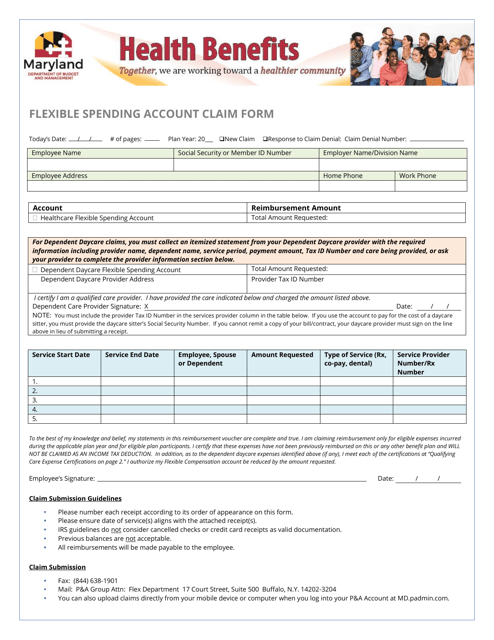

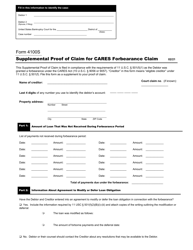

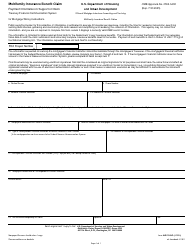

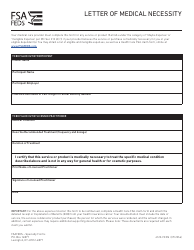

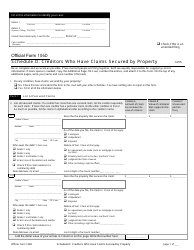

Flexible Spending Account Claim Form - Maryland

Flexible Spending Account Claim Form is a legal document that was released by the Maryland Department of Budget and Management - a government authority operating within Maryland.

FAQ

Q: What is a Flexible Spending Account (FSA)?

A: A Flexible Spending Account (FSA) is a tax-advantaged savings account that allows you to set aside pre-tax dollars for eligible medical expenses.

Q: How can I use my FSA funds?

A: You can use your FSA funds to pay for qualified medical expenses, such as doctor visits, prescription medications, and certain medical supplies.

Q: Who is eligible for a FSA?

A: Employees who have access to a Flexible Spending Account (FSA) are typically eligible. You will need to check with your employer to confirm if you are eligible.

Q: How does a FSA work?

A: You contribute a portion of your pre-tax salary into your FSA account, and then you can use those funds to pay for eligible medical expenses.

Q: What is the deadline for submitting a claim?

A: The deadline for submitting a claim may vary depending on your FSA plan. Check with your plan administrator for specific deadlines.

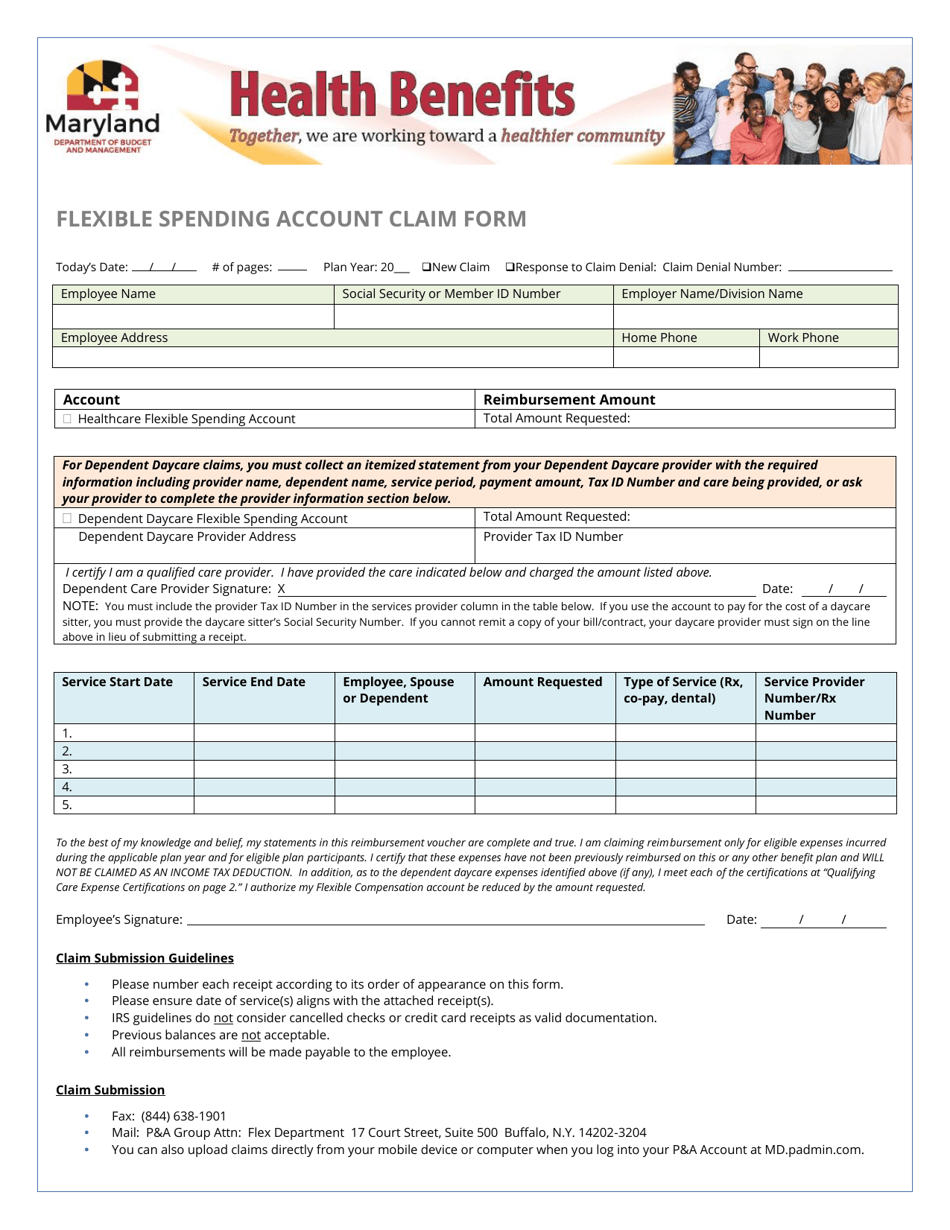

Q: How do I submit a claim?

A: To submit a claim, you can typically fill out a claim form provided by your FSA administrator and provide documentation like receipts or invoices for the expenses.

Q: Can I use my FSA funds for over-the-counter medications?

A: As of 2020, you can use your FSA funds to purchase over-the-counter medications without a prescription.

Q: What happens if I don't use all of my FSA funds by the end of the year?

A: Any funds remaining in your FSA at the end of the year may be forfeited. However, some plans offer a grace period or allow you to carry over a certain amount of funds to the next year.

Q: Can I use my FSA funds for cosmetic procedures?

A: In general, cosmetic procedures are not considered eligible expenses for FSA reimbursement. However, there may be exceptions for certain procedures that are medically necessary.

Q: How do I find out what expenses are eligible for FSA reimbursement?

A: You can refer to the list of eligible expenses provided by your FSA administrator or consult IRS Publication 502 for guidance on eligible medical expenses.

Form Details:

- The latest edition currently provided by the Maryland Department of Budget and Management;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Budget and Management.