This version of the form is not currently in use and is provided for reference only. Download this version of

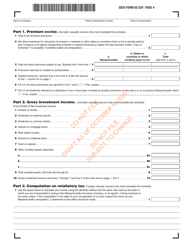

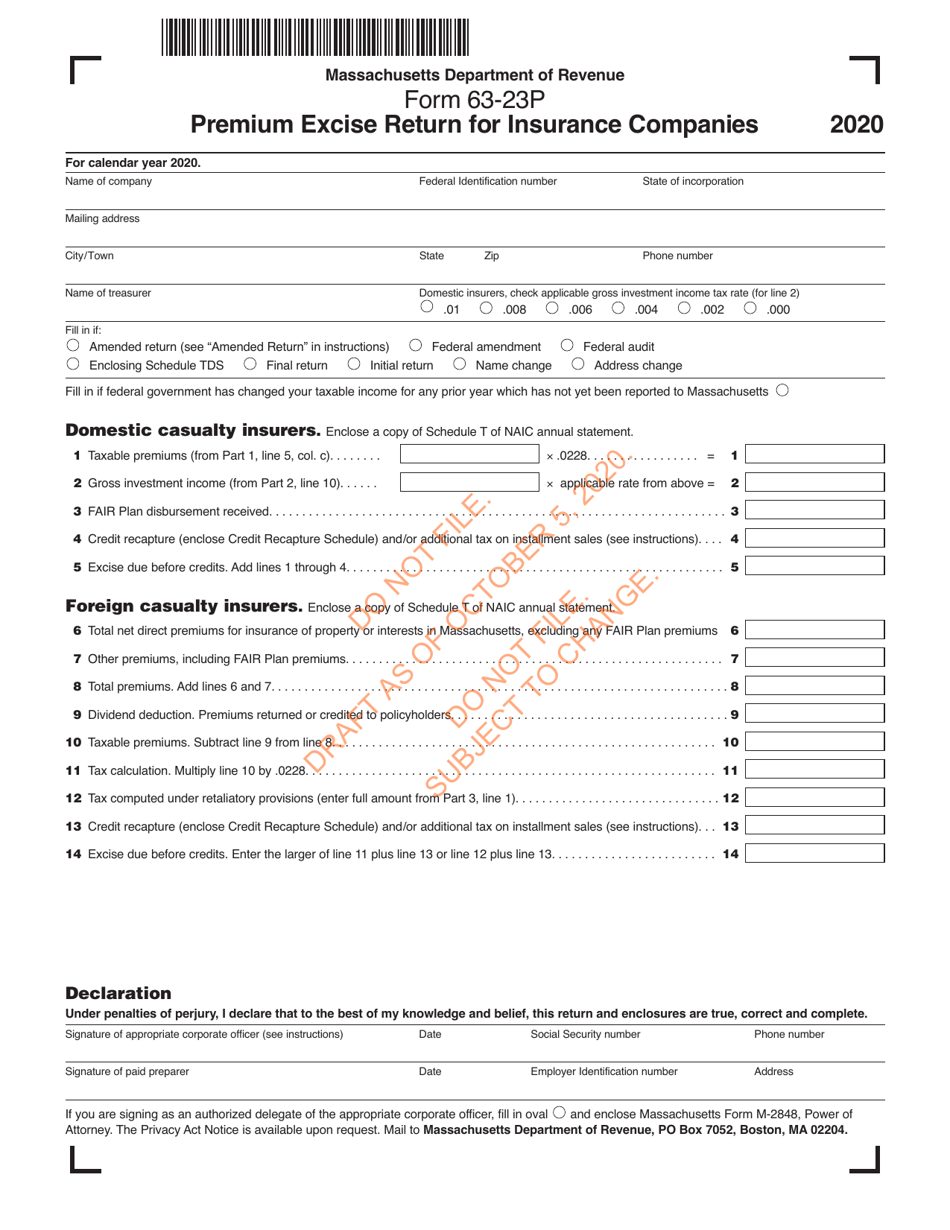

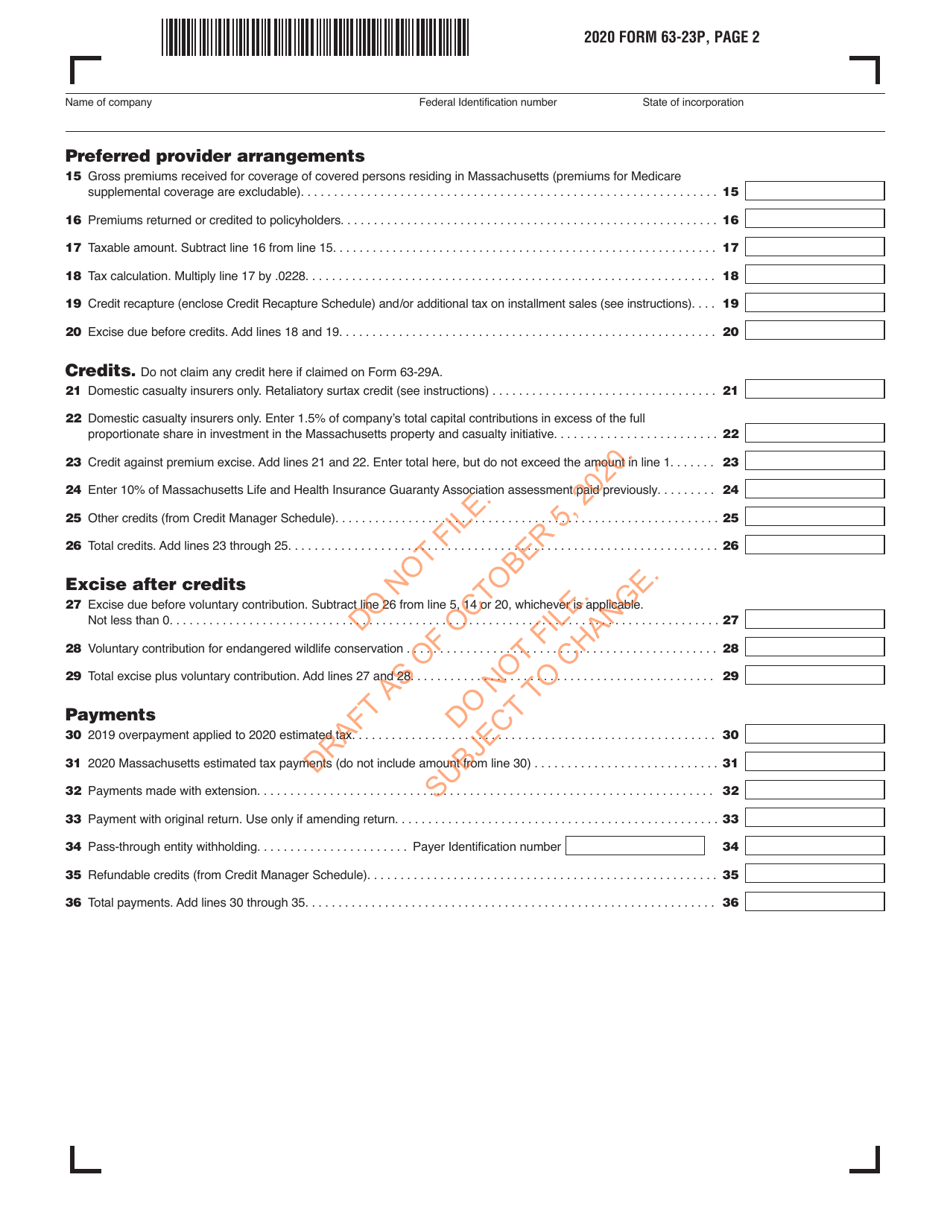

Form 63-23P

for the current year.

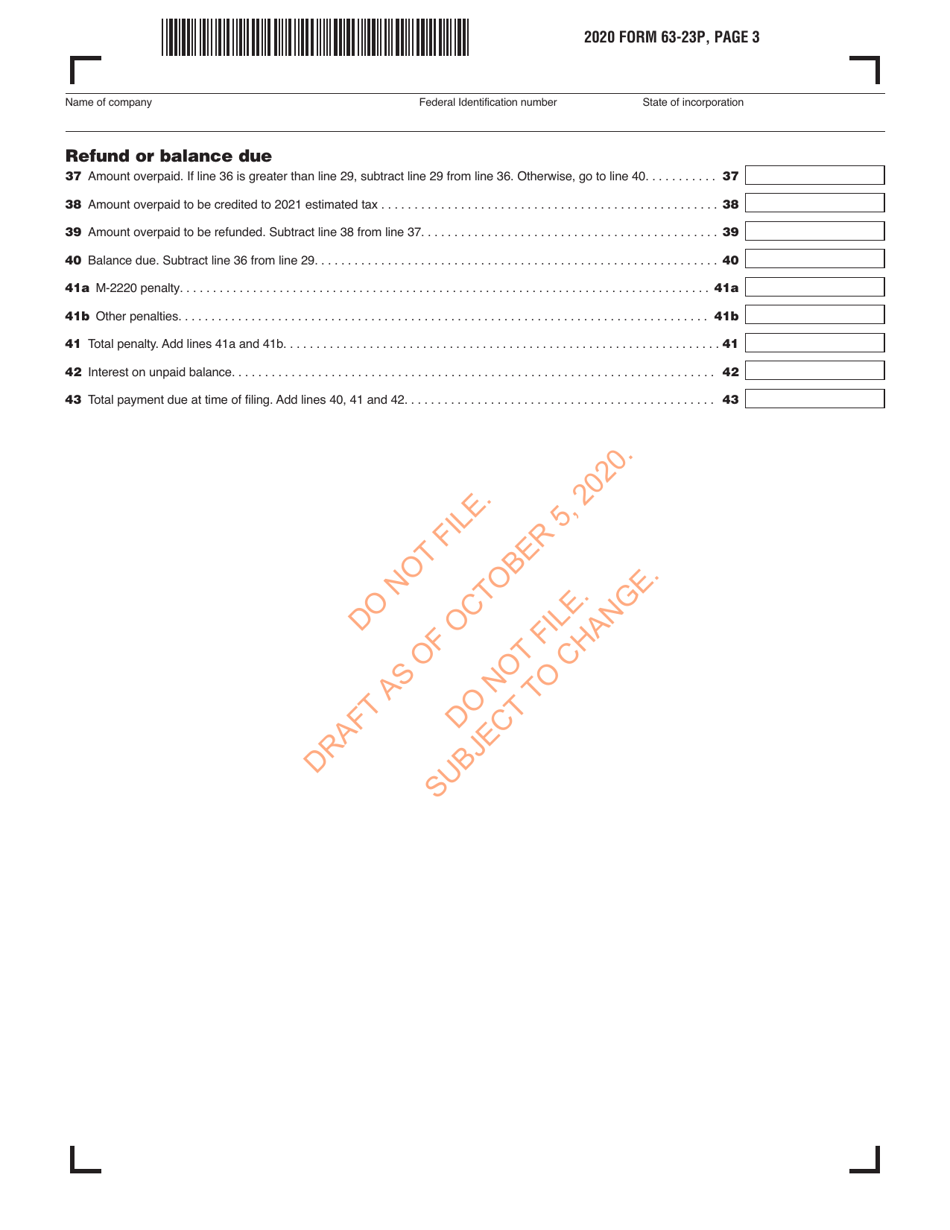

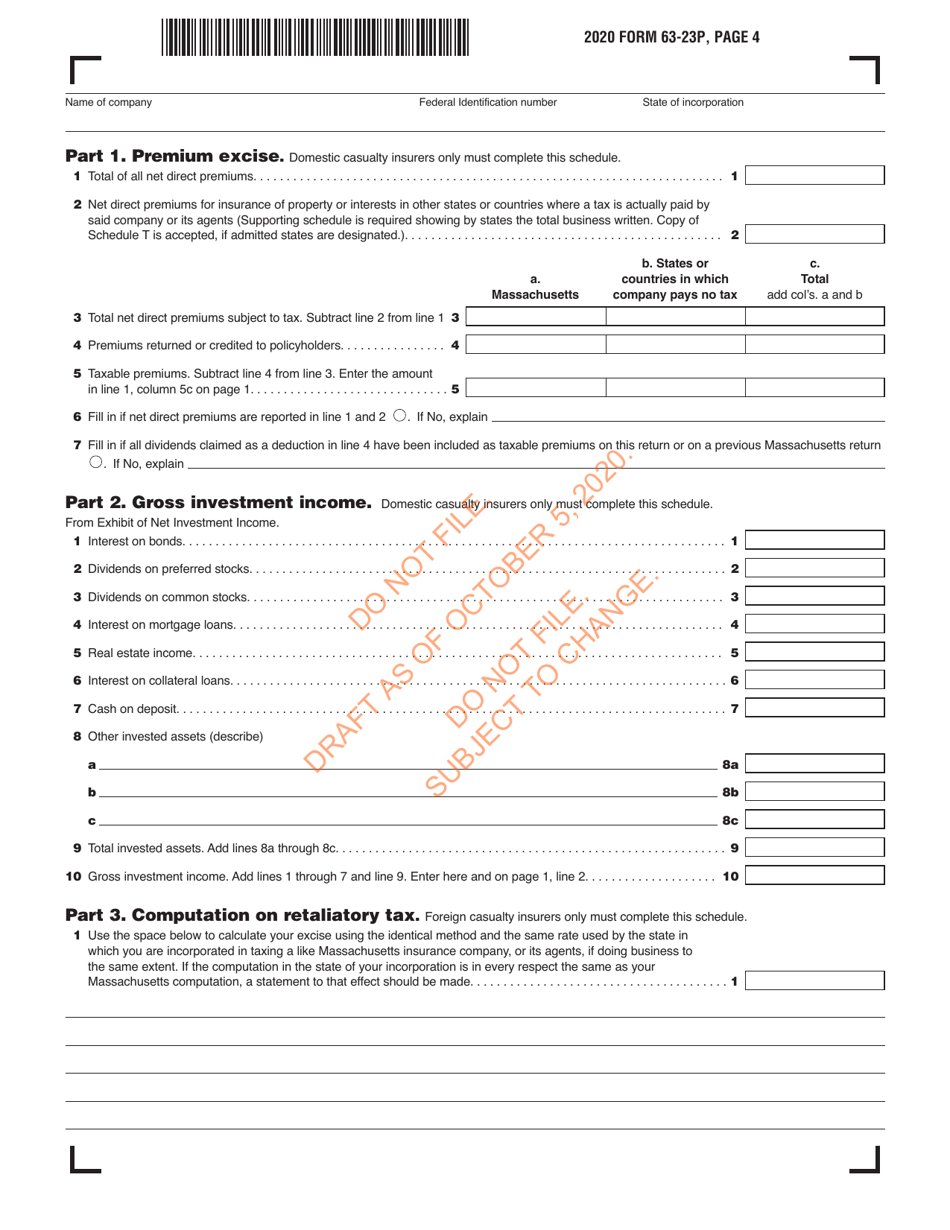

Form 63-23P Premium Excise Return for Insurance Companies - Draft - Massachusetts

What Is Form 63-23P?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. Check the official instructions before completing and submitting the form.

FAQ

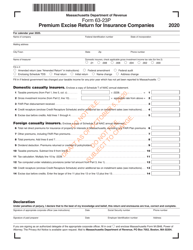

Q: What is Form 63-23P?

A: Form 63-23P is the Premium Excise Return for Insurance Companies.

Q: Who should file Form 63-23P?

A: Insurance companies in Massachusetts are required to file Form 63-23P.

Q: What is the purpose of Form 63-23P?

A: The purpose of Form 63-23P is to report and pay the premium excise tax owed by insurance companies.

Q: Is Form 63-23P mandatory?

A: Yes, filing Form 63-23P is mandatory for insurance companies in Massachusetts.

Q: When is the deadline to file Form 63-23P?

A: The deadline to file Form 63-23P is determined by the Massachusetts Department of Revenue and may vary.

Q: Are there any penalties for late filing of Form 63-23P?

A: Yes, there may be penalties for late filing of Form 63-23P. It is important to file the form on time to avoid penalties.

Q: How do I pay the premium excise tax?

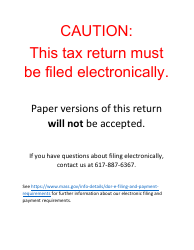

A: The premium excise tax can be paid by check or electronically, as specified by the Massachusetts Department of Revenue.

Q: Do I need to keep a copy of Form 63-23P?

A: Yes, it is recommended to keep a copy of Form 63-23P for your records.

Form Details:

- Released on October 5, 2020;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 63-23P by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.