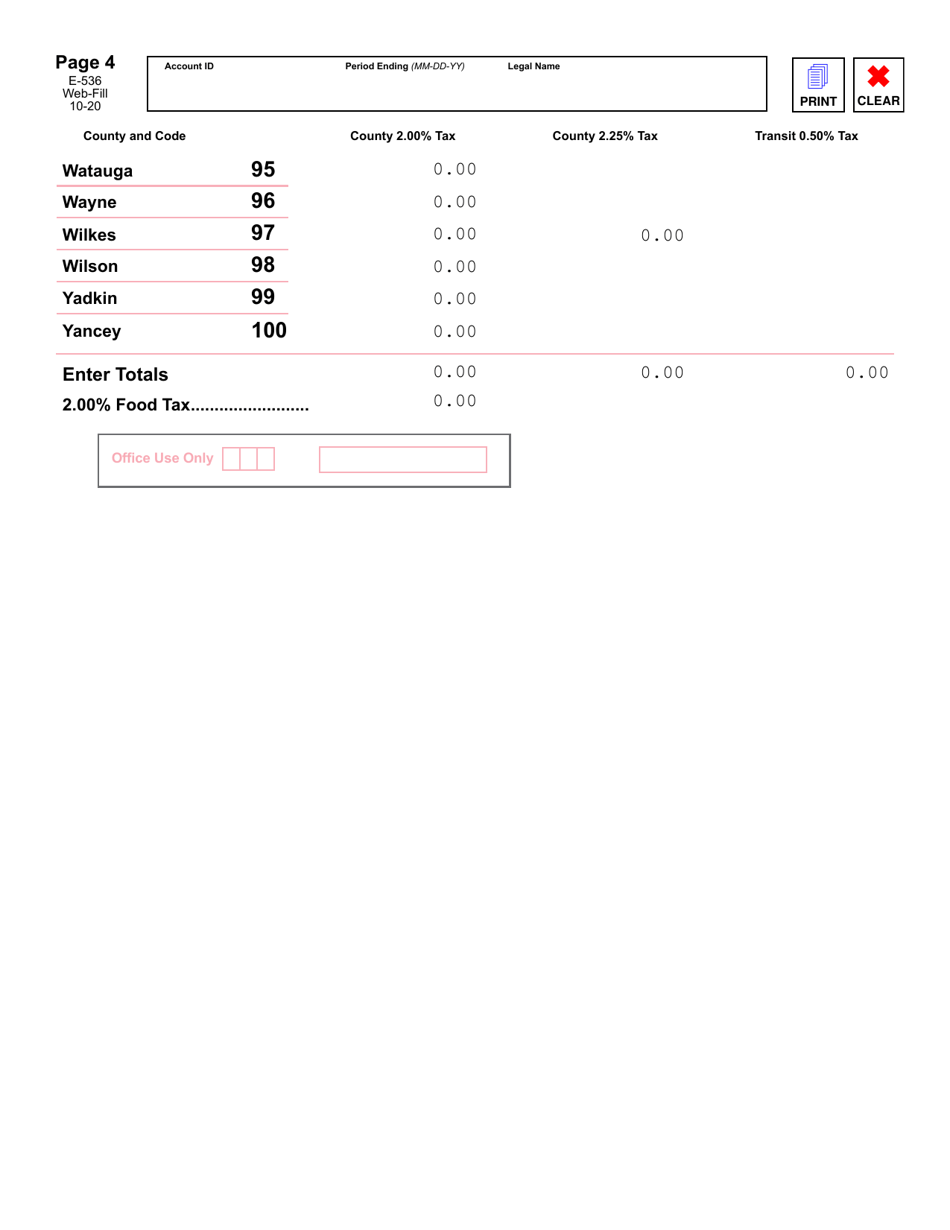

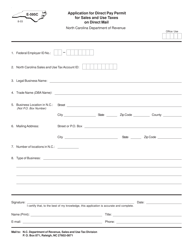

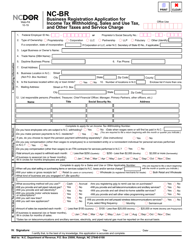

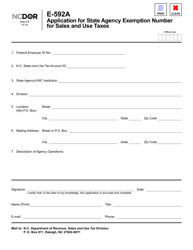

Form E-536 Schedule of County Sales and Use Taxes - North Carolina

What Is Form E-536?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-536?

A: Form E-536 is a schedule of county sales and use taxes in North Carolina.

Q: What is the purpose of Form E-536?

A: The purpose of Form E-536 is to report and remit county sales and use taxes.

Q: Who needs to file Form E-536?

A: Businesses that collect and remit county sales and use taxes in North Carolina need to file Form E-536.

Q: How often do I need to file Form E-536?

A: Form E-536 needs to be filed on a monthly or quarterly basis, depending on your tax liability.

Q: What information do I need to complete Form E-536?

A: You will need to provide information about your business, the counties where you collect taxes, and the amount of taxes collected.

Q: When is Form E-536 due?

A: Form E-536 is due by the 20th of the month following the reporting period.

Q: What happens if I don't file Form E-536?

A: Failure to file Form E-536 or pay the taxes owed may result in penalties and interest.

Q: Are there any exemptions from county sales and use taxes?

A: Yes, there are certain exemptions and exclusions. You should consult the North Carolina Department of Revenue for more information.

Form Details:

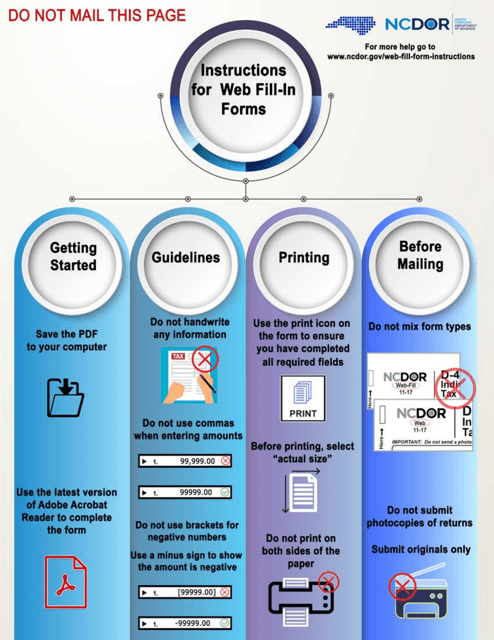

- Released on October 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

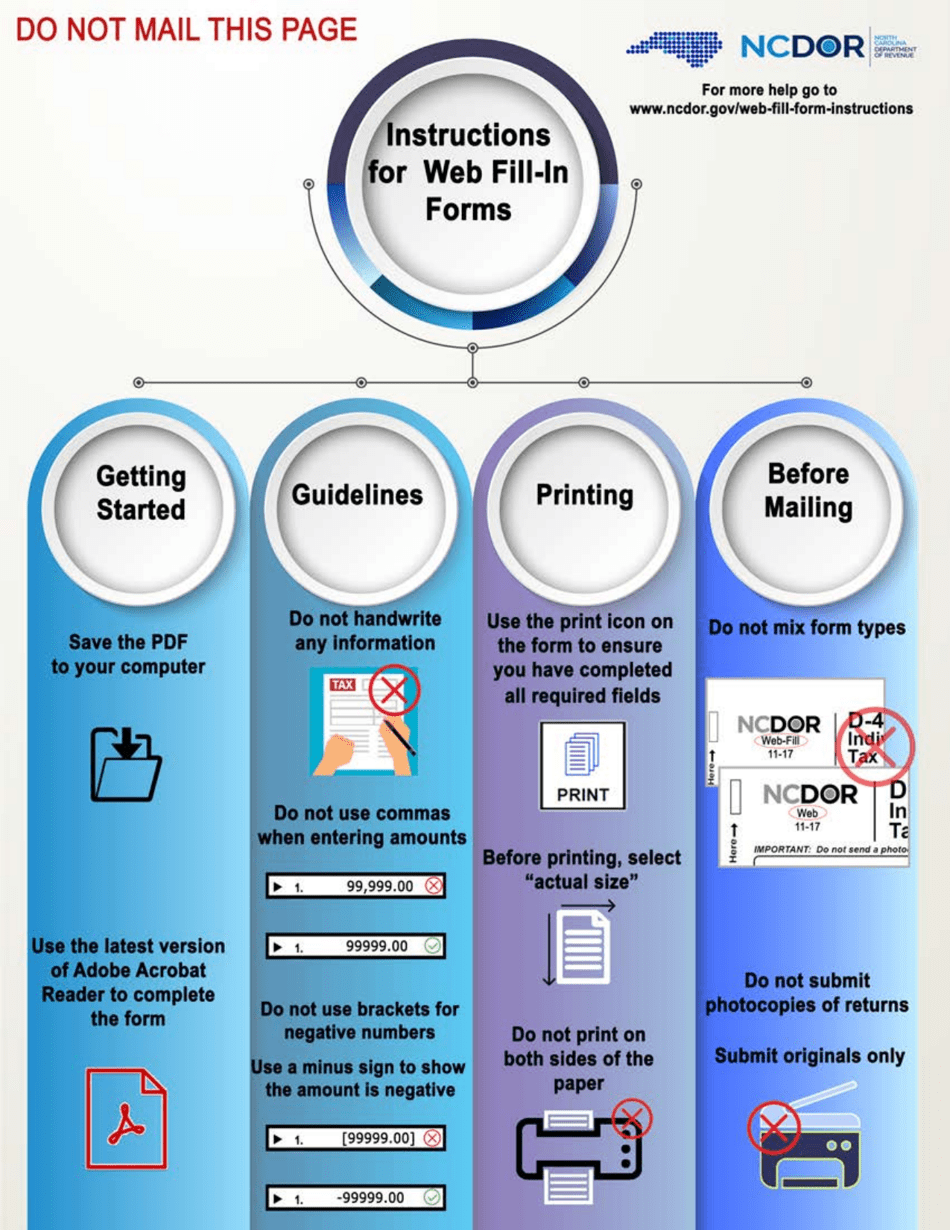

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-536 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.