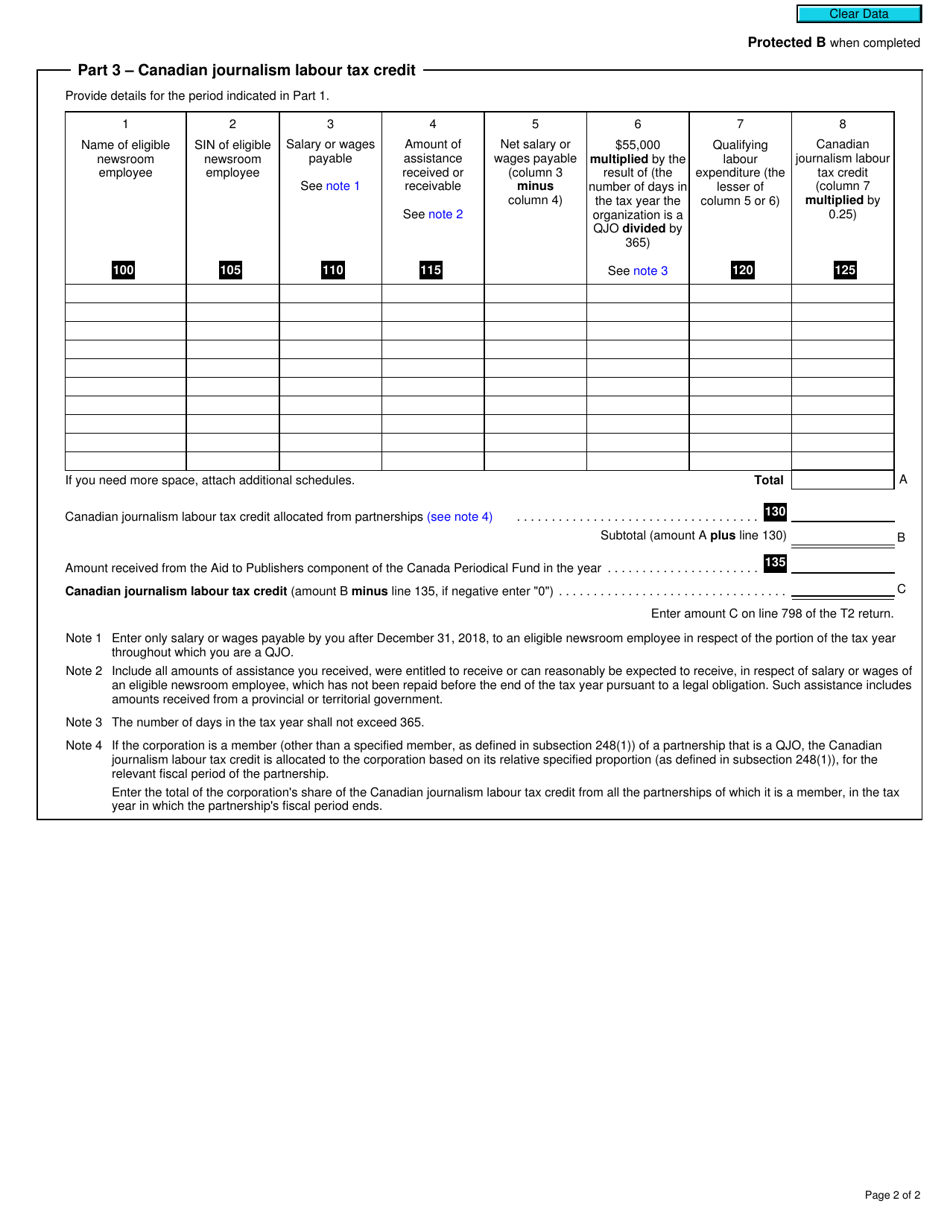

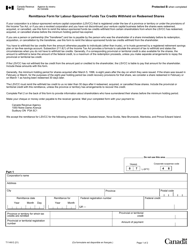

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 58

for the current year.

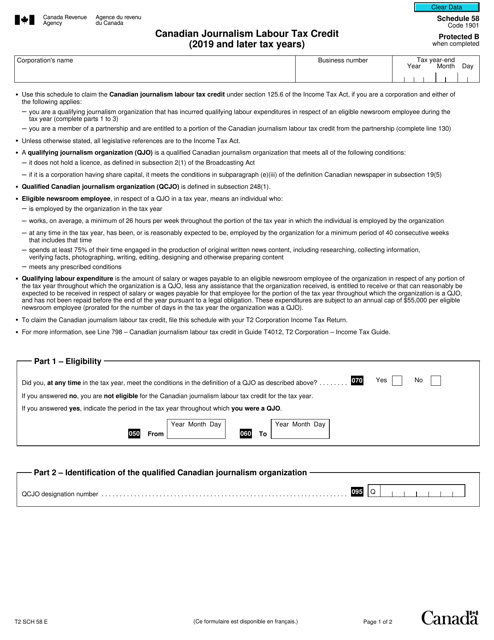

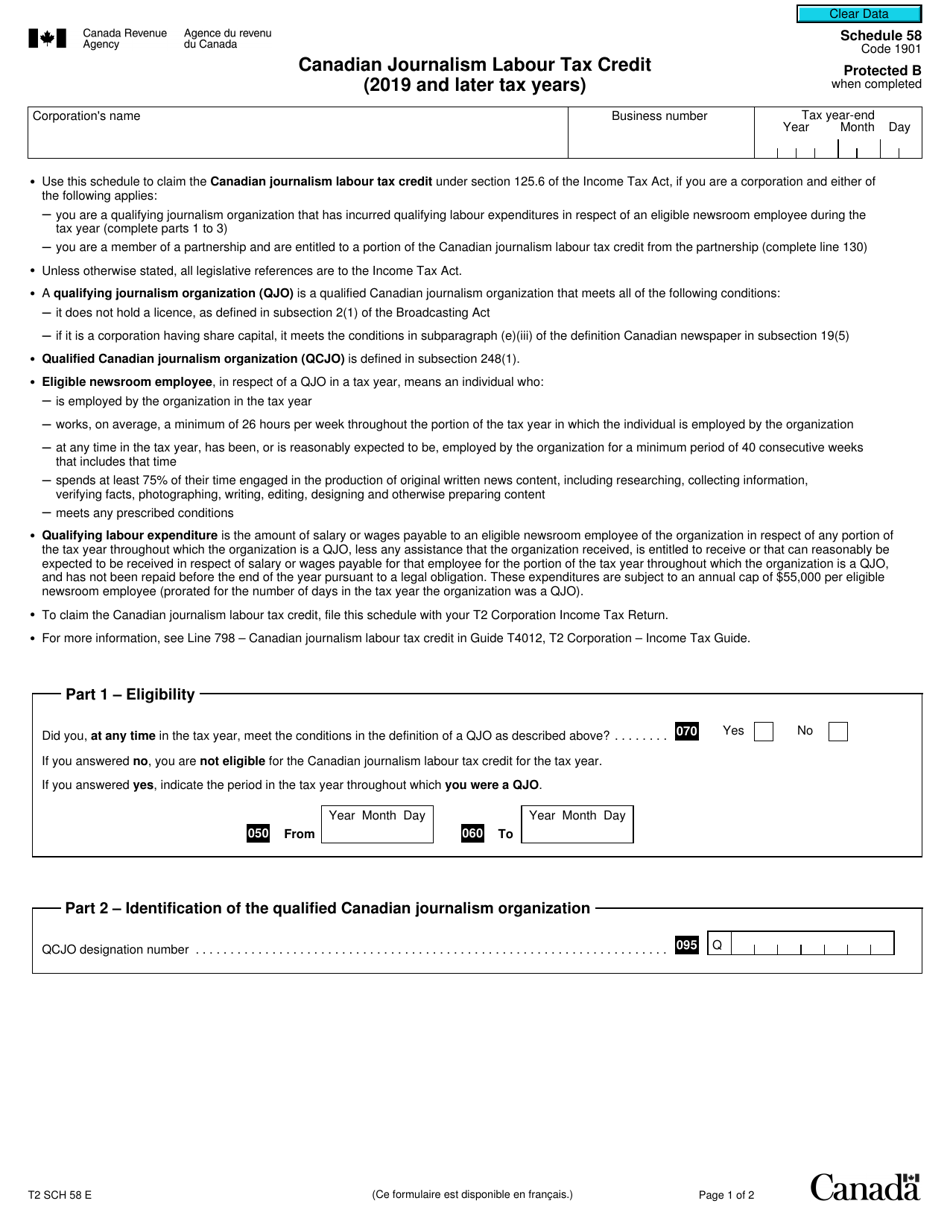

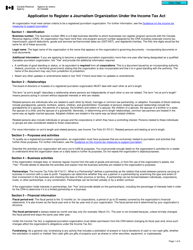

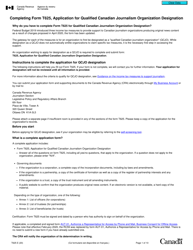

Form T2 Schedule 58 Canadian Journalism Labour Tax Credit (2019 and Later Tax Years) - Canada

Form T2 Schedule 58 Canadian Journalism Labour Tax Credit (2019 and Later Tax Years) is for claiming the Canadian Journalism Labour Tax Credit, which provides a tax credit to qualifying news organizations for eligible newsroom employees. The purpose is to support the viability of journalism in Canada.

The Form T2 Schedule 58 Canadian Journalism Labour Tax Credit is filed by Canadian corporations that are engaged in journalism activities.

FAQ

Q: What is Form T2 Schedule 58?

A: Form T2 Schedule 58 is a tax form used in Canada to claim the Canadian Journalism Labour Tax Credit.

Q: What is the Canadian Journalism Labour Tax Credit?

A: The Canadian Journalism Labour Tax Credit is a tax credit designed to support news organizations in Canada.

Q: Who is eligible to claim the Canadian Journalism Labour Tax Credit?

A: News organizations that meet certain criteria are eligible to claim the Canadian Journalism Labour Tax Credit.

Q: What are the criteria to be eligible for the Canadian Journalism Labour Tax Credit?

A: Eligible news organizations must have a qualified Canadian journalism organization designation and must employ at least one eligible journalist.

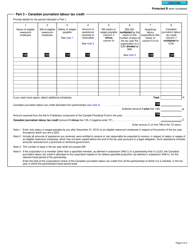

Q: What expenses can be claimed through the Canadian Journalism Labour Tax Credit?

A: Eligible expenses include salary and wages paid to eligible journalists and costs associated with producing original content for news media.

Q: Is there a limit to the amount of the tax credit that can be claimed?

A: Yes, there is a limit on the amount of the tax credit that can be claimed by each eligible news organization.

Q: How can a news organization claim the Canadian Journalism Labour Tax Credit?

A: To claim the tax credit, a news organization must complete and file Form T2 Schedule 58 along with their corporate income tax return.