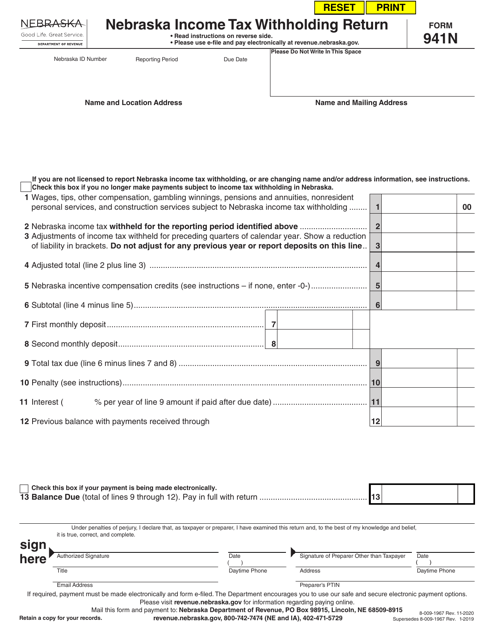

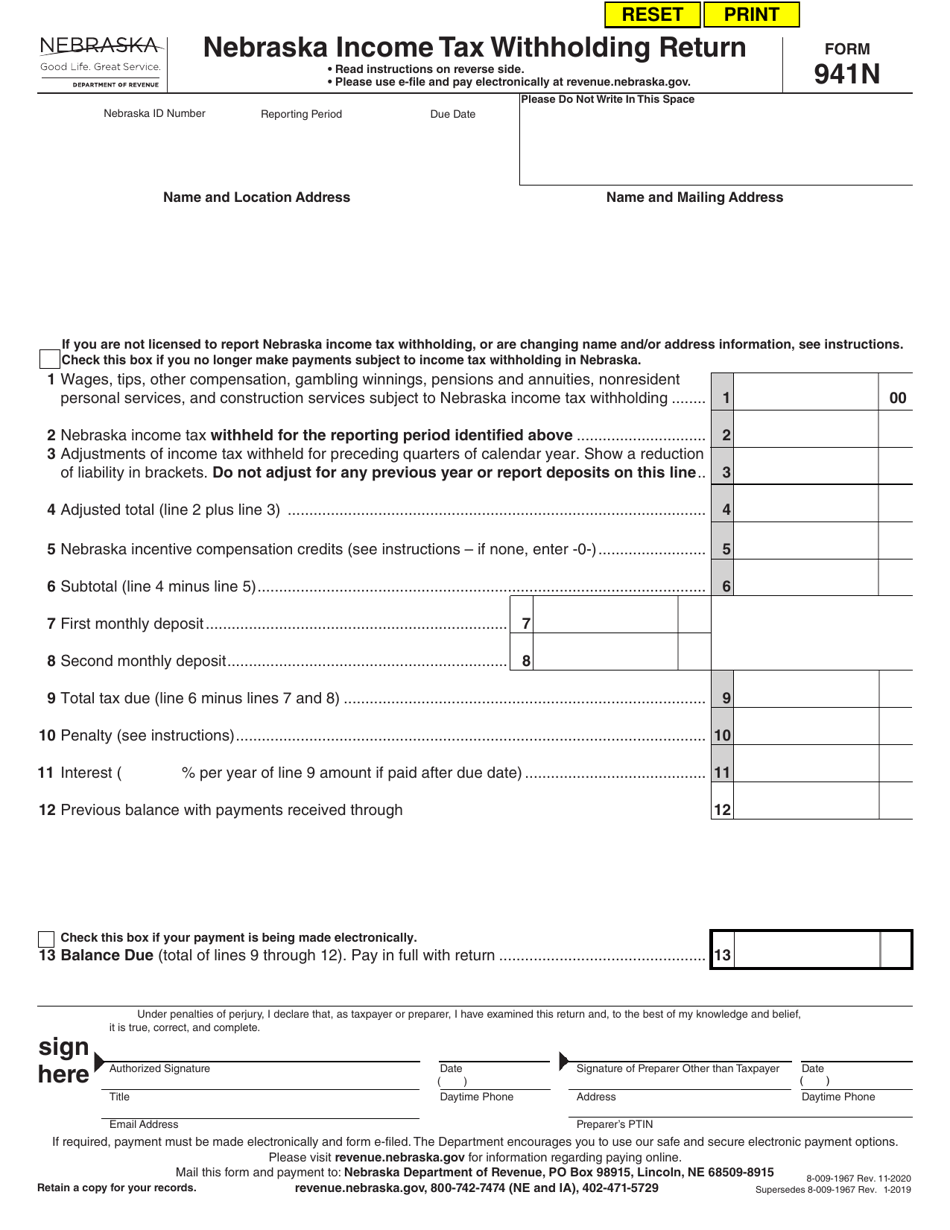

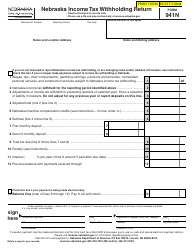

Form 941N Nebraska Income Tax Withholding Return - Nebraska

What Is Form 941N?

This is a legal form that was released by the Nebraska Secretary of State - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 941N?

A: Form 941N is the Nebraska Income Tax Withholding Return.

Q: Who needs to file Form 941N?

A: Employers who have employees in Nebraska and withhold state income tax from their wages need to file Form 941N.

Q: What information do I need to complete Form 941N?

A: You will need to provide your employer information, employee information, wages paid, and the amount of state income tax withheld.

Q: When is Form 941N due?

A: Form 941N is due quarterly, by the last day of the month following the end of the calendar quarter.

Q: Are there any penalties for late or incorrect filing of Form 941N?

A: Yes, there may be penalties for late or incorrect filing, including penalties for failure to file, failure to pay, and negligence.

Q: Can I use Form 941N for federal income tax withholding?

A: No, Form 941N is specifically for Nebraska state income tax withholding and should not be used for federal income tax withholding.

Q: What should I do if I have questions about Form 941N?

A: If you have questions about Form 941N, you can contact the Nebraska Department of Revenue for assistance.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the Nebraska Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 941N by clicking the link below or browse more documents and templates provided by the Nebraska Secretary of State.